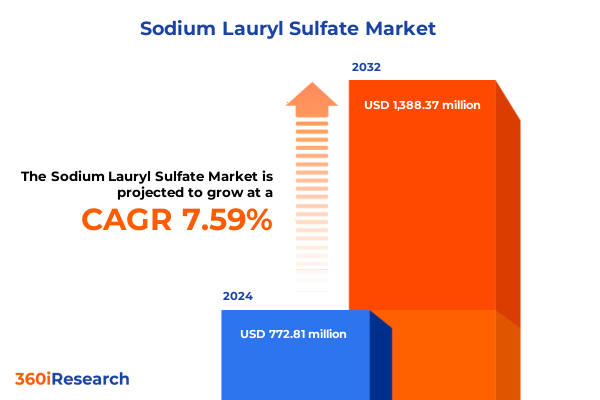

The Sodium Lauryl Sulfate Market size was estimated at USD 824.91 million in 2025 and expected to reach USD 882.87 million in 2026, at a CAGR of 7.72% to reach USD 1,388.37 million by 2032.

Unveiling the Current State of the Sodium Lauryl Sulfate Market with a Comprehensive Contextual Overview of Industry Drivers and Foundational Dynamics

Unveiling the Current State of the Sodium Lauryl Sulfate Market with a Comprehensive Contextual Overview of Industry Drivers and Foundational Dynamics

Sodium lauryl sulfate continues to occupy a pivotal position as one of the most versatile surfactants in global industrial and consumer applications, owing to its exceptional cleansing, foaming, and emulsifying properties. Derived from either palm or coconut feedstock, this anionic surfactant underpins formulation excellence across personal care, household cleaning, and a broad spectrum of industrial processes. Its widespread adoption reflects an enduring balance of performance, cost efficiency, and compatibility with a wide array of ingredients and formulation matrices.

Against the backdrop of mounting regulatory scrutiny, the pace of innovation in green chemistry, and shifting consumer preferences toward transparency and sustainability, the sodium lauryl sulfate market has entered a phase of heightened complexity. While its historical reputation for mildness and reliability continues to underpin demand in body washes, shampoos, facial cleansers, and toothpaste, an increasing number of formulators are also exploring opportunities in food and beverage processing as well as heavy-duty cleaning and mining treatments. This multifaceted usage landscape underscores the importance of a thorough understanding of both traditional and emerging drivers, as well as the challenges posed by supply chain constraints, raw material volatility, and evolving compliance regimes.

By examining key supply dynamics, regulatory developments, and end-use sector shifts, this introduction lays the groundwork for a holistic view of sodium lauryl sulfate’s current market environment. Through clear articulation of foundational dynamics, stakeholders can better navigate the confluence of cost pressures, sustainability imperatives, and innovation pathways that will determine competitive success in the years ahead.

Highlighting the Transformative Shifts Reshaping the Sodium Lauryl Sulfate Landscape Through Innovation, Regulation, and Evolving Consumer Preferences

Highlighting the Transformative Shifts Reshaping the Sodium Lauryl Sulfate Landscape Through Innovation, Regulation, and Evolving Consumer Preferences

Recent years have brought a wave of transformative shifts that are reshaping every facet of the sodium lauryl sulfate value chain. On the innovation front, advancements in green chemistry have led to novel production pathways that reduce energy consumption and minimize byproducts, while emerging fractionation and purification techniques are enhancing the quality and consistency of both coconut and palm oil–derived feedstocks. These technological breakthroughs are not only elevating performance metrics but also offering manufacturers the opportunity to differentiate through sustainability certifications and reduced environmental footprints.

Regulatory pressures have concurrently intensified, with major markets tightening permissible residue levels and expanding labeling requirements to address concerns over skin sensitivity and environmental impact. As policies in North America and key European jurisdictions evolve, formulators and raw material suppliers are compelled to refine their quality assurance protocols and invest in enhanced analytical capabilities. This regulatory landscape is further complicated by divergent regional frameworks, which underscore the necessity for robust compliance strategies and agile supply chain management.

Consumer preferences are evolving in parallel, as end-users increasingly seek transparency, cruelty-free sourcing, and bio-based ingredients. Influencers and social media channels have amplified calls for cleaner labels, prompting personal care and household cleaning brands to reformulate legacy offerings or launch premium, certified alternatives. This shift is driving market participants to explore hybrid blends that combine sodium lauryl sulfate with milder co-surfactants or to invest in consumer education campaigns that reinforce the ingredient’s safety profile and efficacy. Collectively, these innovation, regulatory, and consumer-driven forces are converging to create a dynamic environment in which adaptability and foresight are indispensable.

Analyzing the Cumulative Impact of United States Tariffs Imposed in 2025 on the Sodium Lauryl Sulfate Supply Chain and Cost Structures

Analyzing the Cumulative Impact of United States Tariffs Imposed in 2025 on the Sodium Lauryl Sulfate Supply Chain and Cost Structures

The introduction of targeted import tariffs by the United States government in early 2025 has had a pronounced effect on sodium lauryl sulfate supply chains. With duties imposed on key intermediate feedstocks and downstream shipments, producers have faced upward pressure on landed costs, prompting many to reevaluate their sourcing strategies. Suppliers heavily reliant on palm-based intermediates from Southeast Asia, in particular, experienced a sudden increase in effective procurement costs, which in some cases translated to higher bargaining leverage for distributors.

In response, leading formulators accelerated diversification efforts by forging closer partnerships with regional feedstock producers in the Americas, including those supplying coconut-derived lauric acid. This strategic pivot not only mitigated exposure to the most punitive tariff lines but also reduced transit times and logistical complexity. However, the shift towards Western Hemisphere feedstocks has introduced its own set of challenges, including variable quality profiles and increased competition for limited domestic capacity in refining and fractionation.

As cost structures realigned, downstream manufacturers responded in different ways: some absorbed additional expenses to maintain competitive pricing, while others passed through incremental costs to end-users, leading to modest retail price adjustments. Meanwhile, several industry participants have engaged in forward-hedging arrangements and inventory optimization to smooth out the impact of tariff-driven price volatility. The collective outcome of these strategic responses has been a more geographically balanced supply network, although the risk of reprisal duties and evolving trade policies underscores the importance of ongoing scenario planning and risk management.

Providing Segmentation Insights to Illuminate Application, Grade, Form, Source, and Distribution Channel Dynamics in the Sodium Lauryl Sulfate Market

Providing Segmentation Insights to Illuminate Application, Grade, Form, Source, and Distribution Channel Dynamics in the Sodium Lauryl Sulfate Market

A nuanced segmentation framework is essential for capturing the varied demand drivers across the sodium lauryl sulfate ecosystem. In applications spanning Cosmetics & Personal Care-which encompasses body wash, facial cleanser, shampoo, and toothpaste-this surfactant remains the cornerstone of formulation design, valued for its reliable foaming and emulsification. Within Food & Beverage processing, including bakery, beverage processing, confectionery, and dairy products, usage patterns underscore the ingredient’s role in enhancing texture and ensuring product stability under thermal and mechanical stress. Household Cleaning applications such as dishwashing liquid, laundry detergent, and surface cleaners leverage sodium lauryl sulfate’s ability to dislodge grease and soil, while industrial domains like mining, oilfield chemicals, paper & pulp, and textile processing rely on its surface activity to optimize extraction and enhance process efficiencies.

Grade differentiation also shapes procurement and utilization strategies. Cosmetic grade sodium lauryl sulfate is held to rigorous purity and dermatological standards, supporting premium skin and haircare applications, whereas food grade must comply with stringent food safety and traceability protocols. Technical grade offerings, with broader impurity tolerances, are tailored for heavy-duty cleaning and specialized industrial operations. In addition, the form in which the surfactant is supplied-whether granular, liquid, or powder-plays a critical role in ease of handling, solubility, and batch-to-batch consistency. Granular forms often feature in industrial feed systems, liquid grades streamline metering for continuous processes, and powders are favored in dry-mix consumer formulations.

Source origin further influences both cost and sustainability narratives. Coconut oil–derived lauryl sulfate is prized for superior mildness, while palm oil–based streams generally provide a cost advantage due to scale. Finally, distribution channel strategies vary from direct sales agreements that foster close customer collaboration to tiered models utilizing distributors for market reach, as well as digital marketplaces that offer agility and rapid order fulfillment. This layered segmentation approach reveals the complexity of matching grade, form, and source to specific functional requirements and delivery mechanisms.

This comprehensive research report categorizes the Sodium Lauryl Sulfate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Source

- Distribution Channel

- Application

Uncovering Key Regional Insights Demonstrating Demand Patterns Across the Americas, Europe Middle East & Africa, and Asia-Pacific Sodium Lauryl Sulfate Markets

Uncovering Key Regional Insights Demonstrating Demand Patterns Across the Americas, Europe Middle East & Africa, and Asia-Pacific Sodium Lauryl Sulfate Markets

In the Americas, robust personal care and household cleaning sectors continue to underpin consistent demand for sodium lauryl sulfate, with notable growth in sustainable and naturally derived formulations. Regional feedstock producers have expanded refining capabilities, enabling local supply chains to absorb a larger share of domestic consumption. Meanwhile, beverage and dairy processors are increasingly attentive to clean label claims, driving discussions around food grade acceptance and certification standards. This regional momentum is buttressed by collaborative efforts between manufacturers and agricultural stakeholders to optimize coconut and palm oil sourcing under traceability frameworks.

Europe, Middle East & Africa is characterized by stringent regulatory oversight and a heightened emphasis on environmental stewardship. The European Union’s chemical regulations have catalyzed investments in high-efficiency production technologies, as well as the development of lower-impact fractionation processes. In the Middle East, industrial applications-particularly in oilfield chemicals-remain a key anchor, while North African personal care brands are leveraging imported grades to serve rapidly urbanizing markets. Across the region, distributors are enhancing value-added services, such as on-site blending and analytical support, to navigate complex compliance requirements.

Asia-Pacific stands as the largest global hub for surfactant production, driven by integrated refining complexes in Southeast Asia and India. Here, competitive feedstock access and scale advantages have fostered a cost-effective supply base, though recent tariff shifts and supply chain reconfigurations have prompted greater regional integration. Rapid urbanization, rising disposable incomes, and the proliferation of e-commerce platforms have accelerated demand for personal care and household cleaning products, while industrial sectors-spanning textile processing and paper & pulp-continue to explore performance enhancements through custom surfactant blends. These region-specific dynamics underscore the importance of localized strategies and partnerships in capturing future growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Sodium Lauryl Sulfate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting the Strategic Positioning and Innovations of Leading Global Producers in the Sodium Lauryl Sulfate Industry

Spotlighting the Strategic Positioning and Innovations of Leading Global Producers in the Sodium Lauryl Sulfate Industry

Market leadership in sodium lauryl sulfate increasingly hinges on a combination of production scale, feedstock integration, and differentiated product portfolios. Established players have leveraged their upstream access to refine both coconut and palm derivations, allowing for flexible grade offerings that meet stringent regulatory and performance criteria. Such vertically integrated models have been complemented by novel partnerships with green chemistry startups to pilot renewable feedstock streams and bio-based processing catalysts.

Simultaneously, surging demand for mild surfactants has led to targeted investments in research and development capabilities, with leading producers collaborating closely with tier-one brand owners to co-create tailored formulations. These strategic alliances have facilitated the rapid commercialization of specialty grades that blend sodium lauryl sulfate with co-surfactants to achieve balanced performance, while minimizing irritation potential. Moreover, supply agreements incorporating sustainability metrics, such as traceability reporting and responsible sourcing certifications, have become hallmarks of company strategies aimed at securing preferential supplier status among environmentally conscious formulators.

Expansion of regional manufacturing footprints has further reinforced competitive positions, enabling rapid response to shifting trade policies and local content requirements. In parallel, global participants have optimized their distribution channel mix by strengthening direct sales teams in key markets, developing distributor training programs, and enhancing digital platforms to improve order visibility and technical support. These multifaceted approaches illustrate how leading producers are navigating market complexity through integrated strategies that combine operational excellence, product innovation, and customer-centric engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sodium Lauryl Sulfate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Clariant AG

- Croda International Plc

- Dow Inc.

- Evonik Industries AG

- Galaxy Surfactants Ltd.

- Huntsman Corporation

- Indorama Ventures Public Company Limited

- Innospec Inc.

- Kao Corporation

- Oxiteno S.A.

- Solvay S.A.

- Stepan Company

Delivering Actionable Recommendations to Empower Industry Leaders in Navigating the Complex Sodium Lauryl Sulfate Market Landscape

Delivering Actionable Recommendations to Empower Industry Leaders in Navigating the Complex Sodium Lauryl Sulfate Market Landscape

To thrive in the increasingly competitive sodium lauryl sulfate arena, industry leaders should prioritize supply chain diversification by establishing strategic partnerships with multiple feedstock suppliers across both coconut and palm oil origins. Such an approach reduces exposure to geopolitical and tariff-related disruptions while enhancing negotiating leverage. Complementary to this, investing in advanced inventory management systems and forward-hedging mechanisms can help smooth price volatility and maintain margin stability.

Innovation investments should focus on sustainable processing technologies and co-surfactant blends that align with consumer demands for mild and bio-based formulations. Collaborating with universities and specialized research institutes will expedite product differentiation and accelerate time to market. At the same time, firms must proactively engage with regulatory bodies across all key regions to shape emerging standards and ensure compliance readiness, particularly as labeling and certification requirements become more rigorous.

Finally, optimizing distribution strategies through a balanced mix of direct sales, distributor partnerships, and robust e-commerce capabilities will expand market reach and enhance customer responsiveness. Implementing digital customer portals that provide real-time order tracking, technical data access, and sustainability documentation will foster deeper client relationships and support premium positioning. By integrating these strategic actions, leaders can build resilient operations, anticipate market shifts, and capitalize on evolving growth vectors.

Defining the Robust Research Methodology Underpinning Data Collection, Validation, and Analysis for Sodium Lauryl Sulfate Market Intelligence

Defining the Robust Research Methodology Underpinning Data Collection, Validation, and Analysis for Sodium Lauryl Sulfate Market Intelligence

The insights presented in this report are grounded in a dual-phase research approach combining primary and secondary methods to ensure both breadth and depth. Primary research involved extensive interviews with surfactant producers, feedstock suppliers, regulatory experts, and key formulators, providing direct perspectives on market drivers, technology adoption, and compliance challenges. These discussions were supplemented by surveys conducted with brand owners across personal care, household cleaning, and industrial sectors to gauge adoption trends and future requirements.

Secondary research encompassed an exhaustive review of technical literature, industry white papers, and regulatory publications to validate primary findings and contextualize them within broader chemical industry developments. Data analysis techniques included triangulation of insights from multiple data sources, ensuring consistency and reliability, alongside qualitative thematic coding to identify emergent trends. Quantitative analyses leveraged historical production and trade data to map supply chain movements, while advanced modeling simulations evaluated the potential impact of tariff scenarios and regulatory changes.

Throughout the process, rigorous data validation protocols were applied, including cross-verification of supplier-reported figures against customs databases and independent market intelligence. All qualitative inputs were subject to peer review, guaranteeing that interpretations remained objective and actionable. This systematic methodology underpins the report’s credibility and provides a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sodium Lauryl Sulfate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sodium Lauryl Sulfate Market, by Grade

- Sodium Lauryl Sulfate Market, by Form

- Sodium Lauryl Sulfate Market, by Source

- Sodium Lauryl Sulfate Market, by Distribution Channel

- Sodium Lauryl Sulfate Market, by Application

- Sodium Lauryl Sulfate Market, by Region

- Sodium Lauryl Sulfate Market, by Group

- Sodium Lauryl Sulfate Market, by Country

- United States Sodium Lauryl Sulfate Market

- China Sodium Lauryl Sulfate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Key Findings and Forward-Looking Perspectives to Illuminate the Future Trajectory of the Sodium Lauryl Sulfate Market Landscape

Summarizing Key Findings and Forward-Looking Perspectives to Illuminate the Future Trajectory of the Sodium Lauryl Sulfate Market Landscape

Sodium lauryl sulfate stands at the intersection of performance, sustainability, and regulatory complexity, driven by a confluence of technological advancements, shifting consumer expectations, and evolving trade policies. The diversification of feedstock origins, coupled with innovations in green processing techniques, is redefining supply chains and enabling more resilient procurement strategies. Regulatory developments in major markets underscore the need for agile compliance frameworks, while consumer demand for transparency and mild formulations continues to shape product development roadmaps.

Regional dynamics are creating differentiated growth pockets, from the Americas’ focus on sustainable sourcing to EMEA’s stringent environmental mandates and Asia-Pacific’s scale-driven cost efficiencies. Leading companies are responding with integrated strategies that combine vertical integration, targeted R&D collaborations, and digitalized customer engagement. As the market navigates the implications of new tariff regimes and sustainability imperatives, organizations that proactively adapt their sourcing, manufacturing, and go-to-market approaches will be well positioned to capitalize on emerging opportunities.

Looking ahead, the sodium lauryl sulfate market is poised for continued transformation, with advanced bio-based routes, specialty mild surfactant blends, and enriched digital ecosystems set to drive the next wave of innovation. By building on the insights detailed in this report, stakeholders can develop resilient strategies, foster collaborative partnerships, and deliver differentiated value in an increasingly dynamic environment.

Act Now to Partner with Ketan Rohom and Secure Essential Sodium Lauryl Sulfate Market Intelligence to Drive Strategic Growth and Competitive Advantage

To gain a deeper and more nuanced understanding of the forces shaping the sodium lauryl sulfate landscape, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Leveraging years of sector expertise and a proven track record in guiding strategic decisions for leading industry participants, Ketan can tailor the full market research findings to your organization’s unique requirements. Secure access to granular insights, actionable data, and customized scenario analyses that will empower your team to optimize supply chains, anticipate regulatory developments, and capitalize on emerging demand opportunities. Reach out today to explore partnership options and take decisive steps toward sustainable growth and competitive advantage in the evolving sodium lauryl sulfate market.

- How big is the Sodium Lauryl Sulfate Market?

- What is the Sodium Lauryl Sulfate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?