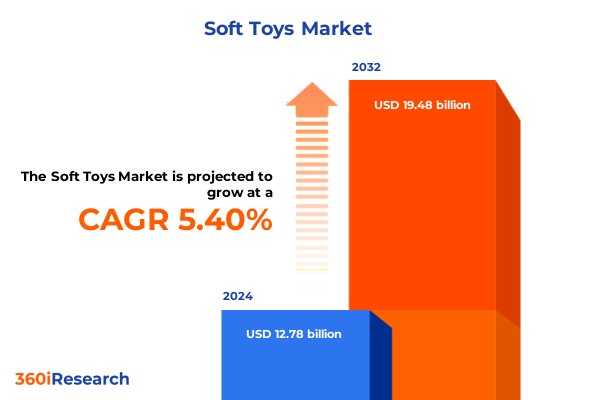

The Soft Toys Market size was estimated at USD 13.38 billion in 2025 and expected to reach USD 14.14 billion in 2026, at a CAGR of 5.51% to reach USD 19.48 billion by 2032.

Unveiling the Soft Toys Industry’s Scope Through a Comprehensive Overview of Key Drivers, Consumer Behaviors, and Market Dynamics

The soft toys landscape has evolved into a vibrant ecosystem driven by diverse consumer demands and innovative design approaches. In recent years, the market has witnessed a surge in interest from both traditional retailers and digital platforms, reflecting a shift in purchasing patterns. Driven by heightened consumer awareness regarding product quality and sustainability, manufacturers have pivoted to eco-friendly materials and limited edition releases, thereby broadening appeal across age groups and demographics. Amid this backdrop, the interplay between nostalgia and contemporary pop culture has further catalyzed demand for collectible plush items and character-driven designs.

Moreover, the sector is marked by its resilience against economic fluctuations, underpinned by the emotional resonance that soft toys hold for consumers. To begin with, childhood development theory underscores the role of tactile engagement in early learning, reinforcing the enduring relevance of plush items in educational contexts. Furthermore, the integration of smart textiles and interactive elements has opened new avenues for personalization, enabling brands to offer customizable features that resonate with tech-savvy parents and collectors alike. As the industry continues to mature, strategic partnerships between licensors and toy houses are becoming increasingly common, ensuring that emerging intellectual properties reach global audiences with greater efficiency and impact.

Examining Fundamental Transformations That Are Redefining the Competitive Soft Toys Landscape with Technology, Innovation, and Consumer Shifts

In recent years, the soft toys market has undergone transformative shifts driven by technological advancements and changing consumer expectations. Brands are increasingly leveraging digital manufacturing techniques, including 3D printing and laser-cutting technologies, to accelerate prototyping and streamline product customization. These approaches are empowering small-scale artisans and large-scale manufacturers alike to offer bespoke soft toys that cater to niche segments, thereby enhancing exclusivity and customer engagement. At the same time, the proliferation of IoT-enabled playthings and interactive features has blurred the lines between traditional plush companions and smart devices, creating a hybrid category that appeals to tech-oriented demographics.

Concurrently, societal movements advocating sustainability and ethical production have exerted significant influence on material sourcing and supply chain transparency. Consequently, producers are exploring alternative textiles such as recycled polyester and organically farmed cotton, which resonate with environmentally conscious segments. Furthermore, augmented reality integrations embedded in packaging and online experiences are redefining buyer journeys, allowing consumers to visualize soft toys in virtual environments prior to purchase. As these and other innovations continue to permeate the sector, companies that adapt quickly will capitalize on new revenue streams, while those anchored in legacy practices risk obsolescence.

Additionally, shifting demographic trends are reshaping market priorities. With the rise of multigenerational households and the expansion of adult collector communities, there is growing demand for premium collectibles and sophisticated designs that transcend conventional age boundaries. Brands that recognize and harness these cross-generational dynamics are establishing stronger emotional connections and fostering long-term loyalty. In essence, the current landscape is characterized by an intricate balance between innovation, sustainability, and cultural relevance, which collectively determine competitive positioning.

Analyzing the Economic and Strategic Consequences of Recent United States Tariff Adjustments on Soft Toys Throughout 2025 Supply Chains

The introduction of revised tariff schedules by U.S. trade authorities in early 2025 has prompted significant reevaluations among soft toy manufacturers and importers. These duty adjustments have primarily targeted non-local textile and plush submissions entering through key ports, leading to increased landed costs and amplified scrutiny of supply routes. In response, many industry participants have initiated sourcing diversification strategies, favoring nearshoring options in Mexico and the Caribbean, or expanding partnerships with domestic fabricators to mitigate tariff exposure. This realignment has underscored the strategic importance of agile logistics planning and cross-border collaboration.

Furthermore, the tariff landscape has driven a wave of innovation in product engineering, as companies seek to optimize weight-to-value ratios and minimize classification risks under complex harmonized tariff codes. Research and development teams are refining stuffing densities and exploring alternative fabric blends to ensure compliance while maintaining tactile quality. Moreover, the heightened cost structure has amplified the role of dynamic pricing algorithms, enabling retailers and e-commerce platforms to adjust margins in real time in response to duty fluctuations. Consequently, businesses that integrate tariff intelligence into their digital platforms are better positioned to preserve profitability and streamline customer experience.

Simultaneously, the regulatory environment has intensified compliance demands, with customs authorities enhancing audit protocols for textile origins and country-of-consignment declarations. In effect, supply chain stakeholders are investing in enhanced traceability systems, including blockchain-based ledgers and digital twin solutions, to document provenance and secure fast-track clearance. Collectively, these measures illustrate how tariff-driven imperatives are reshaping operational strategies, driving resilience, and inspiring process innovation across the soft toys ecosystem.

Revealing Essential Insights into Soft Toys Market Segmentation Spanning Product Variants, Distribution Channels, Materials, and Consumer Demographics

A nuanced understanding of product type segmentation reveals that Animal Figures, encompassing both Farm Animals and Wild Animals, continue to capture significant consumer interest, driven by educational themes and wildlife conservation awareness campaigns. Concurrently, Characters derived from beloved animated franchises, whether Cartoon Characters or Movie Characters, maintain strong brand affinity, appealing to younger audiences and adult collectors who seek nostalgic or fandom-oriented pieces. Within the Dolls category, the spectrum ranges from Fashion Dolls with high design fidelity to Plush Dolls that emphasize softness and tactile appeal, as well as Rag Dolls that evoke traditional craftsmanship. Beyond these, Plush Cushions serve dual functions as decorative accents, while classic Teddy Bears persist as timeless companions that bridge generations.

Examining distribution channels highlights the complementary roles of Hypermarkets and Supermarkets in delivering broad-based accessibility with intuitive in-store experiences, alongside the rapid growth of Online Retail, which encompasses both dedicated E-Commerce Websites and multifunctional Marketplaces. Specialty Stores further enrich the landscape by offering curated assortments and personalized customer service. On the material front, Acrylic remains a cost-effective option enabling vibrant colors and diverse textures, whereas Cotton appeals to premium buyers valuing natural fibers, and Polyester offers durability and stain resistance. These material preferences intersect with consumer priorities related to sustainability and hygiene.

A closer look at end user segmentation indicates that distinct gender categories targeting Boys, Girls, and Unisex audiences inform thematic choices and styling cues. Age group distinctions, ranging from Infants aged 0 to 2 years through Toddlers aged 3 to 5 years, to Children aged 6 to 12 years, and extending to Teens and Adults aged 13 years and above, shape size, safety features, and design complexity. Finally, the Price Range segmentation, including Mass Market, Premium, and Luxury tiers, dictates packaging, branding narratives, and omni-channel positioning, thereby ensuring that offerings are tailored to varied purchasing capacities and aspirational demands.

This comprehensive research report categorizes the Soft Toys market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Price Range

- Distribution Channel

- End User

Exploring Regional Dynamics Shaping the Soft Toys Market with In-Depth Insights into Americas, EMEA, and Asia-Pacific Growth Drivers

The Americas region remains a pivotal hub for soft toys, driven by large-scale retail networks and a dynamic e-commerce landscape. In the United States and Canada, retailers have been integrating immersive in-store experiences, such as interactive play zones, to enhance foot traffic and capture consumer imagination. Meanwhile, Latin American markets are displaying robust appetite for locally themed designs that resonate with cultural narratives and regional festivals. Cross-border trade agreements and logistics corridors between the U.S. and Central American nations have further facilitated supply chain diversification, enabling faster restocking and reduced stockouts.

Across Europe, Middle East, and Africa, the market exhibits a mosaic of regulatory standards and consumer tastes. Western European countries are characterized by high sustainability standards, prompting manufacturers to obtain certifications for organic textiles and fair-trade compliant production. Meanwhile, the Middle East has witnessed increased demand for luxury-tier plush collections in response to rising discretionary income and a growing collector base. In parts of Africa, nascent specialty toy retailers and digital ventures are collaborating to bring international brands to underserved regions, leveraging mobile commerce platforms to overcome infrastructural challenges.

The Asia-Pacific territory encompasses some of the world’s most significant manufacturing centers alongside rapidly expanding domestic markets. In China, India, and Southeast Asia, low-cost production capabilities are balanced against escalating labor standards and environmental regulations, driving investments in automation and cleaner manufacturing processes. Consumer trends within markets such as Japan and South Korea have spurred innovation in limited-edition releases and character tie-ins, while Australian retailers have been capitalizing on cross-border e-commerce to import unique designs. Overall, this triad of regions underscores the importance of tailored go-to-market strategies that address diverse regulatory landscapes, cultural affinities, and distribution infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Soft Toys market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Key Competitive Profiles and Strategic Moves of Leading Soft Toys Manufacturers Globally to Reveal Emerging Market Trends

In the competitive soft toys arena, leading manufacturers have been refining their portfolios to balance core franchises with niche offerings. Prominent players such as Hasbro and Mattel continue to leverage sprawling licensing agreements with global entertainment giants, thereby ensuring a steady stream of character-driven launches that capitalize on blockbuster films and popular streaming series. These companies have also expanded their digital footprints by collaborating with gaming platforms and social media influencers to generate buzz and foster virtual communities around new releases. At the same time, innovators like Build-A-Bear Workshop have enhanced experiential retail by introducing mobile workshops and in-app customization tools, thereby deepening customer engagement through co-creation.

Meanwhile, emerging specialists such as Jellycat and other boutique plush designers are gaining traction among discerning adult collectors by emphasizing artisanal craftsmanship, limited runs, and premium materials. Their strategies include pop-up events in key metropolitan centers and partnerships with upscale department stores, which lend an aura of exclusivity and align with luxury segment expectations. Additionally, regional champions in markets such as Europe and Asia are forging cross-border alliances to tap into complementary strengths, whether in sustainable material sourcing or advanced manufacturing automation. This convergence of scale-driven and niche-focused players illustrates a bifurcated landscape where collaboration and differentiation coexist.

Furthermore, mid-tier companies are investing in omnichannel capabilities to bridge offline and online experiences. By deploying advanced CRM systems and leveraging data analytics, these entities can tailor promotional campaigns, recommend products based on browsing behavior, and implement dynamic pricing models. As result, stakeholders who harness digital ecosystems and strategic partnerships are securing heightened visibility, richer consumer insights, and enhanced agility in responding to market shifts, thereby setting new benchmarks for competitiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Soft Toys market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurora World, Inc.

- Build-A-Bear Workshop, Inc.

- Douglas Cuddle Toys, Inc.

- Duncan Toys Company

- Hansa Toys USA Inc.

- Hasbro, Inc.

- Jellycat Ltd.

- Kellytoy Worldwide LLC

- Kosen Corporation

- Manhattan Group LLC

- Mary Meyer Corporation

- Mattel, Inc.

- MGA Entertainment, Inc.

- Moose Toys Pty Ltd.

- Nici GmbH

- Playmates Toys Limited

- Steiff GmbH

- The Gund Company

- The Manhattan Toy Company

- Ty Inc.

Delivering Practical Strategies and Actionable Steps for Industry Leaders to Capitalize on Soft Toys Market Opportunities and Overcome Emerging Challenges

Industry leaders can gain a competitive edge by embracing a multidimensional approach that integrates innovation, operational excellence, and customer-centricity. To start, companies should establish cross-functional innovation hubs that unite design, R&D, and marketing experts to expedite concept-to-market cycles. By embedding consumer insights at each stage of product development, these hubs can deliver soft toys that resonate with evolving preferences, whether through smart features or sustainable materials. Furthermore, expanding direct-to-consumer channels-such as branded storefronts and subscription services-can foster deeper loyalty and enrich data on purchasing behaviors.

Operationally, supply chain resilience is paramount. Executives must diversify supplier networks by qualifying additional sources for critical components and exploring nearshoring to reduce lead times and mitigate tariff impacts. Investing in advanced inventory management systems and digital twins can enhance visibility across global operations, enabling real-time adjustments to procurement and distribution plans. In parallel, aligning sustainability goals with circular economy initiatives-such as recycling take-back programs or biodegradable packaging-will bolster brand reputation and appeal to eco-conscious demographics.

On the commercial front, marketing strategies should leverage omnichannel storytelling and community-building tactics. Collaborations with content creators, licensing partners, and educational institutions can amplify brand narratives and cultivate long-term relationships. Additionally, deploying AI-driven personalization engines on e-commerce platforms can render tailored product recommendations and dynamic promotions, thereby optimizing conversion rates. Altogether, these measures offer a roadmap for industry leaders to harness emerging opportunities, fortify resilience, and steer sustained growth in the increasingly competitive soft toys landscape.

Outlining a Robust Research Methodology Combining Quantitative and Qualitative Techniques to Ensure Rigor and Reliability in Soft Toys Market Analysis

The research methodology underpinning this study integrates multiple data sources and analytical frameworks to deliver comprehensive insights. Initially, secondary research encompassed a thorough review of industry publications, trade association reports, and regulatory filings to establish foundational knowledge of market drivers, material innovations, and policy developments. This stage also involved evaluating patent databases and academic journals to identify emerging technologies and proprietary processes influencing the soft toys sector.

Subsequently, the primary research phase engaged a diverse cohort of stakeholders through structured interviews and focus groups. Executives from manufacturing firms, sourcing specialists, and retail buyers provided firsthand perspectives on operational challenges and strategic priorities. Meanwhile, consumer panels comprising parents, collectors, and children yielded qualitative insights into purchasing motivations, product preferences, and brand perceptions. These discussions were complemented by an online survey spanning multiple geographies and demographic segments, which captured quantitative data on consumer behavior and channel preferences.

Data triangulation techniques were applied to reconcile findings from both primary and secondary streams, ensuring consistency and enhancing validity. In addition, advanced statistical tools, including regression analysis and sentiment mapping, were employed to uncover correlations among variables such as material selection, price tier, and end user segment. Quality control protocols, such as double-blind data verification and cross-audits by independent experts, further fortified the reliability of insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Soft Toys market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Soft Toys Market, by Product Type

- Soft Toys Market, by Material

- Soft Toys Market, by Price Range

- Soft Toys Market, by Distribution Channel

- Soft Toys Market, by End User

- Soft Toys Market, by Region

- Soft Toys Market, by Group

- Soft Toys Market, by Country

- United States Soft Toys Market

- China Soft Toys Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights Highlighting the Core Value Propositions of the Soft Toys Market and Key Takeaways for Decision-Making and Strategic Planning

The soft toys market stands at the intersection of emotional resonance, technological evolution, and sustainable innovation. Throughout this report, it is evident that consumer preferences are extending beyond basic functionality toward experiences that blend interactivity, personalization, and ethical production. Importantly, the enduring appeal of classic forms such as teddy bears and artisanal dolls coexists with the rise of smart plush companions and limited-edition collectibles, creating a dynamic spectrum of offerings.

Decision-makers should prioritize agility in supply chain management and continuous innovation in design to meet shifting demands. The analysis of tariff impacts and regional dynamics underscores the value of flexible sourcing strategies and tailored market entry plans. Meanwhile, segmentation insights reveal opportunities to optimize product portfolios across various types, materials, and demographic segments. By harnessing these insights, executives can allocate resources more effectively and align growth initiatives with prevailing consumer and regulatory trends.

Altogether, the synthesis of competitive intelligence, actionable recommendations, and methodological rigor offers a clear roadmap for navigating the complex soft toys ecosystem. Industry stakeholders are thus equipped with the strategic knowledge required to enhance market positioning, foster brand loyalty, and achieve long-term success.

Seizing Opportunities in the Soft Toys Market with Personalized Guidance from Ketan Rohom to Accelerate Growth and Maximize Competitive Advantage

To fully leverage the insights contained within this report, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, who can provide tailored consultation and facilitate access to additional data sets, custom analyses, and executive workshops. By engaging in a strategic dialogue, stakeholders can refine their go-to-market plans, validate critical assumptions, and integrate specialized modeling tools that address unique product, channel, and regional requirements. Moreover, Ketan Rohom’s expertise in aligning market intelligence with commercial objectives ensures that each initiative is grounded in actionable intelligence and measurable outcomes.

Whether your organization seeks to optimize product portfolios, strengthen supply chain resilience, or anticipate consumer trends, this comprehensive study serves as a foundation for informed decision-making. Reach out today to secure your copy of the full report and embark on a collaborative journey toward sustained growth and innovation in the soft toys landscape.

Don’t miss the opportunity to gain a competitive edge in an industry defined by rapid innovation and evolving consumer expectations. Ketan Rohom is available to discuss customized research briefs, volume licensing options, and hands-on training sessions for sales and product development teams. Partnering with him will not only expedite your market entry strategies but also empower your leadership with the confidence to invest in high-impact initiatives. Contact Ketan Rohom now and unlock the strategic insights that will drive profitability and market differentiation in the years ahead.

- How big is the Soft Toys Market?

- What is the Soft Toys Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?