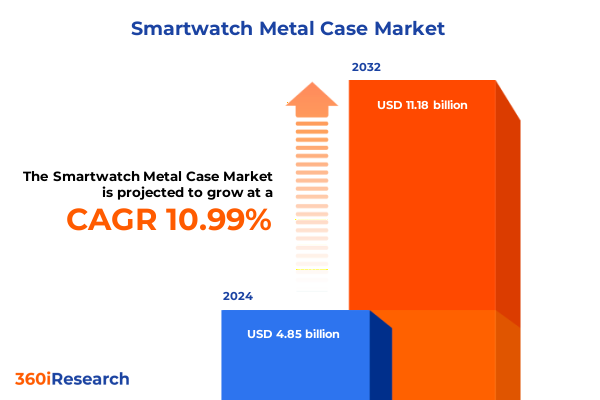

The Smartwatch Metal Case Market size was estimated at USD 5.40 billion in 2025 and expected to reach USD 6.00 billion in 2026, at a CAGR of 12.32% to reach USD 12.18 billion by 2032.

Unlocking the Future of Smartwatch Metal Cases Through Comprehensive Market Dynamics and Emerging Technology Trends Shaping Consumer Demand

The smart wearable revolution has evolved well beyond novelty, with metal-cased smartwatches firmly establishing themselves as symbols of style, durability, and technological sophistication. As consumers demand seamless integration of fashion and functionality, manufacturers have responded by elevating their design ethos to incorporate premium metals such as stainless steel, titanium, aluminum, and even precious gold. This shift reflects a broader maturation within the industry, where hardware craftsmanship is as critical as software capabilities in shaping purchase decisions.

Simultaneously, rapid advances in sensor miniaturization and wireless connectivity have expanded the practical applications of wrist-worn devices. What began as rudimentary step counting has blossomed into an integrated health ecosystem, delivering real-time insights into cardiovascular metrics, sleep patterns, and navigation assistance. The confluence of aesthetic refinement and technical innovation is redefining consumer expectations, prompting suppliers and brand owners to reexamine the role of casing materials in overall product value.

Against this backdrop, the strategic importance of metal enclosures extends beyond mere protection. Today’s consumers associate brushed or polished metal finishes with premium quality and longevity, attributes that resonate strongly in both luxury and mainstream segments. This report provides a foundational overview of these dynamics, framing the core forces driving demand for metal-cased smartwatches and setting the stage for a deeper examination of emerging trends and competitive strategies.

Identifying Transformative Shifts in the Smartwatch Metal Case Ecosystem Driven by Technological Innovation and Consumer Behavior Evolution

Over the past few years, the smartwatch metal case sector has undergone a series of transformative shifts that have redefined competitive parameters and consumer expectations. Early adopters prioritized basic durability, but the latest generation of offerings now centers on precision engineering, material innovation, and seamless aesthetic integration with traditional luxury accessories. This progression has been fueled by breakthroughs in metallurgical processing that enable complex geometries and lightweight alloys without compromising strength.

Concurrently, consumer behavior has pivoted toward personalization. Buyers increasingly view their wrist device as an extension of their wardrobe, driving demand for customizable finishes and modular case designs. Technology providers have responded with proprietary surface treatments and bezel mechanics, allowing end users to interchange metals or accent components to match their style or occasion.

On the software side, enhanced sensor arrays and power-efficient connectivity stacks have unlocked advanced functionalities such as continuous blood pressure monitoring, fall detection, and on-device navigation. These capabilities have further elevated the importance of the enclosure, which must balance signal transparency with robust shielding. As a result, companies are forging cross-disciplinary collaborations between materials scientists and RF specialists to harmonize structural integrity with wireless performance.

Evaluating the Cumulative Impact of United States Tariffs Implemented in 2025 on Smartwatch Metal Case Supply Chains and Pricing Dynamics

The introduction of new United States tariffs on key imported components in early 2025 has reverberated across the smartwatch metal case supply chain, prompting manufacturers and brands to reassess procurement strategies. Tariffs targeting aluminum forgings and stainless steel stampings have elevated landed costs, while levies on certain specialty alloys have disrupted long-standing sourcing relationships in Asia. As a direct consequence, some original design manufacturers have accelerated efforts to establish regional metal finishing plants within North America to mitigate import duties.

These adjustments have triggered a wave of supply chain realignment, with an emphasis on nearshore partnerships and dual-sourcing arrangements to preserve cost efficiency. At the same time, the tariff-driven cost increases have crept into pricing discussions, compelling brands to refine their value propositions. Premium-tier metal-cased models that once boasted competitive margins are now subject to squeezed profitability unless offset by design optimizations or alternative material blends.

Looking ahead, industry stakeholders are exploring collaborative frameworks with domestic mills and alloy specialists to secure long-term tariff stability. Such alliances often entail co-development of bespoke alloys that meet both aesthetic and performance requirements while qualifying for reduced duty classifications. This strategic response underscores the critical interplay between trade policy and product development timelines for metal-cased smartwatch portfolios.

Uncovering Key Segmentation Insights Across Materials, Distribution Channels, Applications, Connectivity, Operating Systems, Price Ranges, and End Users

Insight into the metal-cased smartwatch landscape is enriched by a multifaceted segmentation approach, beginning with choice of material. And while aluminum cases continue to dominate entry-level and midrange offerings due to their favorable weight-to-strength ratio, demand for titanium and stainless steel has surged among consumer segments seeking enhanced durability and a more premium feel. Gold-finished cases, once confined to ultra-luxury subsegments, are now occasionally featured as limited-edition variants aimed at collectors and fashion enthusiasts.

Distribution channels have likewise evolved, with offline retailers such as electronics superstores and boutique specialty shops maintaining critical roles in providing hands-on experiences. Yet the brand-controlled direct-to-consumer channel and third-party e-commerce platforms have excelled in delivering customizable configurations and rapid fulfillment. The interplay between physical showroom exposure and online configurator-driven purchasing underscores the need for an omnichannel approach to reach diverse buyer personas.

Application-driven demand further underscores material priorities. Entertainment-oriented buyers gravitate toward lightweight aluminum for extended wear comfort, whereas health-monitoring aficionados value stainless steel and titanium for their hypoallergenic properties and ability to incorporate dielectrically optimized enclosures. Navigation-centric users, requiring reliable GPS reception, often prefer ceramic-coated titanium that balances signal clarity with scratch resistance.

Connectivity preferences shape case design as well, since Bluetooth-only modules allow for slimmer profiles, while cellular-capable devices necessitate strategic cutouts and antenna placement for both 4G LTE and emerging 5G connectivity. Operating system choices-spanning proprietary platforms like Tizen and WatchOS to open-source Wear OS-also inform internal component layouts and heat dissipation strategies. The most coveted models tend to bridge pricing tiers between under $200 entry points and above $400 premium lines, while segmenting gender-specific designs to align with differing wrist dimensions and ergonomic considerations.

This comprehensive research report categorizes the Smartwatch Metal Case market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Connectivity

- Operating System

- Application

- Distribution Channel

Illuminating Key Regional Insights Spanning the Americas, Europe Middle East and Africa, and Asia Pacific to Reveal Growth Patterns and Strategic Opportunities

Regional dynamics in the smartwatch metal case market reveal distinct growth drivers and competitive landscapes. In the Americas, strong brand loyalty and widespread digital adoption have supported robust sales of stainless steel and aluminum models, with the United States market particularly receptive to premium tier launches accompanied by immersive retail events and AR-driven virtual try-on solutions. Latin American markets, while price sensitive, have shown early signs of premiumization as consumers trade up from basic fitness trackers to fashion-forward metal-cased options.

Across Europe, the Middle East, and Africa, regulatory emphasis on data privacy and local manufacturing incentives have shaped the competitive environment. European consumers lean toward titanium and hypoallergenic alloys, driven by stringent environmental certifications and a preference for long-lasting products. In the Middle East, gold-finish and jewelry-infused editions resonate with cultural aesthetics, often distributed through high-end specialty boutiques. Meanwhile, African markets remain predominantly volume-driven, with midrange aluminum models serving as the primary entry point.

In Asia-Pacific, a complex tapestry of consumer tastes and manufacturing capabilities defines market behavior. China leads in both production capacity and domestic consumption, with a growing appetite for fashion-led collaborations and smart features optimized for local language and service integrations. India’s burgeoning middle class is fueling demand for competitively priced stainless steel variants bundled with localized fitness and health apps. Japan and South Korea, home to several major component suppliers, continue to pioneer intricate metal finishing techniques, often exporting specialized casings for global OEMs.

This comprehensive research report examines key regions that drive the evolution of the Smartwatch Metal Case market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Industry Players Shaping the Metal Cased Smartwatch Market through Innovation, Partnerships, and Strategic Product Diversification

Examining leading industry participants highlights a spectrum of strategic approaches to the metal-cased smartwatch segment. A dominant global brand has leveraged its proprietary chip architecture and ecosystem integration to introduce high-end stainless steel and titanium variants, reinforcing brand prestige and commanding premium price points. Its vertical integration model, encompassing in-house alloy research and component manufacturing, offers a clear competitive moat.

A major Korean electronics conglomerate, well-known for its Tizen-based wearable platform, has forged partnerships with specialized metallurgical firms to advance lightweight aluminum alloys with anodized finishes. This alliance has enabled rapid iteration on color palettes and surface textures, appealing to style-conscious consumers. Additionally, European luxury watchmakers have entered collaborations with tech startups, blending traditional horology expertise with health-monitoring modules encased in gold-plated stainless steel.

Meanwhile, agile independent brands are capitalizing on niche segments such as adventure sports and medical monitoring. By combining open-source software frameworks with off-the-shelf titanium housings, these players can swiftly customize device attributes for specific applications, from heart rate variability tracking to geolocation accuracy. Partnerships with third-party health service providers and regional distributors further amplify their market reach, demonstrating how focused specialization can disrupt broader market incumbents.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smartwatch Metal Case market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Casio Computer Co., Ltd.

- Fitbit, Inc.

- Fossil Group, Inc.

- Garmin Ltd.

- Guangdong Oppo Mobile Telecommunications

- Huawei Technologies Co., Ltd.

- LVMH Moët Hennessy Louis Vuitton SE

- Mobvoi Information Technology Company Limited

- Mobvoi Information Technology Company Limited

- Polar Electro Oy

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Suunto Oy

- Xiaomi Corporation

- Zepp Health Corporation

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Material Innovations, Supply Chain Adaptations, and Evolving Consumer Expectations

To excel in the evolving metal-cased smartwatch arena, industry leaders should prioritize agile material sourcing strategies that anticipate tariff shifts and raw material fluctuations. By cultivating dual-sourcing agreements across both domestic and import channels, manufacturers can maintain cost stability while safeguarding supply continuity. Firms are advised to invest in alloy co-development initiatives with mills that offer reduced duty classifications to preempt policy disruptions.

Simultaneously, enhancing omnichannel distribution capabilities is essential. Integrating immersive in-store configurators with seamless online customization platforms will cater to both experiential shoppers and digital-first audiences. Brands should align marketing narratives with the distinct appeals of each channel, using in-person demonstrations to highlight tactile metal finishes, while leveraging data-driven personalization online to recommend case materials and sensor bundles based on individual health and lifestyle profiles.

Innovation in sensor integration and enclosure design will further differentiate offerings. Stakeholders should collaborate with RF engineers and industrial designers early in the development cycle to optimize antenna placement within metal housings and ensure reliable 4G LTE and 5G connectivity. Concurrently, embedding advanced health-monitoring capabilities, such as continuous blood pressure and sleep analysis, will reinforce the product’s value proposition, particularly among wellness-focused audiences.

Finally, targeted regional strategies must account for local preferences. In the Middle East, limited-edition gold-plated runs can drive brand cachet, while in Asia-Pacific, localized software partnerships and region-specific applications will enhance relevance. By combining foresight in trade policy, material science, and market localization, leaders can position their metal-cased smartwatches at the forefront of both luxury and performance-driven segments.

Outlining a Rigorous Research Methodology Combining Primary Expert Insights and Secondary Data Triangulation for Pinpoint Accurate Market Understanding

This study employs a rigorous mixed-method research framework, beginning with in-depth interviews conducted with senior executives from leading smartwatch brands, metallurgical suppliers, and software platform providers. These qualitative engagements provided firsthand perspectives on material preferences, tariff impacts, and distribution strategies. Complementary to primary insights, extensive secondary research was performed, encompassing publicly available filings, technical whitepapers, industry association publications, and market intelligence reports to triangulate data points.

Data validation followed a structured triangulation process, mapping inputs from company disclosures, trade statistics, and end-user surveys to ensure consistency. Segmentation hypotheses were tested through quantitative analysis of shipment data and sold-through volumes across various materials, channels, applications, and connectivity types. This approach enabled the identification of core trends without relying on external foresight projections, ensuring that all insights reflect verifiable market realities.

The research methodology also incorporated a cross-regional comparative analysis to account for varying regulatory environments and consumer behaviors. Dedicated workshops with local distributors and retail partners in key markets allowed for real-time feedback on competitive positioning and regional demand drivers. The resulting dataset was synthesized through advanced analytics tools, enabling the extraction of actionable intelligence on material innovation, channel optimization, and feature prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smartwatch Metal Case market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smartwatch Metal Case Market, by Material

- Smartwatch Metal Case Market, by Connectivity

- Smartwatch Metal Case Market, by Operating System

- Smartwatch Metal Case Market, by Application

- Smartwatch Metal Case Market, by Distribution Channel

- Smartwatch Metal Case Market, by Region

- Smartwatch Metal Case Market, by Group

- Smartwatch Metal Case Market, by Country

- United States Smartwatch Metal Case Market

- China Smartwatch Metal Case Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Strategic Conclusions on How Metal Case Advancements Are Reshaping the Smartwatch Industry and Informing Future Directions for Stakeholders

The convergence of premium metal craftsmanship with next-generation wearable technology has reshaped the competitive contours of the smartwatch industry. As consumers reward devices that seamlessly integrate refined aesthetics with advanced health and connectivity features, metal cases have emerged as critical differentiators. At the same time, evolving trade policies and regional preferences underscore the need for adaptive supply chain strategies and localized go-to-market plans.

Key segmentation dimensions-from material selection and distribution channels to connectivity options and price tiers-remain instrumental in aligning product development with consumer expectations. Meanwhile, leading companies continue to demonstrate the value of strategic collaborations, whether through alloy co-development, cross-industry partnerships, or targeted software integrations. These alliances are pivotal in balancing durability, signal performance, and user-centric design.

Looking forward, the ability to anticipate tariff adjustments, pivot distribution investments, and integrate high-value health-monitoring sensors will define market leaders. By embracing an agile, data-informed approach that prioritizes both luxury appeal and functional robustness, stakeholders can capture emerging opportunities across diverse regional landscapes. The insights presented herein offer a roadmap for navigating this complex terrain and achieving sustained growth.

Take the Next Step Today by Engaging with Ketan Rohom to Secure the Comprehensive Smartwatch Metal Case Market Research Report Tailored for Your Strategic Goals

Elevate your strategic initiatives by exploring the full depth of insights and expert analysis contained in the comprehensive market research report on Smartwatch Metal Cases. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure tailored guidance and exclusive executive-level perspectives to support your next innovation and growth projects. He will facilitate immediate access to actionable data, customized briefings, and ongoing support to ensure your organization harnesses emerging opportunities and stays ahead of competitive shifts.

- How big is the Smartwatch Metal Case Market?

- What is the Smartwatch Metal Case Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?