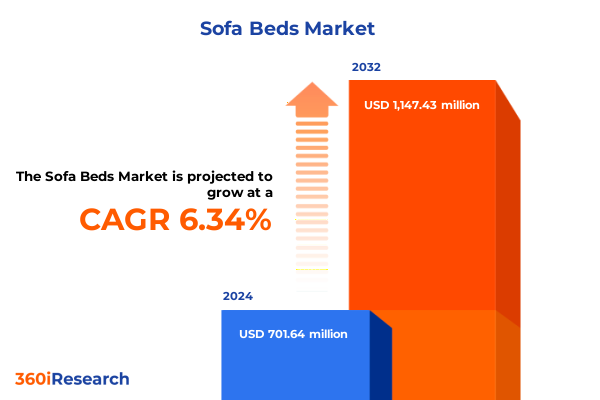

The Sofa Beds Market size was estimated at USD 701.64 million in 2024 and expected to reach USD 743.53 million in 2025, at a CAGR of 6.34% to reach USD 1,147.43 million by 2032.

Unveiling the Comfortable Fusion of Form and Function Redefining Modern Living Spaces Through Innovative Sofa Bed Designs

The fusion of seating comfort and sleeping functionality has positioned the sofa bed as an indispensable element in modern interiors. Originally conceived to address space constraints in urban dwellings, sofa beds have evolved from rudimentary futons into sophisticated furniture pieces that marry aesthetic appeal with mechanical ingenuity. Today’s consumers seek products that not only serve dual purposes but also reflect their personal style and lifestyle needs, driving manufacturers to innovate in ways that seamlessly blend form and function.

Recent shifts in living patterns, including remote work and flexible guest accommodations, have intensified demand for versatile furnishings. Stakeholders have responded by reimagining traditional conversion mechanisms, integrating automated lift systems, and collaborating with designers to introduce customizable upholstery options. As a result, the sofa bed category has transcended its utilitarian roots, emerging as a design statement in contemporary homes and commercial environments alike.

This executive summary delves into the pivotal factors redefining the sofa bed sector, examining transformative trends, regulatory impacts, and granular segmentation insights. It synthesizes regional performance nuances and competitive strategies deployed by leading entities, and outlines an actionable roadmap backed by rigorous research methodology. Decision-makers will find a clear narrative that elucidates market drivers, highlights potential challenges, and provides a foundation for informed strategic planning.

Tracing the Revolutionary Shifts Shaping Consumer Preferences and Technological Advances in Sofa Bed Market Dynamics Today

Over recent years, evolving consumer expectations and technological progress have catalyzed a dramatic transformation in the sofa bed domain. The rise of micro-living trends has elevated the importance of compact, multi-use furnishings, prompting manufacturers to prioritize space-saving mechanisms that maintain ease of use without compromising on comfort. Concurrently, advancements in materials science have introduced high-resilience foams and lightweight metal alloys, enabling slimmer profiles and smoother conversion processes that delight end users.

Digital tools for virtual room visualization and augmented reality applications are revolutionizing the purchase journey. Shoppers can now preview sofa bed configurations, fabrics, and finishes in real time, elevating confidence and personalization. This technology-driven engagement has reshaped marketing strategies, compelling brands to invest heavily in immersive digital platforms that integrate 3D modeling and artificial intelligence for recommendations based on user preferences and spatial constraints.

Moreover, shifting societal values around sustainability have driven the adoption of eco-friendly materials and circular design principles. Manufacturers are increasingly sourcing renewable fabrics and recycled metal components while establishing take-back programs to extend product lifecycles. These collective shifts not only reflect contemporary demands but also chart a course for future innovation, setting a new benchmark for the sofa bed industry.

Evaluating the Compounded Effects of 2025 United States Tariff Measures on Import Costs Supply Chains and Pricing Structures

The imposition of new tariff measures in 2025 by the United States has exerted a multifaceted influence on the sofa bed supply chain and pricing strategies. Tariffs targeting imported components such as metal frames and high-grade fabrics have prompted manufacturers to reassess sourcing decisions. Many have accelerated plans to locate fabrication closer to end markets, thereby mitigating added costs and preserving margin structures amidst shifting duties.

These policy changes have also triggered strategic realignments among global suppliers. Companies traditionally reliant on overseas production hubs are exploring partnerships with domestic fabricators, leveraging incentives and capacity expansions to offset tariff burdens. While nearshoring initiatives can entail initial capital investment, they offer advantages in terms of shortened lead times, reduced transportation expenses, and enhanced responsiveness to fluctuating consumer demand.

On the retail front, increased input costs have necessitated refined pricing tactics. Tiered product offerings now differentiate through upgraded features or premium upholstery, allowing brands to justify price adjustments while protecting value-oriented models. Furthermore, manufacturers have optimized logistics networks to aggregate shipments and negotiate consolidated freight rates, demonstrating proactive adaptation to regulatory landscapes.

Deciphering Core Market Segments Illuminating Consumer Needs Through Types Materials Configurations End Users and Distribution Channels

Consumer demand for sofa beds varies widely based on the product’s fundamental design, with convertible sofa beds appealing to those who prioritize straightforward transformation while pull-out models attract shoppers seeking seamless extension into a full mattress. Sectional sofa beds, in contrast, meet the requirements of larger living areas by offering modular flexibility. These preferences reflect evolving lifestyles, where adaptability and room configuration dictate the choice of type, compelling manufacturers to curate collections that align with diverse spatial scenarios.

Material selection further shapes performance and perceived value. Fabric upholstery, available in woven and non-woven variants, delivers breathability and cost-effectiveness, resonating with budget-conscious consumers in urban apartments. Velvet surfaces evoke luxury, while leather options, whether genuine hides or high-quality faux alternatives, cater to both premium positioning and ethical considerations. By tailoring cushioning technology and textile treatments, brands can address wear-resistance, ease of maintenance, and aesthetic trends in equal measure.

The arrangement of seating units exerts a strong influence on consumer purchase behavior. L shaped configurations satisfy the demand for lounge-style layouts in open plan spaces, whereas three-seater and two-seater configurations offer classic proportions for traditional living rooms or secondary guest areas. End-user contexts also drive specification; corporate interiors and hospitality venues demand commercial-grade durability and compliance with safety standards, while residential buyers focus on ergonomic support and interior harmony.

Turning to distribution pathways, offline channels remain vital for consumers seeking tactile experiences, with department stores, furniture superstores, and specialty boutiques providing opportunities to test seating comfort and mechanical ease. Simultaneously, brand websites and e-commerce platforms deliver convenience, virtual customization tools, and home delivery options that align with the expectations of digitally native shoppers. These dual channels require harmonized inventory management and omnichannel engagement strategies to maximize market reach.

This comprehensive research report categorizes the Sofa Beds market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Configuration

- End User

- Distribution Channel

Unearthing Distinct Regional Dynamics That Drive Growth Demand Patterns and Competitive Landscapes Across Americas EMEA and Asia Pacific Markets

In the Americas, high disposable incomes and a strong emphasis on urban apartment living drive the adoption of sophisticated sofa bed solutions. North America, in particular, exhibits robust demand for premium materials and advanced conversion mechanisms, with consumers gravitating toward models that balance style with sleep quality. Market participants leverage established retail networks alongside burgeoning online marketplaces to capture value across diverse consumer segments.

Europe, the Middle East & Africa presents a tapestry of distinct tastes and regulatory frameworks. Western European markets value sustainable design certifications and have stringent flammability standards, prompting manufacturers to integrate eco-labels and specialized fire-retardant materials. In the Middle East, luxury interiors command a premium on bespoke upholstery, while African demand often centers on durability and affordability, reflecting wider economic variations within the region.

Asia-Pacific encapsulates both mature and emerging economies, each with unique drivers. In Japan and Australia, compact living trends and design minimalism sustain interest in low-profile, multifunctional furniture. Rapid urbanization across India and Southeast Asia fuels growth in middle-class home furnishings, spurring local manufacturers to innovate with cost-effective materials and streamlined production methods. Cross-border e-commerce in this region continues to expand access to global brands, intensifying competitive dynamics.

This comprehensive research report examines key regions that drive the evolution of the Sofa Beds market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants Driving Innovation Design Excellence and Strategic Partnerships in the Global Sofa Bed Ecosystem

Leading companies in the global sofa bed arena demonstrate a blend of heritage craftsmanship and forward-looking innovation. Established furniture groups have invested in advanced manufacturing facilities, enabling automated weld lines for frames and high-speed upholstery stitching. These operational enhancements support rapid new product introductions and ensure consistent quality across production batches.

Strategic partnerships between designers and manufacturers have resulted in collections that resonate with targeted demographics. Collaborative capsule releases featuring signature patterns or limited-edition color palettes foster premium positioning, while licensing agreements with home decor brands extend reach into adjacent lifestyle segments. Concurrently, direct-to-consumer start-ups capitalize on streamlined supply chains to offer competitive pricing and rapid delivery, challenging traditional retail paradigms.

Sustainability commitments have become a key differentiator among top players. Many have embedded recycled steel components and low-VOC finishes into their core product lines, enhancing appeal among environmentally conscious buyers. Beyond product attributes, companies are enhancing transparency through traceability platforms that provide origin data for materials, reinforcing ethical credentials and building consumer trust.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sofa Beds market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashley Furniture Industries, LLC

- Dorel Industries Inc.

- Natuzzi S.p.A.

- Flexsteel Industries, Inc.

- The Lovesac Company

- Bassett Furniture Industries

- Bernhardt Furniture Company

- BoConcept

- Darlings of Chelsea Limited

- Durian Industries Ltd.

- DYP Ltd

- Ethan Allen Global, Inc.

- Futon Company

- Hooker Furniture Corporation

- Inter IKEA Systems B.V.

- Kimball International, Inc.

- Kuka AG

- Natuzzi Group

- Palliser Furniture Ltd.

- Poltrona Frau S.p.a.

- Restoration Hardware, Inc.

- Roche Bobois

- The Sofa & Chair Company

- West Elm by Williams-Sonoma Inc.

Presenting Targeted Strategic Recommendations to Enhance Competitiveness Expand Market Reach and Foster Sustainable Profitability in the Sofa Bed Industry

Industry leaders should prioritize modular design frameworks that facilitate rapid customization and ease of assembly. By adopting universal conversion mechanisms with interchangeable end panels and upholstery attachments, manufacturers can reduce tooling complexity while catering to a multitude of consumer preferences. This approach also streamlines aftermarket accessory opportunities, driving incremental revenue streams beyond initial purchase.

Strengthening localized supply networks offers a buffer against tariff volatility and transportation disruptions. Establishing regional assembly hubs in proximity to major demand centers enables faster order fulfillment and tailored product assortments. Collaborative ventures with local logistics providers can further optimize warehousing and distribution, reducing lead times and carbon footprint simultaneously.

Elevating the digital customer experience remains critical for market differentiation. Integrating virtual showrooms with real-time inventory tracking and AI-driven styling suggestions enhances consumer confidence and conversion rates. Additionally, investing in warranty management platforms and post-purchase support builds brand loyalty and encourages repeat business. Finally, embedding sustainability metrics into product narratives, from carbon footprints to material recyclability, will resonate with evolving consumer values and unlock premium positioning potential.

Detailing Comprehensive Methodological Approaches Emphasizing Data Integrity Expert Interviews and Rigorous Validation Protocols Employed in the Analysis

The analytical framework underpinning this research integrates both secondary and primary inputs to ensure comprehensive coverage and validity. Initial stages involved systematic review of trade publications, industry journals, and public filings to aggregate existing insights on material innovations, tariff developments, and consumer trends. Concurrently, global trade databases were examined to map supply chain flows and identify potential bottlenecks.

To complement desk research, extensive primary interviews were conducted with executives across manufacturing, retail, and distribution segments. These conversations illuminated strategic priorities, operational challenges, and emerging consumer behaviors. The interview cohort encompassed sourcing managers, design directors, and e-commerce specialists, providing a 360-degree perspective on market dynamics.

Data triangulation techniques were applied to reconcile findings across sources, ensuring consistency between reported shipment data, interview feedback, and secondary literature. Throughout the process, quality assurance protocols-such as cross-referencing with customs records and validating expert opinions through multiple respondents-reinforced the reliability of conclusions. This rigorous methodology underpins the actionable insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sofa Beds market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sofa Beds Market, by Type

- Sofa Beds Market, by Material

- Sofa Beds Market, by Configuration

- Sofa Beds Market, by End User

- Sofa Beds Market, by Distribution Channel

- Sofa Beds Market, by Region

- Sofa Beds Market, by Group

- Sofa Beds Market, by Country

- Competitive Landscape

- List of Figures [Total: 30]

- List of Tables [Total: 783 ]

Synthesizing Key Findings and Insights to Illuminate Future Trajectories and Strategic Imperatives Within the Competitive Sofa Bed Market Landscape

The sofa bed market’s evolution is characterized by the convergence of consumer-driven design, technological advancement, and regulatory factors. Key findings highlight the critical role of adaptable conversion mechanisms, the growing emphasis on sustainable materials, and the importance of omnichannel distribution strategies. Across regions, diverse end-user requirements underscore the necessity for market participants to tailor offerings to local tastes and compliance standards.

Competitive landscape analysis reveals that success hinges on balancing premium innovation with cost-effective manufacturing practices. Tariff-driven supply chain realignments illustrate the need for agility, while digital engagement tools have emerged as pivotal in driving consumer trust and purchase intent. Segmentation insights confirm that type, material, configuration, and distribution channel preferences intersect in complex ways, demanding nuanced product roadmaps.

Looking forward, industry stakeholders who embrace modular product architectures, reinforce supply chain resilience, and deepen customer relationships through data-driven experiences will be positioned to capture growth opportunities. Strategic collaboration with regional partners and investments in sustainability will further solidify market leadership as consumer expectations continue to evolve.

Inviting Industry Stakeholders to Connect with Ketan Rohom for Exclusive Access to the Comprehensive Sofa Bed Market Research Report and Insights

For those ready to gain a competitive advantage and unlock the full potential of the sofa bed landscape, connecting directly with Ketan Rohom offers an unparalleled opportunity. As Associate Director of Sales & Marketing with deep expertise in furniture market dynamics and insights, Ketan possesses the knowledge to guide stakeholders through the nuances of design trends, supply chain considerations, and strategic positioning. Engaging with Ketan ensures access to exclusive data analysis, in-depth industry perspectives, and tailored support for decision-making.

Reach out today to explore how the comprehensive research report can inform product development, investment strategies, and market expansion plans. Ketan is committed to delivering actionable intelligence that aligns with your organizational goals and accelerates time-to-market. Seize this moment to transform insight into impact by securing your copy of the report and discussing your unique requirements. Elevate your understanding of the sofa bed market by starting the conversation with Ketan Rohom.

- How big is the Sofa Beds Market?

- What is the Sofa Beds Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?