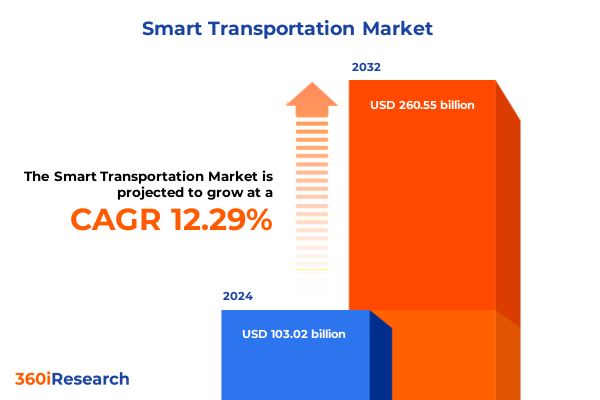

The Smart Transportation Market size was estimated at USD 114.74 billion in 2025 and expected to reach USD 128.11 billion in 2026, at a CAGR of 12.42% to reach USD 260.55 billion by 2032.

Navigating the Next-Generation Mobility Revolution Through Intelligent Connectivity, Sustainable Frameworks, and Strategic Infrastructure Evolution

The transportation industry is undergoing an unprecedented convergence of technological, environmental, and societal pressures that collectively define the next era of mobility. Urban centers around the globe are grappling with congestion, deteriorating air quality, and rising commuter expectations, prompting public and private stakeholders to adopt smarter, more efficient transportation frameworks. At the core of this transformation lies an ecosystem of interconnected hardware and software solutions that bring real-time visibility to traffic flows, optimize vehicle performance through predictive analytics, and integrate renewable energy sources in ways that enhance both sustainability and reliability. As this dynamic environment unfolds, executives must understand the fundamental shifts that drive strategic decision-making, ranging from evolving regulatory mandates to consumer demand for seamless, multimodal travel experiences.

Against this backdrop of rapid innovation, the assimilation of Internet of Things connectivity, artificial intelligence, and advanced telematics has empowered transportation networks to transcend legacy limitations. Charging infrastructure is no longer a static utility; it is a smart, grid-responsive asset that communicates with vehicle systems to balance load and reduce peak-hour strain. Likewise, intelligent urban pathways now incorporate embedded sensors and adaptive controls to manage pedestrian flows, bicycle lanes, and autonomous shuttle services in harmony with existing traffic. The proliferation of digital platforms for ticketing and parking management has further elevated the user experience, eliminating friction points and fostering a data-driven culture across municipal authorities and private operators alike.

In this executive summary, readers will be guided through the key market drivers, emerging trends, and strategic considerations that define the smart transportation landscape. By unpacking critical insights into supply-chain dynamics, segment performance, regional variances, and corporate strategies, this document equips decision-makers with the contextual clarity and foresight required to align investments, forge high-impact partnerships, and navigate regulatory complexities. The following sections illuminate each dimension of this evolving market, ensuring that organizations are prepared to capitalize on both near-term opportunities and long-term growth trajectories.

Exploring Disruptive Technological and Regulatory Converging Forces Reshaping Smart Mobility Ecosystems and User Experiences Across Urban Corridors

Over the past decade, a series of disruptive innovations and policy imperatives have converged to redefine what it means to move people and goods securely, efficiently, and sustainably. Legacy platforms rooted in internal combustion engines are ceding ground to electric powertrains, while advanced driver-assistance systems are progressively bridging the gap between manual operation and full autonomy. These technological currents are intersecting with regulatory currents: governments worldwide are enacting stringent emissions standards, incentivizing low-carbon vehicle fleets, and mandating open data protocols to facilitate seamless integration across disparate mobility providers.

Simultaneously, the rise of Mobility-as-a-Service (MaaS) concepts is reframing traditional notions of ownership. Consumers increasingly demand on-demand access to ride-hailing, micromobility, and multimodal trip planning via unified digital platforms. This shift necessitates robust back-end architectures capable of routing real-time data from navigation systems, telematics modules, and payment gateways. In parallel, public agencies are investing heavily in smart city infrastructure, embedding connectivity devices and urban sensing technologies into roadways, bridges, and parking facilities to orchestrate traffic flows and improve safety outcomes.

These cascading transformations compel industry participants to reassess standing strategies. Vehicle manufacturers are forging partnerships with technology firms to co-develop sensor suites and AI algorithms, while software providers are opening application programming interfaces to enable ecosystem interoperability. At the same time, municipal authorities are piloting data-driven congestion pricing schemes and deploying adaptive signal control to manage peak-hour demands. The collective momentum of these technological breakthroughs and policy frameworks is propelling the smart transportation sector toward an integrated, user-centric future-one in which data, connectivity, and cross-sector collaboration underpin every journey.

Assessing the Comprehensive Effects of Recent US Tariff Measures on Supply Chains, Component Sourcing, and Cost Structures in the Smart Transportation Sector

In 2025, the United States implemented a series of tariff enhancements targeting key components integral to smart transportation infrastructure. These measures, which encompass imported charging hardware, semiconductor devices, advanced sensors, and telematics modules, have triggered a strategic realignment among manufacturers and service providers. Companies reliant on heavily tariffed imports have encountered rising input costs, prompting a reassessment of global supply networks and an accelerated push toward local manufacturing capabilities.

The immediate consequence of these tariffs has been a recalibration of procurement strategies. Several leading original equipment manufacturers have initiated near-shoring initiatives to mitigate exposure to elevated duties, simultaneously investing in regional fabrication facilities to preserve margin integrity. Component suppliers, in turn, are exploring alternative sourcing corridors in Southeast Asia and Latin America, while dedicating engineering resources to develop tariff-exempt material substitutions and modular hardware architectures that can be more flexibly produced across diverse geographies.

Over the medium term, tariff-driven cost increases are beginning to find their way into contract negotiations and capital expenditure plans. Municipal agencies and commercial fleet operators are analyzing total cost of ownership with greater scrutiny, balancing upfront equipment premiums against long-term maintenance and energy savings. This heightened cost awareness is spurring innovation in financing models, such as usage-based pricing and public-private partnerships that distribute risk across stakeholders. Looking ahead, these market adaptations will influence global trade flows, incentivize investment in domestic production ecosystems, and shape the competitive landscape for years to come.

Uncovering Critical Segment Performance Drivers Across Components, Autonomy Levels, Applications, Industries, and Vehicle Types in Smart Mobility Solutions

A granular understanding of market segmentation reveals how distinct subsectors are evolving under the weight of technological disruption and shifting customer priorities. When examining the component dimension, hardware offerings-spanning charging stations, connectivity devices, intelligent urban pathways, sensors and controllers, and telematics systems-remain the foundational enablers of networked mobility. Meanwhile, service tiers segmented into managed solutions, professional engagements, and support and maintenance contracts are gaining traction as organizations seek end-to-end operational continuity. Overlaying these is a suite of software solutions, including integrated supervision platforms, parking management applications, ticketing management tools, and comprehensive traffic management systems, which collectively orchestrate field-level hardware into cohesive mobility networks.

Layered atop this component taxonomy is the level of autonomy spectrum, stretching from L1 through L5. Entry-level driver assistance functions have achieved mainstream deployment, while L3 conditional automation projects are progressing through regulatory approval phases in select markets. Higher-level autonomy research continues to attract investment, with pilot programs demonstrating the feasibility of fully autonomous shuttles and freight convoys in controlled environments.

From an application standpoint, the prominence of fleet management solutions-encompassing asset tracking and route optimization-underscores the pressing need for operational efficiency in logistics and last-mile delivery. Navigation systems, ranging from cloud-based platforms to in-dash and smartphone integrations, are evolving to support predictive routing and dynamic map updates that accommodate real-time traffic conditions. Telematics segments, divided into driver telematics and vehicle telematics, offer visibility into driver behavior and vehicle health, while traffic management subsystems focused on congestion management and signal control are foundational to alleviating bottlenecks in dense urban corridors.

End-use industries illuminate how demand drivers vary across stakeholder groups. Automotive manufacturers are embedding smart features at the point of assembly, logistics and freight companies are prioritizing telematics for cost management, public transportation operators are investing in integrated ticketing and passenger information systems, and urban planning agencies are leveraging data analytics to inform infrastructure investments. Finally, vehicle type segmentation highlights divergent adoption curves: commercial vehicles are often early adopters of telematics and electrification, passenger cars are pushing the envelope on advanced driver assistance and in-vehicle connectivity, and public transport vehicles are exploring vehicle-to-infrastructure collaborations to enhance service reliability and passenger safety.

This comprehensive research report categorizes the Smart Transportation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Level Of Autonomy

- Application

- End-Use Industries

- Vehicle Type

Analyzing Distinct Regional Dynamics and Growth Catalysts Shaping Smart Transportation Adoption Across the Americas, EMEA, and Asia-Pacific Territories

Regional market dynamics underscore how geopolitical, economic, and infrastructural factors are shaping the pace and direction of smart transportation adoption. In the Americas, the United States leads in terms of policy incentives for electric vehicles and funding for infrastructure upgrades, supported by robust private sector investment in charging networks and connected vehicle trials. Canada is methodically advancing smart corridor initiatives along key freight routes, while Latin American nations are leveraging public-private partnerships to pilot intelligent traffic control systems in major metropolitan areas.

Turning to Europe, the European Union’s aggressive carbon reduction targets have catalyzed wide-scale deployment of zero-emission buses and trucks, accompanied by the rollout of smart grid-compatible charging hubs. The Middle East has witnessed sovereign wealth fund investments in large-scale mobility innovation zones, integrating autonomous shuttle services and digital ticketing across urban developments. African markets remain nascent but are demonstrating interest in leapfrogging legacy infrastructure through IoT-based traffic monitoring and solar-powered charging installations in emerging cities.

Asia-Pacific stands at the vanguard of smart transportation transformation. China’s rapid expansion of electric vehicle charging infrastructure and national smart city standards has created fertile ground for large-scale pilot districts. Japan’s leadership in robotics and sensor fusion is manifest in advanced vehicle-to-infrastructure demonstration corridors, while India is addressing severe congestion challenges through integrated traffic management platforms and strategic data partnerships. Southeast Asian urban centers are embracing app-based mobility services, parking solutions, and micro-mobility integrations to serve densely populated corridors.

This comprehensive research report examines key regions that drive the evolution of the Smart Transportation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Positioning, Collaborative Innovations, and Competitive Landscapes Among Leading Players Transforming Smart Transportation Markets Globally

The competitive landscape of smart transportation is characterized by a diverse array of established industrial champions and agile technology innovators. Traditional automotive original equipment manufacturers are leveraging scale and manufacturing expertise to introduce integrated hardware-software bundles, frequently collaborating with software developers and telecommunications providers. Tier-one component suppliers are investing heavily in sensor fusion and connectivity modules, positioning themselves as indispensable partners in next-generation vehicle architectures.

Concurrently, leading software vendors are differentiating through analytics platforms that harness machine learning to optimize routing, energy consumption, and maintenance schedules. Charging infrastructure firms are expanding footprint through strategic joint ventures, while electric utility providers are exploring managed charging services that balance grid stability with user convenience. Autonomous vehicle specialists, originally focused on research and development, are transitioning to commercial pilots via partnerships with logistics operators and municipal transit authorities.

This dynamic environment is further invigorated by a flurry of mergers, strategic equity investments, and ecosystem alliances. Incumbents seek to fortify their technology roadmaps through acquisitions of niche software startups, while emerging players capitalize on open platform standards to integrate solutions rapidly. As the market evolves, the defining success factors will include cross-industry collaboration, scalability of integrated solutions, and the ability to navigate an increasingly complex regulatory environment on a global scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Transportation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- AECOM Group

- ALE International SAS

- Allied Telesis, Inc.

- ALSTOM Holdings

- Axiomtek Co., Ltd.

- Cisco Systems, Inc.

- Cubic Corporation

- DENSO Corporation

- EFKON GmbH

- GMV Innovating Solutions S.L.

- Hitachi Vantara LLC

- Indra Sistemas, S.A.

- Intel Corporation

- Intellias LLC

- Kapsch TrafficCom AG

- Mitsubishi Heavy Industries, Ltd.

- NEC Corporation

- Parsons Corporation

- Q-Free ASA

- Robert Bosch GmbH

- Serco Inc.

- Siemens AG

- Stantec Inc.

- Sumitomo Electric Industries, Ltd.

- Teledyne Digital Imaging Inc.

- Teledyne FLIR LLC

- Thales Group

- Tom Tom International BV

- Webdyn by Flexitron Group

- ZF Friedrichshafen AG

Delivering Tactical Guidance and Strategic Pathways for Executives to Accelerate Innovation, Enhance Resilience, and Drive Scalable Growth in Smart Mobility

To capitalize on the transformative potential of smart transportation, industry leaders should proactively diversify supply chains by forging relationships with multiple component fabricators and regional hubs. This approach will mitigate tariff risks and ensure greater resilience in the face of geopolitical disruptions. Furthermore, investing in modular hardware architectures and open-source software frameworks will enable more rapid iteration of new features and facilitate integration with partner ecosystems.

Another imperative is the cultivation of cross-industry alliances. By collaborating with technology providers, utilities, municipalities, and academic institutions, organizations can orchestrate pilot deployments that de-risk large-scale roll-outs. These collaborative testbeds also serve as valuable data sources for refining predictive maintenance algorithms, optimizing traffic control models, and validating consumer acceptance in real-world contexts.

Leveraging advanced analytics and artificial intelligence should be a central pillar of any strategy. Deploying machine learning models to forecast demand, detect anomalies in fleet operations, and dynamically adjust pricing or signal timing can yield significant efficiency gains. Equally important is proactive engagement with regulators to shape policy frameworks that balance innovation with safety and privacy concerns. A flexible compliance strategy, underpinned by a comprehensive understanding of local and international standards, will prevent delays in product launches and facilitate smoother market entry.

Finally, cultivating a skilled workforce through interdisciplinary training programs will be critical. Organizations that invest in upskilling engineers, data scientists, and operational teams will maintain competitive advantage by accelerating development cycles and ensuring seamless system integration throughout evolving technology stacks.

Detailing Robust Research Framework Incorporating Primary Interviews, Secondary Data Synthesis, and Quantitative Analytical Techniques for Market Insights

The research methodology underpinning this market analysis is founded on a rigorous combination of primary and secondary data collection, designed to ensure both breadth and depth of insight. Secondary research involved an exhaustive review of regulatory filings, technical white papers, industry conference proceedings, and academic studies. This phase established a baseline understanding of historical trends, technology maturation trajectories, and macroeconomic variables.

Building on this foundation, primary research was conducted through structured interviews with senior executives at vehicle manufacturers, tier-one suppliers, infrastructure operators, and government agencies. These conversations provided real-time perspectives on strategic priorities, investment roadmaps, and operational challenges. In parallel, targeted surveys were administered to fleet managers and urban planners to quantify adoption timelines, service level requirements, and financing preferences.

Quantitative models were developed to triangulate data points from multiple sources, ensuring that insights reflect consistent patterns rather than isolated observations. The analytical framework incorporated market segmentation, regional growth differentials, and regulatory impact assessments. Each dataset underwent thorough validation through cross-referencing and expert review, while iterative feedback loops with industry specialists refined key assumptions and verified the robustness of conclusions.

Quality control measures, including data sanity checks and peer reviews, were embedded throughout the research cycle. This disciplined approach guarantees that strategic recommendations rest on a solid empirical foundation, equipped to guide stakeholders through the complexities of a rapidly evolving smart transportation ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Transportation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Transportation Market, by Component

- Smart Transportation Market, by Level Of Autonomy

- Smart Transportation Market, by Application

- Smart Transportation Market, by End-Use Industries

- Smart Transportation Market, by Vehicle Type

- Smart Transportation Market, by Region

- Smart Transportation Market, by Group

- Smart Transportation Market, by Country

- United States Smart Transportation Market

- China Smart Transportation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Key Strategic Takeaways and Forward-Looking Opportunities to Navigate Complexities and Seize Growth Potential in the Evolving Smart Transportation Domain

The smart transportation sector stands at an inflection point where converging technological, regulatory, and economic forces are opening new pathways for sustainable and efficient mobility. Electrification continues to accelerate across passenger and commercial vehicle segments, while advances in autonomy and connectivity promise to redefine the user experience and operational paradigms for fleet operators and public agencies alike. These core drivers, coupled with enhanced data intelligence, are enabling stakeholders to deliver seamless, multimodal services that respond dynamically to real-time conditions.

The introduction of targeted tariff measures has underscored the importance of supply-chain agility, prompting organizations to explore regional sourcing strategies and modular designs that minimize exposure to duty fluctuations. Meanwhile, segmentation insights reveal that end-use applications-from route optimization in logistics to adaptive signal control in urban corridors-are coalescing around platforms that offer end-to-end visibility and predictive analytics capabilities. Regional analyses underscore a mosaic of adoption trajectories, with the Americas, EMEA, and Asia-Pacific each exhibiting distinct policy environments and investment priorities.

As the competitive landscape intensifies, success will hinge on an organization’s ability to orchestrate cross-industry collaborations, adopt open technology standards, and navigate evolving regulatory frameworks proactively. The imperative for industry leaders is clear: to achieve and sustain market leadership, companies must blend strategic foresight with operational excellence and maintain relentless focus on delivering tangible value through innovation.

This executive summary has distilled the critical insights necessary to inform strategic roadmaps, investment decisions, and partnership strategies. Stakeholders equipped with these analyses are poised to exploit emerging opportunities and chart a course toward a future where smart transportation is both a catalyst for growth and a cornerstone of resilient, sustainable mobility networks.

Connect Directly with Ketan Rohom to Access Detailed Smart Transportation Market Insights and Empower Strategic Decisions with Comprehensive Research Solutions

To engage with the full breadth of insights and detailed analyses contained in this comprehensive market research report, decision-makers are encouraged to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By initiating a confidential dialogue, stakeholders can explore tailored briefings, address specific questions related to strategic priorities, and secure an executive summary outlining the report’s core findings. This personalized approach ensures that your organization receives targeted guidance aligned with unique operational requirements and investment objectives. Reach out through your established corporate channels to schedule a private consultation, gain early access to proprietary data visualizations, and discuss flexible licensing options that support both enterprise-wide deployments and focused departmental research initiatives. Embark on an informed journey toward next-generation mobility leadership by partnering with Ketan Rohom to obtain the full report and unlock actionable intelligence designed to drive sustained growth and competitive advantage in the rapidly evolving smart transportation ecosystem.

- How big is the Smart Transportation Market?

- What is the Smart Transportation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?