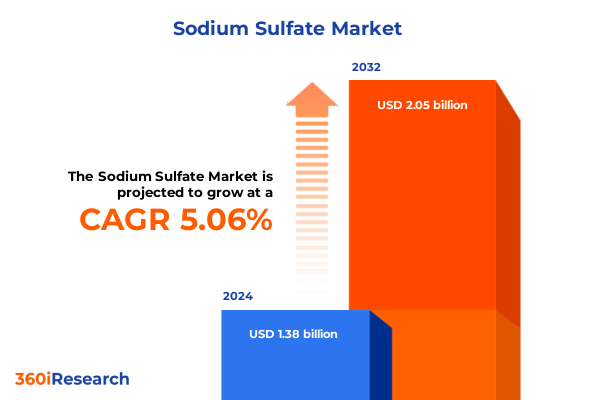

The Sodium Sulfate Market size was estimated at USD 1.44 billion in 2025 and expected to reach USD 1.50 billion in 2026, at a CAGR of 5.17% to reach USD 2.05 billion by 2032.

Comprehensive Introduction to Sodium Sulfate’s Fundamental Chemical Properties and Its Pivotal Role Across the Global Chemical and Manufacturing Industries

Sodium sulfate, an inorganic compound with the chemical formula Na₂SO₄, exists in both anhydrous and hydrous forms, the most common being the decahydrate known as Glauber’s salt. The anhydrous variant crystallizes in the orthorhombic system, while the decahydrate adopts a monoclinic structure. Both forms present as odorless, white crystalline solids exhibiting hygroscopic behavior and high solubility in water under ambient conditions, making them versatile across numerous industrial applications.

Global production of sodium sulfate is substantial, with annual output ranging from 5.5 to 6 million tonnes, predominantly in the decahydrate form. Production is split roughly equally between natural sources-such as mirabilite mined from saline lake beds-and chemical synthesis, with both sources yielding functionally interchangeable products in terms of performance and purity.

Historically, approximately half of worldwide decahydrate production served as a filler in powdered home laundry detergents due to its cost-effectiveness and neutral chemistry, although this application has diminished in mature markets where compact and liquid detergents prevail. In addition, sodium sulfate has played a supporting role in the Kraft process of pulp and paper manufacturing, providing makeup sulfates to sustain black liquor processing before advances in sulfur recovery reduced this demand significantly.

Beyond detergents and pulp and paper, sodium sulfate is integral to glass manufacturing, where it functions as a fining agent to aid in bubble removal, and to textile finishing processes, in which it serves as a leveling agent that neutralizes fiber surface charges and ensures uniform dye penetration. These diversified applications underscore the compound’s broad industrial importance and form the basis for continued interest in its market dynamics.

Navigating Transformative Shifts in Sodium Sulfate Demand: From Detergent Reformulations to Sustainable Manufacturing Innovations Driving Market Evolution

As the global detergent market evolves, the historic reliance on sodium sulfate as a bulky filler in powdered formulations has waned. Modern consumer preferences have shifted decisively toward compact and liquid detergents, which no longer require the volume-adding characteristics of sodium sulfate. This transition has redirected a significant portion of demand toward alternative surfactant chemistries and concentrated systems, challenging traditional sodium sulfate suppliers to adapt logistics and production strategies to slower growth in this segment.

The pulp and paper industry has undergone its own transformation through technological advancements in the Kraft recovery process. Enhanced thermal recovery systems and more efficient sulfur reclamation have curtailed the need for makeup sodium sulfate, reducing annual demand from historical highs of over 1.4 million tonnes in the 1970s to a fraction of that volume in recent decades. This structural decline underscores the critical influence of process innovation on raw material markets and highlights the necessity for sodium sulfate producers to diversify end-use channels.

While detergent and pulp applications have contracted, the glass and textile sectors have provided relative stability. In Europe, sodium sulfate consumption in glass fining has remained at approximately 110,000 tonnes per year, reflecting its essential role in achieving clarity and homogeneity in molten glass. Likewise, textile dyeing applications in regions such as Japan and the United States have sustained consumption near 100,000 tonnes annually, where sodium sulfate’s capacity to facilitate uniform dye uptake remains unmatched by simpler salts like sodium chloride.

Assessing the Cumulative Effects of the United States’ 2025 Tariff Regime on Sodium Sulfate Supply Costs, Trade Flows, and Industry Competitiveness

On April 5, 2025, a 10 percent global tariff was enacted on all imports under an executive order issued by the U.S. President, marking a comprehensive baseline increase across $3.3 trillion in annual inbound trade. A subsequent order on April 9, 2025, implemented country-specific “reciprocal” tariff rates-ranging up to 34 percent for China and 20 percent for the European Union-further intensifying the cost pressures on imported sodium sulfate and related chemicals.

The U.S. Trade Representative’s exclusion list under the new tariff regime exempted a broad array of polymers, petrochemicals, and major commodity chemicals, yet sodium sulfate did not feature among these exceptions. As a result, sodium sulfate imports are subject to the full scope of both the baseline and reciprocal tariffs, imparting a notable headwind to domestic chemical processors. According to industry analysts, these measures are projected to impose a roughly 0.8 percent drag on overall chemical sector demand, with specialized applications in durable goods and apparel markets potentially experiencing up to a 6 percent reduction in growth prospects due to elevated input costs.

Industry associations, including the American Chemistry Council and the Society of Chemical Manufacturers and Affiliates, have publicly called for sector-informed trade policies and engagement with the administration to mitigate supply-chain vulnerabilities. These organizations emphasize collaboration on tailored exemptions and reciprocal trade agreements to preserve domestic production competitiveness while balancing strategic economic objectives against the risk of cascading cost increases for downstream consumers.

Key Segmentation Insights Revealing Nuanced Demand Patterns Based on Application, Product Type, Purity, Form, End Use, and Distribution Channels

Demand patterns diverge significantly when analyzed by application. Within detergent builders, sodium sulfate competes alongside silicates, tripolyphosphates, and zeolites, each serving distinct functionality in powder formulations. In glass manufacturing, the requirement for specific fluxing and fining agents differentiates borosilicate, soda lime, and specialty glass producers. Paper and pulp operations differentiate usage across kraft pulping, newsprint production, and tissue manufacturing, reflecting variations in process chemistries and recovery efficiencies. Meanwhile, textile finishing processes rely on sodium sulfate to ensure uniform dye uptake and ionic strength control in diverse fabric treatments.

Product type segmentation distinguishes between anhydrous sodium sulfate-favored for moisture-sensitive and high-temperature industrial processes-and decahydrate forms that offer cost-effective volumetric properties. Purity grades range from food grade, adhering to stringent food-safety standards, to pharmaceutical grade requiring rigorous impurity control, and technical grade formulated for large-scale industrial applications where cost considerations predominate.

Form impacts handling and dosing: granular sodium sulfate excels in bulk transport and free-flow characteristics for large process plants, while powder forms enable precise blending and rapid dissolution in specialized formulations. End use industries span chemical manufacturing, where sodium sulfate integrates into base chemical syntheses; detergent production, exploiting its filler role; glass manufacturing, utilizing its fining action; pulp and paper manufacturing, supporting chemical recovery; and the textile industry, leveraging its leveling behavior in dye baths.

Distribution channels bifurcate into traditional offline routes-encompassing regional distributors, wholesalers, and retail outlets that ensure broad geographic reach-and online platforms that facilitate direct procurement, on-demand ordering, and digital marketplace efficiencies, reflecting evolving customer purchasing preferences.

This comprehensive research report categorizes the Sodium Sulfate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Form

- Distribution Channel

- Application

- End Use Industry

Revealing Key Regional Insights into Distinct Sodium Sulfate Consumption, Production, and Trade Dynamics Across Americas, EMEA, and Asia-Pacific Markets

In the Americas, sodium sulfate supply is anchored by significant natural-deposit producers such as Searles Valley Minerals in California and Saskatchewan Mining and Minerals Inc. in Canada. While the United States remains a net importer, these regional producers satisfy critical segments, particularly in glass fining and niche chemical manufacturing, offsetting declines in detergent and pulp applications with stable demand in specialty sectors.

The Europe, Middle East & Africa (EMEA) region features established producers in Spain-such as Minera de Santa Marta and Grupo Crimidesa-and broader output from Russia. The EMEA markets prioritize high-purity technical and specialty glass applications, with emerging demand in Middle Eastern chemical manufacturing facilities diversifying feedstock consumption and stimulating new investment in production capabilities.

Asia-Pacific dominates global sodium sulfate dynamics, led by China’s substantial natural and synthetic output from companies like Hongze Yinzhu Chemical Group and Nafine Chemical Industry Group. India and Japan also represent major consumption centers, driven by large detergent manufacturing sectors and extensive textile dyeing operations. Rapid urbanization, industrial expansion, and infrastructure development across the region continue to underpin sustained market growth and attract capacity-enhancement investments.

This comprehensive research report examines key regions that drive the evolution of the Sodium Sulfate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights into Leading Sodium Sulfate Producers and Their Strategic Market Positioning Within the Global Value Chain

Sinochem Group, one of the world’s largest state-owned conglomerates, leverages its chemical portfolio and global trading network to supply sodium sulfate through its subsidiary Sinofert and affiliated enterprises. As a diversified producer and distributor, Sinochem integrates sodium sulfate within broader fertilizer and petrochemical value chains, enhancing supply stability and market reach.

Saskatchewan Mining and Minerals Inc. stands as a leading North American producer, operating the Chaplin, Saskatchewan facility with an annual capacity of approximately 285,000 tonnes of anhydrous sodium sulfate. Renowned for operational excellence and recognized as one of Canada’s Best Managed Companies, it caters to domestic and export markets with high-quality bulk supply.

In the United States, Searles Valley Minerals, founded in 1916, remains a pivotal natural-deposit operator. Its California-based operations extract and process sodium sulfate for glass fining and detergent applications, maintaining century-long expertise in natural sulfate mining and distribution logistics.

China’s domestic producers, including Hongze Yinzhu Chemical Group in Jiangsu and Nafine Chemical Industry Group in Shanxi, command significant share through extensive mirabilite mining and cost-efficient synthetic routes. These enterprises benefit from low-cost labor, abundant natural resources, and proximity to major Asian industrial hubs, reinforcing China’s leadership in global sodium sulfate supply.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sodium Sulfate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide

- Ciech S.A.

- Compass Minerals International, Inc.

- Formosa Plastics

- Israel Chemicals Ltd.

- Kemira Oyj

- Linde plc

- Minerals Technologies Inc.

- Mitsubishi Chemical Group

- Nirma Limited

- Nouryon Chemicals B.V.

- Solvay S.A.

- Syngenta Group

- Tata Chemicals Limited

- Wanhua Chemical Group

Actionable Recommendations for Industry Leaders to Navigate Market Complexity, Innovation, and Geopolitical Trade Challenges in Sodium Sulfate

Industry leaders should diversify supply chains by integrating both natural-deposit and synthetic sources of sodium sulfate, thereby mitigating risk from localized disruptions and tariff-induced cost spikes. Establishing strategic partnerships with regional producers and vertically integrating raw material recovery processes can further enhance resilience.

Investing in research and development to formulate high-value, specialty-grade sodium sulfate derivatives will unlock new applications in pharmaceuticals, advanced materials, and emerging green technologies. Tailoring product grades to evolving end-use requirements-such as precision pharmaceutical grade or ultra-high-purity technical grade-will strengthen competitive differentiation.

Adopting sustainable production practices, including membrane separation, zero-liquid discharge, and industrial wastewater recovery, can reduce environmental footprints, enhance resource efficiency, and align with increasingly stringent regulatory standards. Circular-economy initiatives to reclaim and repurpose sodium sulfate from process effluents present opportunities to lower raw material costs and reinforce corporate sustainability credentials.

Proactive engagement with policymakers and industry associations is essential to shape trade policies that balance economic security with market access. Collaborative advocacy for targeted tariff exemptions, streamlined customs procedures for critical chemical imports, and sector-specific trade agreements will support stable supply affordability and preserve global competitiveness.

Robust Research Methodology Detailing Data Sources, Analytical Framework, and Validation Processes Underpinning the Global Sodium Sulfate Market Study

The analysis underpinning this executive summary synthesizes extensive secondary research, including peer-reviewed literature, government publications such as the U.S. Geological Survey Mineral Commodity Summaries, and industry-wide regulatory filings. Tariff structures and trade policy impacts derive from official executive orders and U.S. Trade Representative reports, while chemical exclusion data was sourced from authoritative chemical industry publications.

Primary insights were validated through qualitative interviews with sector experts, procurement managers, and chemical analysts, ensuring the identification of real-world supply chain dynamics and end-user requirements. Data triangulation involved cross-referencing multiple public and proprietary databases to reconcile production statistics, historical consumption patterns, and strategic pricing indices.

This methodology adheres to rigorous standards of data integrity and analytical transparency. The research process incorporated scenario-based sensitivity analyses to assess the implications of external shocks-including tariff adjustments, technological disruptions, and evolving regulatory environments-on sodium sulfate market stability and growth trajectories.

While every effort has been made to ensure data accuracy and comprehensiveness, readers should note that rapidly evolving trade policies and technological innovations may introduce new variables. Ongoing monitoring of geopolitical developments and emerging process technologies is recommended to maintain the relevance of strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sodium Sulfate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sodium Sulfate Market, by Product Type

- Sodium Sulfate Market, by Purity Grade

- Sodium Sulfate Market, by Form

- Sodium Sulfate Market, by Distribution Channel

- Sodium Sulfate Market, by Application

- Sodium Sulfate Market, by End Use Industry

- Sodium Sulfate Market, by Region

- Sodium Sulfate Market, by Group

- Sodium Sulfate Market, by Country

- United States Sodium Sulfate Market

- China Sodium Sulfate Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Strategic Imperatives and Future Outlook for the Sodium Sulfate Market in a Volatile Global Environment

Sodium sulfate continues to serve as a versatile and cost-effective industrial chemical, underpinning established applications in detergents, pulp and paper, glass, and textiles while increasingly finding relevance in high-purity and specialty segments. The compound’s resilience amid shifting end-use demands demonstrates its intrinsic material value and adaptability to evolving process requirements.

Tariff policy shifts have introduced new cost structures that will influence global supply chains and strategic sourcing decisions. Producers and end users must navigate these trade headwinds through diversified supplier portfolios, value-added product innovations, and proactive policy engagement to sustain market competitiveness.

Emerging trends in eco-efficient production, resource recovery, and circular-economy integration present compelling pathways for value creation and environmental stewardship. By aligning investment priorities with sustainability mandates and technological advancement, industry stakeholders can transform market challenges into opportunities for differentiation and growth.

The sodium sulfate market’s future trajectory will hinge on the ability of producers, distributors, and consumers to collectively adapt to regulatory, technological, and geopolitical shifts while fostering collaboration that secures a reliable, cost-effective supply of this indispensable industrial commodity.

Connect with Ketan Rohom to Secure Your Comprehensive Sodium Sulfate Market Research Report and Unlock Critical Insights

To secure your copy of the comprehensive sodium sulfate market research report and gain exclusive access to in-depth analysis, strategic insights, and actionable data tailored for decision makers, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in chemical industry research and is ready to guide you through our report’s offerings, discuss customization options, and facilitate your purchase process. Reach out today to ensure your organization is equipped with the critical intelligence necessary to navigate the evolving sodium sulfate landscape and drive informed strategic decisions.

- How big is the Sodium Sulfate Market?

- What is the Sodium Sulfate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?