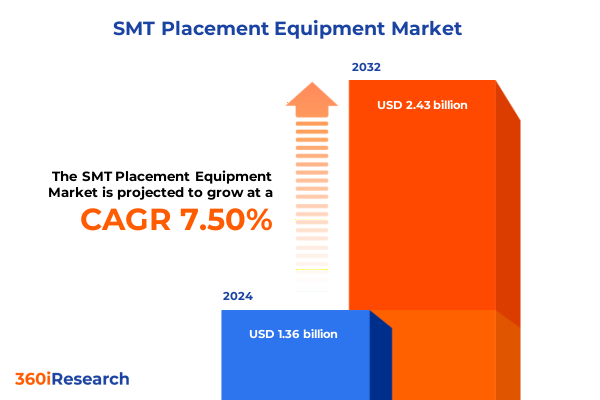

The SMT Placement Equipment Market size was estimated at USD 1.46 billion in 2025 and expected to reach USD 1.56 billion in 2026, at a CAGR of 7.57% to reach USD 2.43 billion by 2032.

Setting the Stage for Next-Generation Surface Mount Technology Placement Equipment with Insights into Current Dynamics and Industry Drivers

The evolution of surface mount technology placement equipment has been shaped by relentless innovation in electronics assembly and the accelerating pace of product miniaturization. As devices shrink further and circuit densities climb, manufacturers face mounting pressure to deploy placement machines that deliver exceptional precision without sacrificing throughput. In this context, placement equipment has become the linchpin of high-mix, high-volume production environments, where even marginal improvements in pick-and-place accuracy can translate into significant yield gains and cost savings.

Moreover, the confluence of labor shortages and the rising demand for flexible manufacturing has elevated the importance of advanced placement systems capable of adaptive handling and rapid changeovers. Consequently, decision-makers are prioritizing machines that not only accommodate diverse component profiles-from fine-pitch QFPs to micro-BGA packages-but also integrate seamlessly with real-time analytics and process monitoring platforms. This introduction sets the stage for an in-depth examination of how these drivers are reshaping the next generation of SMT placement solutions.

Exploring How Automation, Artificial Intelligence, and Flexible Manufacturing Paradigms are Reshaping the Surface Mount Placement Equipment Landscape

Over the past few years, the SMT placement landscape has undergone transformative shifts fueled by automation, artificial intelligence, and the drive toward flexible manufacturing paradigms. Machine builders are embedding AI-powered vision systems that autonomously detect component anomalies, adjust nozzle parameters on the fly, and optimize placement trajectories for maximum efficiency. This convergence of smart sensors and edge computing now empowers manufacturers to achieve sub-20-micron accuracy while maintaining throughput rates that were previously unattainable.

Simultaneously, the adoption of modular, scalable platforms has redefined how production lines respond to evolving product cycles. Whereas traditional machines required extensive retooling for new board designs, next-generation models leverage plug-and-play feeder modules and software-driven recipe management to minimize changeover times. Furthermore, real-time data integration with MES and ERP systems enables closed-loop feedback, ensuring that performance bottlenecks are flagged and resolved proactively. These shifts underscore a broader trend toward digitalized, high-agility assembly operations.

Assessing the Far-Reaching Consequences of Recent United States Tariff Measures on Surface Mount Technology Placement Equipment in 2025

In 2025, the imposition of additional tariffs on imported electronic assembly equipment to the United States has exerted a pronounced impact on capital investments and supply chain strategies. Companies reliant on cost-competitive machines from key manufacturing hubs have encountered elevated unit prices and extended lead times. As a result, procurement teams are recalibrating their sourcing models, balancing the higher initial outlay against potential long-term gains in reliability and maintenance support.

Consequently, manufacturers are exploring nearshoring options to mitigate exposure to tariff fluctuations and enhance supply chain resilience. This shift has prompted OEMs to strengthen partnerships with domestic and regional suppliers, even as they negotiate service-level agreements to ensure uptime and rapid parts replacement. Ultimately, the cumulative effect of the United States tariff measures has been to accelerate a diversification strategy, compelling stakeholders to rethink traditional vendor relationships and prioritize agile procurement frameworks.

Uncovering Critical Insights from Market Segmentation Across Equipment Type, Speed, Components, Process, Heads, and End-User Industries

A nuanced understanding of market segmentation reveals distinct opportunities and challenges across multiple dimensions. Based on equipment type, fully automatic machines command the spotlight in high-volume electronics manufacturing, whereas manual units retain relevance for prototyping labs and repair centers, and semi-automatic systems bridge the gap for medium-run applications requiring a balance of flexibility and throughput. When viewed through the lens of placement speed, products targeting consumer electronics and large-scale contract manufacturers emphasize high-speed capability to meet aggressive cycle-time targets, while low and medium-speed offerings carve a niche in specialized applications such as aerospace and medical electronics, where precision outweighs raw speed.

Delving deeper, segmentation by component type underscores how handling requirements diverge between active and passive parts. Active components such as diodes and transistors necessitate delicate nozzle alignment and precise pick pressures, driving machine builders to refine vacuum control systems. In contrast, passive components like capacitors and resistors, often supplied in bulk reels, demand reliable feeder mechanisms to sustain continuous flow. Further segmentation by operational process shows that batch production configurations excel in high-mix, low-volume contexts by enabling rapid recipe swaps, whereas continuous production setups prevail in dedicated lines with minimal product variation. Additionally, analysis by placement head configuration highlights the throughput advantages of multi-head machines in large-scale assembly environments, while single-head variants offer cost-effective solutions for low-volume or prototype runs. Finally, end-user industry segmentation demonstrates that electronics manufacturing services providers leverage flexible platforms to serve diverse client portfolios, original equipment manufacturers invest in integrated lines to secure proprietary processes, and telecommunications companies focus on placement systems designed for high-reliability modules in networks and infrastructure equipment.

This comprehensive research report categorizes the SMT Placement Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Placement Speed

- Component

- Operational Process

- Placement Head

- End-User Industry

Examining Regional Dynamics and Growth Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific in the SMT Placement Equipment Sector

Regional dynamics play a pivotal role in shaping growth trajectories and competitive landscapes across the SMT placement equipment sector. In the Americas, nearshoring and reshoring initiatives have revitalized investment in domestic production facilities, as manufacturers seek to reduce logistical complexity and buffer against geopolitical risks. This trend has been bolstered by government incentives aimed at enhancing regional supply chain resilience, leading to a resurgence of interest in state-of-the-art placement machinery tailored for North American manufacturing standards.

Europe, Middle East & Africa present a mosaic of mature markets and emerging hubs. Western European countries continue to drive innovation through advanced applications in automotive electronics and Industry 4.0 initiatives, while Middle Eastern and African economies gradually develop assembly capabilities supported by infrastructure investments. In parallel, Asia-Pacific remains the epicenter of SMT equipment demand, with high-volume output in China, Taiwan, and South Korea complemented by burgeoning requirements in Southeast Asian markets. The Asia-Pacific region’s deep supplier ecosystems and cost-competitive manufacturing base position it as both a leading consumer and innovator of placement technologies.

This comprehensive research report examines key regions that drive the evolution of the SMT Placement Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Surface Mount Placement Equipment Providers and Their Strategic Initiatives Driving Competitive Advantage

Leading equipment providers continue to differentiate through strategic investments in research, partnerships, and service networks that deliver tangible value to end users. Some of the most influential players have expanded their portfolios to include AI-enhanced vision and inspection modules, enabling proactive quality control at speeds that align with next-generation production demands. Others have forged alliances with software vendors to offer comprehensive Industry 4.0 solutions that integrate placement data with broader factory automation platforms.

Moreover, top manufacturers are focusing on modular product lines that allow for incremental upgrades, reducing total cost of ownership while future-proofing capital assets. Service-oriented business models, featuring remote diagnostics and predictive maintenance packages, have emerged as key differentiators in a highly competitive market. Taken together, these strategic initiatives underscore the critical role that vendor selection plays in achieving both operational excellence and strategic agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the SMT Placement Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AISIN CORPORATION

- Autotronik-SMT GmbH

- Bayerische Motoren Werke AG

- Beijing Huawei Silkroad Electronic Technology Co., Ltd.

- Beijing Torch Co., Ltd.

- Cadillac Products Automotive Company

- Continental AG

- DDM Novastar, Inc.

- DENSO CORPORATION

- ESO Electronic Service Ottenbreit GmbH

- Essemtec AG

- Europlacer Limited

- FANUC CORPORATION

- Ford Motor Company

- Fritsch GmbH

- Fuji Corporation

- Generac Power Systems, Inc.

- General Motors Company

- Guangxi Yuchai Machinery Co., Ltd.

- Hangzhou TronStol Technology Co., Ltd.

- Hanwha Group

- Heller Industries, Inc.

- Hillmancurtis

- Hirata Corporation

- Hitachi, Ltd.

- Honda Motor Co., Ltd.

- HYUNDAI INFRACORE Co., Ltd.

- IBE SMT Equipment, LLC

- Juki Corporation

- Kawasaki Heavy Industries, Ltd.

- Kirloskar Oil Engines Ltd.

- KUKA AG

- Kulicke and Soffa Industries, Inc.

- LiuGong Machinery Corporation

- Mahindra Construction Equipment

- Manncorp Inc.

- Marelli Holdings Co., Ltd.

- Mirae Corporation

- Mycronic AB

- Nordson Corporation

- Obayashi Corporation

- Ouster, Inc.

- Panasonic Corporation

- Ren Thang Co., Ltd.

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Sandvik AB

- SANY Group Co., Ltd.

- Scania CV AB

- Shantui Construction Machinery co.,Ltd

- Shenzhen Faroad Intelligent Equipment Co.,Ltd

- SumiLax SMT Technologies Pvt. Ltd.

- Universal Instruments Corporation by Delta Electronics, Inc.

- Valeo SA

- Versatec, LLC

- Wenzhou Yingxing Technology Co., Ltd.

- XCMG Group

- Yamaha Motor Co., Ltd.

- ZF Friedrichshafen AG

- Zhejiang Neoden Technology Co.,Ltd

Offering Actionable Strategic Recommendations for Stakeholders to Capitalize on Emerging Trends and Enhance SMT Placement Equipment Performance

Industry leaders looking to capitalize on emerging trends must adopt a multifaceted approach that balances technological investment with organizational readiness. Prioritizing the adoption of smart automation tools-such as AI-driven vision systems and adaptive feeders-can unlock significant efficiency gains while enhancing first-pass yield. Additionally, diversifying supply chains through a combination of regional and global partnerships will mitigate the risk of tariff-related disruptions and ensure continuity of operations.

Simultaneously, stakeholders should invest in workforce training programs to equip technicians and engineers with the skills required to manage complex, software-driven platforms. Implementing digital twin simulations and real-time process analytics can further accelerate problem-solving and enable continuous improvement cycles. By aligning strategic procurement, technological deployment, and talent development, companies can effectively navigate the evolving landscape of SMT placement equipment and secure sustainable competitive advantage.

Detailing the Rigorous Research Methodology Employed to Deliver Robust and Actionable Insights on SMT Placement Equipment Market Dynamics

The analysis presented in this report is underpinned by a robust, multi-tiered research methodology designed to ensure depth, accuracy, and relevance. Initially, comprehensive secondary research was conducted, encompassing industry journals, white papers, and regulatory filings to establish a foundational understanding of market and technology trends. This was complemented by primary qualitative interviews with machine builders, contract manufacturers, and end-user operations managers to capture first-hand perspectives on adoption drivers and pain points.

Data triangulation techniques were then applied to reconcile quantitative insights-such as industry shipment volumes and equipment utilization rates-with qualitative findings. Peer benchmarking and expert panel reviews provided further validation, while a systematic review of published case studies and patent filings offered visibility into innovation trajectories. Throughout the process, rigorous quality controls and cross-functional audit checks were employed to maintain objectivity and ensure that conclusions are both actionable and reliable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our SMT Placement Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- SMT Placement Equipment Market, by Equipment Type

- SMT Placement Equipment Market, by Placement Speed

- SMT Placement Equipment Market, by Component

- SMT Placement Equipment Market, by Operational Process

- SMT Placement Equipment Market, by Placement Head

- SMT Placement Equipment Market, by End-User Industry

- SMT Placement Equipment Market, by Region

- SMT Placement Equipment Market, by Group

- SMT Placement Equipment Market, by Country

- United States SMT Placement Equipment Market

- China SMT Placement Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding the Executive Overview with Key Observations and Forward-Looking Perspectives on Surface Mount Placement Equipment Evolution

This executive overview has illuminated the pivotal role of advanced SMT placement equipment in supporting modern electronics assembly, underscoring how automation, AI integration, and modular design are revolutionizing production capabilities. By examining the implications of recent tariff measures, key segmentation across equipment types and end-user industries, and regional dynamics, it becomes clear that agility and resilience are the twin pillars of strategic success in this space.

Looking ahead, stakeholders who proactively embrace data-driven decision making, diversify their procurement networks, and cultivate a workforce adept at managing increasingly intelligent systems will be best positioned to thrive. As placement equipment continues to evolve-influenced by miniaturization, customization, and sustainability imperatives-the insights offered here provide a roadmap for navigating both current challenges and future opportunities in surface mount technology.

Engaging with Associate Director Ketan Rohom to Explore Customized SMT Placement Equipment Insights and Secure Complete Market Intelligence Access

To delve deeper into the comprehensive analysis and strategic implications presented in this executive summary, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through the full breadth of insights on surface mount technology placement equipment, tailoring the discussion to your organization’s unique objectives and operational context. By collaborating with Ketan, you gain privileged access to detailed chapters on technological innovations, regional market drivers, and targeted segmentation findings that align precisely with your decision-making priorities.

Securing the complete market intelligence report unlocks actionable strategies grounded in rigorous research and field-tested recommendations. Reach out to Ketan Rohom to schedule a personalized demonstration of key data points, discuss custom add-on analyses, and explore licensing options. Take the next step to empower your team with the intelligence needed to navigate evolving tariffs, harness emerging automation trends, and secure a competitive advantage in the rapidly advancing landscape of SMT placement equipment.

- How big is the SMT Placement Equipment Market?

- What is the SMT Placement Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?