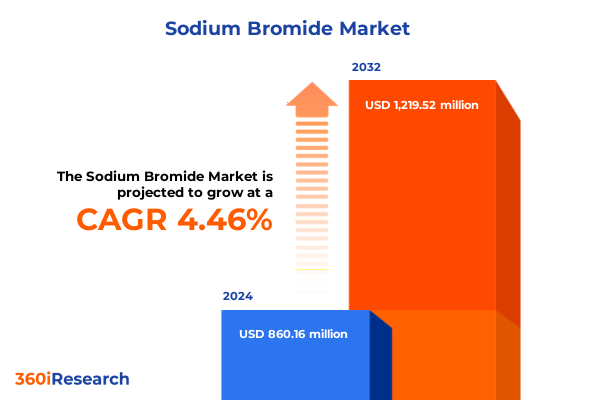

The Sodium Bromide Market size was estimated at USD 899.37 million in 2025 and expected to reach USD 947.08 million in 2026, at a CAGR of 6.73% to reach USD 1,419.52 million by 2032.

Comprehensive Overview of Sodium Bromide’s Role in Modern Industries Highlighting Its Diverse Applications and Market Dynamics and Technological Advancements

The sodium bromide ecosystem spans a spectrum of critical industrial and specialty chemical applications, each demanding precise performance characteristics and supply chain resilience. As an inorganic compound with versatile physicochemical traits, sodium bromide underpins processes from analytical laboratory research to large-scale water treatment systems. Recent developments illustrate that the compound’s role has evolved beyond mere reagent status, positioning it as a linchpin in global value chains affected by dynamic regulatory, environmental, and technological pressures.

This strategic overview introduces the multifaceted drivers shaping sodium bromide utilization, including technological innovations in analytical reagents, stringent environmental mandates for brine management, and the compound’s significance in oil and gas completion fluids. Coupled with shifts in pharmaceutical API production, sodium bromide’s demand profile reflects broader trends toward specialized, high-purity chemical inputs. By anchoring this discussion in contemporary market realities and emerging sustainability paradigms, the stage is set for a nuanced exploration of transformative forces, tariff impacts, segmentation insights, regional differentiators, corporate strategies, and actionable recommendations.

Exploration of Technological, Environmental and Operational Disruptions Reshaping Sodium Bromide Supply Chains and Usage Practices

Recent years have been marked by profound shifts in how sodium bromide is sourced, processed, and applied across end markets. The oil and gas sector, long reliant on high-density clear brine completion fluids, is increasingly adopting digitally optimized formulations that integrate real-time monitoring sensors, accelerating well completion timelines and reducing fluid losses. Simultaneously, water treatment operators are transitioning from conventional bromine-based disinfection to hybrid systems that pair sodium bromide with advanced oxidation processes, reflecting a broader industry imperative to minimize disinfection byproducts while ensuring microbial control.

In pharmaceutical manufacturing, demand for pharmaceutical-grade sodium bromide has surged as companies refine protocols for API production and diagnostic kit reagents. Analytical laboratories are also witnessing an uptick in research-grade requirements, driven by burgeoning life sciences initiatives in precision medicine. Underpinning these sectoral changes is the growing emphasis on circular economy principles, prompting producers to explore brine recycling techniques and closed-loop chemical recovery. Collectively, these transformative shifts underscore a landscape in which technological integration, environmental stewardship, and operational agility coalesce to redefine sodium bromide’s role as a critical performance chemical.

Assessing the Compounded Effects of Section 301 and De Minimis Policy Changes on Sodium Bromide Imports and Cost Structures

The cumulative impact of U.S. trade policies in 2025 has imparted significant cost pressures and supply chain reconfiguration in the sodium bromide sector. Under the Section 301 statutory review, the Office of the U.S. Trade Representative finalized tariff adjustments on key chemical inputs, imposing duty increases across semiconductors, electric vehicle components, and related specialty chemicals effective January 1, 2025. Although the general Most-Favored-Nation rate for bromides of sodium remains duty-free, the additional 25% duty on products of China under HTS 2827.51.00.00 has elevated landed costs for importers relying on Asian-sourced salt derivatives.

Beyond Section 301, the elimination of the Section 321 de minimis exemption for Chinese goods disrupted low-value e-commerce and small-scale chemical shipments, introducing ad valorem duties of up to 120% or specific duties of $200 per postal item from May 2 through June 1 2025, before stabilizing at revised rates thereafter. This policy shift, designed to fortify domestic manufacturers and curb illicit trade, has prompted firms to diversify sourcing strategies, accelerate domestic production capacity investments, and advocate for exclusion requests via CBP’s proposed rulemaking process.

Insights into Application-Driven Demand Patterns and Product-Type Preferences Shaping Market Opportunities

Segmentation of the sodium bromide market by application reveals distinct growth vectors anchored in both traditional and emerging end uses. Laboratory analysts have intensified purchases of analytical reagents and high-purity research-use grades to support life science R&D, while oilfield service providers continue to demand robust completion and drilling fluid formulations for deepwater and horizontal well operations. In pharmaceuticals, end-product manufacturers are selecting specific grades optimized for active pharmaceutical ingredient synthesis and diagnostic reagent production, reflecting tighter regulatory standards. Municipal and industrial water treatment facilities, in turn, require brine treatment solutions for both desalination plants and brine management systems, compelling suppliers to engineer tailored sodium bromide compositions that balance microbial efficacy with environmental compliance.

From a product type perspective, the market stratifies into anhydrous crystalline powders and granules favored for solid-state reactions, aqueous solutions across concentration bands that enable precise fluid density control, and tablet forms standardized for field-deployable dosing in water treatment. Purity grade segmentation differentiates bulk industrial grades used in non-critical applications from pharmaceutical and technical grades demanded by regulated sectors. Distribution channels range from traditional dealer-distributor networks that support onsite logistics to direct sales relationships with large industrial end users and emerging online platforms enabling smaller purchasers to access standardized product catalogs efficiently.

This comprehensive research report categorizes the Sodium Bromide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Product Type

- Purity Grade

- Distribution Channel

Comprehensive Examination of Regional Dynamics Influencing Production Capabilities and Consumption Trends

The Americas region remains a focal point for sodium bromide production and consumption, with North America’s mature chemical infrastructure and shale drilling activity sustaining robust demand for oilfield completion fluids and brine management services. Latin American desalination initiatives, particularly in arid zones, are incrementally expanding use of bromide-based disinfection, while regional trade agreements influence raw material flows across the hemisphere.

In Europe, the Middle East & Africa, stringent environmental regulations and rising water scarcity are propelling adoption of sodium bromide in advanced oxidation and hybrid water treatment platforms. The Gulf Cooperation Council’s investments in large-scale seawater desalination projects further accentuate the need for high-quality bromide salts, even as the European Union’s regulatory frameworks drive suppliers to validate product stewardship and safety protocols rigorously.

Asia-Pacific remains the volume leader, anchored by China’s extensive bromine extraction facilities and India’s expanding pharmaceutical and oil & gas sectors. Yet the recent tariff reclassifications and de minimis policy revisions have accelerated localization efforts, prompting multinational chemical firms to augment regional production capacities and pursue joint ventures to mitigate cross-border trade risks.

This comprehensive research report examines key regions that drive the evolution of the Sodium Bromide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Overview of Industry Leaders’ Strategic Investments and Portfolio Expansions in Sodium Bromide Supply

Leading sodium bromide suppliers are strategically aligning investments to fortify market positions amid evolving end-use dynamics. Albemarle Corporation, a global bromine specialty chemicals powerhouse, continues to expand its Arkansas extraction and processing facilities, recently unveiling a multi-year modernization program aimed at increasing capacity for high-purity solid and solution grades. The company’s bifurcated business model encompasses mercury control, oilfield services, and precision chemical reagents, underpinned by proprietary brine processing technologies.

LANXESS AG has amplified its focus on microbial control and water treatment, notably through the acquisition of International Flavors & Fragrances’ microbial control business, adding production sites in St. Charles, Louisiana, and Institute, West Virginia. This expansion significantly enhanced LANXESS’s biocide portfolio, enabling deeper integration of sodium bromide-based formulations in disinfection and material protection applications. Additional players, including niche producers and regional distributors, continue to differentiate via service offerings, quality certifications, and digital order management platforms to meet the specific demands of specialty segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sodium Bromide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Aldon Corporation

- Alpha Chemika

- American Elements

- Anron Chemicals Co.

- Cowin Industry Ltd Shandong Hirch Chemical Co Ltd

- Dharoya Pharmaceuticals Private Limited

- Ebrator Biochemicals Inc.

- ICL Industrial Products

- Jordan Bromine Company

- LANXESS AG

- Nilkanth Organics

- Noah Chemicals

- PARTH INDUSTRIES

- ProChem, Inc.

- Redox Pty Ltd.

- Schlumberger Limited

- Shandong Haiwang Chemical Industry Co., Ltd.

- Tata Sons Pvt. Ltd.

- TETRA Technologies Inc.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Vizag Chemical International

- Windia Chemicals P Ltd

- Yogi Intermediates Pvt. Ltd.

Actionable Strategies for Enhancing Supply Chain Resilience, Cost Efficiency, and Innovation in Sodium Bromide Operations

To navigate the evolving terrain, industry leaders should pursue a balanced sourcing strategy that leverages domestic production while maintaining selective import channels with tariff mitigation plans. Establishing long-term supplier agreements that include flexible pricing mechanisms and volume discounts can buffer against sudden duty hikes. Companies should also invest in on-site brine recycling and closed-loop recovery systems to reduce raw material consumption and align with sustainability mandates.

Innovation in product formulations remains crucial; developing custom-tuned sodium bromide blends for emerging applications-such as energy storage flow batteries-can unlock new revenue streams. Digital supply chain platforms that integrate real-time tariff tracking, customs classification automation, and predictive logistics will enhance responsiveness to regulatory changes. Advocacy for targeted tariff exclusions, supported by trade compliance teams, will further shield core commodity flows, while cross-sector partnerships can foster collaborative R&D to address end-use performance challenges.

Comprehensive Description of Research Techniques Including Data Triangulation and Expert Validation Methodologies

This analysis integrates qualitative and quantitative methodologies to ensure robust insights. Secondary research encompassed review of government publications, USTR tariff notices, CBP rulemaking documents, industry journals, and relevant HTS code databases. Primary interviews were conducted with senior executives at chemical manufacturers, oilfield service providers, water utilities, and pharmaceutical firms to validate market perceptions and capture forward-looking demand signals.

Data triangulation involved corroborating trade flow statistics from U.S. customs databases with proprietary shipment records and financial disclosures of key public companies. Environmental and regulatory trends were mapped through analysis of policy proposals and industry compliance benchmark reports. The segmentation framework emerged from iterative workshops with subject-matter experts, ensuring that application, product type, purity grade, and distribution channel categorizations reflect current market realities and align with stakeholder priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sodium Bromide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sodium Bromide Market, by Application

- Sodium Bromide Market, by Product Type

- Sodium Bromide Market, by Purity Grade

- Sodium Bromide Market, by Distribution Channel

- Sodium Bromide Market, by Region

- Sodium Bromide Market, by Group

- Sodium Bromide Market, by Country

- United States Sodium Bromide Market

- China Sodium Bromide Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesis of Key Findings Emphasizing Resilience Drivers and Strategic Imperatives for Market Leadership

Sodium bromide’s enduring relevance across critical industrial segments is reinforced by its adaptability to technological, environmental, and regulatory shifts. The 2025 U.S. tariff landscape has introduced cost and logistical complexities, yet also catalyzed supply chain diversification and domestic capacity investments. Robust segmentation analysis underscores distinct demand drivers in laboratory, oil & gas, pharmaceutical, and water treatment applications, while regional insights reveal divergent growth trajectories predicated on infrastructure development and policy frameworks.

Industry leaders who embrace strategic sourcing flexibility, innovative formulation development, and advanced supply chain digitalization will be best positioned to capitalize on emerging opportunities. In an environment where tariff regimes and sustainability imperatives converge, a proactive, data-driven approach will be the cornerstone of competitive advantage and long-term value creation in the sodium bromide market.

Reach Out to Ketan Rohom for Exclusive Access to the Full Sodium Bromide Market Analysis Report and Strategic Insights

To delve deeper into these insights and secure a comprehensive, data-driven blueprint for navigating the sodium bromide landscape, we encourage you to engage with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through tailored solutions, bespoke service offerings, and exclusive access to the full market research report. Leverage this opportunity to inform strategic investments, optimize supply chain decisions, and stay ahead of regulatory and tariff developments.

- How big is the Sodium Bromide Market?

- What is the Sodium Bromide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?