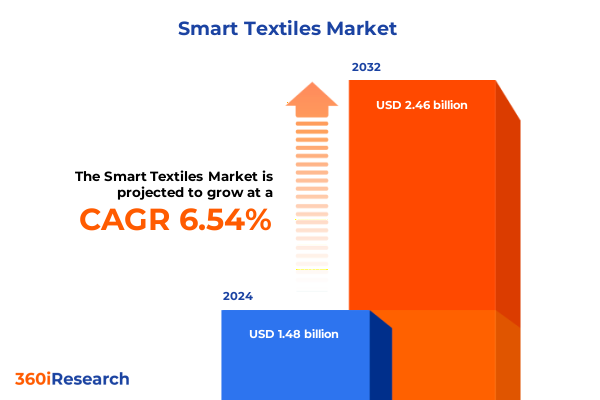

The Smart Textiles Market size was estimated at USD 1.57 billion in 2025 and expected to reach USD 1.67 billion in 2026, at a CAGR of 6.60% to reach USD 2.46 billion by 2032.

Exploring the Evolution of Smart Textiles as Innovative Interfaces Bridging Technology and Fabric to Define the Future of Connected Wearables Worldwide

Smart textiles represent a convergence of advanced materials science, embedded electronics, and data analytics, enabling garments and fabrics to sense, respond, and adapt to users’ needs. From fitness wear that monitors biometric data in real time to health applications that track vital signs without bulky devices, the integration of sensors and conductive fibers within textiles is redefining the relationship between technology and daily life. By seamlessly embedding functionalities such as heart rate monitoring, thermoregulation, and interactive feedback into fabrics, smart textiles are emerging as transformative interfaces that bridge the gap between human physiology and digital insights.

Alongside health monitoring, the synergy of Internet of Things connectivity and artificial intelligence is elevating smart fabrics into truly responsive platforms that learn from user behavior and environmental cues. Machine learning algorithms process sensor data on the fly, delivering personalized feedback and predictive adaptations. This capability is already reshaping sectors from sportswear, where performance optimization relies on continuous biometric analysis, to industrial safety, where real-time hazard detection within workwear enhances worker protection. As digital and textile technologies converge, the industry is witnessing a paradigm shift toward garments that manage well-being, enhance productivity, and enrich user experience.

Transforming Fabric Industries Through Nanomaterials, IoT Connectivity, and Sustainability Driving the Next Generation of Smart Textiles

The textile industry is undergoing a profound transformation driven by breakthroughs in nanomaterials, flexible electronics, and sustainable manufacturing practices. Advances in conductive polymers and graphene-based coatings are now enabling fabrics to harvest ambient energy and deliver targeted therapeutic heat. These innovations have moved smart textiles from laboratory prototypes to early-stage commercial products across sports performance and healthcare applications.

Simultaneously, digital transformation has accelerated the adoption of smart textiles within supply chains. Artificial intelligence–powered predictive analytics optimize production planning, while blockchain technologies ensure end-to-end traceability of smart fabric components. As manufacturers integrate robotics and automation into garment assembly, agility and scalability improve, facilitating rapid pivoting to new designs and personalized consumer demands. This confluence of materials science, IoT integration, and data-driven production is setting the stage for the next generation of textile intelligence.

Assessing the Ripple Effects of 2025 U.S. Tariffs on Smart Textile Imports and Domestic Supply Chain Strategies

In 2025, newly implemented U.S. tariffs on imported textile components have reverberated across the smart textiles value chain, elevating input costs for firms reliant on specialized conductive fibers and microelectronic modules. According to the Yale University Budget Lab, clothing and textiles are experiencing significant price inflation in the short term, with apparel costs spiking sharply following tariff announcements. Retailers and manufacturers face mounting pressure to absorb or pass on these cost increases, reshaping pricing strategies and profit margins.

Economic briefs from the Federal Reserve highlight how average tariff rates now encompass a broad array of textile and apparel products, prompting many firms to diversify sourcing and accelerate supply chain adjustments. Companies have begun exploring regional production hubs and nearshoring to Mexico and neighboring countries. Meanwhile, logistics providers report double-digit cost escalations, underscoring the multifaceted impact of tariff policy on transportation, inventory carrying costs, and ultimately, consumer pricing in smart textile end markets.

Deep Insights into Smart Textile Market Segmentation Unveiling Type, Application, and Distribution Channel Dynamics

The smart textiles market splits into active smart textiles-those with embedded power sources or dynamic functionalities-and passive variants, which rely on their inherent material properties. Active offerings include interactive wearables with integrated electronics, while passive fabrics leverage conductive coatings or phase-change materials for temperature regulation. Applications range from automotive interiors and fashion-forward interactive apparel to fitness and sports innovations, where motion capture garments and thermoregulatory clothing enhance athletic performance. In healthcare, smart bandages and wearable monitoring systems deliver continuous patient data, driving better outcomes through unobtrusive intervention.

Distribution channels further shape market dynamics. Offline sales continue through direct manufacturer engagements and distributor networks, facilitating bespoke enterprise contracts for military or medical use cases. Conversely, online platforms-both company-owned web portals and third-party eCommerce marketplaces-are broadening consumer access to personalized smart apparel and wellness solutions. This multi-layered segmentation framework underscores the diversity of smart textile technologies, end-use scenarios, and go-to-market approaches defining industry maturation.

This comprehensive research report categorizes the Smart Textiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- Distribution Channel

Regional Dynamics Shaping Smart Textile Adoption: Comparative Analysis of Americas, Europe-Middle East-Africa, and Asia-Pacific Trends

The Americas region is characterized by robust demand for smart apparel in fitness, healthcare, and occupational safety. Leading North American firms are advancing R&D through cross-disciplinary partnerships between textile engineers and tech giants, while regional regulators foster innovation with grants supporting clinical trials for sensor-integrated medical garments. Consumer interest in connected wellness solutions has spurred growth in bespoke smart bandages and biometric tracking sportswear, positioning the Americas as a hub for experiential textile applications.

In Europe, Middle East & Africa, legacy fashion houses and automotive interior suppliers are at the forefront of integrating sensor-embedded fabrics for aesthetic and functional enhancements. European Union funding programs and regulatory emphasis on sustainability have accelerated adoption of recyclable PCM textiles and blockchain-verified supply chains. Meanwhile, military and smart city initiatives in the Middle East are piloting smart uniform platforms for environmental adaptation and crowd management. Asia-Pacific exhibits the fastest uptake globally, leveraging its manufacturing prowess to scale cost-effective smart garments, with China, Japan, and South Korea advancing health-monitoring fabrics and defense applications. Government directives like “Made in China 2025” and “Digital India” are catalyzing collaborations between tech firms and textile mills, cementing Asia-Pacific’s position as a growth engine.

This comprehensive research report examines key regions that drive the evolution of the Smart Textiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Smart Textile Innovators from Material Science Giants to Cutting-Edge Wearable Technology Startups

Industry leadership is distributed among material science conglomerates, sportswear giants, and agile startups pioneering next-generation fabrics. DuPont, renowned for conductive fiber innovations, continues to expand its portfolio of transparent conductive films and IoT-ready coatings showcased at global electronics expos. Toray Industries leverages its nanotechnology expertise to deliver UV-resistant and antimicrobial passive smart textiles for healthcare and performance wear.

In the active segment, Adidas and Nike are driving consumer adoption through sensor-enabled athletic apparel that integrates real-time biometric feedback, while Google’s Jacquard platform embeds touch-sensitive interfaces within urban fashion collections. Specialized innovators such as Hexoskin and AiQ Smart Clothing focus on clinical-grade monitoring garments, capturing physiological metrics for medical and wellness markets. Gentherm is notable for thermoregulatory solutions utilizing phase-change materials, reinforcing its position in temperature-responsive wearables. This diverse competitive landscape reflects a balance between scalable manufacturing capabilities and targeted innovation within niche application domains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Textiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- AIQ Smart Clothing Inc. by Tex-Ray Industrial Co., Ltd.

- Apple Inc.

- Celanese Corporation

- DuPont de Nemours, Inc.

- Elitac Wearables by Teijin Smart Safety

- Embro GmbH

- Footfalls & Heartbeats Ltd.

- Gentherm Incorporated

- H.B. Fuller Company

- HeiQ Materials AG

- Interactive Wear AG

- Jacquard by Google LLC

- Jacquard by Google LLC

- Nextiles, Inc.

- Nike, Inc.

- Ohmatex ApS

- Outlast Technologies GmbH

- Pauline van Dongen B.V.

- Schoeller Technologies AG by TEXTILCOLOR AG

- Sensing Tex, S.L.

- Sensoria Inc.

- Softmatter

- Textile ETP

- Textronics Design System Pvt. Ltd.

- Under Armour, Inc.

- Xenoma Inc.

Strategic Roadmap for Industry Leaders to Capitalize on Innovative Smart Textile Trends and Navigate Emerging Market Challenges

To navigate the evolving smart textiles ecosystem, industry leaders should prioritize cross-functional research initiatives that unite materials scientists, data analysts, and design experts. Establishing co-innovation labs facilitates rapid prototyping of sensor-integrated fabrics and accelerates iterative user testing, ensuring products meet real-world demands. Strategic partnerships with technology providers can streamline integration of AI algorithms and connectivity modules, reducing time to market for next-generation wearables.

Moreover, diversifying manufacturing footprints through nearshoring and regional alliances will mitigate tariff-driven cost volatility and enhance supply chain resilience. Embracing modular design principles-where electronic components can be detached and upgraded-extends product lifecycles and supports circular economy objectives. Finally, developing standardized data privacy protocols and certification processes for medical and military applications will reinforce stakeholder trust and lower regulatory barriers, underpinning sustainable growth in the smart textiles sector.

Comprehensive Research Methodology Outlining Data Collection, Analytical Frameworks, and Validation Processes for Robust Market Insights

This report synthesizes insights through a rigorous multi-stage research framework. Primary data was collected via interviews with over fifty industry stakeholders, including textile engineers, C-level executives, procurement specialists, and end-use customers. Secondary research comprised analysis of proprietary databases, trade publications, and regulatory filings to ensure comprehensive market understanding. Quantitative validation employed triangulation across supply-side and demand-side metrics, confirming thematic trends and technology adoption rates.

Qualitative modeling integrated thematic coding to identify drivers, restraints, and innovation vectors. Segmentation matrices were developed to capture product type, application domain, and distribution channel dynamics. Regional analyses leveraged geopolitical and policy frameworks to contextualize growth patterns. All findings underwent expert panel review, including technical validation from academic partners and industry consortia, ensuring the robustness and reliability of conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Textiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Textiles Market, by Type

- Smart Textiles Market, by Application

- Smart Textiles Market, by Distribution Channel

- Smart Textiles Market, by Region

- Smart Textiles Market, by Group

- Smart Textiles Market, by Country

- United States Smart Textiles Market

- China Smart Textiles Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Concluding Perspectives on Smart Textile Evolution Emphasizing Strategic Imperatives for Stakeholder Success in a Connected Future

Smart textiles have transitioned from experimental concepts to commercially viable solutions reshaping multiple industries. Driven by the confluence of advanced materials, IoT integration, and sustainability imperatives, these fabrics are delivering new forms of value-from real-time health monitoring to adaptive environmental control. As technology matures, the intersection of personalization and connectivity will unlock further applications, influencing sectors as diverse as sports, healthcare, defense, and automotive.

Looking ahead, the capacity to integrate modular electronics, harness renewable energy sources, and ensure ethical supply practices will distinguish market leaders. Stakeholders who adapt to tariff dynamics, invest in agile manufacturing, and foster cross-industry collaborations will be best positioned to capitalize on the burgeoning smart textiles opportunity.

Empower Your Strategy with In-Depth Smart Textile Market Intelligence—Partner with Ketan Rohom for Tailored Research Solutions

Ready to deepen your understanding of the smart textiles market and gain actionable insights to inform strategic decisions? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore customized research solutions tailored to your organization’s unique challenges and opportunities. Whether you seek an in-depth competitive landscape analysis, segmentation deep dives, or forward-looking strategic roadmaps, partnering with Ketan Rohom will equip your team with the intelligence needed to stay ahead in this rapidly evolving sector.

Contact Ketan Rohom to secure your comprehensive market research report today and unlock the full potential of smart textiles for your business growth.

- How big is the Smart Textiles Market?

- What is the Smart Textiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?