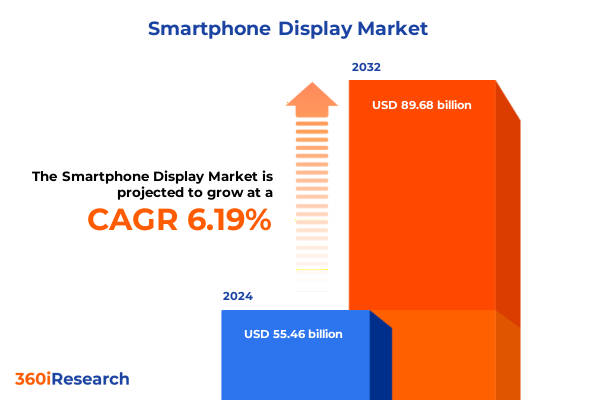

The Smartphone Display Market size was estimated at USD 58.43 billion in 2025 and expected to reach USD 61.56 billion in 2026, at a CAGR of 6.31% to reach USD 89.68 billion by 2032.

Exploring the Evolution of Smartphone Display Technologies Revolutionizing User Engagement Through Advanced Visual Performance and Innovative Design Approaches

The smartphone display segment has undergone rapid transformation over the past decade, evolving from basic LCD panels to cutting-edge high-resolution OLED and MicroLED solutions. This evolution has been driven by consumer demand for richer color reproduction, deeper contrast ratios, and more immersive visual experiences. Display manufacturers have invested heavily in advanced materials and production processes to deliver thinner bezels, higher brightness levels, and improved energy efficiency, setting new benchmarks for what users expect from mobile screens.

Meanwhile, smartphone OEMs have leveraged these technological advancements to differentiate their offerings, integrating features such as high refresh rates, under-display fingerprint sensors, and foldable designs. As a result, displays have become a primary battleground for market competition, influencing product positioning and driving new use cases in gaming, augmented reality, and multimedia consumption. In this context, understanding the nuances of display technologies and the forces shaping their adoption is essential for stakeholders seeking to navigate the complexity of the smartphone ecosystem.

Identifying the Fundamental Shifts in Display Technology Innovation and Changing Consumer Preferences Transforming the Future of Smartphone Experiences

Over recent years, several transformative shifts have redefined the smartphone display landscape. One of the most notable changes is the widespread adoption of OLED panels, which offer superior color accuracy and contrast compared to traditional LCDs. OLED technology has progressed from rigid sheets to flexible substrates, enabling the emergence of foldable and rollable devices. This transition has challenged industry norms and unlocked design possibilities that were previously unattainable, fundamentally altering consumer perceptions of what a mobile screen can achieve.

Simultaneously, the demand for higher refresh rates has intensified, with 120 Hz and beyond becoming standard among premium devices. This shift has elevated user expectations for smooth scrolling, responsive touch interactions, and competitive gaming performance. At the same time, the integration of advanced display drivers and low-power modes has addressed concerns around battery life, striking a balance between performance and endurance. The proliferation of HDR content and the ongoing refinement of display calibration techniques have further enriched the viewing experience, cementing the display’s role as a critical touchpoint in the user journey.

Assessing the Broad Influence of U.S. Trade Measures and Tariff Policies on Smartphone Display Manufacturing Cost Structures and Supply Chain Resilience

The United States implemented its initial wave of tariffs targeting Chinese electronics imports beginning in early 2025, with the Trump administration announcing a 10% levy on a broad array of consumer goods, including smartphone components. This policy escalated further when, effective May 2, an additional 10% tariff was applied, raising the cumulative tariff burden on Chinese-made smartphones to 20% and intensifying cost pressures along the display supply chain.

Despite this increase, a critical exemption for smartphones and computer monitors was enacted in April. A directive from U.S. Customs and Border Protection specified that these categories would be excluded from the new tariffs, with refunds issued for duties collected since April 5. This exemption provided immediate relief to major OEMs and display assemblers, helping to stabilize pricing amid broader trade tensions.

Meanwhile, legal challenges have introduced further complexity. On May 28, 2025, the United States Court of International Trade struck down certain tariffs imposed under the International Emergency Economic Powers Act, a decision that was temporarily stayed by the Court of Appeals for the Federal Circuit on May 29 as the administration appealed. These rulings underscore the uncertain legal framework governing tariff authority and highlight the potential for policy reversals to affect supply chain resilience. Concurrently, analysis from global market research indicates that as much as 80% of finished display-related products imported into the U.S. could be exposed to tariff fluctuations, emphasizing the need for manufacturers to reassess sourcing and production strategies in light of evolving trade measures.

Delivering Actionable Perspectives on Market Segmentation Impact Across Display Technologies, Resolution Classes, Screen Size Preferences, and Refresh Rate Trends

Analysis of display technology segmentation reveals that LCD variants, particularly IPS LCD, continue to serve as the workhorse for cost-conscious smartphone models, offering reliable performance and energy efficiency. At the same time, the rise of MicroLED has begun to capture attention for its unparalleled brightness and longevity, though it remains in the early stages of commercial adoption. Meanwhile, OLED panels, especially AMOLED implementations, have seen accelerated integration across mid- to high-end tiers, with flexible and rigid AMOLED formats enabling sleeker device profiles and foldable form factors.

Resolution categorizations further illustrate market stratification, as Full HD solutions remain prevalent among mainstream devices, balancing visual clarity with power consumption. Quad HD options have found a home in performance-oriented flagships, while Ultra HD panels are reserved for niche applications where pixel density commands a premium. In parallel, screen size preferences are gravitating toward larger displays, with the above 6-inch segment driving phablet adoption, even as the 5-to-6-inch category retains strong appeal for its ergonomic balance. The sub-5-inch segment persists in entry-level and compact offerings.

Refresh rate distinctions underscore consumer demand for fluid interaction, as 120 Hz has rapidly transitioned from a high-end differentiator to an expected feature in premium lines. At the same time, 60 Hz panels maintain their position in budget-oriented models, and 90 Hz has carved a niche in value-added tiers. Furthermore, refresh rates above 120 Hz are emerging among gaming-centric devices, demonstrating how frequency performance has become a strategic lever within display segmentation.

This comprehensive research report categorizes the Smartphone Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Technology

- Resolution Category

- Screen Size Category

- Refresh Rate

Uncovering Critical Regional Market Dynamics and Growth Drivers Influencing Smartphone Display Demand Across Americas, Europe Middle East Africa and Asia Pacific

In the Americas, demand for premium smartphone displays is driven by consumers’ appetite for OLED and high-refresh-rate panels, with North America leading in the adoption of advanced form factors such as foldables. U.S. policy incentives aimed at reshoring production have prompted OEMs and suppliers to explore domestic or near-shore assembly options. This trend has created partnerships between display manufacturers and regional foundries, bolstering supply chain security and reducing transit-related disruptions.

Europe, the Middle East, and Africa display a more heterogeneous pattern, as Western Europe exhibits strong uptake of Ultra HD and HDR-capable screens in flagship devices, while emerging markets in the Middle East and Africa remain price-sensitive, favoring cost-efficient LCD solutions. Regulatory initiatives around energy efficiency and sustainability in the EU are influencing display panel selection, incentivizing manufacturers to adopt lower-power components and eco-friendly production techniques.

Asia-Pacific remains the epicenter of display manufacturing and consumption. China continues to dominate capacity, with OLED and LCD fabrication facilities scaling to meet both domestic and global demand. South Korea’s panel leaders maintain technological leadership in AMOLED development, whereas emerging markets such as India and Southeast Asia are witnessing rapid growth in local assembly, encouraged by government-sponsored production incentives and an expanding consumer base seeking both premium and budget-friendly devices.

This comprehensive research report examines key regions that drive the evolution of the Smartphone Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Revolutionizing Smartphone Display Capabilities Partnerships and Competitive Market Approaches

Samsung Display has solidified its position at the forefront of AMOLED and flexible OLED innovations, investing significantly in next-generation LTPO backplane technologies that optimize power consumption. Its strategic partnerships with major OEMs ensure that its panels anchor flagship offerings, while its forays into foldable display R&D continue to shape industry roadmaps.

Apple’s deep integration of OLED across its premium smartphone line underscores its commitment to superior visual performance, with proprietary calibration techniques that enhance color accuracy and brightness uniformity. The company’s diversification of supply chain, including expanded sourcing from South Korean and Japanese panel makers, has fortified its ability to mitigate regional risks and maintain production continuity.

China’s BOE Technology Group has leveraged economies of scale to challenge incumbents in the LCD and OLED arenas, securing contracts with both domestic and international brands. Its rapid capacity expansion and focus on low-cost high-volume TFT LCD and AMOLED production have disrupted traditional market share allocations, particularly in entry-level and mid-tier segments.

LG Display continues to push the boundaries of large-format and flexible OLED, though it has refocused on niche markets such as rollable and transparent displays. Meanwhile, emerging MicroLED specialists are forging alliances with tier-one OEMs to pave the way for the next display revolution, signaling a long-term shift toward emissive, ultra-high-brightness panel technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smartphone Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- E Ink Holdings Inc.

- Innolux Corporation

- Japan Display Inc.

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- Sharp Corporation

- Tianma Microelectronics Co., Ltd.

- Visionox Technology Inc.

Delivering Practical Strategic Recommendations for Industry Leaders to Navigate Disruptions and Drive Innovation in Smartphone Display Production Efficiency

Industry leaders should prioritize diversification of their display supply chains to mitigate tariff-related cost uncertainties and maintain production agility. By establishing relationships with multiple panel manufacturers across different regions, OEMs can balance pricing pressures and avoid single-source dependencies.

Additionally, investing in advanced manufacturing capabilities for flexible AMOLED and exploring pilot production of MicroLED can position companies at the cutting edge of design innovation. Collaborative R&D alliances with component suppliers and universities can accelerate technology maturation and reduce time-to-market for next-generation form factors.

Sustainability and energy-efficiency considerations are also paramount. Display fabs that adopt renewable energy sources and implement waste-minimization processes will not only comply with emerging regulatory standards but also appeal to environmentally conscious consumers. Integrating lifecycle assessments into product roadmaps will strengthen brand equity and open new channels for green marketing differentiation.

Detailing a Robust Multistage Research Methodology Combining Comprehensive Primary Interviews Secondary Analysis and Data Triangulation for Market Insights

This report’s methodology is built on a multistage research framework, beginning with in-depth interviews of display technology experts, OEM executives, and supply chain stakeholders. These conversations provided first-hand insights into technological challenges, investment priorities, and emerging use cases that shaped our analysis of market dynamics.

Complementing the primary inputs, extensive secondary research was conducted, including examination of patent filings, financial disclosures, and academic publications. Data triangulation was applied to reconcile company statements with external market indicators and publicly available trade data, ensuring that findings reflect both qualitative perspectives and quantitative evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smartphone Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smartphone Display Market, by Display Technology

- Smartphone Display Market, by Resolution Category

- Smartphone Display Market, by Screen Size Category

- Smartphone Display Market, by Refresh Rate

- Smartphone Display Market, by Region

- Smartphone Display Market, by Group

- Smartphone Display Market, by Country

- United States Smartphone Display Market

- China Smartphone Display Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Conclude the Comprehensive Smartphone Display Market Evaluation with Forward-Looking Perspectives

The collective insights presented underscore the critical role of display technologies in defining smartphone value propositions and shaping competitive differentiation. As OLED, MicroLED, and high-refresh-rate LCD variants continue to evolve, manufacturers and OEMs must remain vigilant to shifts in consumer preferences and regulatory landscapes.

Strategic agility-anchored in supply chain diversification, targeted R&D investment, and sustainable production practices-will determine which players can effectively navigate this dynamic environment. By integrating the actionable intelligence and sector-specific perspectives herein, decision-makers are empowered to make informed choices that align with both short-term resilience and long-term innovation ambitions.

Encouraging Immediate Engagement with Our Sales Leader to Access the Full Smartphone Display Market Research Report and Unlock Strategic Advantages

To explore the full depth of our smartphone display market analysis and uncover strategic insights tailored to your business requirements, we invite you to engage directly with our sales leader, Ketan Rohom, Associate Director, Sales & Marketing. His expertise and detailed understanding of the report will ensure you receive targeted guidance and the data you need to inform critical decisions.

Connect with Ketan Rohom today to discuss how the smartphone display market research report can empower your organization to anticipate emerging trends, mitigate risks, and secure competitive advantages in a rapidly evolving landscape.

- How big is the Smartphone Display Market?

- What is the Smartphone Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?