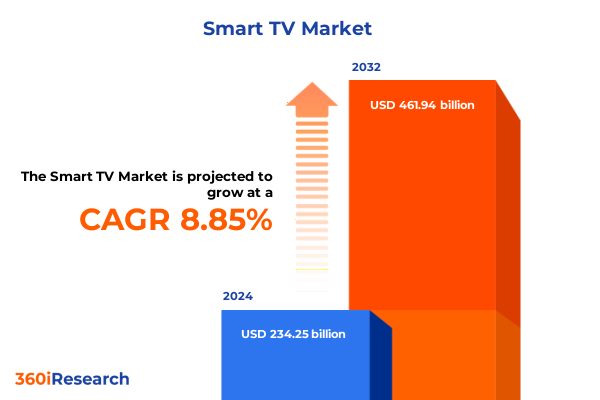

The Smart TV Market size was estimated at USD 253.88 billion in 2025 and expected to reach USD 275.51 billion in 2026, at a CAGR of 8.92% to reach USD 461.94 billion by 2032.

Discover How Smart Television Innovations Are Redefining Home Entertainment Experiences Through Connectivity, Content Delivery, and User-Centric Features

The accelerating evolution of smart television technology has fundamentally reshaped consumer entertainment behaviors, enhancing connectivity and redefining how audiences engage with content. With built-in internet connectivity, voice control mechanisms, and integration with IoT ecosystems, modern smart TVs have transformed passive viewing into interactive experiences. Manufacturers have embedded artificial intelligence and machine learning algorithms to deliver personalized content recommendations, automated system optimizations, and advanced voice-enabled search functionalities, while content providers have expanded their offerings from traditional broadcast to on-demand streaming and immersive gaming platforms. As a result, the television set has evolved from a single-purpose display into a multifunctional hub that supports video conferencing, smart home control, and targeted advertising.

In parallel, shifts in consumer expectations have prompted a convergence between technology developers, content creators, and service providers. Partnerships between streaming platforms and device makers have accelerated the rollout of optimized interfaces, quality-enhanced codecs, and low-latency gaming modes. Meanwhile, global connectivity improvements, including widespread deployment of broadband infrastructure and low-orbit satellite services, have widened the addressable market for streaming applications in both urban and rural regions. Taken together, these developments indicate that smart television is not merely a display technology but a critical node in a broader convergence of media, connectivity, and consumer lifestyle applications, setting the stage for continued innovation and ecosystem expansion.

Examining the Key Technological, Consumer Behavior, and Industry Partnership Shifts That Are Transforming the Global Smart TV Ecosystem

Over the past several years, the smart television market has witnessed transformative shifts driven by advances in display technology, software integration, and shifting consumer demands. The emergence of next-generation display panels, including quantum dot-enhanced variants and self-emissive pixel structures, has elevated contrast ratios, color accuracy, and viewing angles to new heights. Concurrently, the rise of embedded operating systems with open-source flexibility has empowered third-party developers to create innovative applications, from immersive VR content and cloud-gaming platforms to AI-based health-monitoring utilities. These software ecosystems have become as critical to device differentiation as hardware specifications.

On the consumer front, adoption patterns have evolved in response to content diversification and personalization. Viewers increasingly demand seamless cross-device interoperability, enabling features like “continue watching” and synchronized profiles across living rooms and mobile devices. This demand has spurred collaborations between television OEMs and major content aggregators to preinstall or co-brand apps, providing instant access to extensive libraries. Furthermore, the growing preference for gaming as an entertainment category has prompted deeper integration of low-latency HDMI standards, auto-game mode settings, and proprietary GPU-accelerated interfaces. Consequently, the smart TV landscape is now characterized by a convergence of audiovisual performance, software extensibility, and strategic platform alliances, creating an ecosystem in which hardware and content innovation co-evolve.

Analyzing How Escalating United States Trade Tariffs Implemented in 2025 Have Impacted Supply Chains, Component Costs, and Consumer Pricing Dynamics

In early 2025, the United States implemented a series of trade measures that have significantly influenced smart television supply chains and pricing structures. Beginning January 1, 2025, Section 301 tariffs on semiconductors surged to 50 percent, affecting critical components such as processors, memory modules, and SoC chips that underpin smart TV functionality. Manufacturers have navigated these increases by strategically adjusting supply agreements, negotiating tariff exclusions where possible, and relocating certain assembly operations to free‐trade or tariff-preferred jurisdictions to mitigate input cost pressures.

Subsequently, on March 4, 2025, the administration invoked the International Emergency Economic Powers Act to raise baseline tariffs on Chinese imports from 10 percent to 20 percent, while simultaneously imposing a 25 percent levy on goods originating from Canada and Mexico. This adjustment directly impacted imported display panels, backlight units, and other subassemblies, prompting many producers to explore alternative sourcing in Southeast Asia and Latin America to diversify risk and preserve price competitiveness.

Furthermore, temporary tariff relief negotiated in mid-2025 is scheduled to expire on August 1, 2025, potentially reinstating elevated duties on key finished television imports. With the cumulative effect of these measures, consumer equipment prices have experienced upward pressure, compelling retailers to adopt promotional strategies, deepen cost-sharing arrangements with vendors, and refine inventory management practices. As trade policy continues to evolve, stakeholders across the smart TV ecosystem remain vigilant, balancing the imperative to maintain affordability against the need to secure stable component supply and protect manufacturing margins.

Uncovering How Display Technologies, Screen Sizes, Resolutions, Distribution Channels, and Application Verticals Shape Smart TV Market Dynamics

The smart television market’s structure is shaped by multiple axes of segmentation that reveal nuanced performance and growth pockets. When considering display technology, legacy panels such as LCD and LED continue to dominate entry-level offerings, while advanced emissive formats like OLED and QLED cater to premium-segment consumers seeking superior contrast, wider color gamuts, and immersive viewing angles. This technological stratification influences manufacturing complexity, lifespan considerations, and price brackets across the value chain.

In terms of screen size, consumer preferences range from compact below-32-inch models suited for secondary rooms and budget-conscious buyers, to mid-range sizes of 32–43 inches that balance cost and viewing area, to popular flagship sizes of 44–55 inches that align with living room standards, and up to large-format screens of 56–65 inches or above 65 inches that serve premium home theater applications and commercial deployments seeking maximum visual impact.

Resolution segmentation further differentiates the market, as Full HD (1080p) and HD (720p) configurations maintain relevance in cost-sensitive and regional markets, while 4K Ultra HD has emerged as the mainstream standard in many developed regions, offering refined detail for streaming and gaming. Meanwhile, 8K Ultra HD remains a niche innovation, targeted at early adopters and specialized commercial venues requiring extreme pixel density for large-scale installations.

Distribution channels reveal divergent dynamics: offline retail through brand stores, hypermarkets, and independent electronics outlets remains vital for experiential buying and regionally localized service, whereas online channels-including eCommerce marketplaces and direct-to-consumer manufacturer websites-have surged as digital commerce infrastructure and logistics efficiencies mature. Finally, application-based segmentation spans household and residential streaming environments, gaming-centric deployments, commercial and hospitality installations, educational institution use cases, and healthcare monitoring setups, each presenting distinct requirements for durability, warranty, and content integration.

This comprehensive research report categorizes the Smart TV market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Technology

- Screen Size

- Resolution

- Distribution Channel

- Application

Investigating Regional Variations in Consumer Preferences, Regulatory Environments, and Technological Adoption Across Key Global Markets for Smart TVs

Regional perspectives on smart television adoption vary widely based on infrastructure maturity, regulatory frameworks, and cultural viewing habits. In the Americas, widespread broadband penetration, strong content‐licensing ecosystems, and prevalent over-the-top streaming platforms have fostered rapid uptake of 4K Ultra HD smart TVs, particularly in urban centers where subscription service penetration is highest. Additionally, North American OEMs and retailers have prioritized bundled offerings with premium streaming services, leveraging exclusive content deals to drive device sales and foster brand loyalty.

Within Europe, Middle East & Africa, market trajectories are influenced by diverse regulatory environments and varying levels of internet accessibility. In Western Europe, stringent energy efficiency standards and eco-labeling requirements have incentivized manufacturers to optimize power consumption and secure green certifications. Meanwhile, in the Middle East and Africa, growth is propelled by urbanization, expansion of pay-TV services, and government initiatives to bolster digital infrastructures, prompting regional assembly hubs to emerge and supporting a dual strategy of entry-level LCD models alongside selective premium OLED launches in major metropolitan markets.

Across the Asia-Pacific region, consumers exhibit a robust appetite for cutting-edge display innovations and high-refresh-rate gaming capabilities, driven by a thriving esports culture and proliferating 5G networks. OEMs based in East Asia continue to set global benchmarks in panel R&D, while Southeast Asian economies serve as key manufacturing and export bases. Trade agreements within ASEAN and regional free trade pacts have further streamlined component flows, enabling fast-paced product rollouts that cater to localized content partnerships and vernacular interface customizations.

This comprehensive research report examines key regions that drive the evolution of the Smart TV market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations, Collaborative Partnerships, and Competitive Differentiators Driving Growth Among Leading Smart TV Manufacturers Worldwide

Leading players in the smart television landscape are pursuing differentiated strategies to capture market share, enhance brand positioning, and secure supply chain advantages. Samsung Electronics leverages its vertically integrated display and semiconductor manufacturing capabilities to deliver high-performance QLED and Neo QLED ranges, while investing in AI-driven content optimization and advanced audio solutions to enrich user experiences. By establishing global partnerships with major streaming providers, Samsung ensures seamless content licensing and preloaded applications that appeal to a broad demographic spectrum.

LG Electronics, a pioneer in self-emissive OLED technology, continues to expand its product portfolio with both consumer and professional-grade screens, targeting segments that demand unparalleled contrast and form-factor innovation, such as ultra-slim and rollable displays. Through selective collaborations with gaming console manufacturers and premium AV integrators, LG reinforces its position in the high-end residential and hospitality segments.

Sony Corporation emphasizes its proprietary image processing engines and audio-visual synergies derived from its entertainment divisions, differentiating its smart TVs with cinematic color calibration, immersive soundtracks, and integrated PlayStation connectivity. Meanwhile, Chinese OEMs such as TCL and Hisense capitalize on cost-effective LCD production and aggressive channel expansions in emerging markets, often adopting strategic alliances with local content providers and regional retailers to accelerate adoption.

Smaller manufacturers and boutique brands are also gaining traction by focusing on niche applications-such as healthcare monitoring interfaces, educational display software, or hospitality management systems-demonstrating that targeted vertical solutions can complement mass-market offerings and create new revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart TV market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Element Electronics

- Google LLC by Alphabet Inc.

- Grundig

- Haier Inc.

- Hisense International Co., Ltd.

- Hitachi Ltd.

- Intex Technologies

- Koninklijke Philips N.V.

- LG Electronics

- Loewe Technology GmbH

- OnePlus Technology (Shenzhen) Co., Ltd.

- Panasonic Corporation

- Panasonic Holding Corporation

- Polaroid International B.V.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Skyworth Group Co., Ltd.

- Sony Corporation

- TCL Communication Technology Holdings Limited

- Toshiba Corporation

- VIZIO, Inc.

- Xiaomi Group

Strategic Recommendations for Industry Leaders to Enhance Supply Chain Resilience, Diversify Offerings, and Capitalize on Emerging Smart TV Trends

Industry leaders should prioritize supply chain diversification to mitigate ongoing trade uncertainties and tariff exposures. By establishing strategic partnerships with component suppliers across multiple geographies, companies can ensure a robust pipeline of display panels, semiconductors, and backlighting modules. Simultaneously, investing in regional assembly capabilities-particularly in tariff-advantaged zones-will help optimize cost structures and shorten lead times, enabling more agile responses to shifting demand patterns.

Product innovation must remain at the forefront, with a focus on advanced display formats such as MicroLED and hybrid quantum-dot panels to distinguish premium offerings. Integrating AI-based user interfaces, voice recognition, and predictive maintenance capabilities will further enhance value propositions and foster deeper customer engagement. Collaborations with leading streaming platforms, gaming studios, and software developers can create proprietary content bundles and exclusive features that drive brand loyalty and recurring revenue streams.

Diversification of distribution channels is equally vital. While traditional retail partners provide experiential showcases and localized service, direct-to-consumer digital channels offer data-driven personalization and higher margin opportunities. Implementing omnichannel strategies that harmonize online and offline touchpoints will enable seamless checkout experiences, inclusive financing options, and efficient post-sale support.

Finally, sustainability and regulatory compliance should underpin product roadmaps, with emphasis on energy efficiency, recyclability, and adherence to evolving eco-standards. Transparent reporting on environmental impact and the adoption of circular economy practices can enhance brand reputation and align with consumer expectations for responsible technology.

Comprehensive Overview of Statistical, Qualitative, and Triangulated Research Approaches Employed to Ensure Robustness and Accuracy of Market Insights

This report is founded on a rigorous methodology that integrates both primary and secondary research to ensure comprehensive and reliable insights. Primary research efforts included in-depth interviews with key executives, engineers, and product managers within leading TV OEMs, display component suppliers, and major retail and distribution partners. These discussions yielded qualitative perspectives on strategic priorities, technology roadmaps, and supply chain resilience measures, providing valuable context behind quantitative industry trends.

Secondary research encompassed a detailed review of industry publications, financial disclosures, corporate white papers, and policy announcements from trade authorities. These sources informed the analysis of regulatory shifts, tariff adjustments, and macroeconomic factors impacting the smart television sector. In addition, syndicated consumer surveys and viewership data from established media tracking organizations were triangulated to gauge adoption rates, usage patterns, and content preferences across regions.

Data validation protocols involved cross-referencing findings from multiple sources, applying triangulation techniques to reconcile discrepancies, and conducting quantitative modeling to test hypotheses. Wherever possible, regional and segment-specific insights were verified through local market experts and on-the-ground stakeholder feedback. This multi-pronged approach ensures that the conclusions and recommendations presented herein are both robust and actionable for industry decision-makers seeking accurate market intelligence and strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart TV market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart TV Market, by Display Technology

- Smart TV Market, by Screen Size

- Smart TV Market, by Resolution

- Smart TV Market, by Distribution Channel

- Smart TV Market, by Application

- Smart TV Market, by Region

- Smart TV Market, by Group

- Smart TV Market, by Country

- United States Smart TV Market

- China Smart TV Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Insights on Smart TV Evolution, Trade Dynamics, Technological Breakthroughs, and Strategic Imperatives for Stakeholder Success

As the smart television market continues to converge at the intersection of cutting-edge display technology, intelligent software ecosystems, and dynamic trade policies, stakeholders must maintain a forward-looking perspective. The proliferation of AI-driven interfaces and next-generation panel innovations, such as MicroLED and rollable OLED, signal ongoing opportunities to redefine user experiences and command premium positioning.

Simultaneously, the cumulative impact of heightened tariffs and evolving geopolitical trade agreements underscores the importance of agile supply chain strategies and localized manufacturing footprints. Companies that proactively diversify sourcing, leverage tariff-focused planning, and invest in regional assembly will be better positioned to manage cost pressures and preserve competitive pricing.

Additionally, segmentation dynamics-ranging from entry-level LCD models to flagship 8K Ultra HD and specialized commercial applications-highlight the need for portfolio breadth and targeted go-to-market approaches. Regional nuances in connectivity infrastructure, regulatory incentives, and consumer content preferences further emphasize the value of localized partnerships and tailored marketing initiatives.

Ultimately, success in the smart TV arena will hinge on harmonizing technological leadership, strategic alliances, and a deep understanding of shifting market drivers. By aligning innovation roadmaps with evolving consumer demands and regulatory landscapes, industry players can unlock sustained growth and reinforce their positions in an increasingly complex global ecosystem.

Engage with Ketan Rohom to Access In-Depth Smart Television Market Intelligence and Custom Solutions to Empower Strategic Decisions

To unlock the comprehensive insights, tailored analyses, and strategic recommendations contained in this report, reach out today to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will connect you to an expert who can guide your organization through the complexities of the smart television landscape and provide bespoke market intelligence solutions designed to support informed decision-making and sustained competitive advantage. Act now to secure the in-depth research that will empower your next growth strategy and ensure your team is equipped with the critical intelligence needed to lead in a dynamic and rapidly evolving industry.

- How big is the Smart TV Market?

- What is the Smart TV Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?