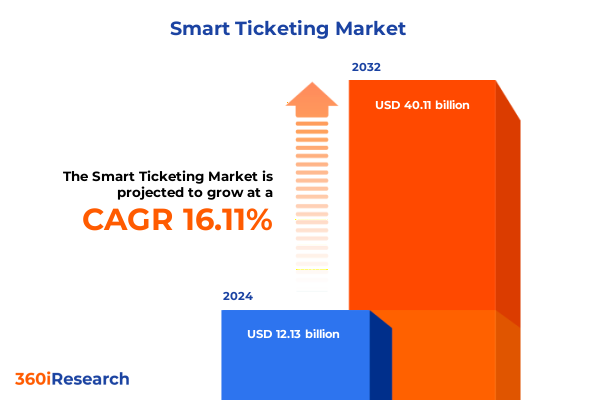

The Smart Ticketing Market size was estimated at USD 14.07 billion in 2025 and expected to reach USD 16.33 billion in 2026, at a CAGR of 16.13% to reach USD 40.11 billion by 2032.

Revolutionary strides in smart ticketing are redefining customer experiences and operational efficiency across transportation and events industries

The rapid transition towards digital ecosystems has catalyzed a fundamental shift in the way tickets are issued, validated, and managed across multiple sectors. Incorporating sophisticated technologies such as contactless payments, mobile applications, and cloud-based platforms, the smart ticketing paradigm is elevating the customer experience while creating more sustainable and data-driven operational models. What once relied primarily on paper tickets and manual processing is now evolving into seamless, secure, and real-time systems that integrate effortlessly with broader mobility and event infrastructures.

Amidst these changes, stakeholders across transportation networks, event venues, and parking facilities are facing growing expectations for convenience, personalization, and interoperability. Meanwhile, regulatory frameworks continue to advance, pressing solution providers and end users to implement robust security measures, adhere to privacy regulations, and ensure accessibility. The convergence of consumer demand, regulatory oversight, and technological innovation is shaping a truly transformative era in ticketing, laying the groundwork for more resilient and agile business models.

Emerging digital innovations are converging to transform hardware, software, and service ecosystems within the smart ticketing landscape

In recent years, an array of transformative shifts has propelled the smart ticketing landscape from niche applications to mainstream adoption. The proliferation of smartphones equipped with near-field communication has empowered passengers and attendees to purchase, store, and validate tickets within a single digital wallet. This evolution has prompted solution providers to reimagine hardware, moving beyond traditional ticket vending machines and paper validators toward integrated handheld devices and mobile point-of-sale terminals.

Concurrently, service offerings have expanded to encompass not only system deployment but also consulting on user experience design, integration with legacy infrastructure, and ongoing support and maintenance. In turn, software modules have matured to include sophisticated fare management algorithms, real-time payment processing, and advanced reporting and analytics capabilities that mine usage data for actionable insights. Crucially, platforms are being architected to support hybrid deployments that combine cloud scalability with on-premise data sovereignty, ensuring both agility and compliance.

The convergence of these factors has produced a landscape where interoperability and open standards are becoming paramount. Industry consortia are working to harmonize communication protocols, enabling seamless transfers between public transport networks, parking operators, and event venues. As a result, the concept of mobility-as-a-service has gained traction, with integrated ticketing serving as a cornerstone for unified travel experiences.

United States 2025 tariff adjustments on electronic components have reshaped procurement strategies and cost models across the smart ticketing sector

In 2025, the United States imposed a series of tariffs targeting imported electronic components and specialized hardware used in smart ticketing systems. These measures, aimed at promoting domestic manufacturing and safeguarding critical supply chains, have had a cumulative impact on vendors, integrators, and end users. Particularly affected are handheld validation devices, ticket vending machines, and the modular components underpinning next-generation validators, which now face higher input costs and elongated lead times.

As industry participants adjust to these shifts, some have accelerated efforts to localize production and forge partnerships with domestic component manufacturers. Meanwhile, service providers have been compelled to revisit contractual terms, factoring in tariff-related cost variances and potential delivery delays. For software-centric solutions, the effect has been more nuanced; while the core codebase remains unaffected, the deployment of on-premise devices that interface with hardware modules has seen a recalibrated total cost of ownership. This has spurred renewed interest in cloud-first models that minimize reliance on tariff-exposed equipment.

These developments underscore the importance of agile procurement strategies, diversified supplier networks, and proactive dialogue with policymakers. By monitoring tariff schedules and fostering collaborative supply chain ecosystems, market participants can mitigate risk and maintain project timelines. Ultimately, the trajectory of tariff policy will continue to shape capital expenditure decisions and technology roadmaps across the smart ticketing domain.

Deep dive into solution, end user, distribution channel, ticket type, and deployment spectra reveals critical market differentiation

A granular view of the market reveals differentiated dynamics across solution categories, where hardware spans handheld devices, ticket vending machines, and validators that serve as the physical touchpoints for end users. In parallel, consulting, integration, and support and maintenance services underpin successful deployments by ensuring seamless interoperability and sustained performance. Software offerings are equally diverse, encompassing fare management modules that calculate and enforce complex pricing rules, payment processing engines that enable multi-channel acceptance, and reporting and analytics platforms that unlock strategic insights from transaction data.

End users exhibit distinct needs, with event organizers demanding flexible ticketing schemes to accommodate large-scale venues, parking operators prioritizing streamlined access control to maximize throughput, public transport operators seeking real-time passenger analytics to optimize capacity, and toll operators integrating dynamic pricing to regulate traffic flow. Distribution channels also play a pivotal role, as tickets are delivered via agent outlets for traditional audiences, mobile apps for tech-savvy consumers, ticket vending machines for on-site convenience, and web portals for purchase flexibility.

Moreover, ticket types such as concessions, multi-ride bundles, season passes, and single-ride fares cater to varying usage patterns and demographic segments. Deployment models further influence solution architecture, with cloud platforms offering rapid scalability, hybrid approaches balancing local control with elastic resources, and on-premise systems providing maximum data sovereignty. These layered segmentation lenses highlight the importance of aligning strategic priorities with the unique demands of each market slice.

This comprehensive research report categorizes the Smart Ticketing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution

- Ticket Type

- End User

- Distribution Channel

- Deployment Type

Unearthing how regional priorities in Americas, EMEA, and Asia-Pacific drive diverse innovation and adoption trajectories

Regional dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific underscore distinct drivers of smart ticketing adoption. In the Americas, the focus is on modernizing legacy transit networks in densely populated urban corridors and enriching live entertainment venues with contactless and mobile ticketing options that enhance patron satisfaction. Regulatory momentum toward digital identity frameworks and open payment systems further accelerates growth, particularly in metropolitan hubs.

Within Europe, Middle East & Africa, interoperability and cross-border harmonization are paramount, with initiatives aimed at enabling seamless travel across national rail networks and international bus services. Public-private partnerships are facilitating pilot programs that integrate fare capping, loyalty schemes, and biometric validation. Meanwhile, emerging markets in the Middle East and Africa are leapfrogging traditional infrastructure by adopting cloud-native ticketing platforms that require minimal on-site hardware investment.

In Asia-Pacific, the emphasis is on high-volume transport systems and large-scale events that demand ultra-high reliability and low-latency validation. Governments and operators are collaborating on national standards for smart cards and mobile wallets, while technology vendors innovate around AI-driven analytics to predict demand spikes and optimize service scheduling. Across all regions, sustainable practices such as paperless tickets and energy-efficient validators are gaining prominence as environmental imperatives.

This comprehensive research report examines key regions that drive the evolution of the Smart Ticketing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Vendor differentiation through integrated platforms, modular software, and service-led innovation shaping competitive dynamics

Leading solution providers are distinguishing themselves through technology specialization, strategic alliances, and service excellence. Some have built robust end-to-end platforms combining proprietary hardware with cloud-based fare management systems, enabling a unified interface for operators. Others focus on bespoke integration services, tailoring middleware solutions that bridge new digital tools with entrenched legacy architectures. Partnerships between hardware OEMs and software innovators are yielding compact, energy-efficient validators optimized for high-frequency use.

Concurrently, pure-play software vendors are carving niches by offering modular components-such as dynamic pricing engines or real-time analytics dashboards-that can be easily integrated into broader ecosystems. These companies often collaborate closely with consulting firms to deliver tailored deployment roadmaps, ensuring that customization aligns with operational goals. On the services front, specialist consultancies are differentiating their offerings by embedding data science capabilities into support contracts, transforming routine maintenance engagements into opportunities for performance optimization.

Collectively, these company-level approaches illustrate a competitive environment where agility and innovation are rewarded. Decision-makers must evaluate vendor roadmaps, partnership networks, and domain expertise to determine the optimal fit for their unique operational contexts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Ticketing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atos SE

- Cammax Ltd.

- Conduent Inc.

- Confidex Ltd.

- Cubic Corporation

- Fujitsu Limited

- Giesecke+Devrient GmbH

- INIT Innovation in Traffic Systems SE

- INIT Innovations in Traffic Systems GmbH

- NEC Corporation

- Rambus Inc.

- Scheidt & Bachmann GmbH

- Thales Group

- Vix Technology Pty Ltd

Proactive strategies in procurement, analytics, cloud-first deployment, and sustainability empower market leadership

Industry leaders must adopt a proactive stance to navigate this complex landscape effectively. First, cultivating flexible supplier ecosystems that balance domestic and international sourcing can mitigate tariff exposure and supply chain disruptions while ensuring access to cutting-edge hardware components. Equally important is the prioritization of open APIs and interoperability standards to future-proof systems against evolving technology stacks and emerging mobility ecosystems. Collaborative participation in industry consortia will accelerate harmonization and unlock synergies with public sector initiatives.

Second, operators should invest in advanced data analytics capabilities by integrating reporting platforms with AI-driven modules that anticipate demand fluctuations, optimize pricing strategies, and personalize user experiences. Embedding analytics expertise within support and maintenance contracts can transform reactive troubleshooting into strategic improvement cycles. Moreover, a disciplined shift toward cloud-first architectures should be complemented by hybrid deployment pilots, allowing organizations to balance agility, performance, and regulatory compliance.

Finally, executive teams need to embed sustainability and inclusivity into ticketing strategies by embracing paperless options, energy-efficient devices, and accessible interface designs that serve all demographic segments. By aligning technology roadmaps with broader ESG goals, organizations will enhance public perception, foster stakeholder trust, and unlock potential financing advantages. Acting decisively on these recommendations will empower leaders to capture the full potential of the smart ticketing evolution.

Robust primary and secondary inquiry methods combined with qualitative analysis and triangulation ensure credible market insights

This report is grounded in a comprehensive research framework that integrates primary interviews with technology executives, operator decision-makers, and policy influencers, ensuring a multifaceted perspective on market dynamics. Primary research encompassed in-depth discussions to validate real-world deployment challenges, technology adoption barriers, and emerging innovation priorities. Secondary research included systematic review of regulatory publications, industry whitepapers, and vendor technical documentation to contextualize findings within broader market trends.

Quantitative data collection focused on capturing thematic insights rather than numeric projections, emphasizing qualitative assessments of solution capabilities, service quality, and partnership ecosystems. Triangulation methods were employed to cross-verify information from multiple sources, enhancing credibility and reducing potential biases. A rigorous editorial review process further ensures that analysis remains current, balanced, and relevant, with ongoing monitoring of policy updates and technology breakthroughs integrated up to the publication date.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Ticketing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Ticketing Market, by Solution

- Smart Ticketing Market, by Ticket Type

- Smart Ticketing Market, by End User

- Smart Ticketing Market, by Distribution Channel

- Smart Ticketing Market, by Deployment Type

- Smart Ticketing Market, by Region

- Smart Ticketing Market, by Group

- Smart Ticketing Market, by Country

- United States Smart Ticketing Market

- China Smart Ticketing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Convergence of innovation, regulation, and user demands sets the stage for next-generation smart ticketing excellence

The landscape of smart ticketing has entered a pivotal moment, where technological innovation, regulatory imperatives, and evolving user expectations converge to drive profound transformation. Organizations that align their strategic roadmaps with open standards, diversified partnerships, and sustainability objectives will outpace competitors and realize true operational excellence. By embracing cloud and hybrid deployment models, embedding analytics into routine operations, and proactively addressing supply chain risks, stakeholders can navigate complexity and unlock new value streams.

As the market continues to evolve, the ability to adapt quickly, collaborate across ecosystems, and maintain a customer-centric focus will determine long-term success. This report provides the foundational insights and actionable guidance leaders need to chart a confident course through the next wave of smart ticketing innovation.

Unlock unparalleled market intelligence by engaging with Ketan Rohom to acquire the definitive smart ticketing industry report

For a deeper dive into strategic insights, market dynamics, and deployment best practices, reach out directly to Ketan Rohom, who brings extensive expertise in sales and marketing leadership for market intelligence. His guidance will ensure organizations can leverage the nuanced findings of this report to drive innovation, optimize operational efficiency, and seize emerging opportunities. Engage with Ketan to secure your copy of the comprehensive smart ticketing market research report and position your organization ahead of the curve in this rapidly evolving landscape.

- How big is the Smart Ticketing Market?

- What is the Smart Ticketing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?