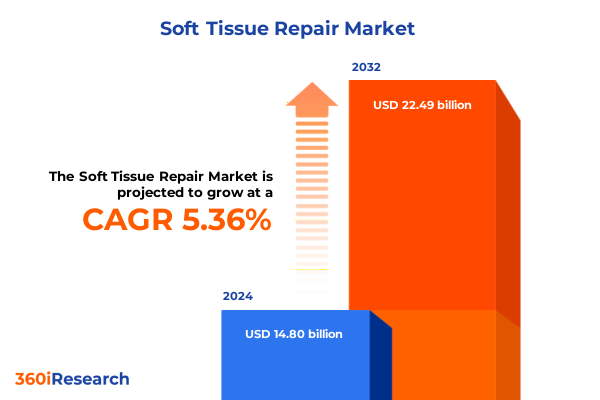

The Soft Tissue Repair Market size was estimated at USD 15.55 billion in 2025 and expected to reach USD 16.35 billion in 2026, at a CAGR of 5.41% to reach USD 22.49 billion by 2032.

Understanding the Expanding Soft Tissue Repair Landscape with Evolving Clinical Needs and Market Dynamics Shaping the Future

The soft tissue repair field is undergoing rapid expansion as demographic shifts and clinical demands converge to create unprecedented opportunities. Aging populations worldwide are driving a surge in conditions such as hernias, tendon tears, and ligament injuries, while the rise in sports and lifestyle-related trauma among younger cohorts further amplifies procedural volumes. Minimally invasive techniques, once considered niche, are now standard practice, enhancing patient outcomes with shorter recovery times and reduced postoperative complications. At the same time, healthcare systems are embracing value-based care models that prioritize both clinical efficacy and economic efficiency, elevating the strategic importance of soft tissue repair solutions in surgical portfolios.

Concurrently, technological advancements and translational research are fostering a new wave of innovation in soft tissue repair. Regenerative medicine approaches, including engineered scaffolds and stem cell–enhanced matrices, are transitioning from early-stage trials to clinical adoption, promising improved tissue integration and accelerated healing. Supply chain resilience has also gained prominence, with manufacturers investing in nearshoring and diversified sourcing to mitigate geopolitical risks. These forces collectively define a dynamic environment in which agility, evidence-based product development, and collaborative partnerships have become critical drivers of success.

Exploring the Transformative Innovations and Disruptive Technologies Redefining Soft Tissue Repair Procedures in the Current Clinical Environment

Advances in minimally invasive and robotic-assisted surgery have fundamentally altered the soft tissue repair landscape by enabling greater procedural precision and consistency. Leading robotic platforms, initially deployed in urologic and gynecologic applications, are now routinely used in orthopedic and general soft tissue repairs, offering high-definition visualization and instrument dexterity that were previously unattainable. Surgeons report that these systems reduce intraoperative variability and improve surgical margins, contributing to faster patient recovery and lower readmission rates.

Biologic and bioabsorbable materials are also at the forefront of the transformation. Next-generation meshes and patches, incorporating patient-friendly polymers or advanced extracellular matrix components, facilitate host tissue remodeling and gradually resorb to minimize long-term foreign body presence. Medtronic’s launch of a bioabsorbable surgical mesh in early 2023 exemplifies the trend toward patient-centric design, addressing concerns about infection risk and chronic inflammation associated with permanent materials.

Artificial intelligence is emerging as another disruptive force, with AI-driven platforms streamlining both preoperative planning and postoperative care. Predictive modeling tools analyze patient-specific factors-such as age, injury chronicity, and comorbidities-to forecast healing trajectories and customize rehabilitation protocols. In research and development, machine-learning algorithms accelerate biomaterial discovery by simulating tissue-material interactions, thereby optimizing performance characteristics before bench testing. These innovations promise to reduce time to market and improve cost-effectiveness of new soft tissue repair technologies.

Analyzing the Multifaceted Impact of Recent U.S. Tariff Measures on Soft Tissue Repair Supply Chains, Costs, and Innovation Pathways for 2025

The United States’ 2025 tariff landscape has introduced significant headwinds for soft tissue repair manufacturers and healthcare providers. While a pause on certain duties has provided temporary relief, multilateral tariff measures-especially on exports to key trading partners-continue to challenge cost structures. Johnson & Johnson recently revised its tariff-related cost estimate downward to $200 million for 2025, citing both currency strength and deferred implementation of Canada and Mexico tariffs, yet the potential for further levies on pharmaceutical and medical device inputs remains a pressing concern.

In March 2025, the U.S. imposed 25% duties on steel- and aluminum-containing derivative products, directly affecting staples, anchoring systems, and a broad range of laparoscopic instruments. These measures have elevated raw material expenses and forced many suppliers to absorb cost increases or pass them down the value chain, thereby squeezing hospital budgets and reimbursement margins.

Moreover, precision fixation devices and intricate mesh platforms rely on specialty metals and high-performance polymers, which are susceptible to tariff-induced inflation. Smaller OEMs and startups face heightened vulnerability due to limited sourcing flexibility and reduced scale economies, leading to delayed product launches and constrained innovation pipelines. Even biological mesh manufacturers have reported logistical delays as a result of tariff complexities on packaging materials and ancillary components.

To counteract these pressures, leading medtech companies are accelerating nearshore manufacturing initiatives in Mexico, Costa Rica, and select U.S. states. Strategic sourcing diversification, coupled with tariff exemption applications for medical essentials, has become a central theme of supply chain strategies. Fitch Solutions notes that multinationals are increasingly shifting production hubs to lower-tariff regions while leveraging free trade agreement provisions to maintain competitive pricing without compromising quality or patient safety.

Uncovering Critical Insights from Product, Injury, Application, and End User Segmentations That Illuminate Soft Tissue Repair Market Dynamics

Segmenting the soft tissue repair market by product type reveals distinct innovation trajectories across fixation devices, laparoscopic instruments, and mesh solutions. Within fixation, interference screws, ligation devices, staples, and suture anchors each present unique engineering challenges-from biomaterial compatibility to load-bearing durability-driving specialized R&D initiatives. Laparoscopic instrument providers are investing in ergonomic enhancements and single-use platforms to balance clinical performance with cost management. Mesh developers are advancing both biological and synthetic technologies, with allograft and xenograft scaffolds forming a complementary portfolio alongside polymeric constructs designed for rapid integration and host remodeling.

Differentiating by injury type-acute versus chronic-underscores the need for tailored product offerings and clinical protocols. Acute repair cases, such as sports-related tendon ruptures, demand rapid fixation and structural stability, while chronic injuries like degenerative tendon conditions prioritize biologic augmentation and regenerative support strategies. Application-based segmentation extends this nuance further; breast reconstruction and dental soft tissue repair capitalize on scaffold designs optimized for cosmetic and functional outcomes, whereas hernia repair and orthopedic procedures hinge on meshes and anchors engineered for mechanical resilience and infection control. Vaginal sling procedures illustrate specialized niches requiring precision-delivered implants that align with stringent safety and biocompatibility standards.

End-user analysis illuminates the varying adoption patterns across ambulatory surgical centers, hospitals, research and academic institutes, and specialty clinics. Hospitals and ASC settings emphasize throughput efficiency and cost containment, driving interest in reusable laparoscopic systems and bulk-discount mesh contracts. Research and academic institutions focus on investigational devices and clinical evidence generation, often serving as early-adopters for cutting-edge scaffolds or robotic platforms. Specialty clinics, particularly those in sports medicine and plastic surgery, gravitate toward high-value, differentiated solutions that enhance patient satisfaction and support premium reimbursement pathways.

This comprehensive research report categorizes the Soft Tissue Repair market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Injury Type

- Application

- End User

Gleaning Strategic Regional Perspectives from the Americas, Europe Middle East Africa, and Asia-Pacific to Inform Soft Tissue Repair Investments

In the Americas, robust healthcare infrastructure and favorable reimbursement policies underpin market leadership in soft tissue repair. The United States, in particular, benefits from high procedure volumes, strong private investment in medtech innovation, and a growing network of ambulatory surgical centers that facilitate minimally invasive interventions. Canada’s publicly funded system supports widespread adoption of advanced repair protocols, while Latin American markets show accelerating uptake driven by expanding healthcare access and targeted public-private partnerships.

Europe, the Middle East, and Africa embody a diverse landscape. Western Europe’s mature healthcare ecosystems are highly receptive to novel biologic implants and robotic-assisted surgeries, with countries such as Germany and Switzerland leading in clinical trial volume and regulatory approvals. The United Kingdom’s NHS expansion of robotic keyhole surgeries is set to increase use of advanced soft tissue repair equipment nationwide. In the Middle East, government-backed investment in integrated care facilities is creating new opportunities for high-performance meshes, while sub-Saharan Africa remains an emergent frontier where surgical capacity building and training programs aim to expand access to essential repair technologies.

Asia-Pacific is evolving into the fastest-growing soft tissue repair market globally, fueled by rising healthcare expenditure, demographic shifts, and medical tourism. China and India are rapidly scaling hospital infrastructure, with a focus on enhancing surgical specialty centers that perform hernia and orthopedic soft tissue procedures. Japan’s advanced geriatric healthcare sector is also a key catalyst for regenerative scaffold adoption. Southeast Asian hubs like Thailand and Malaysia are leveraging cost advantages to attract cross-border surgery demand, positioning the region as both a manufacturing base and an end-user growth engine for soft tissue repair solutions.

This comprehensive research report examines key regions that drive the evolution of the Soft Tissue Repair market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Driving Innovation and Competitive Advantage in Soft Tissue Repair

Johnson & Johnson maintains a commanding presence in soft tissue repair through its Ethicon portfolio, which spans surgical meshes, fixation anchors, and advanced stapling systems. The company’s global supply chain resilience-bolstered by tariff mitigation strategies and diversified manufacturing-has allowed it to navigate the evolving trade landscape while continuing to fund clinical research that underpins new product launches.

Medtronic has distinguished itself by accelerating bioabsorbable scaffold development, exemplified by its 2023 launch of a next-generation hernia mesh that integrates seamlessly with patient tissues. Its strategic investments in R&D centers across North America and Europe enable rapid iteration of polymer formulations designed to optimize host integration and reduce long-term foreign material burden.

Stryker and Arthrex have leveraged their orthopedic heritage to innovate within soft tissue repair. Stryker’s enhanced rotator cuff repair system combines robotics with arthroscopic techniques to improve anchor placement accuracy, while Arthrex’s bioabsorbable anchor innovations have gained significant share in shoulder and knee repair markets. Both companies are expanding nearshore production to safeguard against tariff volatility and ensure continuity of high-precision device supply.

Intuitive Surgical continues to lead the robotic soft tissue repair segment with its da Vinci platforms, which have achieved a 17% year-over-year increase in U.S. procedural volume. The company’s integration of AI-driven suturing modules and enhanced visualization tools underscores its focus on end-to-end software-hardware systems that improve both surgeon experience and patient outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Soft Tissue Repair market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aroa Biosurgery Limited

- Arthrex, Inc.

- Axogen Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- CONMED Corporation

- CorMatrix Cardiovascular Inc.

- Geistlich Pharma AG

- Glycar SA Pty Ltd.

- Henry Schein, Inc

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- LifeNet Health, Inc.

- Medtronic plc

- Neoss AG

- Organogenesis Inc.

- Organogenesis Inc.

- Smith & Nephew plc

- Stryker Corporation

- Tissue Regenix Group Plc

- W. L. Gore & Associates, Inc.

- Zimmer Biomet Holdings, Inc.

Implementing Actionable Strategies and Best Practices for Industry Leaders to Navigate Challenges and Capitalize on Growth in Soft Tissue Repair

Industry leaders should prioritize end-to-end supply chain fortification by expanding nearshore manufacturing capabilities, securing tariff exemptions for critical surgical components, and implementing real-time inventory analytics. Engaging with trade compliance experts and legal advisors will be essential to preempt emerging tariff proposals and to ensure seamless cross-border logistics for both raw materials and finished devices.

Simultaneously, companies must deepen collaborations with academic centers and integrated health systems to generate high-quality clinical evidence that validates next-generation innovations. Co-development partnerships around AI-driven surgical planning tools or regenerative biologics can accelerate time-to-market and foster early adoption. Investing in surgeon training programs-particularly for robotic-assisted and minimally invasive techniques-will further differentiate offerings and support premium positioning in competitive segments.

Detailing the Rigorous Research Methodology Employed to Ensure Comprehensive, Data-Driven Analysis of the Soft Tissue Repair Market

This report integrates primary research insights from in-depth interviews with leading surgeons, key opinion leaders, and senior executives across OEMs, as well as secondary data collection from regulatory filings, clinical trial registries, and industry publications. Market dynamics have been validated through a triangulation methodology that cross-references supply-side inputs with hospital procurement data and third-party trade intelligence.

Quantitative analysis incorporates rigorous modeling of tariff scenarios, segmentation breakdowns, and regional performance indicators. Data accuracy is ensured through routine benchmarking against publicly available financial disclosures, patent filings, and trade statistics. Qualitative insights are enriched by expert panel reviews and advisory board consultations, providing a balanced and comprehensive understanding of the soft tissue repair market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Soft Tissue Repair market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Soft Tissue Repair Market, by Product Type

- Soft Tissue Repair Market, by Injury Type

- Soft Tissue Repair Market, by Application

- Soft Tissue Repair Market, by End User

- Soft Tissue Repair Market, by Region

- Soft Tissue Repair Market, by Group

- Soft Tissue Repair Market, by Country

- United States Soft Tissue Repair Market

- China Soft Tissue Repair Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Strategic Takeaways to Guide Stakeholders in the Evolving Soft Tissue Repair Ecosystem

The soft tissue repair landscape is being reshaped by demographic imperatives, tariff-driven supply chain realignments, and the rapid adoption of minimally invasive and regenerative technologies. Organizations that strategically align product development with evolving clinical practices, while actively managing trade and regulatory risks, will unlock significant competitive advantage. Regional expansion into high-growth markets, underpinned by localized manufacturing and evidence-based collaborations, constitutes a critical pathway to sustainable growth.

As the industry continues to evolve, a forward-looking approach-incorporating AI-enabled planning, agile supply chain frameworks, and robust clinical data generation-will be essential. Stakeholders who embrace this holistic paradigm will be best positioned to meet rising patient needs, support healthcare system objectives, and drive long-term value creation in the soft tissue repair domain.

Secure Your Comprehensive Soft Tissue Repair Market Intelligence Today with Ketan Rohom to Propel Your Organization’s Strategic Decision-Making

Elevate your strategic planning with access to our in-depth soft tissue repair market research report. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights, clarify your specific business needs, and secure a comprehensive analysis that supports your next growth initiative. Whether you require granular segmentation data or a detailed assessment of regional dynamics, Ketan will guide you through the purchasing process and ensure you obtain the exact intelligence your organization needs.

Connect with Ketan Rohom today to unlock the full potential of this market research, deepen your competitive understanding, and make informed decisions that drive long-term success in the soft tissue repair arena.

- How big is the Soft Tissue Repair Market?

- What is the Soft Tissue Repair Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?