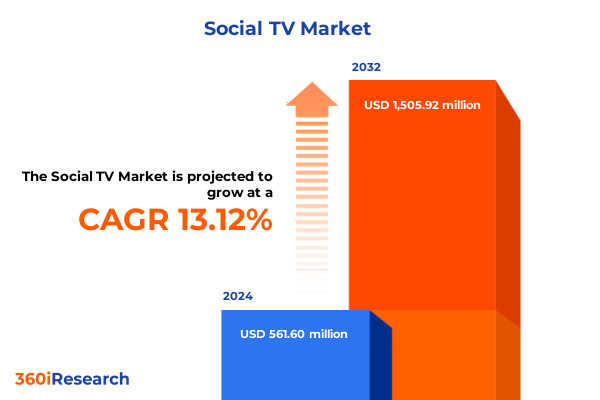

The Social TV Market size was estimated at USD 635.48 million in 2025 and expected to reach USD 713.42 million in 2026, at a CAGR of 13.11% to reach USD 1,505.92 million by 2032.

Unveiling the Dynamics of Social Television as Audiences Reinvent Viewing Through Immersive Interaction Across Screens and Platforms

The convergence of traditional broadcasting and social media has given rise to an interactive phenomenon reshaping how audiences consume content. Viewers no longer remain passive observers; instead, they actively participate in real time by sharing opinions, voting in polls, and engaging with live discussions. As a result, Social TV has emerged as a strategic imperative for media companies aiming to foster deeper viewer loyalty, differentiate their offerings, and drive new revenue streams. Over the past two years, platforms have leveraged integrated social features to align broadcast programming with dynamic audience behavior, turning solitary experiences into communal events.

This shift is underscored by significant shifts in consumption patterns. YouTube usage on television screens surpassed mobile for the first time in early 2025, with audiences viewing more than one billion hours of content daily on their connected TVs. Simultaneously, the proliferation of affordable streaming devices and the rise of user-generated content have democratized the ability to broadcast events from anywhere, further empowering audiences. Consequently, media stakeholders must embrace this interactive landscape, where every second-screen interaction and personalized touchpoint can influence engagement metrics and long-term loyalty.

As the market embraces this dynamic environment, decision-makers are tasked with understanding the strategic role of Social TV within a broader omnichannel ecosystem. From programming executives planning live events to advertisers optimizing cross-device campaigns, the relevance of real-time feedback and social sentiment analysis cannot be overstated. In the sections that follow, this report examines the transformative shifts, tariff impacts, segmentation strategies, regional nuances, and generative industry insights that will equip leaders to make informed choices and capitalize on emerging opportunities.

Exploring the Revolutionary Shifts and Technological Innovations That Are Redefining How Audiences Engage with Social Television Experiences

Audiences today navigate a media landscape no longer defined by linear broadcasting alone but by multifaceted interactions across multiple devices. Second-screen engagement has become ubiquitous, with 86 percent of internet users regularly using a smartphone, tablet, or laptop while watching primary content on a television screen. In parallel, a recent Deloitte study confirms that 81 percent of U.S. viewers incorporate a second screen to enhance their viewing experience, from participating in live polls to accessing supplementary information in real time. These statistics underscore a pivotal shift: viewers expect synchronized experiences that merge social conversation, additional content, and interactive features without disrupting core program consumption.

Meanwhile, streaming platforms and broadcasters are broadening their feature sets to capitalize on this behavior. Live polling and Q&A modules have become standard tools during live events, enabling real-time audience contributions that directly influence on-screen discussions and outcomes. Beyond engagement, this interactivity has tangible monetization potential; advertisers can leverage data from viewer responses to refine targeting and measure sentiment with unprecedented granularity. Furthermore, leading service providers are integrating AI-driven personalization engines that tailor content recommendations and ads based on user profiles, viewing history, and social behavior. As a result, the era of one-size-fits-all programming is giving way to dynamic, data-driven experiences that better resonate with individual preferences.

Looking ahead, generative AI stands poised to further transform Social TV by automating the creation of highlights, short-form clips, and interactive overlays. According to industry analysis, 86 percent of advertisers are already adopting or planning to adopt generative AI for video ad production, with expectations that it will account for 40 percent of all video ads by 2026. Simultaneously, content personalization investments are being scaled across live and on-demand environments; companies like Roku and Netflix are enhancing metadata quality and leveraging machine learning to deliver contextually relevant experiences that mitigate churn. Collectively, these technological innovations are redefining engagement by making every viewer interaction count towards a more immersive, personalized narrative.

Assessing the Multifaceted Consequences of Recent U.S. Tariffs on Television Hardware, Device Manufacturing, and Consumer Spending Trends in 2025

The U.S. government’s imposition of new reciprocal tariffs on imported electronics in early 2025 has sent ripples through the Social TV ecosystem, markedly affecting hardware manufacturers, platform providers, and ultimately consumers. President Trump’s tariff policy closed the longstanding duty-free exemption for Chinese parcels under $800, leading to price hikes on a wide array of consumer electronics, including smart TVs, streaming media players, and set-top boxes. Manufacturers are grappling with increased input costs for key components sourced from China and other Asian markets, prompting some to consider relocating assembly to Mexico or expanding domestic production. However, shifting production footprints involves significant capital deployment and logistical challenges, potentially resulting in supply bottlenecks without immediate relief from cost pressures.

Industry data indicates that leading TV brands may pass these additional tariffs onto consumers, driving up retail prices in the second half of 2025. TrendForce’s analysis highlights that global TV shipments are projected to decline by 0.7 percent year over year, as brands such as Samsung, LG, and TCL balance pre-tariff stockpiling against weakening peak season demand. Moreover, consumer advocacy groups, including the National Retail Federation and Consumer Technology Association, project that U.S. households could collectively incur an additional $711 million in TV expenditures over the next year as a result of these levies. Such cost inflation risks dampening upgrade cycles and accelerating a shift toward lower-priced, ad-supported streaming tiers.

Beyond hardware, broader industry valuations have also felt the tariff headwinds. S&P Global Market Intelligence reports that the imposed duties contributed to a $720 billion erosion in market capitalization among publicly traded media and technology firms since early April 2025. As consumer spending power is constrained by rising device costs and elevated general inflation, platform operators face potential attrition of subscription revenues and reduced advertising budgets. In this environment, strategic adaptation-whether through tariff mitigation strategies, dynamic pricing models, or enhanced ad monetization-will be vital to sustaining growth and preserving consumer engagement at scale.

Illuminating Key Segmentation Perspectives to Decode How Content Types, Devices, Interaction Modes, and Applications Shape the Social TV Ecosystem

Market segmentation analysis reveals a complex tapestry of content formats that shape Social TV engagement. The universe of programming extends from real-time broadcasts and social media highlights to user-generated streams, each uniquely positioning audiences along interactivity spectrums. Within this framework, Video on Demand emerges as a pivotal pillar, further differentiated into Advertising-supported Video on Demand and Subscription-based Video on Demand, each delivering distinct monetization pathways and user experiences.

Device ecosystems represent another dimension of strategic relevance. Connected televisions anchor the viewing experience through platforms such as Roku OS, Tizen OS, and webOS, while media streaming devices on Android TV, Fire OS, and Roku OS bridge legacy sets and smart functionalities. Simultaneously, personal computing remains integral, with Windows, macOS, and Linux desktops facilitating both content origination and niche viewing, and smartphones and tablets-on Android and iOS-powering on-the-go interactions.

Viewer interaction modes add further texture to segmentation insights. Gesture control offers immersive, hands-free experiences, while second-screen applications synchronize with primary streams to deliver augmented content. Voice control, through leading assistants such as Alexa, Google Assistant, and Siri, enables seamless navigation and content discovery. Finally, application verticals-spanning educational programming, entertainment franchises, news updates, and live sports coverage-demonstrate the breadth of Social TV’s impact across audience interests and behaviors.

This comprehensive research report categorizes the Social TV market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Content Type

- Functionality

- Application

Uncovering Regional Dynamics to Highlight How Americas, EMEA, and Asia-Pacific Markets Influence Growth Patterns and Audience Engagement Models

Regional dynamics play an instrumental role in shaping Social TV adoption and engagement. In the Americas, the United States and Canada lead with advanced broadband infrastructure, widespread adoption of ad-supported streaming models, and sophisticated data-driven advertising ecosystems. Advertisers leverage rich cross-device attribution to measure campaign outcomes, and content creators benefit from large, engaged social communities that amplify programming reach.

Meanwhile, Europe, the Middle East, and Africa (EMEA) present a fragmented yet vibrant landscape characterized by diverse regulatory environments and content quotas. European markets often mandate minimum local content thresholds, driving demand for region-specific programming and localized social engagement strategies. In the Middle East and Africa, mobile-first consumption prevails in many areas, and partnerships between broadcasters and telecom operators have accelerated the delivery of hybrid streaming-broadcast services, supported by second-screen interactivity.

In the Asia-Pacific region, innovation is fueled by super-app ecosystems and robust mobile commerce integration. Streaming platforms embed shoppable elements directly into live events, enabling viewers to purchase products without leaving an interactive overlay. Regional streaming giants collaborate with social media platforms to co-produce events that harness influencer ecosystems, while governments in the region explore regulatory frameworks that balance platform growth with content moderation and data privacy concerns.

This comprehensive research report examines key regions that drive the evolution of the Social TV market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analytical Perspectives on Leading Social TV Stakeholders to Spotlight How Key Companies Are Driving Innovation and Shaping Future Viewing Behaviors

Leading technology and media companies continue to define and refine the Social TV landscape through targeted innovations and strategic partnerships. Netflix pioneers hyper-personalized recommendations across its global subscriber base, leveraging AI-empowered metadata curation to dynamically surface new titles and interactive storylines. Meanwhile, YouTube, with over eight million paid TV service subscribers, has solidified its position as one of the most influential Social TV platforms, enabling live broadcasts that seamlessly integrate real-time chat and reaction overlays.

On the hardware side, Roku, Amazon Fire, and Google’s Chromecast compete fiercely in the streaming device category, each optimizing their user interfaces to promote social features such as watch parties and synchronized viewing. Roku’s growing ad-supported streaming offering underscores the convergence of device sales and revenue-generating services. Samsung and LG, through their proprietary connected TV operating systems, have integrated social sharing capabilities directly into the television experience, reducing friction for audience interaction.

Meanwhile, media conglomerates such as Disney and NBCUniversal are investing in second-screen companion apps that deliver supplementary content, interactive games, and social media integration timed to live broadcasts. These proprietary applications enhance viewer retention and open new sponsorship opportunities. In the advertising ecosystem, demand-side platforms and agency trading desks are adopting programmatic CTV solutions that enable real-time bidding, addressable ad insertion, and detailed performance analytics, reflecting a broader industry pivot toward data-driven monetization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Social TV market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Apple Inc.

- Comcast Corporation

- Dailymotion SA

- Discord Inc.

- Fox Corporation

- FuboTV Inc.

- Hulu, LLC

- Lions Gate Entertainment Corp.

- Microsoft Corporation

- Paramount Global

- Reddit, Inc.

- Roku, Inc.

- Sony Interactive Entertainment LLC

- Twitch Interactive, Inc.

- Twitter, Inc.

- Vimeo, Inc.

- Warner Bros. Discovery, Inc.

Strategic and Actionable Recommendations to Empower Media and Technology Leaders in Navigating Social TV Challenges and Capitalizing on Emerging Opportunities

Industry leaders must embrace agile approaches to harness the full potential of Social TV. First, organizations should invest in advanced data analytics and AI-driven personalization engines that tailor both content recommendations and advertising messages to individual viewer profiles. By doing so, they can reduce churn rates and increase average engagement duration.

Second, media firms need to develop cohesive second-screen strategies that complement live broadcasts. This involves collaborating with technology partners to ensure real-time synchronization, interactive polling, and social sharing functionalities align with programming goals. Building these capabilities in house or through strategic alliances will be critical to maintaining competitive differentiation.

Third, businesses should explore hybrid monetization models that combine subscription and advertising revenues. Ad-supported tiers provide entry points for price-sensitive audiences, while premium subscriptions can deliver exclusive interactive experiences. Such diversification mitigates the risks associated with economic fluctuations and regulatory changes, including the effects of recent tariff impositions.

Finally, cross-functional teams must prioritize regulatory compliance and data privacy best practices. As voice control and gesture-based interactions proliferate, ensuring secure data handling and transparent consent mechanisms will preserve consumer trust. Establishing clear governance frameworks for AI-powered features will help organizations scale responsibly and ethically.

Detailing the Research Methodology Underpinning Social TV Analysis to Ensure Robust Data Integrity, Comprehensive Insights, and Reproducible Findings

This research employed a rigorous, multi-method approach to deliver comprehensive insights. The analysis began with an extensive review of secondary literature, including industry reports, academic studies, and regulatory filings, to establish the macroeconomic and technological context. Publicly available data from leading analytics providers were triangulated to validate trends in viewership, device penetration, and advertising spend.

Primary data was gathered through in-depth interviews with senior executives across broadcasting, streaming, technology manufacturing, and advertising agencies. These conversations provided qualitative perspectives on strategic priorities, operational challenges, and innovation roadmaps. Additionally, a targeted survey of over 200 decision-makers gauged the adoption rate of interactive features and AI-driven tools within live and on-demand environments.

Quantitative modeling techniques were applied to segment the market based on content type, device category, interaction mode, and application verticals. Statistical analysis, including cluster segmentation and cross-tabulations, ensured the robustness of insights. Finally, all findings were peer-reviewed by subject matter experts to ensure accuracy, neutrality, and relevance for stakeholders across the Social TV value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Social TV market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Social TV Market, by Content Type

- Social TV Market, by Functionality

- Social TV Market, by Application

- Social TV Market, by Region

- Social TV Market, by Group

- Social TV Market, by Country

- United States Social TV Market

- China Social TV Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Concluding Perspectives on the Continued Evolution of Social Television and Its Strategic Implications for Industry Stakeholders and Audience Engagement Models

The Social TV landscape has transitioned from a supplementary novelty to a core strategic pillar for broadcasters, platforms, and advertisers alike. The integration of interactive features, second-screen experiences, and AI-driven personalization has fundamentally altered the audience-content relationship, turning passive consumption into active participation. As global trade policies and tariff impositions reshape hardware costs, stakeholders must balance supply chain agility with innovative pricing and monetization frameworks.

Segmentation insights reveal that success hinges on mastering multiple dimensions-content type, device ecosystem, interaction mode, and application use case. Regional dynamics underscore the importance of localizing strategies to align with diverse regulatory and consumer behavior profiles. Meanwhile, leading companies demonstrate that value creation emerges from seamless user experiences, data-rich advertising solutions, and collaborative partnerships.

Moving forward, the imperative for industry decision-makers is clear: invest in advanced analytics, embrace flexible monetization models, and uphold ethical standards in data usage. By doing so, organizations will not only navigate current headwinds but also unlock new avenues for growth and engagement in an increasingly interactive media ecosystem.

Connect with Ketan Rohom to Secure In-Depth Social TV Insights and Unlock Tailored Intelligence That Will Drive Your Strategic Media Decisions Today

I appreciate your interest in unlocking unparalleled insights within the ever-evolving Social TV ecosystem. To receive the comprehensive market research report and gain access to detailed data, in-depth competitive analysis, and bespoke strategic recommendations, please connect with Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the report’s key findings and tailor the engagement to your organization’s unique needs.

- How big is the Social TV Market?

- What is the Social TV Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?