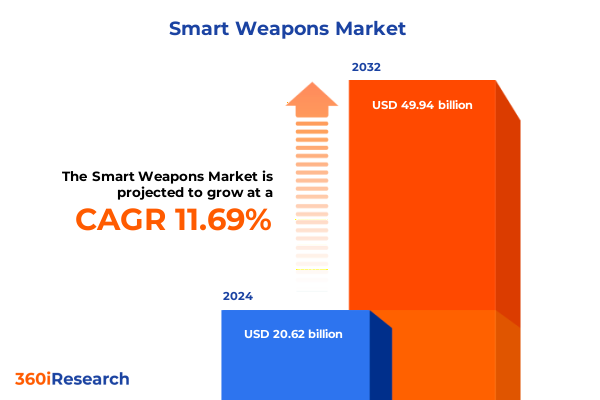

The Smart Weapons Market size was estimated at USD 23.00 billion in 2025 and expected to reach USD 25.66 billion in 2026, at a CAGR of 11.71% to reach USD 49.94 billion by 2032.

Emerging Smart Weapons Are Redefining Modern Defense Strategies Through Unprecedented Precision Automation and Operational Efficiency

The advent of smart weapons has catalyzed a profound transformation in defense ethos, ushering in an era where precision, connectivity, and automation redefine tactical and strategic paradigms. This evolution transcends mere technological enhancement; it represents a fundamental shift in how armed forces conceptualize and execute missions. Sensor fusion, data analytics, and networked communication converge to deliver unprecedented accuracy and real-time responsiveness, enabling mission planners and operators to make decisions with unparalleled confidence and speed.

In parallel, geopolitical tensions and asymmetric threats have intensified the demand for smarter, more adaptable capabilities. Rapid advances in guidance systems, digital target acquisition, and autonomous platforms are no longer the preserve of science fiction but have become integral to modern arsenals. As such, the smart weapons domain has emerged as a strategic imperative for nations seeking to bolster deterrence, optimize resource allocation, and maintain a competitive edge in multi-domain operations. The subsequent sections delve into the critical shifts, regulatory influences, and segmentation insights that collectively outline the contours of this dynamic landscape.

Rapid Innovations in Smart Weapons Are Catalyzing a Paradigm Shift Through AI Integration and Multi-Domain Operational Synergies

The smart weapons landscape is experiencing an unprecedented pace of innovation driven by artificial intelligence, machine learning, and advanced materials science. Autonomous targeting capabilities and decision-support algorithms are augmenting human judgment, reducing reaction times, and expanding operational envelopes. Concurrently, the integration of directed energy systems and hypersonic propulsion technologies is redefining threat profiles, compelling defense planners to innovate countermeasures and adapt force structures accordingly.

Moreover, the proliferation of network-centric warfare concepts has spurred the development of interoperable command-and-control architectures. These digital ecosystems facilitate seamless data exchange across air, land, sea, and space domains, enabling synchronized multi-domain operations. As a result, legacy platforms are undergoing rapid modernization to embed smart weapon payloads, while collaborative R&D ventures between established primes and technology startups are accelerating time-to-market for next-generation solutions. This wave of convergence underpins a transformative shift that will shape defense postures well into the coming decade.

Assessment of United States Tariff Policies in 2025 Reveals Critical Influence on Supply Chains Technology Transfer and Domestic Industrial Competitiveness

In 2025, revised tariff regulations introduced by the United States have exerted substantial influence on the smart weapons supply chain and technology transfer mechanisms. Heightened duties on select imported components have elevated procurement costs for foreign subsystems, prompting defense contractors to reassess global sourcing strategies. This protectionist stance has yielded dual outcomes: while stimulating investments in domestic production capabilities, it has also introduced transitional cost pressures that require careful mitigation through strategic supplier partnerships and contract renegotiations.

Simultaneously, the tariff environment has reconfigured international collaboration frameworks, incentivizing foreign governments to seek alternative suppliers and deepen alliances with U.S. firms to navigate trade barriers. The resultant shift has fostered a renewed focus on indigenization initiatives, with major primes expanding in-country manufacturing and R&D sites. In turn, this has reinforced resilience in critical component availability and bolstered advanced manufacturing ecosystems. As defense stakeholders contend with these evolving trade dynamics, the cumulative impact of 2025 tariffs underscores the imperative for agile supply chain management and proactive engagement with policy developments.

In-Depth Multi-Dimensional Market Structure Reveals Strategic Segmentation Insights Across Weapon Types Platforms End Users Technologies and Applications

Analyzing the smart weapons market through a multi-dimensional segmentation lens reveals nuanced opportunities and challenges across distinct cohorts. When considering weapon types, the spectrum ranges from traditional artillery munitions-encompassing both conventional shells and rocket artillery-to ballistic missiles categorized by intercontinental, medium-range, and short-range capabilities. Cruise missiles further diversify the landscape with platforms optimized for anti-ship and land-attack missions, while directed energy offerings such as high energy lasers and high power microwaves usher in novel engagement methods. Complementing these, precision guided munitions leverage GPS and laser guidance to deliver pinpoint effects on target.

Platform segmentation underscores the breadth of delivery systems, spanning air assets that include fixed wing aircraft, rotary wing systems, and unmanned aerial vehicles, to land-based fixed installations and ground vehicles. Sea-based platforms comprise both submarines and surface vessels capable of deploying torpedoes, missiles, and energy-based defenses. Extending beyond the atmosphere, the space domain introduces satellites and space weapons designed for persistent domain awareness and strategic deterrence. End users such as the Air Force, Army, Marine Corps, Navy, homeland security agencies, and law enforcement entities each drive unique procurement requirements based on mission scope and jurisdictional mandates.

Technological segmentation highlights the rise of artificial intelligence–enabled systems-featuring autonomous targeting and decision support-alongside directed energy implementations, hypersonic air-breathing and boost-glide vehicles, and advanced precision guidance suites. Application-oriented analysis differentiates defensive constructs, including laser and missile defense solutions, from offensive operations centered on strategic and tactical strike capabilities. Together, this segmentation framework illuminates distinct growth vectors and investment priorities for suppliers and end users operating across the full spectrum of smart weaponry.

This comprehensive research report categorizes the Smart Weapons market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Weapon Type

- Platform

- Technology

- Application

- End User

Comparative Regional Dynamics Highlight Unique Growth Drivers and Strategic Priorities Spanning Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the trajectory of smart weapons adoption and development. In the Americas, the United States continues to lead innovation through robust funding for joint development programs, collaborative exercises with NATO allies, and public-private partnerships that accelerate prototyping of next-generation munitions and energy-based defenses. Latin American nations exhibit a growing interest in cost-effective precision systems to combat transnational threats, with select governments initiating pilot procurements to modernize coastal and border security postures.

Across Europe, Middle East, and Africa, defense modernization strategies exhibit diverse priorities. Western European states prioritize integrated air and missile defense architectures, often co-developing capabilities under collaborative European Union frameworks. In the Gulf region, rapid procurement cycles fueled by strategic defense objectives have accelerated acquisitions of interceptors and smart guided systems, while concurrent investments in domestic defense industries aim to localize production. African nations, constrained by budgetary limitations, are selectively acquiring mid-tier smart munitions to bolster peacekeeping and counter-insurgency missions, often relying on foreign military financing programs to bridge funding gaps.

The Asia-Pacific region is characterized by a dual dynamic of high-volume indigenous production and prolific domestic R&D. China’s extensive deployment of hypersonic and unmanned systems has spurred neighboring states such as India, Japan, South Korea, and Australia to expand their own smart weapons portfolios. ASEAN members, meanwhile, pursue interoperability initiatives within multilateral security dialogues, integrating cost-rationalized precision defenses into maritime surveillance and littoral security infrastructures. These differentiated regional trajectories underscore the importance of tailored market approaches and strategic alliances within each geography.

This comprehensive research report examines key regions that drive the evolution of the Smart Weapons market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Smart Weapons Developers Illuminate Innovation Trajectories Collaborative Ventures and Competitive Positioning in Dynamic Context

A close examination of leading defense contractors reveals strategic investments and collaborative ventures that are redefining competitive positioning. One prominent prime has channeled significant R&D resources into hypersonic propulsion and advanced guidance suites, forging partnerships with specialized technology firms to expedite flight testing and prototype validation. Another market leader has deepened its focus on directed energy demonstrations, leveraging modular open system architectures to integrate high energy lasers onto existing combat platforms while pursuing international joint ventures to de-risk development costs.

Innovation trajectories also intersect with cross-sector alliances. Certain systems integrators have formed equity partnerships with emerging artificial intelligence developers to embed autonomous targeting and predictive analytics into munitions design. Simultaneously, established players are consolidating supply chains through strategic acquisitions of precision guidance component manufacturers, thereby ensuring vertical integration of key subsystems. Beltway-area firms continue to benefit from sustained government sponsorship of advanced research programs, while selected midsize enterprises carve niche expertise in counter-UAS and electronic warfare payloads. These strategic profiles underscore the dynamic collaborative ecosystem underpinning smart weapons advancement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Weapons market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASELSAN A.S.

- BAE Systems plc

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hanwha Aerospace

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- RTX Corporation

- Saab AB

- Textron Inc.

- Thales Group

- The Boeing Company

Actionable Strategic Imperatives for Smart Weapons Industry Leaders to Enhance Operational Readiness Drive Innovation and Strengthen Supply Chain Resilience

Industry leaders must pursue a multifaceted strategy to capitalize on the evolving smart weapons environment. To begin, allocating resources toward dual-use research initiatives can facilitate the rapid transition of commercial artificial intelligence and sensor advances into robust defense applications. Driving further value requires forging partnerships with nontraditional suppliers in the technology sector, enabling access to agile development cycles and cutting-edge software architectures that enhance targeting precision and system resilience.

Supply chain diversification remains a critical imperative; organizations should map and engage alternative sources for high-value components, thereby mitigating risks associated with concentrated dependencies. Moreover, adopting modular open-system designs can accelerate capability upgrades, reduce integration timelines, and foster interoperability across joint force structures. Investing in advanced manufacturing processes-such as additive manufacturing for custom warhead geometries-can further streamline production pipelines while enabling rapid fielding of specialized munitions. By embracing these actionable imperatives, defense industry stakeholders will be well positioned to navigate regulatory shifts, capitalize on emerging technologies, and sustain competitive advantage.

Comprehensive Research Methodology Outlining Multi-Source Data Collection Expert Interviews and Advanced Analytical Frameworks Ensuring Smart Weapons Insights

This research employed a robust methodology designed to ensure comprehensive and accurate insights. Primary data collection involved structured interviews with defense procurement officials, R&D directors at leading primes, and subject-matter experts in advanced weapons technologies. These interviews were complemented by on-site visits to experimental test facilities and production sites, providing firsthand validation of emerging capabilities and manufacturing practices.

Secondary research encompassed a thorough review of government publications, defense white papers, regulatory filings, and academic journals. Proprietary databases and open-source intelligence platforms were leveraged to track technology roadmaps and acquisition trends. Data were triangulated through comparative analysis frameworks-incorporating SWOT, PESTLE, and Porter’s Five Forces models-to synthesize a holistic perspective on market dynamics, competitive pressures, and regulatory influences. Rigorous quality control measures, including cross-validation by independent analysts, ensured the integrity and reliability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Weapons market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Weapons Market, by Weapon Type

- Smart Weapons Market, by Platform

- Smart Weapons Market, by Technology

- Smart Weapons Market, by Application

- Smart Weapons Market, by End User

- Smart Weapons Market, by Region

- Smart Weapons Market, by Group

- Smart Weapons Market, by Country

- United States Smart Weapons Market

- China Smart Weapons Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Conclusive Synthesis of Smart Weapons Market Drivers Technological Advancements and Evolving Operational Dynamics Shaping Defense Modernization Pathways

In summation, the smart weapons domain is characterized by rapid technological progression, strategic realignments driven by policy shifts, and differentiated regional imperatives. Precision guidance, autonomous targeting, and directed energy systems are converging to create versatile and highly effective combat solutions. Concurrently, tariff-induced supply chain realignments and allied collaboration frameworks are reshaping procurement and production ecosystems, underscoring the importance of adaptability and foresight.

As defense organizations continue to modernize their arsenals, the segmentation insights and regional analyses presented herein offer a clear roadmap for prioritizing investments and partnerships. Leaders in this space must integrate multidisciplinary expertise, leverage open architectures, and cultivate resilient supply chains to remain at the forefront of innovation. The compelling trajectory of smart weapons underscores an irreversible shift toward more intelligent, connected, and adaptable defense capabilities, making informed strategy and execution paramount in the years ahead.

Engage With Expert Associate Director to Secure Comprehensive Smart Weapons Market Intelligence and Drive Strategic Decision Making Through Tailored Insights

For tailored guidance on leveraging the strategic insights of the smart weapons market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By engaging directly with Mr. Rohom, organizations can secure a personalized briefing that aligns with their unique priorities and operational imperatives. His expertise in defense market dynamics and customer-focused solutions ensures a seamless process from data acquisition to actionable intelligence integration.

Whether seeking to fortify procurement strategies or to deepen understanding of regional and technological nuances, an introductory consultation with Mr. Rohom will provide clarity on how to harness comprehensive market analysis for competitive advantage. Take the next step toward informed decision making and unlock the full potential of the latest smart weapons research by scheduling a detailed discussion today

- How big is the Smart Weapons Market?

- What is the Smart Weapons Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?