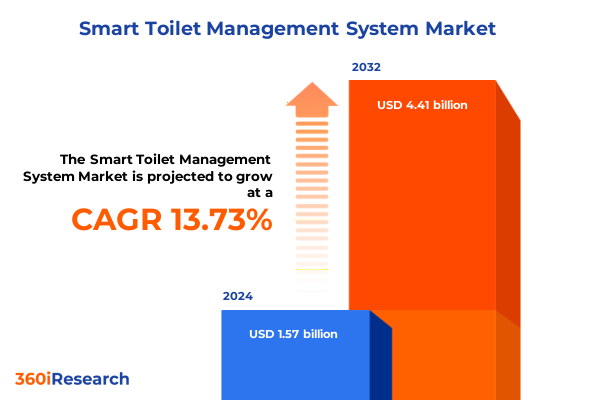

The Smart Toilet Management System Market size was estimated at USD 1.77 billion in 2025 and expected to reach USD 2.02 billion in 2026, at a CAGR of 13.88% to reach USD 4.41 billion by 2032.

Discover how next-generation smart toilet management solutions are redefining hygiene, operational efficiency, and user wellness across modern facilities

Smart toilet management systems have emerged as a pivotal innovation in restroom hygiene and operational efficiency, leveraging interconnected sensors, advanced analytics, and automated controls to transform traditional facilities into data-driven environments. From real-time monitoring of supply levels to intelligent occupancy detection, these solutions redefine the way facility teams maintain cleanliness and service quality. Integrating IoT-enabled dispensers and automated cleaning alerts, smart restroom platforms provide actionable insights that inform maintenance schedules, optimize labor allocation, and significantly reduce user complaints.

Moreover, leading manufacturers have infused these systems with personalized user experiences, such as touchless bidet functions, ambient lighting, and health-monitoring sensors that track water flow patterns and biomarker data. High-profile deployments by premium brands underscore the convergence of wellness, sustainability, and luxury in bathroom design. Dr. N.B. Mahesh Kumar’s research further highlights the integration of pH and turbidity sensors for early disease detection, illustrating the potential of smart toilets to serve as proactive health diagnostics tools within residential, commercial, and healthcare settings.

Uncover the revolutionary convergence of IoT connectivity, sustainability imperatives, and demographic dynamics transforming smart toilet management

The smart toilet management landscape is undergoing transformative shifts driven by the maturation of IoT connectivity. Modern systems now harness occupancy sensors, automated bowl-cleaning modules, and AI-driven analytics to capture data on restroom usage, water consumption, and supply status. These insights enable facility managers to preemptively address maintenance needs, streamline workflows, and enhance user satisfaction. Companies specializing in dispenser monitoring and fixture performance are pioneering seamless integrations across multiple locations, delivering centralized dashboards for actionable intelligence.

In parallel, sustainability mandates and water conservation regulations have intensified focus on resource-efficient solutions. Smart toilets equipped with dual-flush technologies, real-time leak detection, and dynamic flow controls are reducing water usage by responding precisely to usage patterns and environmental conditions. As environmental stewardship becomes a boardroom priority, facility leaders are investing in toilet management systems that align with organizational ESG commitments and deliver quantifiable reductions in operational costs and ecological impact.

Furthermore, demographic changes are reshaping product development and deployment strategies. The global population aged 60 and older is projected to reach 1.4 billion by 2030, driving demand for elderly-friendly restroom solutions with fall-detection seats, automated emergency alerts, and ergonomic design considerations. These features not only support aging-in-place initiatives but also expand opportunities within healthcare facilities, assisted living centers, and senior housing communities, reinforcing the role of smart toilets as integral components of age-inclusive infrastructure.

Examine the cascading effects of United States tariffs on smart toilet management components, sensor supply chains, and manufacturing cost structures

The United States maintains a complex tariff regime on imported electronics components, including semiconductors and IoT sensors, which are critical to smart toilet management systems. Recent proposals involve tariffs reaching up to 50% on select electronic imports, introducing cost pressures and supply risks across the value chain. Manufacturers sourcing control units and sensor modules internationally are preparing for potential duty escalations that could ripple through pricing structures and profitability margins.

In particular, the smart toilet sector’s reliance on precision sensors-such as pressure and motion detectors-exposes it to tariff-induced cost increases estimated between 4% and 6%. These levies can lead to higher end-user prices or compressed margins for system integrators and OEMs. Logistics complexities and extended lead times further challenge just-in-time inventory models, heightening the imperative for strategic planning and capital allocation decisions.

To mitigate these headwinds, industry leaders are diversifying sourcing strategies and establishing alternative manufacturing partnerships in regions like Vietnam, India, and Mexico. By reallocating procurement away from high-tariff jurisdictions, companies aim to stabilize input costs and secure continuity of supply. Additionally, selective tariff exemptions and negotiation of bilateral trade agreements are being pursued to preserve competitive positioning and support long-term investment in smart restroom innovation.

Gain deep insights into market segmentation by product type, application, installation type, and sales channels that drive smart toilet management adoption

Delving into product type segmentation reveals that hardware components underpin the smart toilet management market’s core value proposition. Actuators provide automated flushing and lid movement, while control units orchestrate system logic and user interfaces. The Sensors category, encompassing both motion and pressure detectors, offers real-time data on occupancy and usage patterns, enabling precise maintenance triggers and resource optimization. Complementing hardware, services such as analytics, maintenance, and support drive ongoing customer engagement and operational excellence. Analytics platforms collect and visualize performance metrics, maintenance teams execute proactive interventions, and support channels ensure rapid resolution of technical issues. The software spectrum ranges from cloud-based solutions that facilitate multi-site administration to on-premise deployments favored by privacy-conscious organizations.

Application segmentation highlights distinct requirements between commercial and residential environments. Within the commercial realm, healthcare facilities-spanning clinics and hospitals-demand stringent hygiene standards and fall-detection functionalities. Hospitality venues, including hotels and restaurants, prioritize seamless guest experiences and brand differentiation through luxury restroom amenities. Office properties, whether corporate headquarters or public buildings, seek to balance cost efficiency with employee well-being through occupancy-driven cleaning schedules. In residential settings, multi-family complexes leverage smart toilets to enhance communal sanitation and operational workflows, while single-family homeowners adopt advanced bidet features and health monitoring capabilities to enrich personal wellness.

Installation type segmentation distinguishes new construction projects from retrofit applications. Retrofit opportunities abound in commercial hospitality and office spaces where upgrading existing restroom infrastructure delivers rapid ROI and aligns with sustainability goals. Residential retrofits, whether in multi-family apartments or single-family homes, offer cost-effective pathways to smart technology adoption without extensive renovation. Finally, sales channel segmentation encompasses direct sales relationships and distribution networks. Direct engagements facilitate tailored solution design and integration, whereas offline retailers and online platforms extend reach and accessibility. Offline channels rely on dealer and wholesaler partnerships for localized support, while e-commerce outlets expedite procurement cycles.

This comprehensive research report categorizes the Smart Toilet Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sales Channel

- Application

- Installation Type

Explore the unique regional dynamics propelling smart toilet management growth across the Americas, EMEA, and Asia-Pacific

In the Americas, the United States leads smart toilet management adoption, fueled by high demand for premium hygiene solutions, robust smart home ecosystems, and a rapidly aging population that prioritizes wellness and autonomy. Healthcare providers in North America are integrating fall-detection and emergency alert features to enhance patient safety, while commercial real estate managers leverage smart restroom data to command rental premiums and bolster tenant satisfaction. Investment in water conservation programs at the state level further incentives deployment of intelligent dual-flush fixtures and automated leak detection systems.

Europe, the Middle East, and Africa maintain a strong market position, with Europe alone accounting for over 36% of global smart toilet revenue. Stringent water-efficiency regulations and consumer preferences for sustainable, technology-enriched bathroom products drive widespread adoption across Germany, the United Kingdom, and France. The Middle East’s luxury real estate developments in the UAE and Saudi Arabia are incorporating smart restrooms as hallmark amenities, while Africa’s urban centers are gradually embracing IoT-enabled sanitation solutions to address public health and infrastructure challenges.

Asia-Pacific is experiencing the fastest expansion, spearheaded by urbanization in Japan, China, and South Korea. Established brands headquartered in this region set global benchmarks for product innovation, including advanced bio-sensor integration and automated cleaning cycles. Emerging markets such as India are witnessing surging demand for luxury smart toilets, driven by rising disposable incomes and aspirational consumption patterns. Market entrants are ramping up localized production and distribution to capitalize on these growth opportunities, fueling a dynamic competitive landscape throughout the Asia-Pacific region.

This comprehensive research report examines key regions that drive the evolution of the Smart Toilet Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlight the leading smart toilet management system providers, their strategic differentiators, and rising challengers redefining the sector

The competitive landscape of smart toilet management systems is dominated by established bathroom fixture innovators that have integrated digital features into their product portfolios. TOTO leads in sensor-based hygiene and wellness functionalities, leveraging decades of experience in bi-directional bidet systems and advanced self-cleaning mechanisms. Kohler continues to invest in ambient user experiences, combining voice assistant integration, heated seating, and personalized cleansing cycles to differentiate its premium offerings. LIXIL Corporation capitalizes on its expansive distribution network and R&D capabilities to deliver tailored solutions for both residential and commercial projects.

Key European competitors such as Roca Sanitario and Geberit focus on modular hardware platforms that enable rapid customization and streamlined installation. Duravit has pursued collaborations with technology partners to integrate AI-driven maintenance alerts into its fixture lines. Hansgrohe has expanded its presence in emerging markets through strategic partnerships and localized manufacturing, reflecting the growing appetite for premium bathroom products in India and beyond. Additionally, GP PRO’s KOLO Smart Monitoring System has gained traction within commercial real estate and hospitality segments, with over 90% of property managers recognizing its ability to warrant rental premiums through consistently high hygiene standards.

Emerging technology startups are also reshaping the market by focusing on niche segments such as health-analytics toilets, odor-neutralization systems, and sensor-agnostic retrofit kits. Academic research initiatives are bridging the gap between manufacturing and data science, exploring novel biomarker detection methods and predictive maintenance algorithms that extend beyond standard restroom applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Toilet Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Standard Brands LLC

- CIS IT Solutions Private Limited

- Convergent Smart Technologies Private Limited

- Coway Co., Ltd.

- Duravit AG

- Faststream Technologies, Inc.

- Geberit AG

- Georgia-Pacific Consumer Products LP

- GWA Group Limited

- Jomoo Kitchen & Bath Co., Ltd.

- Kohler Co.

- LIXIL Corporation

- Overdrive IoT Private Limited

- PsiBorg Technologies Private Limited

- Qonda System Private Limited

- Roca Sanitario, S.A.

- SmartClean Technologies Pte. Ltd.

- TOTO Ltd.

- Villeroy & Boch AG

- VitrA Karo Sanitaryware A.Ş.

Implement strategic innovation, partnership, and supply chain initiatives to maximize smart toilet management market opportunities

Industry leaders are advised to prioritize R&D investments in advanced sensor modalities, such as ultrasonic occupancy detection and multi-parameter biomarker analysis, to differentiate their offerings and capture new revenue streams. Forming strategic alliances with AI analytics firms can expedite the development of predictive maintenance and usage-pattern forecasting capabilities, enabling smarter resource allocation and operational agility. Early adopters of these innovations will secure competitive advantage and establish migration paths for legacy customers seeking next-generation solutions.

Given the significant retrofit potential in both commercial and residential segments, companies should design modular upgrade packages that minimize installation complexity and capitalize on existing plumbing infrastructure. Tailoring solutions for healthcare facilities and hospitality venues-where stringent hygiene and ESG mandates intersect-can unlock high-value contracts and deepen long-term partnerships. Leveraging government incentives for water-efficient fixtures and aligning with aging-in-place initiatives will further enhance value propositions and expand total addressable markets.

Finally, supply chain diversification is crucial to mitigating tariff-related cost volatility. Establishing manufacturing footprints in alternative regions and negotiating tariff exemptions with trade authorities will help maintain stable pricing and safeguard margin performance. Continuous monitoring of trade policy developments and proactive scenario planning will equip organizations to navigate future disruptions and sustain growth momentum.

Explore the rigorous mixed-methods approach combining expert interviews, secondary research, and data validation underpinning our market analysis

This research utilizes a blended primary and secondary methodology to ensure comprehensive coverage and data reliability. Primary insights were gathered through structured interviews with facility managers, restroom technology integrators, and end-user representatives across key verticals, including healthcare, hospitality, and commercial real estate. These discussions informed qualitative understanding of adoption drivers, pain points, and future feature requirements.

Secondary research encompassed a thorough review of corporate filings, regulatory publications, patent databases, and industry thought leadership. Market activity was validated against public announcements, vendor white papers, and academic studies in the fields of IoT and sanitation engineering. Key performance indicators, such as water savings, maintenance frequency, and user satisfaction scores, were triangulated across multiple sources to ensure accuracy and consistency.

Quantitative data was synthesized using both top-down and bottom-up approaches. Segmentation modeling was applied to derive market component breakdowns by hardware, services, and software; geographic region; and installation type. Rigorous data validation procedures, including cross-checking against global sensor shipment statistics and sanitation infrastructure investment data, reinforced the robustness of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Toilet Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Toilet Management System Market, by Product Type

- Smart Toilet Management System Market, by Sales Channel

- Smart Toilet Management System Market, by Application

- Smart Toilet Management System Market, by Installation Type

- Smart Toilet Management System Market, by Region

- Smart Toilet Management System Market, by Group

- Smart Toilet Management System Market, by Country

- United States Smart Toilet Management System Market

- China Smart Toilet Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesize key trends and future pathways guiding the evolution of smart toilet management systems for informed strategic planning

Smart toilet management systems stand at the intersection of evolving technological capabilities and shifting user expectations. The convergence of IoT connectivity, sustainability imperatives, and demographic trends has created a fertile environment for innovation and growth. Companies that excel in delivering differentiated sensor technologies, seamless software experiences, and robust service models will lead the market and redefine restroom operations.

Regional dynamics present both challenges and opportunities. North America’s emphasis on wellness and water efficiency, Europe’s stringent sustainability regulations, and Asia-Pacific’s rapid urban expansion and aspirational consumption patterns will shape competitive strategies and investment decisions. Tariff volatility underscores the importance of agile supply chain management and strategic sourcing, while aging-driven feature requirements highlight the social impact potential of smart restroom solutions.

Looking ahead, integrating health diagnostics, AI-powered analytics, and interoperable platform architectures will be critical to sustaining momentum. As the market matures, cross-industry collaborations and standardization efforts will accelerate technology adoption, driving value for facility managers, end users, and public health stakeholders alike. This executive summary lays the groundwork for strategic planning and decision-making in a rapidly evolving landscape.

Accelerate your business outcomes by engaging with our Associate Director to acquire the definitive smart toilet management system market research report

Ready to elevate your strategic planning with comprehensive insights, get in touch with Ketan Rohom at 360i to secure your copy of the smart toilet management system market research report and uncover the data-driven advantage your organization needs to stay ahead

- How big is the Smart Toilet Management System Market?

- What is the Smart Toilet Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?