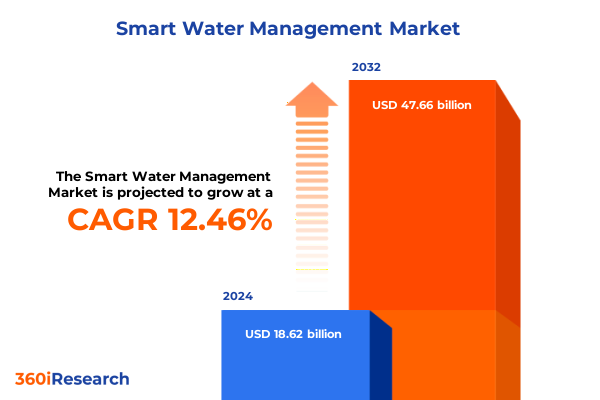

The Smart Water Management Market size was estimated at USD 20.90 billion in 2025 and expected to reach USD 23.47 billion in 2026, at a CAGR of 12.49% to reach USD 47.66 billion by 2032.

Exploring the critical need for intelligent water management solutions against mounting resource scarcity and infrastructure challenges nationwide

Smart water management stands at the forefront of modern infrastructure transformation. In an era defined by increasing water scarcity, aging distribution networks, and heightened regulatory demands, stakeholders across utilities, municipalities, and private enterprises are compelled to rethink traditional systems. The confluence of environmental stressors and urban growth places unprecedented pressure on water resources, rendering conventional approaches inadequate for meeting future needs.

Against this backdrop, digitalization emerges as a critical lever for resilience and efficiency. Connected sensors, real-time monitoring platforms, and advanced analytics collectively enable predictive maintenance, demand forecasting, and resource optimization that were previously unattainable. As a result, asset managers can anticipate failures before they occur, reduce unplanned downtime, and extend the lifecycles of critical infrastructure.

Moreover, the integration of cloud computing and edge devices provides the computational backbone to process vast streams of water quality and flow data securely and at scale. By harnessing these technologies, organizations can transition from reactive operations toward proactive management paradigms. This shift not only mitigates risk but also establishes a foundation for sustainable growth and environmental stewardship.

Unveiling transformative shifts driving a technological renaissance in water infrastructure through advanced digital tools and data-driven operational approaches

Water systems across the globe are undergoing a profound metamorphosis, propelled by advances in digital technologies and changing stakeholder expectations. The proliferation of Internet of Things sensors within pipelines and treatment facilities has unlocked continuous, granular visibility into pressure differentials, leak occurrences, and quality metrics. This granular data flow accelerates decision cycles, enabling utility operators to respond swiftly to anomalies before they escalate.

Simultaneously, big data analytics and artificial intelligence frameworks are redefining operational boundaries. Machine learning algorithms ingest historical performance records and real-time readings to surface patterns that human oversight might overlook. As a result, predictive modeling can drive optimal pump scheduling, energy consumption reduction, and targeted maintenance interventions tailored to the unique characteristics of each asset.

Another transformative shift lies in the democratization of control systems. Modern platforms facilitate remote management through intuitive dashboards and mobile interfaces, empowering field technicians and central command centers to collaborate seamlessly. This blending of physical and digital realities lays the groundwork for dynamic, self-healing networks that adjust flows and pressures autonomously based on predefined policies and real-time stimuli. Consequently, stakeholders can achieve heightened reliability, cost containment, and operational agility.

Assessing the far-reaching effects of 2025 United States tariff adjustments on cost structures and innovation paths within smart water technology ecosystems

The introduction of new United States tariff measures in 2025 has introduced significant complexities for the supply chains underpinning smart water management solutions. Imported hardware components, ranging from specialized sensors to communication modules, have become subject to elevated duties, driving up procurement costs for systems integrators and end users. These tariff escalations have sharpened the focus on domestic sourcing, incentivizing local manufacturers to scale production of critical IoT devices and control equipment.

Beyond hardware, software platforms that rely on cross-border data exchanges and licensing agreements have encountered nuanced compliance challenges. Licensing fees denominated in foreign currencies have been recalibrated to offset tariff surcharges, impacting annual subscription budgets. To mitigate these pressures, several solution providers have restructured their pricing models, introducing tiered service arrangements and localized data centers to bypass cross-border fees.

Despite these headwinds, the tariff landscape has also galvanized innovation and investment in homegrown technology. Public-private partnerships are emerging to underwrite research and development in next-generation analytics, while utilities are exploring joint procurement coalitions to negotiate volume discounts from domestic suppliers. As a result, the ecosystem is evolving toward a more resilient and geographically diversified supply base, better positioned to withstand future policy shocks.

Revealing critical market segmentation insights that illuminate component roles applications end-user demands deployment models and technology integrations

Component analysis reveals that hardware remains foundational to networked water systems, with a growing emphasis on rugged, low-power sensors and communication devices. Services such as system integration, maintenance, and training are gaining prominence as utilities seek end-to-end support for complex deployments. Within the software domain, analytics modules that process vast telemetry streams are increasingly complemented by control systems that automate valve operations and monitoring suites that visualize performance in intuitive formats.

In application contexts, asset monitoring programs deploy sensor arrays to map pressure variations and detect anomalies before leaks become critical. Distribution management tools optimize flow allocations across network segments, improving delivery reliability while reducing energy demands. Leak detection algorithms leverage acoustic signatures and pressure modeling to pinpoint fissures, minimizing water losses. Meanwhile, water quality management dashboards aggregate chemical and biological readings, ensuring compliance and safeguarding public health.

Municipal water utilities lead adoption efforts, driven by regulatory imperatives and aging infrastructure pressures. Industrial operators in sectors such as manufacturing and mining are embracing real-time monitoring to prevent costly disruptions. Commercial facilities prioritize preventive service contracts, while residential projects integrate smart metering for efficient consumption tracking. Cloud-based deployments facilitate rapid scalability, but on-premise solutions remain critical for sites with stringent security requirements. Underpinning these segments, advanced technologies - including artificial intelligence, big data analytics, IoT, and machine learning - are converging to create self-optimizing networks that balance supply, demand, and sustainability targets with unprecedented precision.

This comprehensive research report categorizes the Smart Water Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

- Deployment

Mapping distinct regional dynamics across the Americas Europe Middle East Africa and Asia-Pacific to uncover varied adoption trends and growth enablers

The Americas continue to drive global leadership in smart water management innovation, leveraging robust capital markets and progressive regulatory frameworks. Across North America, public funding programs have subsidized pilot deployments of advanced sensor networks and analytics platforms. In Latin America, urban centers are prioritizing digital upgrades to address chronic losses and extract maximum value from limited water allocations.

In Europe, Middle East, and Africa, water scarcity and resource stewardship are paramount. European Union directives on water efficiency have compelled member states to adopt stringent monitoring requirements, while Gulf countries are investing heavily in desalination integration with smart control systems. In Africa, international development agencies are collaborating with local utilities to deploy cost-effective IoT solutions that enhance rural distribution reliability.

Asia-Pacific stands out for its scale and diversity of implementation. Rapid urbanization across China and India has prompted large-scale digital water networks, supported by national smart city initiatives. Australia’s experience in drought management has fostered innovative conservation platforms, while Southeast Asian nations are exploring public-private partnerships to fund smart infrastructure projects. Each region’s unique socio-economic landscape shapes adoption pathways, yet they collectively contribute to an accelerating global shift toward intelligent, resilient water ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Smart Water Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading corporations driving innovation with strategic alliances advanced technologies and strong sustainability commitments in water management

A cohort of industry leaders is defining the competitive landscape by marrying technology prowess with strategic partnerships. Key players have established regional innovation centers to co-develop localized solutions with utility clients, while others have acquired niche specialist firms to expand their offerings across the full water management spectrum. These corporate strategies underscore a shift toward bundled solutions that combine hardware reliability, software intelligence, and service excellence.

Major equipment manufacturers now boast integrated platforms that blend predictive analytics engines with edge-computing devices, enabling on-site decision-making that complements cloud-based oversight. Collaboration agreements between telecommunications operators and water technology vendors have accelerated the rollout of LPWAN networks tailored to long-range, low-energy sensor deployments. At the same time, software pure plays are differentiating through subscription models that offer modular feature sets and rapid integration into existing SCADA systems.

Sustainability imperatives have driven companies to embed circular economy principles into their roadmaps, introducing product leasing schemes and end-of-life recycling programs. Meanwhile, several firms have launched open innovation challenges to attract startups and research institutions, fostering an ecosystem that continually replenishes the pipeline of disruptive solutions. This convergence of corporate foresight and collaborative innovation is elevating the benchmark for what constitutes a comprehensive smart water management offering.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Water Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Aclara Technologies LLC

- AquamatiX Limited

- Badger Meter, Inc.

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- HydroPoint

- Itron, Inc.

- Kamstrup A/S

- Mueller Water Products, Inc.

- Schneider Electric SE

- Siemens AG

- Veolia Environnement S.A.

- Xylem Inc.

Actionable strategies for executives to accelerate digital transformation foster collaboration and secure competitive advantage in evolving water infrastructure markets

Industry leaders must prioritize interoperability standards that enable seamless data exchange across heterogeneous networks and devices. By adopting common communication protocols and APIs, utilities can integrate new sensors and control modules without disrupting existing operational workflows. In parallel, forming strategic alliances with telecommunications carriers and cybersecurity experts will ensure robust connectivity and data protection across the value chain.

Investment in advanced analytics capabilities is essential for unlocking deeper insights from the relentless stream of operational data. Leaders should evaluate platforms that offer automated anomaly detection, root-cause analysis, and prescriptive recommendations. These intelligence layers empower decision-makers to transition from manual troubleshooting to strategic asset performance management, driving greater cost efficiency and system reliability.

To capture underserved market segments, executives are encouraged to tailor solutions for small-scale and remote sites by leveraging cloud-native architectures and pay-as-you-go models. Deploying edge computing for real-time local control alongside cloud analytics can balance performance and affordability. Finally, embedding sustainability metrics into performance dashboards will align investment decisions with environmental objectives, reinforcing stakeholder trust and regulatory compliance.

Elaborating on rigorous research approaches integrating primary data validation triangulation and expert insights to ensure market analysis integrity

This analysis draws on a multi-tiered research framework that fuses primary engagements with secondary intelligence sources. Our primary research encompassed structured interviews with senior executives at leading utilities, systems integrators, and technology providers to capture firsthand perspectives on emerging priorities, challenges, and investment drivers. These insights were further validated through in-depth discussions with independent consultants and industry thought leaders.

Secondary research included a comprehensive review of corporate disclosures, regulatory filings, and academic publications, supplemented by a systematic scan of patent registrations and conference proceedings. Publicly available technical standards and benchmarks provided context for assessing performance thresholds and interoperability considerations. Data triangulation techniques ensured that insights from multiple sources converged to enhance accuracy and reduce bias.

Quantitative and qualitative data were synthesized using a proprietary analytical model that maps technology maturity curves against regulatory timelines and funding cycles. This rigorous methodology underpins the credibility of the findings, delivering a robust, evidence-based foundation for strategic decision-making in smart water management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Water Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Water Management Market, by Component

- Smart Water Management Market, by Technology

- Smart Water Management Market, by Application

- Smart Water Management Market, by End User

- Smart Water Management Market, by Deployment

- Smart Water Management Market, by Region

- Smart Water Management Market, by Group

- Smart Water Management Market, by Country

- United States Smart Water Management Market

- China Smart Water Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing powerful conclusions on emerging opportunities risks and strategic imperatives shaping the next frontier in smart water management evolution

The convergence of digital technologies and water management presents a watershed moment for utilities and stakeholders aiming to optimize resources and bolster resilience. Emerging opportunities lie in leveraging artificial intelligence to transform raw sensor data into actionable intelligence, while advanced communication networks enable granular control over distributed assets. As adoption accelerates, service models will continue to evolve toward outcome-oriented contracts that align vendor incentives with performance improvements.

Despite the compelling benefits, organizations must navigate challenges such as data security, legacy system integration, and workforce readiness. Addressing these risks requires a strategic, phased approach that balances rapid innovation with prudent risk management. Leaders who invest in upskilling their teams and fostering a culture of digital fluency will be best positioned to harness the full potential of smart water solutions.

Ultimately, the imperative for sustainable water stewardship will drive continued investment, regulatory support, and collaborative innovation. By aligning technological advancements with environmental and social objectives, stakeholders can forge water systems that are not only efficient and reliable but also equitable and future-proof.

Take decisive action today to secure exclusive market intelligence and gain a competitive edge in smart water management by partnering with our sales associate

To delve deeper into these transformative insights and harness data-driven strategies tailored to your organizational objectives, we invite you to connect with our Associate Director for Sales & Marketing. Ketan Rohom brings a wealth of experience in translating complex market intelligence into actionable business outcomes and can guide you through the comprehensive market research report. Your engagement with Ketan will ensure you receive personalized recommendations, exclusive data extracts, and expert interpretations designed to accelerate your strategic planning and investment decisions. Reach out today to unlock the full spectrum of findings, secure early access to newly identified growth vectors, and gain a competitive advantage in the rapidly evolving smart water management landscape. By partnering with Ketan, you will move beyond high-level overviews and into a targeted, bespoke consultation, positioning your organization to capitalize on the most lucrative technology applications, deployment models, and regional growth pockets. Act now to ensure your decision-makers have the confidence and visibility needed to transform water infrastructure, optimize asset performance, and drive sustainable outcomes. The opportunity to leverage this premium research resource awaits your proactive engagement, and Ketan Rohom is ready to support your journey toward innovative, resilient, and future-proof water management strategies

- How big is the Smart Water Management Market?

- What is the Smart Water Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?