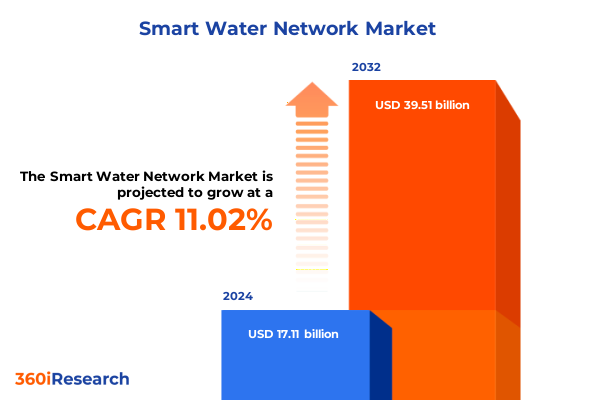

The Smart Water Network Market size was estimated at USD 18.98 billion in 2025 and expected to reach USD 21.06 billion in 2026, at a CAGR of 11.04% to reach USD 39.51 billion by 2032.

Laying the groundwork for era of interconnected water management through smart water network solutions that redefine operational efficiency and sustainability

Across modern utility management, the development of intelligent water systems represents a pivotal shift in how municipalities and service providers approach infrastructure challenges. The introduction of smart water network solutions has emerged as a core enabler of visibility, offering granular, real-time data that allows operators to mitigate losses and optimize distribution efficiency. By integrating advanced sensing technologies and communication layers, these networks address longstanding pain points-such as leak detection and pressure management-while supporting evolving regulatory demands for resource conservation and reporting transparency.

In this context, stakeholders ranging from public utilities to private engineering firms are redefining their capital priorities. Investments are no longer solely focused on physical asset replacement but are centering on digital transformation initiatives that deliver long-term cost savings and environmental benefits. The convergence of Internet of Things connectivity with proprietary software platforms creates an ecosystem where predictive analytics can forecast demand patterns and mitigate risks before they escalate into service outages.

Moving forward, understanding the foundational principles and drivers that underpin this ecosystem is essential for decision-makers seeking to align operational objectives with sustainability mandates. This introduction sets the stage for a deeper exploration of how technological innovation, policy shifts, and competitive dynamics are reshaping the future of water network management.

Unveiling the progression from metering automation to predictive analytics that drives the next wave of smart water network transformation

Over the past decade, smart water network adoption has experienced transformative shifts driven by technological maturation and evolving stakeholder expectations. Early implementations focused primarily on Advanced Metering Infrastructure deployments aimed at automating billing and consumption tracking for end users. Although these initiatives delivered incrementally improved data accuracy, they lacked the holistic operational insights required to address system-wide inefficiencies.

The emergence of Supervisory Control And Data Acquisition platforms as a complementary technology heralded the next wave of innovation. By connecting a broader array of field devices-including flow sensors and pressure transducers-SCADA systems provided centralized control capabilities that empowered operators to respond to real-time anomalies. This expanded visibility created opportunities for more sophisticated applications such as dynamic pressure management and targeted leak identification, reducing water loss while improving service reliability.

The latest paradigm shift involves the integration of advanced analytics, cloud computing, and edge processing. Software platforms are now capable of handling massive streams of sensor-generated data and applying machine learning algorithms to predict infrastructure failures before they occur. Services such as consulting, implementation, and maintenance have become essential to ensure seamless integration and system optimization. As a result, intelligent water networks are no longer isolated pilot projects; they constitute an end-to-end framework for resilient, data-driven water management that can adapt to the dynamic environmental challenges of the twenty-first century.

Assessing the far-reaching effects of updated 2025 United States tariff frameworks on smart water network deployment costs and planning

In 2025, the introduction of revised tariff structures by United States regulatory bodies has had a cumulative effect on the lifecycle costs of smart water network deployments. Historically, tariff schedules focused on consumption volumes and peak demand, which allowed utilities to recover capital costs gradually. The newly implemented tariffs, however, incorporate additional surcharges for infrastructure upgrades tied to digital adoption and environmental compliance. These adjustments aim to accelerate the shift toward more sustainable network operations, albeit with near-term budgetary impacts on project planning.

Utilities in regions impacted by higher surcharges have been prompted to reprioritize digital investments, often delaying upgrades to ancillary systems such as billing and customer portals in favor of core sensing and communication infrastructure. Conversely, municipalities leveraging grant funding or green financing instruments are capitalizing on tariff incentives to pursue more ambitious smart network expansions. The net result is a rising divergence in implementation timelines: organizations that act swiftly benefit from lower operational expenditures over the long term, while those taking a conservative stance are grappling with increased maintenance costs.

The true measure of this tariff-driven shift will be observed in service reliability metrics and water loss reduction statistics. Early adopters report double-digit improvements in unaccounted-for water percentages, directly correlating to the ability to detect and address leaks in near real time. As regulatory frameworks continue to evolve, utilities must balance regulatory compliance with operational imperatives, ensuring that tariff structures serve as catalysts rather than hindrances to robust intelligent network adoption.

Illuminating the interconnected dynamics of components, technologies, applications, and utility types that shape smart water network adoption

Examination by component type reveals that services remain a critical driver of network success, with implementation and maintenance offerings ensuring that installed hardware-such as flow meters and sensors-operate at peak performance. Consulting expertise guides municipalities through complex selection processes, marrying Communication Network architectures with Software platforms that synthesize data streams into actionable dashboards. On the technology front, the interplay between Advanced Metering Infrastructure and Supervisory Control And Data Acquisition has created differentiated pathways: AMI remains essential for consumption profiling, whereas SCADA delivers system-wide operational controls that feed data into enterprise models.

Applications vary significantly between commercial and residential contexts; high-density residential zones demand rapid sensor deployments and user-friendly portals, while large-scale commercial sites prioritize precision metering and leak-detection algorithms capable of addressing high-volume flows. Further segmentation by utility type underscores contrasting priorities: water utilities focus on pressure optimization and potable water integrity, whereas wastewater utilities emphasize early warning systems that prevent sanitary overflows and environmental violations.

Collectively, these segmentation lenses illustrate a multifaceted ecosystem where strategic investments in hardware, software, services, and network technologies must be carefully orchestrated. Decision-makers must evaluate each dimension cohesively to unlock the full potential of intelligent water networks and deliver sustainable outcomes across diverse service territories.

This comprehensive research report categorizes the Smart Water Network market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Technology

- Application

- Utilities Type

Exploring the diverse regional pathways driving adoption of smart water networks across the Americas, Europe-Middle East-Africa, and Asia-Pacific markets

Regional dynamics play a vital role in shaping the smart water network environment. In North and South America, aging infrastructure and pronounced regulatory pressures have driven accelerated digital modernization initiatives. Public utilities are adopting advanced sensor arrays and networked communication platforms to tackle legacy asset challenges while securing federal infrastructure grants that offset implementation costs. Meanwhile, strategic partnerships between private technology providers and municipal operators have become increasingly common, enabling proof-of-concept deployments that scale rapidly.

The Europe, Middle East & Africa zone presents a diverse tapestry of market maturity. Western European nations benefit from robust regulatory frameworks that incentivize reduced non-revenue water and carbon footprint targets. In contrast, emerging economies in Eastern Europe, the Gulf region, and sub-Saharan Africa are embracing more tailored solutions-often prioritizing turnkey implementations that cater to limited operational budgets. In this context, software platforms with flexible subscription models have gained significant traction, enabling utilities to access advanced analytics without heavy upfront capital expenditures.

Across Asia-Pacific, a dichotomy exists between well-established markets such as Australia and Japan and rapidly developing nations with burgeoning urbanization demands. Stakeholders in the former segment have progressed toward fully integrated digital water grids, while those in the latter are leveraging low-cost, scalable sensor deployments to address immediate water loss concerns. Together, these regional trajectories underscore the importance of localized strategies that align technological offerings with specific regulatory, economic, and environmental conditions.

This comprehensive research report examines key regions that drive the evolution of the Smart Water Network market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the competitive landscape and strategic partnerships that define today’s smart water network technology and service leaders

Leading the charge in smart water network innovation, established technology firms have expanded their portfolios to deliver end-to-end solutions encompassing hardware, software, and services. Their deep domain expertise underpins scalable communication networks and robust data platforms that meet the stringent reliability standards of major utilities. Concurrently, agile specialized providers have carved out niches by offering customizable sensor packages and rapid deployment services that cater to smaller municipalities and commercial customers.

Key strategic alliances between software vendors and implementation partners have also emerged, blending advanced analytics capabilities with local service expertise. These collaborations streamline the integration process and reduce time to value by aligning product roadmaps with evolving regulatory requirements. Moreover, several industry leaders have invested heavily in research and development, launching pilot programs that test edge-computing architectures and AI-driven anomaly detection models in live operational environments.

The competitive landscape increasingly rewards providers that demonstrate a strong track record of interoperability, offering open-architecture platforms that integrate seamlessly with existing SCADA systems and third-party devices. As a result, companies that prioritize extensible solutions and continuous innovation are well-positioned to capture growth opportunities amid rising demand for resilient and sustainable water infrastructure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Water Network market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aquamatix Limited

- Arad Group

- Badger Meter, Inc.

- Bentley Systems Inc.

- Diehl Stiftung & Co. KG

- Emerson Electric Co.

- Evoqua Water Technologies Corp.

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- Hubbell Incorporated

- HydroPoint Data Systems, Inc.

- IBM Corporation

- Itron Inc.

- Kamstrup A/S

- Landis + Gyr AG

- Moen Incorporated

- Mueller Water Products, Inc. by Walter Industries Inc.

- Neptune Technology Group Inc.

- Oracle Corporation

- SCHNEIDER ELECTRIC INDUSTRIES SAS

- Siemens AG

- Smart Water Networks Forum

- SPML Infra Limited

- SUEZ Group

- TaKaDu Ltd.

- Trimble Inc.

- Veolia Environnement S.A.

- Xylem Inc.

Outlining a strategic framework for phased smart network adoption that maximizes interoperability, ROI, and operational agility

Industry stakeholders seeking to capitalize on the smart water network evolution should embrace a phased but comprehensive adoption strategy. Early stages require robust stakeholder alignment across engineering, finance, and regulatory teams to establish clear objectives and key performance indicators. Securing executive buy-in hinges on articulating tangible return on investment through pilot programs that demonstrate leak reduction, energy savings, and enhanced customer transparency.

As deployments scale, prioritizing interoperability becomes paramount. Selecting solutions that adhere to open standards and that can integrate across legacy SCADA architectures ensures future flexibility. Coupled with targeted workforce training, this approach equips operational teams with the skills necessary to leverage digital dashboards and advanced analytics tools effectively. Moreover, utilities should explore innovative financing mechanisms-such as performance-based contracts and green bonds-to mitigate upfront capital burdens while aligning vendor incentives with long-term network performance.

Lastly, maintaining an agile posture is critical. Continuous evaluation of emerging technologies-from edge AI modules to next-generation communication protocols-enables organizations to refine system capabilities and address evolving regulatory requirements. By adopting a holistic framework that balances strategic planning with tactical execution, industry leaders can drive measurable improvements in network resilience and resource stewardship.

Detailing a rigorous multipronged approach combining expert interviews, case study analysis, and statistical modeling for comprehensive insights

This research leverages a blended methodology that combines qualitative expert interviews with quantitative data synthesis. Through in-depth consultations with utility executives, technology vendors, and regulatory authorities, nuanced perspectives on implementation challenges and success factors were captured. Primary data collection was supplemented by an extensive review of public filings, conference proceedings, and standardization documentation.

Quantitative analysis entailed cataloging deployment case studies across diverse service territories and correlating performance metrics-such as water loss reduction rates and system uptime improvements-with technology adoption profiles. Data sets were normalized to account for regional cost variances and tariff structures, enabling meaningful comparative insights. Statistical techniques, including regression modeling and scenario analysis, provided robust validation of identified trends and segmentation dynamics.

Collectively, this rigorous approach ensures that the study reflects both real-world operational complexities and evolving market forces. The resulting insights furnish decision-makers with actionable intelligence to navigate the rapidly changing landscape of smart water network innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Water Network market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Water Network Market, by Component Type

- Smart Water Network Market, by Technology

- Smart Water Network Market, by Application

- Smart Water Network Market, by Utilities Type

- Smart Water Network Market, by Region

- Smart Water Network Market, by Group

- Smart Water Network Market, by Country

- United States Smart Water Network Market

- China Smart Water Network Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing strategic insights and imperatives that underscore the transformative potential of smart water networks for sustainable resource management

Smart water networks are redefining how utilities manage and conserve one of our most vital resources. By harnessing advanced sensor arrays, networked communication systems, and predictive analytics, operators can achieve unprecedented visibility into distribution systems and proactively address inefficiencies. The cumulative impact of regulatory adjustments, including 2025 tariff reforms, underscores the importance of accelerating digital transformation initiatives to secure long-term sustainability and cost efficiencies.

Strategic segmentation analysis highlights that success hinges on integrated approaches across hardware, software, services, and application contexts. Regional insights demonstrate that localized market conditions and funding mechanisms shape adoption pathways, while competitive intelligence underscores the value of interoperability and continuous innovation. Actionable recommendations emphasize the need for phased deployments, stakeholder alignment, and open-standards architectures to ensure system resilience and scalability.

As utilities and technology providers navigate this dynamic environment, the imperative is clear: proactive investment in intelligent networks is not merely an operational upgrade but a strategic cornerstone for future-proof water management. The insights presented herein offer a blueprint for achieving lasting improvements in reliability, resource stewardship, and stakeholder value.

Secure expert guidance and unlock transformative insights into smart water network growth opportunities with Ketan Rohom’s strategic market research support

Ready to elevate your operational capabilities with comprehensive insights into smart water network innovations? Reach out to Ketan Rohom to explore how this market research report can empower decision-making, uncover strategic opportunities, and accelerate growth across infrastructure projects by leveraging deep analysis of tariffs, segmentation, regional dynamics, and company trends present in today’s evolving landscape

- How big is the Smart Water Network Market?

- What is the Smart Water Network Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?