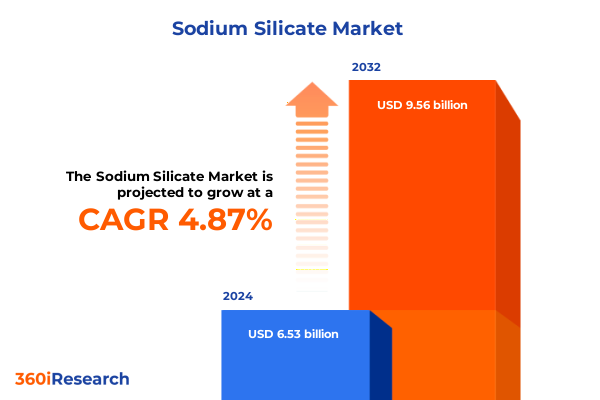

The Sodium Silicate Market size was estimated at USD 6.41 billion in 2025 and expected to reach USD 6.74 billion in 2026, at a CAGR of 5.43% to reach USD 9.28 billion by 2032.

Setting the Stage for an Evolving Sodium Silicate Marketplace Fueled by Sustainability Demands and Technological Advancements

The sodium silicate market stands at the intersection of traditional chemical manufacturing and emerging sustainable solutions, with stakeholders across multiple industries seeking both performance and environmental alignment. Over recent years, this versatile compound has catalyzed innovation in areas ranging from industrial water treatment to advanced adhesives, demonstrating its capacity to address evolving technical requirements while meeting heightened regulatory standards for safety and sustainability. As the industry moves forward, continued emphasis on greener production methods, process efficiency, and product purity is reshaping how manufacturers and end users approach sodium silicate utilization.

Amid growing demand for sustainable industrial practices, the importance of sodium silicate’s inherent properties-such as excellent binding characteristics, pH regulation, and corrosion inhibition-has become increasingly highlighted. This shift is amplified by the global push toward water conservation and circular economy principles, which has underscored the role of sodium silicate in reducing chemical load and enhancing process reliability. Consequently, participants across the supply chain, from raw material suppliers to end application formulators, are reevaluating production protocols, sourcing strategies, and collaborative innovation models to capture both economic and environmental value.

As regulatory frameworks tighten and end users demand greater transparency around product origins and lifecycle impacts, the landscape for sodium silicate suppliers is evolving rapidly. This report provides a strategic lens on the key drivers shaping this transformation, offering stakeholders a foundational perspective on critical market dynamics.

Unveiling the Major Disruptions and Technological Innovations Redefining Sodium Silicate Applications Across Diverse End Use Industries

The sodium silicate industry is experiencing a wave of transformative shifts driven by breakthroughs in manufacturing technologies and heightened focus on environmental stewardship. Recent advancements in low-carbon synthesis routes, including the adoption of alternative feedstocks and energy-efficient reactor designs, have begun to lower the carbon footprint associated with traditional production pathways. This evolution is enabling producers to meet stringent carbon reduction targets while preserving or enhancing product performance characteristics such as silicate modulus consistency and solution stability.

Alongside production innovations, the emergence of digital process analytics and real-time quality monitoring systems is revolutionizing supply chain transparency. Integrating predictive maintenance tools and automated control systems has improved operational uptime and minimized variability, reinforcing product reliability for downstream applications. In parallel, enhanced collaboration between raw material providers and technology licensors is fostering accelerated deployment of niche formulations tailored to specific end use requirements, from specialized water treatment compositions to high-performance sealant precursors.

Furthermore, this period of technological reinvention coincides with escalating regulatory scrutiny on chemical usage and discharge. As a result, industry participants are increasingly prioritizing closed-loop water recovery systems and advanced effluent treatment, positioning sodium silicate as a key enabler of sustainable operational practices. Together, these disruptive forces are redefining competitive positioning, compelling stakeholders to realign investment priorities and deepen partnerships aimed at driving innovation across the value chain.

Examining the Full Spectrum of United States Tariff Measures Through 2025 and Their Collective Influence on Sodium Silicate Supply Chains

The cumulative impact of United States tariff measures implemented through 2025 has introduced both cost pressures and strategic recalibrations for sodium silicate value chain participants. Initial import duties on key raw materials, introduced to protect domestic silicate producers, have shifted sourcing strategies toward localized feedstock integration. Consequently, manufacturers have accelerated partnerships with regional suppliers to secure raw materials at more predictable pricing, thereby mitigating exposure to fluctuating duties and associated supply chain risks.

As tariff escalations extended to semi-finished sodium silicate imports, many downstream formulators have reevaluated their production footprints. In response, some global players have repatriated or expanded North American manufacturing assets to circumvent cross-border levy structures while capitalizing on favorable trade incentives and regional initiative grants. This in-region capacity enhancement has also fostered deeper engagement with local regulators and community stakeholders, streamlining permitting processes and strengthening corporate social responsibility narratives.

Despite these adjustments, certain niche sources remain subject to elevated duties, prompting alternative sourcing from allied markets with preferential trade agreements. This dynamic has introduced complexity around quality standard harmonization and logistics planning. Nevertheless, through proactive hedging strategies and collaborative supplier development programs, many organizations have managed to preserve product availability and maintain stable pricing for end users. Looking ahead, the lessons learned from these tariff-driven adaptations are likely to inform future supply chain resilience planning and scenario analysis initiatives.

Illuminating Essential Sodium Silicate Market Segmentation Dynamics Across Grades, Forms, Channels, and Expansive Application Verticals

A nuanced understanding of market segmentation reveals pivotal insights into sodium silicate demand patterns and innovation pathways. Based on grade, the market bifurcates into food grade and technical grade offerings, with the former witnessing heightened interest from food processing entities seeking natural emulsifier systems and pH regulators, and the latter catering to rigorous performance requirements in industrial applications such as detergent manufacture and oilfield chemistry. This distinction underscores diverse quality benchmarks and regulatory compliance frameworks that guide production and marketing strategies.

Considering physical form, the distinction between liquid and solid sodium silicate products drives logistical and formulation choices. Liquid variants often enable faster integration into continuous processing lines and support rapid dissolution profiles, making them preferred in high-volume detergent and pulp production settings. Conversely, solid beads and powders offer extended shelf life and simplified handling for distributors and end users prioritizing storage efficiency and batch blending flexibility.

Distribution channel analysis highlights three primary routes: direct sales, distributor sales, and online sales. Organizations relying on direct engagement benefit from customized technical support and long-term contractual relationships, particularly in critical water treatment and specialty chemical segments. Distributor networks facilitate broad geographic coverage and smaller order fulfillment, addressing the needs of regional chemical formulators and smaller industrial players. Meanwhile, digital commerce platforms are emerging as a convenient channel for standardized sodium silicate grades, offering rapid transaction cycles and transparent pricing for cost-sensitive end users.

Diving into application segments, sodium silicate demonstrates remarkable versatility across multiple verticals. In adhesives and sealants, automotive sealants require precise rheological control while construction adhesives demand robust substrate bonding. The detergents and cleaners arena splits between household cleaners prioritizing mildness and industrial cleaners valuing aggressive soil removal, with laundry detergents focusing on fabric care balance. Food processing leverages sodium silicate for both emulsification needs and pH stabilization in diverse product formulations. Oil and gas segments utilize it in drilling fluids for wellbore stability and as an additive in enhanced oil recovery strategies. Pulp and paper producers differentiate performance across kraft pulp pulping, newsprint brightness enhancement, and tissue paper softness optimization. Textile manufacturers depend on sodium silicate in both dyeing operations to improve colorfastness and in printing and finishing applications for wrinkle resistance. Finally, water treatment processes range from industrial water purification protocols that protect equipment from scaling to municipal treatment systems designed to meet stringent public health standards.

This comprehensive research report categorizes the Sodium Silicate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Physical Form

- Silicate Species Profile

- Manufacturing Route

- Functional Role

- Packaging Format

- Distribution Channel

- Application

Revealing Distinct Regional Trends and Strategic Opportunities for Sodium Silicate Across the Americas, EMEA, and Asia Pacific Landscapes

Regional variations in sodium silicate consumption and strategic orientation are shaped by distinct end use landscapes and regulatory contexts. In the Americas, demand is buoyed by advanced water treatment infrastructure investments and robust detergent consumption patterns, with the United States serving as a pivotal hub for both production and end use innovation. Meanwhile, Latin American nations are progressively integrating sodium silicate solutions into municipal water projects, driven by evolving environmental mandates and the imperative to expand safe water access.

Europe, the Middle East, and Africa present a heterogeneous regional mosaic where stringent EU chemical regulations coexist with rapidly developing markets in the Gulf Cooperation Council and Sub-Saharan Africa. European stakeholders emphasize closed-loop manufacturing systems and eco-design principles, pushing suppliers to develop lower-alkali formulations and invest in white space innovation for specialty building sealants and green cleaning products. In the Middle East, large-scale oil and gas operations continue to deploy sodium silicate in drilling and reservoir stimulation applications, while an emerging focus on water scarcity solutions has catalyzed interest in advanced industrial wastewater recovery systems. Across Africa, infrastructure development pipelines for both water treatment and construction projects are creating nascent demand pockets that reward early market entrants.

The Asia-Pacific region remains a powerhouse of sodium silicate growth, propelled by expanding pulp and paper capacity in Southeast Asia, booming textile manufacturing hubs in South Asia, and accelerating municipal water treatment agendas in China and Australia. Rapid urbanization and industrial expansion drive ongoing investments in high-efficiency detergents and water treatment modules, while policy frameworks in key APAC nations are increasingly incentivizing local production capabilities to reduce import reliance and bolster supply chain resilience. Together, these regional narratives highlight differentiated growth trajectories and underscore the importance of tailored go-to-market strategies aligned with local stakeholder priorities.

This comprehensive research report examines key regions that drive the evolution of the Sodium Silicate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Movements and Competitive Strengths of Leading Global Providers Dominating the Sodium Silicate Industry

Leading sodium silicate providers are intensifying their focus on strategic collaborations, capacity expansions, and specialized product portfolios to secure competitive advantage. Many have recently forged joint ventures with technology licensors to unlock proprietary low-carbon production processes and expedite entry into specialty application segments. Such alliances are enabling participants to offer differentiated grades tailored to emerging end use needs, particularly in high-value sectors like automotive sealing compounds and advanced water treatment modules.

Capacity augmentation remains a core growth lever, with several firms commissioning greenfield facilities in strategic regions to capitalize on local feedstock availability and favorable regulatory regimes. These investments not only enhance production flexibility but also reinforce supply chain resilience by shortening lead times and reducing exposure to import-related tariff and logistical risks. Concurrently, key players are allocating capital toward retrofitting existing plants with energy-efficient upgrades, including heat integration systems and waste heat recovery units, to improve operating margins and align with decarbonization objectives.

On the innovation frontier, providers are accelerating the launch of premium sodium silicate variants featuring optimized silicate moduli and tailored rheologies for specialized industrial formulations. This product tiering strategy is complemented by expanded technical service capabilities, wherein dedicated application laboratories collaborate closely with end users to co-develop next generation formulations. Through these combined approaches-strategic partnerships, capacity scaling, and premium product rollouts-leading companies are actively shaping the market’s evolution and setting new benchmarks for performance and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sodium Silicate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- PQ Corporation

- BASF SE

- Merck KGaA

- Evonik Industries AG

- INEOS Group Holdings S.A.

- Qemetica Group

- Tokuyama Corporation

- Nippon Chemical Industrial Co., Ltd.

- AGSCO Corporation

- Alumina d.o.o.

- American Elements

- FUJI CHEMICAL Co., Ltd.

- Fujian Sanming Zhengyuan Chemical Co., Ltd.

- Glassven C.A.

- Hindcon Chemicals Ltd.

- Industrias Químicas del Ebro, S.A.

- J.M. Huber Corporation

- Kiran Global Chem Limited

- Luoyang Qihang Chemical Industrial Co., Ltd.

- MALPRO SILICA PRIVATE LIMITED

- Nissan Chemical Corporation

- OGIS GmbH

- Oriental Silicas Corporation

- Qingdao Dongyue Sodium Silicate Co., Ltd.

- Qingdao Haiwan Chemical Co., Ltd.

- Quechen Silicon Chemical Co., Ltd.

- Sanming Fengrun Chemical Industry Co., Ltd.

- Shandong Haihua Group Co., Ltd.

- Shandong Laizhou Welfare Sodium Silicate Co., Ltd.

- Shandong Qingzhou Xiangli Chemical Co., Ltd.

- Shanti Chemical Works

- Shree Ram Chemicals Industries

- Silmaco NV

- Sinchem Silica Gel Co., Ltd.

- Solvay S.A.

- Tata Chemicals Limited

- Univar Solutions LLC

- Zaclon LLC

Actionable Strategic Roadmap for Industry Leaders to Secure Long Term Growth and Resilience in the Sodium Silicate Sector

Industry leaders must chart a proactive course to navigate the evolving sodium silicate landscape and capture emerging growth pockets. First, prioritizing investment in low-carbon production technologies will position organizations at the forefront of regulatory compliance and sustainability reporting, while delivering cost efficiencies over the long term. Embracing circular economy principles through closed-loop water and byproduct recycling programs can further reinforce environmental credentials and enhance community relations.

Second, deepening collaboration with end users through co-innovation initiatives will drive the development of specialized sodium silicate grades optimized for evolving performance requirements. By embedding technical service teams within key accounts, suppliers can accelerate time to market for new formulations and strengthen customer loyalty. This approach should be complemented by robust digital engagement platforms that facilitate seamless knowledge exchange and real-time troubleshooting.

Third, expanding regional manufacturing footprints in response to tariff dynamics and demand shifts will bolster supply chain resilience. Establishing modular, scalable production platforms in high-growth markets can reduce lead times, mitigate price volatility, and unlock tailored go-to-market flexibility. Concurrently, forging strategic alliances with local distributors and industry associations can enhance market penetration and streamline regulatory navigation.

Finally, integrating advanced analytics and predictive maintenance tools across production networks will optimize asset utilization and minimize unplanned downtime. Harnessing these data-driven capabilities enables proactive risk management and continuous improvement, ultimately translating into more reliable supply for end use customers.

Together, these actionable recommendations offer a strategic roadmap for industry participants aiming to secure long-term growth and resilience in the sodium silicate sector.

Detailing the Rigorous Research Framework Underpinning the Insights Validated Through Primary and Secondary Data Collection Methods

This research is grounded in a rigorous multi-tiered methodology designed to ensure accuracy, relevance, and actionable insights. The primary research phase involved in-depth interviews with a cross-section of stakeholders, including senior executives from manufacturing firms, procurement leads at end use organizations, and regulatory experts. These conversations provided nuanced perspectives on production technologies, market entry barriers, and evolving application trends.

Complementing primary interviews, quantitative surveys were distributed to a broader sample of manufacturers, distributors, and formulators to validate qualitative findings and capture comparative data points on sourcing preferences, logistics challenges, and product performance metrics. Secondary research encompassed a comprehensive review of industry publications, patent filings, technical journals, and governmental policy documents. This phase also incorporated an analysis of trade data and regulatory bulletins to contextualize tariff impacts and regional trade flows.

Data triangulation was accomplished by cross-referencing primary and secondary inputs, ensuring consistency and mitigating potential biases. Key findings were further reviewed through interactive workshops with industry advisors and technical specialists to refine strategic implications and ensure that the final conclusions reflect current market realities. Throughout the process, rigorous quality control protocols, including independent peer reviews and data validation checks, were employed to uphold methodological integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sodium Silicate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sodium Silicate Market, by Physical Form

- Sodium Silicate Market, by Silicate Species Profile

- Sodium Silicate Market, by Manufacturing Route

- Sodium Silicate Market, by Functional Role

- Sodium Silicate Market, by Packaging Format

- Sodium Silicate Market, by Distribution Channel

- Sodium Silicate Market, by Application

- Sodium Silicate Market, by Region

- Sodium Silicate Market, by Group

- Sodium Silicate Market, by Country

- United States Sodium Silicate Market

- China Sodium Silicate Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3021 ]

Summarizing Core Takeaways and Strategic Imperatives for Stakeholders Navigating the Complex Sodium Silicate Market Environment

This comprehensive examination of the sodium silicate market underscores several core takeaways that warrant strategic attention. First, sustainability imperatives and technological advancements are reshaping production paradigms, with low-carbon and resource-efficient methodologies gaining prominence. Second, tariff measures introduced in the United States have catalyzed supply chain realignment and encouraged capacity localization, offering lessons for broader risk management strategies. Third, a nuanced segmentation approach highlights distinct growth drivers across grades, physical forms, distribution channels, and diverse application verticals, illuminating opportunities for product and service differentiation.

Regionally, the Americas, EMEA, and Asia-Pacific each exhibit unique demand patterns, regulatory landscapes, and infrastructure priorities that necessitate tailored engagement strategies. Furthermore, leading companies are actively leveraging strategic partnerships, capacity expansions, and premium product innovations to fortify their market positions and address evolving customer requirements. Finally, actionable recommendations focused on sustainable production investments, co-innovation with end users, regional footprint optimization, and digital transformation represent a cohesive blueprint for achieving long-term resilience.

Collectively, these insights equip stakeholders with a holistic understanding of market dynamics, strategic inflection points, and competitive imperatives, enabling informed decision-making and proactive positioning within the rapidly evolving sodium silicate landscape.

Inquiry Invitation for Detailed Sodium Silicate Market Research and Expert Consultation Through Ketan Rohom’s Dedicated Sales & Marketing Support

For a comprehensive analysis of the sodium silicate market and tailored guidance on leveraging these insights for your organization’s strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in chemical industry research and personalized client engagement, ensuring that your requirements are addressed with precision and depth. Whether you are seeking granular data, competitive benchmarking, or customized scenario modeling, he is equipped to provide the support and resources necessary to drive informed decision-making. Engage with our team today to secure your copy of the detailed market research report and begin capitalizing on emerging opportunities within the sodium silicate sector.

- How big is the Sodium Silicate Market?

- What is the Sodium Silicate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?