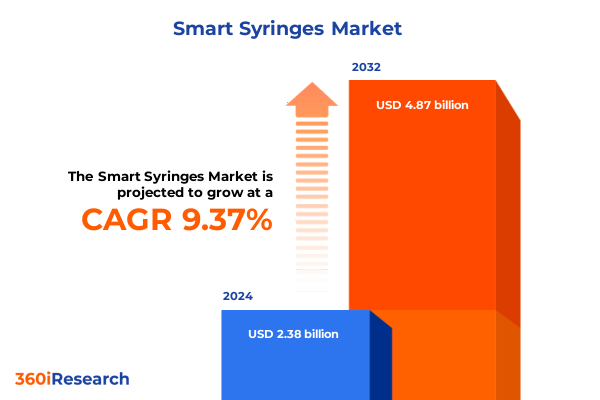

The Smart Syringes Market size was estimated at USD 2.54 billion in 2025 and expected to reach USD 2.72 billion in 2026, at a CAGR of 9.71% to reach USD 4.87 billion by 2032.

Positioning Smart Syringes at the Forefront of Healthcare Innovation to Elevate Patient Safety by Preventing Needle-Related Infections and Optimizing Workflows

In today’s healthcare environment, reducing needle-related injuries and preventing infections are paramount to delivering safe and effective patient care. Smart syringes, equipped with features such as automatic needle retraction, dose tracking sensors, and connectivity for data logging, are quickly ascending from niche innovations to standard practice in hospitals, clinics, and home healthcare settings. These devices not only mitigate the risks associated with accidental needle sticks and reuse but also streamline nursing workflows by enabling real-time dosage verification and inventory management.

Moreover, transitioning from traditional syringes to their smart counterparts marks a significant milestone in patient-centric care. Early adopters have reported measurable improvements in safety outcomes alongside operational efficiencies, as the integration of intelligent injection devices reduces time spent on manual checks and paperwork. Consequently, the adoption of smart syringes aligns with broader healthcare mandates aimed at enhancing quality of care, minimizing adverse events, and optimizing resource utilization. As this market segment continues to mature, understanding the underlying drivers and emerging trends becomes essential for stakeholders seeking to maintain a competitive edge in healthcare delivery.

Analyzing the Convergence of Technological Breakthroughs Regulatory Momentum and End-User Demands That Are Redefining the Smart Syringe Ecosystem

The smart syringe landscape is being reshaped by a confluence of technological breakthroughs and shifting regulatory priorities. On one hand, advances in sensor miniaturization, low-power wireless communication, and auto-disable mechanisms have enabled manufacturers to embed sophisticated features into what was once a simple medical device. These technical strides are facilitating dose–response data capture, tamper resistance, and post-use traceability, effectively redefining the syringe as a connected component of the digital health ecosystem.

Simultaneously, regulatory bodies are intensifying their focus on injection safety, with guidelines that encourage or mandate the adoption of auto-disable and safety-engineered devices. For instance, new directives in key markets require stringent proof of single-use capabilities and performance validation under extreme conditions. Alongside these policies, growing demands from clinicians and patients for higher safety standards are driving healthcare providers to prioritize smart syringes in procurement decisions. Collectively, these transformative shifts are broadening the addressable market and accelerating the integration of smart injections into everyday clinical practice, setting the stage for a new paradigm in patient-centered care.

Unpacking the Cumulative Effects of the 2025 United States Tariff Regime on Smart Syringe Supply Chains Manufacturing Costs and Global Trade Dynamics

In 2025, the United States enacted a series of tariffs on imported medical components, including plastics and electronics critical to smart syringe production. These levies, imposed with the stated goal of bolstering domestic manufacturing, have had cascading effects across supply chains. Manufacturers reliant on specialized plastic resins have encountered increased input costs, while those sourcing microelectronic sensors from overseas suppliers have experienced delays and price pressures.

As a result, smart syringe makers have embarked on strategic responses to mitigate tariff-related disruptions. Several leading producers have expanded domestic partnerships to secure alternative material sources, while others are negotiating long-term contracts to lock in favorable pricing. At the same time, cost increases have necessitated greater emphasis on design for manufacturability and lean process improvements to preserve margin. Although these adjustments have introduced short-term complexity, they are also catalyzing investments in local production capabilities, advanced automation, and closer collaboration with contract manufacturers. In turn, these developments are reinforcing the resilience of the smart syringe industry and redefining competitive dynamics for years to come.

Unveiling Multi-Dimensional Segmentation Insights to Illuminate Technology Product Material Application and End-Use Variances in Smart Syringe Deployment

The smart syringe market is characterized by a rich tapestry of segments that highlight distinct value drivers and adoption patterns. From a technological vantage, active safety designs that automatically retract or shield the needle after use contrast with passive safety mechanisms relying on user engagement to activate protective features. Each approach entails different engineering trade-offs, influencing device complexity, cost structure, and clinical acceptance.

Product type further differentiates the landscape into disposable units prized for ease of use and infection control, and reusable assemblies valued for environmental considerations and longer lifecycles. Material selection introduces another layer of nuance: glass variants deliver superior chemical compatibility and clarity, whereas plastic models offer greater design flexibility and lower weight. These fundamentals cascade into application-specific adaptations, with drug delivery syringes tailored for over-the-counter convenience or prescription precision, insulin devices optimized for type 1 and type 2 therapy regimens, and vaccination offerings engineered for either adult or pediatric administration. Finally, end-use contexts ranging from ambulatory surgical centers to home healthcare settings shape the configuration and regulatory requirements of smart syringes. Understanding how these segmentation variables intertwine is key to identifying white-space opportunities and crafting targeted go-to-market strategies.

This comprehensive research report categorizes the Smart Syringes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Material

- Application

- End Use

Mapping Regional Dynamics across Americas EMEA and Asia-Pacific to Reveal Demand Drivers Adoption Barriers and Growth Enablers in Smart Syringe Markets

Geographic dynamics play a critical role in shaping the uptake of smart syringe solutions. In the Americas, strong reimbursement frameworks and well-established healthcare infrastructures have accelerated the integration of advanced injection devices in both hospital and outpatient settings. Healthcare providers are leveraging data from connected syringes to meet stringent regulatory reporting requirements and to drive internal safety audits, thereby reinforcing the strategic importance of these devices.

Conversely, Europe, the Middle East, and Africa present a more heterogeneous picture. Western European markets exhibit high demand driven by comprehensive safety regulations and patient advocacy initiatives, whereas emerging economies in the region are experiencing cost sensitivity that moderates adoption. Regulatory harmonization efforts at the European Union level are expected to elevate baseline safety requirements, gradually encouraging broader adoption.

Meanwhile, Asia-Pacific is witnessing rapid growth propelled by large patient populations, government incentives for local medical device manufacturing, and a rising focus on community care models. In markets where cold chain logistics and vaccination campaigns are prioritized, pediatric and adult vaccine delivery syringes are gaining prominence. Furthermore, increasing home healthcare penetration in countries such as Japan and Australia is fueling demand for intuitive, connected syringe platforms.

This comprehensive research report examines key regions that drive the evolution of the Smart Syringes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Smart Syringe Innovators and Strategic Partnerships Driving Competitive Differentiation and Market Leadership in Healthcare Safety

A constellation of leading medical device companies is shaping the competitive landscape for smart syringes through innovation, strategic alliances, and targeted acquisitions. Major global manufacturers are investing heavily in in-house R&D to integrate sensors, connectivity modules, and safety-engineered mechanisms directly into their core product lines. These initiatives are often complemented by partnerships with technology firms specializing in IoT platforms and cloud-based analytics to deliver end-to-end solutions.

At the same time, smaller specialized players are carving out niches by focusing on specific application areas, such as insulin management or vaccination campaigns, and by collaborating with pharmaceutical companies on co-development agreements. Such collaborations allow for co-branding opportunities and facilitate streamlined regulatory approvals under combination product pathways. Moreover, contract manufacturers with expertise in precision plastics and electronic assembly are emerging as critical enablers, offering scalable production capacity and rapid prototyping capabilities. Collectively, these corporate maneuvers are driving differentiation, accelerating time-to-market, and reinforcing strategic positioning in a rapidly evolving industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Syringes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton Dickinson and Company

- Henke-Sass, Wolf GmbH

- Nipro Corporation

- Owen Mumford Ltd

- Retractable Technologies, Inc.

- Sarstedt AG & Co. KG

- Schott AG

- Smiths Medical (Smiths Group plc)

- Terumo Corporation

Formulating Strategic Recommendations to Empower Industry Leaders with Decisive Steps for R&D Priorities Regulatory Alignment and Market Penetration in Smart Syringes

Industry leaders aiming to capitalize on the smart syringe opportunity should prioritize a multifaceted strategy that balances technology, regulation, and market outreach. First, accelerating R&D efforts in sensor integration and data analytics will be essential for transitioning from safety-only devices to comprehensive digital health solutions. By establishing modular platforms that can be customized for diverse therapeutic applications, organizations can optimize development cycles and scale across segments.

Next, proactive engagement with regulatory bodies is critical to anticipate evolving safety requirements and to secure expedited pathways for novel device approvals. Collaborative dialogue with health authorities and participation in standards committees will help shape favorable policy frameworks while demonstrating best practices in risk management.

Finally, forging partnerships across the value chain-from raw material suppliers to digital health providers-will enhance supply chain resilience and expand service offerings. Equally important is investing in targeted educational initiatives for clinicians and end users to drive adoption. By aligning these initiatives with evidence-based outcomes and patient testimonials, companies can strengthen market credibility and foster long-term growth.

Detailing a Rigorous Multi-Modal Research Framework Incorporating Primary Interviews Secondary Data Analysis and Validation Protocols for Comprehensive Smart Syringe Insights

This analysis is grounded in a rigorous research approach that combines qualitative and quantitative methodologies. Primary data were collected through in-depth interviews with key stakeholders, including medical professionals, procurement managers, and device engineers, to capture frontline insights into market needs and adoption barriers. Complementing these interviews, an online survey of healthcare administrators provided quantitative metrics on usage patterns and investment priorities.

Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory agency publications, patent filings, and company disclosures to establish a factual baseline on technology innovations, policy shifts, and competitive activities. Data triangulation was employed throughout the research cycle to validate findings, ensuring consistency between primary observations and published data. To enhance robustness, multiple rounds of expert verification were conducted, with feedback loops incorporated to refine segmentation assumptions and to stress-test strategic conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Syringes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Syringes Market, by Technology

- Smart Syringes Market, by Product Type

- Smart Syringes Market, by Material

- Smart Syringes Market, by Application

- Smart Syringes Market, by End Use

- Smart Syringes Market, by Region

- Smart Syringes Market, by Group

- Smart Syringes Market, by Country

- United States Smart Syringes Market

- China Smart Syringes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Reinforce the Strategic Imperatives and Opportunities in Accelerating Smart Syringe Adoption within Evolving Healthcare Ecosystems

This executive summary has synthesized the most critical insights shaping the future of smart syringes, from emerging technological capabilities and tariff-driven supply chain realignments to nuanced segmentation and regional adoption patterns. The convergence of auto-disable mechanisms, data connectivity, and regulatory imperatives underscores a shift toward integrated device ecosystems that deliver measurable safety and efficiency gains.

Furthermore, the segmentation analysis highlights how variations in technology, product type, material, application, and end-use contexts create differentiated pathways for market entry and growth. Regional dynamics further reinforce the need for tailored strategies that address distinct regulatory landscapes and healthcare delivery models. Collectively, these insights point to a landscape ripe with opportunity for organizations willing to innovate, collaborate, and engage proactively with policymakers and end users.

As the healthcare industry continues to prioritize patient safety and digital transformation, smart syringes are poised to play an increasingly central role in achieving clinical excellence and operational resilience.

Connect Directly with Ketan Rohom to Secure Your In-Depth Smart Syringe Market Research Report and Gain a Competitive Edge in Healthcare Innovation

For readers seeking deeper insights and personalized guidance to navigate the complexities of the smart syringe market, engaging with Ketan Rohom represents the most direct route to actionable intelligence. As the Associate Director, Sales & Marketing at 360iResearch, he brings a nuanced understanding of the industry’s evolving dynamics and can tailor solutions that align with your organization’s strategic priorities. Whether you require in-depth data on regulatory impacts, bespoke segmentation analysis, or foresight into emerging technological innovations, Ketan’s expertise will ensure you receive a comprehensive report designed to inform critical decisions. Reach out today to secure your copy of the full market research study and capitalize on the opportunity to lead in healthcare safety innovation.

- How big is the Smart Syringes Market?

- What is the Smart Syringes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?