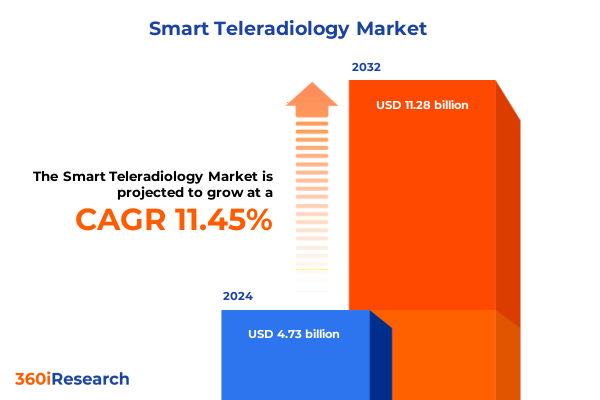

The Smart Teleradiology Market size was estimated at USD 5.28 billion in 2025 and expected to reach USD 5.80 billion in 2026, at a CAGR of 11.43% to reach USD 11.28 billion by 2032.

Unveiling the Critical Role of Smart Teleradiology in Revolutionizing Imaging Diagnostics by Bridging Expertise and Technology Across Healthcare Systems

Smart teleradiology is rapidly redefining the paradigms of diagnostic imaging, seamlessly connecting radiology experts with clinical teams across geographies. By leveraging cutting-edge digital platforms, advanced image processing algorithms, and secure data exchange protocols, this approach enables remote interpretation of scans with unprecedented speed and accuracy. As healthcare systems face mounting pressures to optimize resource utilization and deliver timely diagnoses, smart teleradiology emerges as a pivotal solution to bridge gaps in expertise, enhance patient outcomes, and drive operational efficiencies.

In this context, the introduction outlines the foundational principles and compelling drivers behind the adoption of smart teleradiology. It examines how improvements in network infrastructure, the proliferation of high-resolution imaging devices, and the advent of artificial intelligence (AI) tools have collectively accelerated the maturation of teleradiology services. Moreover, the ongoing shift toward value-based care compels providers to seek modalities that support rapid, reliable diagnostics while containing costs.

Furthermore, this section sets the stage for deeper exploration by highlighting the interplay between technological innovation and regulatory evolution. It emphasizes that successful deployment of smart teleradiology depends not only on robust software and hardware integration but also on compliance with data security standards, accreditation requirements, and reimbursement frameworks. Ultimately, understanding this multifaceted landscape is essential for stakeholders seeking to harness the full potential of remote imaging diagnostics and deliver equitable, high-quality care.

Exploring the Transformative Shifts Shaping the Teleradiology Landscape as AI Connectivity and Regulatory Evolution Redefine Diagnostic Imaging Workflows Globally

The teleradiology landscape has undergone transformative shifts characterized by the integration of AI-driven image analysis, the expansion of cloud-based architectures, and the emergence of standardized interoperability protocols. AI-powered algorithms now assist radiologists in triaging cases, detecting anomalies, and prioritizing studies that require urgent attention, thereby streamlining workflows and mitigating diagnostic delays. Concurrently, cloud adoption has enabled scalable storage and real-time access to imaging data, eliminating traditional limitations associated with on-premise infrastructure and fostering collaboration across institutional boundaries.

Regulatory evolution also plays a crucial role in shaping this new paradigm. Policymakers have increasingly recognized the need for frameworks that safeguard patient privacy while enabling cross-border data exchange. The refinement of telehealth reimbursement policies, coupled with emerging accreditation standards, has reinforced stakeholder confidence in smart teleradiology offerings. Additionally, the proliferation of health information exchanges and the adoption of universal data standards like DICOM and HL7 FHIR have significantly enhanced interoperability, allowing disparate systems to communicate seamlessly.

These shifts underscore a broader industry trend toward precision diagnostics and personalized care pathways. By marrying robust connectivity with intelligent analytics, healthcare organizations can deliver timely, context-rich insights that inform clinical decision-making. As a result, the convergence of technological, regulatory, and clinical imperatives is redefining diagnostic imaging workflows, positioning smart teleradiology as a transformative force in modern healthcare.

Assessing the Pervasive Implications of United States Tariffs Implemented in 2025 on Cross-Border Teleradiology Services Equipment Supply Chains and Cost Structures

The implementation of United States tariffs in 2025 has introduced significant complexities for the smart teleradiology ecosystem, particularly in relation to cross-border equipment procurement and software licensing. The imposition of higher duties on imported imaging devices and related hardware has elevated capital expenditures for service providers, compelling many to reassess sourcing strategies. In response, several organizations have pursued alternative supply chains, forging partnerships with domestic manufacturers or regional distributors to mitigate cost pressures while ensuring continuity of critical diagnostic capabilities.

Moreover, tariff-induced cost increases have reverberated through service delivery models. Providers that historically relied on imported high-end CT or MRI scanners have been prompted to optimize utilization rates, extending equipment lifecycles through enhanced maintenance protocols and service agreements. Simultaneously, some teleradiology providers have diversified their offerings by emphasizing software-centric solutions-such as cloud-based image management and AI-powered analysis-that are less susceptible to import duties and can be deployed on existing IT infrastructure.

These dynamics have also influenced pricing structures and contractual agreements. Clients, including hospitals and diagnostic centers, are increasingly demanding transparent cost breakdowns and flexible pricing models that reflect the impact of tariffs on capital and operational expenses. As a result, service providers are innovating with subscription-based plans and outcome-oriented contracts that align costs with value delivered. The cumulative impact of 2025 tariffs thus underscores the importance of strategic agility and localized collaboration in sustaining growth and maintaining competitive advantage in the smart teleradiology market.

Deriving Key Segmentation Insights Across Modality Delivery Mode Application and End User Dimensions to Illuminate Strategic Opportunities in the Teleradiology Market

A nuanced examination of market segmentation reveals critical insights into how modality, delivery mode, application, and end user dimensions intersect to shape strategic priorities. In terms of modality, conventional CT systems continue to anchor diagnostic capabilities, while the adoption of mobile and spectral CT variants expands service reach and enhances tissue characterization. High-field MRI remains the standard for neurological and musculoskeletal imaging, yet ultralow-field MRI gains traction in resource-constrained settings due to its portability and cost-effectiveness. Meanwhile, PET imaging’s subsegments-cardiology, neurology, and oncology-delineate distinct areas of growth driven by demand for functional insights. Ultrasound’s evolution from two-dimensional imaging toward advanced three-dimensional and four-dimensional modalities enriches diagnostic accuracy, and X-ray subtypes such as computed, digital, and fluoroscopic radiography cater to diverse clinical workflows.

Examining delivery modes, cloud-based models are rapidly displacing traditional on-premise deployments, offering scalable storage and analytics capabilities with minimal upfront investment. Organizations that require strict data control continue to invest in on-premise solutions, while web-based platforms offer a hybrid approach, balancing flexibility with security. Application-specific segmentation further underscores varied adoption patterns: enterprise and modular PACS solutions enable large networks to manage imaging assets efficiently, order management and scheduling modules within RIS streamline operational throughput, and clinical versus enterprise VNAs facilitate long-term archival and cross-institutional image sharing.

End user diversity also informs tailored service models. Clinics leverage agile, cost-effective teleradiology packages to augment local expertise without significant capital outlay. Diagnostic centers capitalize on high-throughput imaging volumes by integrating cloud-native analytics and AI triage tools. Hospitals demand comprehensive, enterprise-grade solutions that seamlessly integrate with electronic health records, support multidisciplinary collaboration, and adhere to stringent regulatory mandates. These segmentation insights illuminate where investment and innovation yield the greatest strategic returns.

This comprehensive research report categorizes the Smart Teleradiology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Modality

- Delivery Mode

- Application

- End User

Examining the Regional Dynamics Driving Adoption of Smart Teleradiology Solutions Across the Americas Europe Middle East Africa and Asia Pacific Territories

Regional dynamics exert a profound influence on smart teleradiology adoption, as infrastructure maturity, regulatory frameworks, and clinical practices vary across territories. In the Americas, advanced network capabilities and well-established telehealth policies have fostered rapid deployment of remote imaging services. Reimbursement mechanisms in healthcare systems reward timely diagnostics, driving uptake among both urban medical centers and rural outreach programs. Key innovations such as AI-driven triage and mobile scanning units address provider shortages in remote areas, further broadening the market footprint.

The Europe, Middle East, and Africa region presents a highly heterogeneous landscape. Western European countries benefit from robust regulatory oversight, standardized interoperability, and progressive telemedicine guidelines, resulting in mature smart teleradiology ecosystems. Conversely, emerging markets across the Middle East and Africa are characterized by infrastructure disparities and evolving reimbursement pathways, yet substantial investment in digital health initiatives signals significant upside potential. Collaborative pilot programs and cross-border partnerships serve as catalysts for growth in these jurisdictions.

Asia-Pacific stands out as the fastest-growing region, propelled by government-led digital health strategies, expanding private healthcare infrastructure, and a rising prevalence of chronic diseases requiring imaging diagnostics. Nations such as Japan, South Korea, and Australia exhibit high levels of technology penetration and reimbursement support, while emerging markets including India and Southeast Asia demonstrate robust demand for cost-effective imaging solutions. The region’s emphasis on localized manufacturing and public–private collaborations further accelerates the diffusion of smart teleradiology capabilities across diverse healthcare settings.

This comprehensive research report examines key regions that drive the evolution of the Smart Teleradiology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leaders and Innovators in Smart Teleradiology Who Are Shaping Service Delivery Models Driving Technological Advancements and Strategic Collaborations

Leading stakeholders in the smart teleradiology space have intensified investments in AI algorithms, cloud infrastructures, and collaborative partnerships to differentiate their offerings. One prominent player has leveraged proprietary deep learning models to enhance lesion detection and streamline report generation, securing strategic alliances with major hospital networks to validate performance in real-world clinical environments. Another innovator has introduced a fully integrated cloud-native imaging platform that consolidates PACS, RIS, and VNA functionalities, appealing to enterprise health systems seeking unified digital workflows.

Collaborative ventures between imaging hardware manufacturers and software providers have also gained momentum. In one case, a renowned medical imaging company partnered with a tech-driven analytics firm to embed AI modules directly within imaging equipment, enabling on-device processing and reducing latency in remote interpretation. Similarly, a digital health specialist forged distribution agreements with regional service providers to deliver turnkey teleradiology solutions tailored for emerging markets, combining localized support with standardized software capabilities.

These competitive maneuvers underscore a broader industry trend toward ecosystem-driven innovation. By integrating advanced analytics, seamless interoperability, and service-oriented delivery models, leading companies are establishing differentiated value propositions that address evolving clinical and operational requirements. As market dynamics intensify, the ability to forge strategic partnerships and continuously refine technology roadmaps will be critical for sustaining leadership in smart teleradiology.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Teleradiology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert Group

- Amazon Web Services Inc.

- Canon Medical Systems Corporation

- Carestream Health Inc.

- Everlight Radiology

- Fujifilm Holdings Corporation

- GE Healthcare

- Google LLC

- IBM Corporation

- IBM Watson Health

- Konica Minolta Inc.

- NVIDIA Corporation

- ONRAD Inc.

- Philips Healthcare

- RadNet Inc.

- RamSoft Inc.

- Siemens Healthineers AG

- StatRad LLC

- TeleDiagnosys Services Pvt. Ltd.

- Teleradiology Experts Inc.

- Teleradiology Solutions LLC

- USARAD Holdings Inc.

Formulating Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends Enhance Operational Efficiency and Drive Sustainable Growth Initiatives

Industry leaders must adopt a multifaceted strategy to capitalize on emerging trends and maintain competitive differentiation in the smart teleradiology market. First, prioritizing robust AI integration across the diagnostic workflow will be essential. Providers should collaborate with specialized algorithm developers to embed advanced triage, measurement, and detection capabilities within their platforms, thereby enhancing diagnostic accuracy and reducing turnaround times.

Secondly, optimizing cloud infrastructure and data management practices is paramount. Organizations need to evaluate hybrid deployment models that balance the agility of cloud-based services with on-premise safeguards for sensitive clinical data. Implementing scalable storage architectures and leveraging containerized applications will facilitate rapid provisioning of resources and support seamless upgrades.

Thirdly, forging localized partnerships can mitigate supply chain disruptions and navigate regulatory complexities introduced by tariffs and import restrictions. By aligning with domestic manufacturers and regional service integrators, companies can ensure continuity of hardware availability and tailor solutions to meet specific market requirements. Coupled with comprehensive training programs and remote support services, this approach fosters stronger customer relationships and ensures high adoption rates.

Lastly, maintaining rigorous focus on interoperability standards and data security compliance will underpin long-term success. Engaging with industry consortia to shape emerging protocols and investing in advanced encryption and identity management tools will safeguard patient information and foster trust among stakeholders. Through these actions, industry leaders can drive sustainable growth, unlock new market segments, and deliver superior value in the evolving landscape of smart teleradiology.

Detailing the Robust Research Methodology Employed to Analyze Market Drivers Restraints Opportunities and Challenges Informing the Comprehensive Teleradiology Study Framework

The research methodology underpinning this study combines rigorous primary and secondary research processes to ensure comprehensive and unbiased insights. Primary research involved in-depth interviews with industry experts, including radiology department heads, IT directors, and clinical informatics specialists, to capture firsthand perspectives on adoption drivers, operational challenges, and future priorities. These qualitative inputs were complemented by workshops facilitating collaborative scenario mapping, enabling the triangulation of expert opinions with real-world implementation experiences.

Secondary research encompassed an exhaustive review of publicly available sources, such as peer-reviewed journals, regulatory publications, industry white papers, and technical standards documentation. Proprietary data repositories and conference proceedings provided additional granularity on technological advancements and competitive strategies. Data from health authorities and trade associations were meticulously cross-checked to validate market trends and regulatory developments across key regions.

Quantitative analysis employed a hybrid bottom-up and top-down approach to model market structures and service ecosystems. Device-level adoption rates and service utilization metrics were synthesized with macroeconomic indicators to contextualize regional dynamics. Rigorous data validation involved multiple rounds of internal and external review, ensuring consistency and accuracy. The methodology’s transparent documentation facilitates reproducibility and supports stakeholders in understanding the basis for key findings and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Teleradiology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Teleradiology Market, by Modality

- Smart Teleradiology Market, by Delivery Mode

- Smart Teleradiology Market, by Application

- Smart Teleradiology Market, by End User

- Smart Teleradiology Market, by Region

- Smart Teleradiology Market, by Group

- Smart Teleradiology Market, by Country

- United States Smart Teleradiology Market

- China Smart Teleradiology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding Insights That Synthesize the Strategic Imperatives Opportunities and Risks Characterizing the Evolving Smart Teleradiology Market in a Post Tariff Environment

In conclusion, the smart teleradiology market stands at a pivotal juncture, propelled by technological advancements in AI, cloud computing, and interoperability protocols that are reshaping diagnostic imaging workflows. Stakeholders must navigate the evolving landscape of tariffs, regulatory frameworks, and regional disparities to unlock the full potential of remote diagnostics. Key segmentation insights reveal distinct growth trajectories across modalities, delivery modes, applications, and end users, underscoring the need for tailored solutions that address specific clinical and operational requirements.

As market dynamics continue to evolve, organizations that adopt agile sourcing strategies, invest in strategic partnerships, and uphold rigorous compliance standards will be best positioned to capitalize on emerging opportunities. The confluence of data-driven analytics, innovative service models, and a patient-centric ethos will define the next generation of teleradiology solutions, delivering enhanced efficiency, improved clinical outcomes, and broader access to quality care across the globe.

Encouraging Engagement with Ketan Rohom Associate Director Sales and Marketing to Secure Access to the Comprehensive Smart Teleradiology Market Research Report and Insights

For decision makers seeking to stay at the forefront of smart teleradiology innovation and drive impactful outcomes in their organizations, engaging directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, provides an unparalleled opportunity. His depth of knowledge and strategic insights, honed through extensive collaboration with healthcare systems, imaging centers, and technology providers, ensure that you receive personalized guidance tailored to your unique challenges and objectives.

By securing the comprehensive market research report through this direct channel, you gain immediate access to granular analysis of market dynamics, detailed segmentation insights, and forward-looking recommendations that can inform capital investments, partnership strategies, and product development roadmaps. Ketan’s consultative approach ensures that you can translate these findings into actionable plans that optimize operational efficiency, enhance patient care, and capture emerging market opportunities.

Reach out to Ketan today to discuss how the intelligence within this report can be leveraged to strengthen your competitive positioning in the rapidly evolving smart teleradiology space. His expert guidance and proven track record will support your leadership team in making informed decisions that align with both immediate priorities and long-term strategic imperatives. Take the next step toward transforming imaging services by securing this essential resource and partnering with a trusted advisor.

- How big is the Smart Teleradiology Market?

- What is the Smart Teleradiology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?