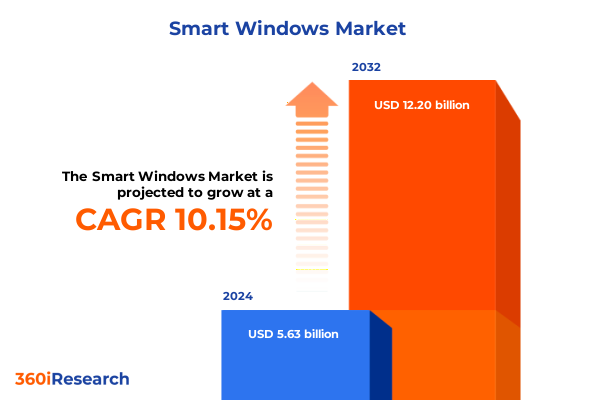

The Smart Windows Market size was estimated at USD 6.15 billion in 2025 and expected to reach USD 6.73 billion in 2026, at a CAGR of 10.26% to reach USD 12.20 billion by 2032.

Setting the stage for a new era of adaptive glazing solutions that balance energy efficiency, occupant comfort, and design versatility

The landscape of dynamic glazing and adaptive glass solutions has evolved into a critical frontier for energy efficiency and occupant comfort across diverse industries. As decision-makers increasingly prioritize sustainability and operational excellence, the demand for intelligent window technologies that can modulate light transmission, manage thermal loads, and enhance building aesthetics has grown exponentially. This introduction sets the context for understanding the multifaceted value propositions that smart windows bring to end users, integrators, and policymakers alike.

By weaving emerging technological advancements with shifting regulatory environments, this section frames the broader narrative of how smart windows are redefining conventional building envelopes and automotive glazing. From legacy applications in high-performance commercial centers to nascent integrations in aerospace cabins, the adaptive capabilities of modern glass solutions are fostering new standards in environmental control and design flexibility. Through a lens focused on both performance metrics and user experience, this overview prepares stakeholders for an in-depth exploration of market drivers, segmentation dynamics, and strategic imperatives underpinning the growth of smart window technologies.

Tracing the convergence of advanced materials, digital control systems, and stringent sustainability mandates transforming the smart window sector

The last several years have witnessed transformative shifts in the smart windows landscape, driven by converging forces of technological innovation, evolving sustainability mandates, and shifting consumer preferences. On one hand, breakthroughs in material science have yielded more reliable and cost-effective electrochromic films, while on the other, integration of IoT-enabled sensors and cloud-based analytics has enabled real-time control over light and thermal management. These concurrent developments are reshaping application models across automotive, commercial, and residential sectors.

Furthermore, the rise of circular economy principles and stringent carbon emission targets are compelling architects and OEMs to reevaluate traditional glazing systems. As a result, smart windows are gaining prominence not only for their energy-saving potential but also for their role in achieving green building certifications and fostering occupant well-being. This realignment underscores a paradigm wherein windows transition from passive architectural elements to active components of intelligent building ecosystems, signifying a profound shift in industry priorities and market opportunities.

Assessing how the 2025 United States tariff adjustments on smart window imports are reshaping supply chains, costs, and innovation trajectories

In 2025, the United States implemented a series of tariffs on imported smart window components and raw materials, altering the cost structure for key stakeholders. Manufacturers that previously relied on competitively priced inorganic electrochromic coatings from abroad now face elevated input costs, prompting supply chain reconfigurations and strategic recalibration. This policy shift is reshaping procurement strategies as firms explore domestic sourcing alternatives and vertical integration opportunities to mitigate import duties.

The cumulative impact of these tariffs extends beyond immediate cost increases. As lead times lengthen and logistics complexities escalate, project timelines for building renovations and new automotive glazing integrations are experiencing delays. In response, several industry players are accelerating R&D investments to develop home-grown technologies that can bypass tariff constraints. Ultimately, this reordering of global supply chains is fostering innovation within the United States, albeit under the pressure of short-term margin compression and the need to balance competitiveness with compliance.

Unveiling comprehensive segmentation dynamics from material innovation to product, application, end-user, and distribution channel opportunities

When examining the smart windows market through the lens of technology, one observes a spectrum that includes electrochromic variants-comprising both inorganic and organic electrochromic materials-liquid crystal displays, photochromic compounds, suspended particle devices distinguished by fluid-based and polymer-dispersed configurations, and thermochromic solutions. This technological diversity provides system integrators with the flexibility to tailor adaptive glazing performance based on application-specific priorities such as switching speed, power consumption, and optical clarity. Transitioning to application-driven segmentation reveals a deployment landscape spanning aerospace and defense platforms, automotive divisions including commercial vehicles and passenger cars, commercial buildings that cover hospitality venues, office towers, and retail spaces, as well as residential structures differentiated between multi-family complexes and single-family homes.

Investigating end-user categories highlights substantial uptake within the automotive sector-where both commercial vehicles and passenger cars leverage smart glazing for thermal comfort and glare management-as well as the building sector that bifurcates into commercial and residential projects, each with unique design and operational imperatives. Product-based insights underscore the prevalence of smart glass panels, switchable films that are further classified into electrochromic and suspended particle film offerings, and transparent LCD modules which employ in-plane switching, twisted nematic, or vertical alignment to achieve precise light modulation. Lastly, distribution channels manifest through aftermarket pathways involving distributors and retrofit specialists, OEM channels represented by automotive manufacturers and building product fabricators, and direct-to-consumer online platforms. This holistic view of segmentation dynamics uncovers both depth and breadth in market opportunities, guiding targeted strategies for product development and go-to-market planning.

This comprehensive research report categorizes the Smart Windows market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

- Distribution Channel

Analyzing diverse regional catalysts from Americas green building uptake to EMEA regulatory landscapes and Asia-Pacific urban expansion trends

Regional dynamics are playing a pivotal role in shaping the competitive contours of the smart windows sector. In the Americas, robust investments in green building initiatives and supportive policy frameworks are accelerating adoption across both commercial and residential projects. Meanwhile, automotive manufacturers in North America are incorporating dynamic glazing to address stringent fuel economy and emissions regulations, fostering a favorable environment for technology uptake.

Across Europe, the Middle East, and Africa, a confluence of regulatory drivers and sustainability commitments is driving demand for adaptive glass solutions in retrofit and new construction alike. Leading economies in Western Europe continue to pioneer energy-efficient building codes, while emerging markets in the Middle East are embracing smart windows for high-end commercial developments seeking premium performance. In the Asia-Pacific region, rapid urbanization and infrastructure expansion are propelling substantial growth in commercial real estate and automotive production, with governments incentivizing innovation through subsidies and research grants. Collectively, these regional insights highlight the importance of tailoring market entry and partnership strategies to local policy landscapes and customer preferences.

This comprehensive research report examines key regions that drive the evolution of the Smart Windows market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring the competitive landscape where global material giants and agile innovators forge alliances to drive smart window technology leadership

The smart windows ecosystem features a blend of established conglomerates and innovative startups, all competing to capture market share through differentiation in technology, scale, and service offerings. Incumbent manufacturers are leveraging extensive production capabilities and global distribution networks to maintain cost leadership in high-volume segments such as commercial glazing and automotive OEM supply. Conversely, agile pure-play technology firms are focusing on niche applications-like transparent LCD modules for aerospace cabins or organic electrochromic films for retrofit residential upgrades-to demonstrate product efficacy and carve out specialized market positions.

Strategic alliances between glass fabricators, material science innovators, and systems integrators are becoming increasingly common, as joint development agreements accelerate time-to-market for novel solutions. Furthermore, forward-looking corporations are embedding digital control platforms and predictive maintenance services into their offerings, signaling a shift toward recurring revenue models beyond one-time hardware sales. This competitive mosaic underscores the imperative for companies to balance scale-driven efficiencies with innovation-led differentiation in order to thrive in an evolving market environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Windows market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- ChromoGenics AB

- Corning Incorporated

- EControl-Glas GmbH

- Fuyao Glass Industry Group Co., Ltd.

- Gauzy Ltd.

- Gentex Corporation

- Guangzhou Huichi Industrial Development Co., Ltd.

- Guardian Industries Holdings, LLC

- Halio Inc.

- Innovative Glass Corp.

- Merck KGaA

- Nippon Sheet Glass Co., Ltd.

- Pleotint, Inc.

- Polytronix, Inc.

- PPG Industries, Inc.

- RavenWindow

- Research Frontiers Incorporated

- Saint-Gobain S.A.

- Smart Glass Technologies, LLC

- SmartGlass International Ltd.

- Taiwan Glass Ind. Corp.

- VELUX A/S

- View, Inc.

- Xinyi Glass Holdings Limited

Implementing supply chain resilience, digital platform integration, and collaborative co-development strategies to seize smart window market leadership

Industry leaders seeking to capitalize on the smart windows opportunity should first prioritize establishing resilient supply chains that can adapt to trade policy shifts and raw material availability. By fostering strategic partnerships with both domestic and international component suppliers, organizations can mitigate the risk of tariff-induced cost volatility while maintaining production continuity. Moreover, investing in flexible manufacturing capabilities-such as modular coating lines and agile assembly processes-will enable rapid scaling of diverse product lines in response to emerging demand patterns.

Simultaneously, companies must accelerate digital integration within their offerings, embedding IoT-enabled sensors and cloud-based control platforms to deliver value-added services like predictive maintenance and energy usage analytics. Collaborating with software developers and building management system providers will enhance interoperability and create stickier customer relationships. Finally, pursuing co-development agreements with architectural firms, automotive OEMs, and retrofit specialists can facilitate early-stage prototyping and validation, ensuring that smart window solutions align with end-user performance expectations and regulatory requirements.

Combining primary stakeholder interviews, exhaustive secondary research, and comparative benchmarking to deliver a transparent and reproducible market analysis framework

This research leveraged a multi-faceted methodology combining primary interviews, secondary literature review, and comparative case study analysis. Initial qualitative data was gathered through in-depth discussions with key stakeholders, including glazing fabricators, material scientists, systems integrators, and end users across automotive, commercial construction, and residential segments. These insights were supplemented by a rigorous review of industry reports, patent filings, academic publications, and regulatory documentation to validate technology trends and policy impacts.

To ensure robust segmentation insights, product specifications and technology roadmaps were analyzed to map feature sets against application requirements. Regional adoption patterns were assessed through examination of government incentive programs, building code evolutions, and import-export data. Competitive benchmarking involved profiling leading companies based on revenue distribution, technology portfolios, and strategic partnerships. This triangulated approach provides a comprehensive view of market dynamics while maintaining transparency and reproducibility of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Windows market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Windows Market, by Product

- Smart Windows Market, by Technology

- Smart Windows Market, by Application

- Smart Windows Market, by End User

- Smart Windows Market, by Distribution Channel

- Smart Windows Market, by Region

- Smart Windows Market, by Group

- Smart Windows Market, by Country

- United States Smart Windows Market

- China Smart Windows Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Highlighting how the fusion of material innovation, digital services, and policy drivers positions smart windows as foundational to future built environments and vehicles

Smart windows have transcended their early status as niche innovations to become integral components of energy-efficient buildings, next-generation vehicles, and specialized aerospace applications. The interplay of advanced materials, digital control capabilities, and evolving policy mandates continues to drive adoption, while shifting trade environments are catalyzing domestic innovation. As the market matures, success will hinge on the ability to navigate complex segmentation dynamics, foster resilient supply chains, and integrate value-added services that extend beyond hardware alone.

Looking ahead, stakeholders who invest in flexible manufacturing, strategic partnerships, and digital ecosystem integration will be best positioned to capture emerging growth opportunities. The confluence of regional policy incentives, sustainability targets, and user-centric design paradigms suggests that smart windows are poised to redefine conventional boundaries of glazing performance. This conclusion underscores the imperative for companies to translate insights into action, aligning organizational capabilities with the trajectory of this rapidly evolving market.

Unlock unprecedented market clarity and strategic foresight by partnering with Ketan Rohom to access the full smart windows market research repertoire

Ready to elevate your strategic planning and gain a competitive edge in the smart windows market? Connect with Ketan Rohom today to explore comprehensive insights tailored to your organization’s needs and unlock actionable intelligence to drive growth and innovation.

- How big is the Smart Windows Market?

- What is the Smart Windows Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?