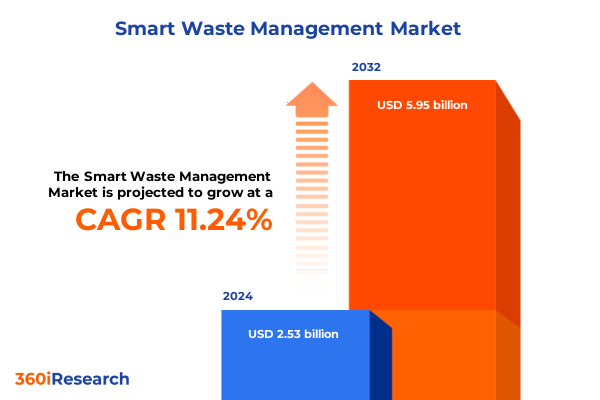

The Smart Waste Management Market size was estimated at USD 2.81 billion in 2025 and expected to reach USD 3.12 billion in 2026, at a CAGR of 11.30% to reach USD 5.95 billion by 2032.

Unveiling How Intelligent Waste Management Systems Propel Operational Efficiency While Driving Sustainable Practices Across Urban and Industrial Landscapes

The accelerating convergence of urbanization, technological innovation, and environmental stewardship is redefining how communities and businesses manage waste. As global urban populations continue to expand-projected to reach nearly 68 percent of the world’s population by 2050-pressures on existing waste infrastructure demand more intelligent and sustainable solutions to prevent environmental degradation and public health risks 【turn2news14】. Simultaneously, heightened regulatory scrutiny and ambitious emissions reduction targets are compelling municipalities and corporations to pursue waste management strategies that not only streamline operations but also contribute meaningfully to circular economy objectives.

Against this backdrop, Smart Waste Management employs a suite of interconnected sensors, analytics platforms, and automated processes to provide real-time visibility into waste generation, optimize collection routes, and enhance sorting efficiency. This approach transforms traditional, schedule-based disposal into a dynamic, need-driven system that reduces unnecessary pickups, curtails operational costs, and lowers greenhouse gas emissions. Digital technologies-ranging from IoT-enabled sensors to artificial intelligence-are enabling up to 20 percent reductions in emissions within high-impact sectors by 2050 【turn2search2】. In this report, we introduce the foundational drivers, challenges, and potential of Smart Waste Management as a critical component of sustainable urban and industrial ecosystems.

Exploring the Paradigm Shift Driven by Internet of Things Integration, Robotic Automation, and Predictive Maintenance That Redefines Traditional Waste Collection Workflows

The waste management ecosystem is experiencing a seismic shift propelled by the maturation of IoT connectivity, robotics, and AI-driven analytics. Historically, waste collection relied on fixed schedules and manual oversight, resulting in inefficiencies, underutilized assets, and excessive environmental impact. Today’s transformative paradigm replaces this reactive model with proactive, autonomous systems. Smart sensors embedded in bins communicate fill levels and environmental parameters to centralized platforms, enabling dynamic route adjustments that reduce idle mileage and fuel consumption. In pilot programs across European cities, sensor-equipped containers have cut operational costs by nearly one-third while boosting recycling rates through real-time composition data that informs targeted public outreach 【turn1search0】.

Robotic automation is further extending these gains in sorting facilities and collection hubs. Advanced sorting lines leveraging computer vision and mechanical arms can identify and separate recyclable streams with unparalleled speed and accuracy, mitigating contamination and enhancing material recovery. Meanwhile, predictive maintenance platforms powered by AI monitor equipment health, forecasting component failures and triggering timely interventions. In manufacturing and recycling environments, such systems have been shown to reduce downtime by up to 30 percent, safeguarding continuity in waste processing operations 【turn3news13】. Collectively, these technological advancements are reshaping conventional waste workflows, shifting the industry toward greater resilience, cost-effectiveness, and environmental stewardship.

Analyzing the Ripple Effects of 2025 United States Tariff Adjustments on Smart Waste Equipment Imports, Supply Chain Resilience, and Cost Structures

Effective implementation of Smart Waste Management hinges on a seamless supply of hardware-sensors, modules, and communication infrastructure-much of which has been subject to escalating trade tensions. The United States finalized Section 301 tariff increases, including a 50 percent duty on semiconductors effective January 1, 2025, alongside elevated rates on critical battery parts and related components 【turn0search5】. These measures translate into direct cost pressures for solution providers and municipalities that rely on imported IoT devices, microchips, and sensor arrays.

Concurrently, standalone IoT hardware has experienced up to 25 percent cost increases under existing tariff regimes, disproportionately affecting high-turnover devices used in asset tracking and environmental monitoring 【turn0search1】. Consequently, businesses are grappling with decisions to absorb margin erosion, renegotiate long-term contracts, or accelerate diversification of supply chains toward tariff-exempt regions. To mitigate these challenges, many organizations are exploring nearshoring strategies in Vietnam, Mexico, and India, as well as intensified domestic manufacturing investments to stabilize costs and delivery timelines. Understanding the cumulative impacts of these policy shifts is critical for stakeholders aiming to forecast capital expenditures, optimize procurement, and sustain momentum in digital waste infrastructure deployments.

Illuminating Critical Segmentation Insights Spanning Product Offerings, Waste Streams, Process Modalities, Technological Innovations, End User Verticals, and Deployment Models

A nuanced appreciation of market segments reveals the varied requirements and growth levers across product, waste type, process, technology, end user, and deployment approaches. In the product domain, hardware innovations span GPS modules, RFID tags, environmental sensors, and sensor-equipped waste bins, complemented by managed and professional services, alongside software suites that enable fleet management, dynamic route optimization, and waste analytics dashboards. Distinct waste types-from biomedical and hazardous streams to construction debris and municipal organics such as agricultural residues, food scraps, and sewage sludge-each demand specialized handling and treatment protocols.

Process distinctions further refine market opportunities, encompassing recycling operations, collection logistics, disposal facilities, and segregation units that maximize resource recovery. Technological underpinnings range from ubiquitous Internet of Things networks to advanced predictive maintenance platforms and robotic automation solutions that streamline labor-intensive tasks. End users, including commercial venues such as hospitality establishments, retail centers, and office complexes; industrial operations in chemicals, manufacturing, and oil & gas; municipal agencies; and residential communities, exhibit divergent priorities in service delivery and sustainability outcomes. Finally, deployment modes-spanning cloud-based platforms for scalable, SaaS-driven offerings to on-premises installations favoring data sovereignty-shape the competitive landscape. By weaving these segmentation insights into strategic planning, organizations can tailor solutions to targeted needs and optimize value capture across diverse market pockets.

This comprehensive research report categorizes the Smart Waste Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Waste Type

- Process Type

- Technology

- End User

- Deployment Mode

Diving into Regional Dynamics That Illustrate Distinct Regulatory, Infrastructure, and Adoption Patterns Across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics exert a profound influence on the adoption and evolution of Smart Waste Management systems, driven by regulatory landscapes, infrastructure maturity, and environmental imperatives. In the Americas, North America leads global market penetration with roughly one-third of the installed base concentrated in the United States and Canada, where robust smart city initiatives, stringent environmental regulations, and extensive investment in digital infrastructure underpin advanced IoT deployments 【turn4search6】. Latin American nations are beginning to follow suit, leveraging public-private partnerships to pilot sensor-driven waste collection in megacities, albeit at a more measured pace due to funding constraints and legacy systems.

Europe, Middle East, and Africa present a heterogeneous landscape shaped by the European Union’s circular economy directives, stringent recycling mandates, and expanding waste-to-energy efforts. Approximately 70 percent of European cities have piloted or implemented IoT-enabled bin networks that optimize collection routes and drive recycling improvements up to 30 percent 【turn1search0】. In the Middle East and Africa, nascent smart waste projects are emerging in GCC countries where urban growth and municipal modernization efforts are priorities, signaling a fertile opportunity to leapfrog traditional practices.

Asia-Pacific stands out as the fastest-growing region, fueled by rapid urbanization in China and India, government-led smart city programs in Japan and South Korea, and a burgeoning manufacturing ecosystem for low-cost IoT hardware. Despite infrastructure disparities, regional initiatives to enhance sustainability, alleviate landfill pressures, and drive resource recovery are catalyzing accelerated adoption of connected waste solutions 【turn1search10】.

This comprehensive research report examines key regions that drive the evolution of the Smart Waste Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Global and Regional Innovators Pioneering Next-Generation Smart Waste Management Through Programmatic Partnerships and Technology Advancements

A cadre of global and regional players is spearheading innovation in Smart Waste Management through strategic partnerships, technology leadership, and service expansions. Waste Management Inc., headquartered in Houston, recently announced plans to automate side-loading and sorting operations, eliminating 1,000 positions in 2025 as part of its drive to enhance safety, efficiency, and reliability in its fleet and facilities 【turn3news12】. Rubicon has solidified its role as a digital integrator by deploying route optimization and data analytics platforms for municipalities such as Houston and Cleveland Heights, enabling significant reductions in fuel consumption and operational downtime 【turn4search7】.

Veolia and SUEZ continue to invest in AI-driven sorting partnerships and acquisitions, extending their footprint in material recovery and resource regeneration. Bigbelly, renowned for its solar-powered, sensor-equipped bins, has scaled deployments in over 50 countries, while Sensoneo and Ecube Labs are driving market expansion in emerging economies through modular, low-cost sensor networks. Enevo’s cloud-native analytics platform and Cisco’s edge infrastructure offerings illustrate the expanding role of technology incumbents in hosting, processing, and securing vast streams of waste-related data. Together, these companies define the competitive frontier, shaping the future of waste management as a service and providing reference points for strategic alignment and investment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Waste Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Anaergia Inc.

- Biffa Group

- Big Belly Solar, LLC.

- Bine sp. z o. o.

- Cisco Systems, Inc.

- Ecube Labs Co., Ltd.

- Enevo, Inc. by REEN AS

- Envac AB

- Evreka A S

- GreenQ

- Honeywell International Inc.

- International Business Machines Corporation

- Masstrans Technologiies Private Limited

- Microsoft Corporation

- Nordsense Inc.

- Pepperl+Fuchs Inc.

- Remondis SE & Co. KG

- Routeware, Inc.

- RTS Holding, Inc.

- Rubicon Technologies, Inc.

- SAP SE

- Schneider Electric SE

- SENSONEO j. s. a

- Siemens AG

- SmartBin.io

- SmartEnds (BV)

- Stericycle, Inc.

- Suez S.A.

- Tana Oy

- TOMRA Systems ASA

- Veolia Environnement S.A.

- Waste Management, Inc.

Outlining Actionable Strategies for Organizational Leaders to Harness Data Integration, Interoperability, Workforce Alignment, and Policy Engagement for Sustainable Growth

To capitalize on the transformative potential of Smart Waste Management, industry leaders should embrace a suite of strategic imperatives. First, prioritize end-to-end data integration by consolidating siloed information from sensors, fleet telematics, and processing facilities into unified platforms. This holistic view enables predictive analytics to forecast waste generation patterns, identify service disruptions, and optimize resource allocation, driving both cost savings and service quality improvements 【turn2search2】. Second, cultivate interoperability standards and open APIs to ensure seamless integration of hardware, software, and third-party applications, reducing vendor lock-in and accelerating innovation cycles.

Third, invest in workforce upskilling and change management initiatives to accompany automation deployments, ensuring that personnel transition smoothly into higher-value roles focused on analytics interpretation, community engagement, and service design. Fourth, engage proactively with policymakers to align technology deployments with evolving regulations-such as Extended Producer Responsibility schemes and landfill-reduction targets-securing public sector incentives and forging collaborative frameworks for data sharing and performance benchmarking. Finally, pursue agile procurement practices that balance total cost of ownership with supply chain resilience, incorporating dual-sourcing strategies and regional manufacturing partnerships to mitigate tariff-induced headwinds and maintain project timelines.

Detailing a Dual-Phased Research Approach Combining Expert Interviews, Broad Surveys, and Rigorous Secondary Data Triangulation for Market Validity

Our research methodology blends rigorous primary inquiries with exhaustive secondary data validation to construct a comprehensive and reliable market narrative. In the primary phase, we conducted in-depth interviews with strategic stakeholders-including municipal waste directors, technology vendors, and industry consultants-complemented by online surveys of over 150 waste operations managers across North America, Europe, and Asia-Pacific to capture firsthand insights on adoption drivers and barriers. Qualitative feedback was systematically coded to identify thematic patterns, enabling the distillation of nuanced perspectives on technology requirements, service expectations, and strategic priorities.

Concurrently, our secondary research process entailed a thorough review of public and proprietary sources, from regulatory filings and industry white papers to academic journals and reputable news outlets. Each data point was triangulated across multiple sources to ensure credibility and mitigate biases, following best practices in secondary analysis that emphasize source evaluation, cross-validation, and metadata tracking 【turn5search0】. Quantitative market data was normalized to consistent definitions of product categories, waste streams, and technology typologies. We also applied scenario analysis to assess the impact of tariff changes and regulatory shifts, modeling potential cost upsides and adoption timelines under varying policy conditions 【turn5search1】. This dual-pronged approach ensures the report’s conclusions and recommendations rest on a foundation of robust evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Waste Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Waste Management Market, by Product

- Smart Waste Management Market, by Waste Type

- Smart Waste Management Market, by Process Type

- Smart Waste Management Market, by Technology

- Smart Waste Management Market, by End User

- Smart Waste Management Market, by Deployment Mode

- Smart Waste Management Market, by Region

- Smart Waste Management Market, by Group

- Smart Waste Management Market, by Country

- United States Smart Waste Management Market

- China Smart Waste Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings Emphasizing Technological Disruptions, Regulatory Impacts, and Regional Dynamics That Define the Future Trajectory of Smart Waste Management

The Smart Waste Management landscape is poised at a pivotal juncture, where digital innovation, policy evolution, and sustainability imperatives converge to redefine industry norms. Technological disruptions-rooted in IoT sensor proliferation, AI-driven analytics, and robotic automation-are shifting operational paradigms from reactive disposal to proactive resource stewardship. These advancements promise substantial reductions in collection costs, emissions, and landfill reliance while enhancing service reliability and recycling effectiveness. Additionally, the cumulative impact of 2025 tariff adjustments has underscored the strategic importance of supply chain diversification and domestic manufacturing investments to ensure uninterrupted deployments.

Regional disparities underscore the need for tailored strategies: North America’s mature regulatory and infrastructure environment contrasts with Europe’s stringent circular economy mandates and Asia-Pacific’s rapid urban expansion. Leading companies are setting benchmarks through strategic partnerships, innovative service models, and platform-based offerings. To remain competitive, organizations must integrate fragmented data assets, establish interoperable ecosystems, and engage stakeholders across the public and private sectors. The combination of robust research, sector-specific segmentation insights, and actionable recommendations presented herein equips decision-makers to navigate market complexities and capture value at the intersection of technology, regulation, and sustainability.

Empowering Decision-Makers to Leverage Tailored Smart Waste Management Insights by Connecting Directly with Ketan Rohom

Are you ready to harness the power of data-driven intelligence and sustainable practices to transform your organization’s waste management strategy? Our comprehensive market research report offers unparalleled insights into the latest technologies, regulatory developments, tariff impacts, and actionable opportunities in the smart waste management landscape. Partnering with Ketan Rohom, Associate Director of Sales & Marketing, you will receive tailored guidance on how to deploy IoT-enabled infrastructure, optimize operations with predictive analytics, and align with evolving regulatory frameworks to achieve both economic and environmental objectives. Reach out to Ketan today to explore customized engagement options and secure the full report that will empower your strategic planning, investment decisions, and operational excellence in smart waste management.

- How big is the Smart Waste Management Market?

- What is the Smart Waste Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?