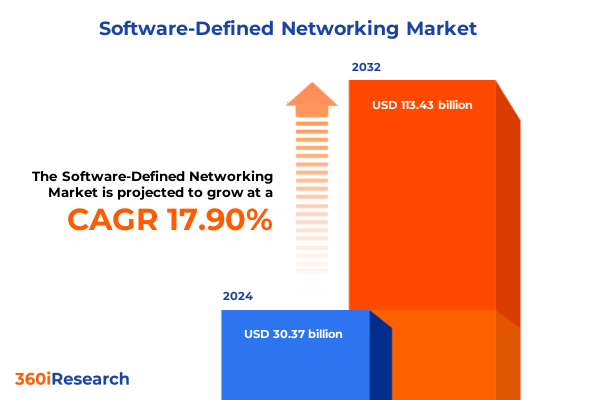

The Software-Defined Networking Market size was estimated at USD 35.60 billion in 2025 and expected to reach USD 41.72 billion in 2026, at a CAGR of 18.00% to reach USD 113.43 billion by 2032.

Unveiling the Strategic Imperative of Software-Defined Networking for Modern Enterprises Seeking Enhanced Performance, Scalability, and Operational Agility in Digital Transformation

Software-defined networking represents a paradigm shift in how enterprises architect, manage, and scale their network infrastructures. Rather than relying on rigid, hardware-centric configurations, organizations now have the ability to decouple control and data planes, delivering unprecedented levels of agility and programmability. This transformation has been driven by the convergence of virtualization technologies, cloud-native architectures, and the pressing demand for rapid service provisioning. As digital transformation initiatives accelerate, businesses face mounting pressures to deliver seamless connectivity, stringent security, and continuous performance alignment with evolving workloads.

In this evolving landscape, software-defined networking emerges as a strategic enabler, providing a unified framework to centralize policy, orchestrate traffic flows, and automate routine tasks that once consumed scarce IT resources. By abstracting network intelligence into a centralized controller, enterprises gain holistic visibility and real-time control over distributed environments. Transitional innovations such as intent-based networking and network function virtualization further augment this approach, allowing organizations to translate high-level business policies into dynamic network configurations. This introduction frames the broader context for understanding how software-defined networking aligns with modern digital imperatives and paves the way for deeper examination of its role in reshaping enterprise connectivity.

Mapping the Evolution from Traditional Network Architectures to Dynamic Software-Defined Frameworks Driving Unprecedented Flexibility, Automation, and Innovative Programmable Connectivity Strategies

The journey from traditional, hardware-bound networks to dynamic, software-defined frameworks has been marked by several pivotal shifts that drive flexibility, automation, and cost efficiency. Initially, virtualization matured within compute environments, creating a solid precedent for abstracting complexity; this set the stage for applying similar principles to networking. As organizations adopted virtual switches and overlay networks, the limitations of manual configuration and siloed management became increasingly apparent. In response, software-defined architectures embraced open APIs and standardized northbound interfaces, empowering orchestration platforms to enact policy uniformly across heterogeneous environments.

Concurrently, open source initiatives such as Open Network Operating System (ONOS) and OpenDaylight gained traction, fostering community-driven innovation and accelerating vendor collaboration. This collaborative ecosystem enabled service providers and enterprise IT teams to trial disaggregated hardware and white box switches, reducing dependency on proprietary box models. Moreover, the advent of intent-based networking introduced higher-order abstractions, translating business requirements into automated network behaviors. As the industry incorporated artificial intelligence and machine learning into telemetry and analytics modules, real-time insights further reinforced network resilience by proactively detecting anomalies and optimizing traffic flows. Each of these transformative shifts underscores the departure from static configurations toward adaptive, programmable infrastructures that anticipate and respond to changing demands.

Assessing the Compounding Effects of 2025 United States Tariff Measures on Supply Chain Dynamics, Hardware Costs, and Vendor Adaptation in Software-Defined Networking

In 2025, the imposition of new United States tariffs has compounded existing supply chain complexities for hardware vendors and enterprises deploying software-defined networking solutions. Originating from broader trade policy shifts, these tariffs target critical components and finished networking equipment, increasing import duties and erecting non-tariff barriers that reverberate across the global value chain. As a result, vendors have encountered elevated production costs, prompting many to reevaluate their manufacturing footprints and contractual pricing models to maintain profitability while shielding customers from sudden price surges.

These trade measures have also accelerated strategic diversification strategies. Several leading suppliers have relocated assembly lines to duty-exempt jurisdictions or nearshore facilities, mitigating exposure to higher tariffs and reducing lead times. At the same time, enterprises have strengthened partnerships with domestically based distributors to secure preferential pricing and to ensure business continuity. Consequently, procurement teams are scrutinizing total landed costs and logistics risk as integral components of vendor selection criteria. Looking ahead, this wave of tariff-driven adjustments is expected to catalyze greater interest in open hardware models and software-centric deployments, as organizations seek to minimize reliance on proprietary, tariff-sensitive equipment while optimizing network architectures for cost-effective innovation.

Deriving Insight from Comprehensive Component, Model Type, Architecture, Deployment, Enterprise Size, and End-User Segmentation to Illuminate SDN Market Diversity and Innovation Trends

Insight into market segmentation reveals critical pathways shaping the adoption and evolution of software-defined networking across multiple dimensions. On the component front, services and solutions define two primary categories: managed and professional services guide strategic deployment and ongoing optimization, while solutions encompass analytics, applications, controllers, security offerings, and switching hardware. Each subcategory addresses distinct operational challenges, from real-time network analytics that illuminate traffic patterns to security solutions engineered for dynamic policy enforcement.

Model types further diversify the landscape, grouping solutions by API-centric interfaces, hybrid deployments that blend legacy and SDN elements, open architectures championing interoperability, and overlay models that deliver rapid provisioning without altering underlying infrastructures. Architectural decisions play a pivotal role as organizations choose between centralized controllers, optimizing policy consistency and threat modeling, or distributed approaches that enhance fault tolerance and reduce latency. Deployment strategies split between cloud-based orchestration platforms, offering elastic scalability and multi-tenant support, and on-premises installations tailored for maximum control and data sovereignty.

Enterprise size influences adoption profiles; large organizations often pursue comprehensive rollouts to harmonize disparate sites, while small and medium enterprises prioritize incremental implementations geared toward immediate operational gains. Finally, end-user sectors-from banking, financial services, and insurance to education, energy and utilities, government and defense, healthcare, manufacturing, retail, and telecommunications-demonstrate unique use cases that drive tailored feature sets and vertical-specific integrations. Taken together, these segmentation insights illuminate the multifaceted nature of SDN adoption and provide a framework for understanding evolving customer requirements.

This comprehensive research report categorizes the Software-Defined Networking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Model Type

- Architecture

- Deployment Model

- Enterprise Size

- End-User

Uncovering Regional Disparities and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia-Pacific to Shape Future SDN Deployment Strategies

Regional dynamics significantly influence the pace and direction of software-defined networking adoption, shaped by economic structures, regulatory frameworks, and technological priorities. In the Americas, the intersection of hyperscale cloud providers and pioneering telcos has created a fertile environment for large-scale SDN implementations. Financial services firms require robust security and compliance features, prompting vendors to integrate advanced encryption and network microsegmentation capabilities. Meanwhile, energy and utility companies leverage programmability to optimize distributed grid management and critical infrastructure resilience.

Across Europe, the Middle East, and Africa, divergent levels of digital maturity coalesce under a shared emphasis on regulatory adherence and sovereign data requirements. In Western Europe, stringent data privacy regulations and green networking initiatives drive demand for energy-efficient controllers and closed-loop automation. Government and defense sectors in the Middle East invest heavily in secure network overlays, leveraging SDN to modernize legacy communications. In Africa, mobile network operators explore scalable, cost-effective SDN architectures to expand connectivity in underserved regions, often through collaborative public-private ventures.

Asia-Pacific stands out for its rapid infrastructure buildout and strong technology export markets. Telecom incumbents in countries like India and Japan leverage SDN to expedite 5G network slicing and to support burgeoning IoT ecosystems. Large manufacturing hubs in China and Southeast Asia experiment with closed-loop control systems that marry edge computing with centralized orchestration. Consequently, the Asia-Pacific region represents a crucible for innovation, where agile deployments and localized partnerships drive next-generation networking modalities.

This comprehensive research report examines key regions that drive the evolution of the Software-Defined Networking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Strategic Partnerships Shaping the Competitive Landscape of Software-Defined Networking Through Innovation and Ecosystem Collaboration

A review of key industry players reveals a competitive environment characterized by rapid innovation, strategic partnerships, and evolving business models. Established networking incumbents have fortified their SDN portfolios through organic development and targeted acquisitions, blending proprietary controllers with comprehensive security and analytics suites. At the same time, cloud-native vendors have entered the arena, offering seamless integration with virtualization platforms and multi-cloud environments, while open source projects continue to attract contributions that expand interoperability and reduce vendor lock-in.

Collaborative alliances between hardware manufacturers, software developers, and system integrators have become increasingly common, enabling end-to-end solutions that span campus, data center, and wide-area network use cases. Telco operators and service providers often act as early adopters, co-developing custom SDN frameworks that address network slicing, traffic steering, and edge service delivery. In parallel, specialist firms focusing on white-box switches and modular software stacks have carved out niche positions, compelling incumbents to enhance their open architecture offerings.

Ecosystem expansion remains a primary competitive lever, with vendors forging go-to-market partnerships across managed service providers, channel networks, and technology alliances. Thought leadership forums and interoperability testing events further accelerate solution validation and foster community confidence. Together, these company strategies underscore a landscape in which differentiation stems from the ability to deliver integrated, secure, and scalable platforms while maintaining the agility to adapt to emerging enterprise requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Software-Defined Networking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Telesis Holdings K.K

- Arista Networks, Inc.

- Broadcom Inc.

- CDW LLC

- Ciena Corporation

- Cisco Systems, Inc.

- Dell Inc.

- Extreme Networks, Inc.

- F5, Inc.

- Fortinet, Inc.

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- HEWLETT PACKARD ENTERPRISE COMPANY

- Huawei Technologies Co., Ltd.

- Infosys Limited

- International Business Machines Corporation

- Juniper Networks, Inc.

- Kyndryl Holdings, Inc.

- Lenovo Group Limited

- Microsoft Corporation

- NEC Corporation

- Nippon Telegraph and Telephone Corporation

- Nokia Corporation

- NVIDIA Corporation

- Oracle Corporation

- Palo Alto Networks, Inc.

- Pica8 Software Inc.

- Telefonaktiebolaget LM Ericsson

- Wipro Limited

Formulating Strategic Roadmaps and Practical Recommendations for Industry Leaders to Accelerate SDN Adoption, Enhance Security, and Maximize Operational Efficiency in Enterprise Networks

To navigate the complexities of software-defined networking adoption, industry leaders should begin by prioritizing the evaluation of open standards and architectures that promote vendor interoperability. By selecting controllers and switch platforms compatible with broadly supported APIs, organizations can safeguard against future market consolidation and maintain the flexibility to integrate best-of-breed components. Additionally, establishing a phased implementation roadmap that aligns with core business objectives ensures that pilot deployments deliver measurable value before wider rollout.

Security must be embedded from the outset, with microsegmentation, real-time threat detection, and policy orchestration forming the foundation of any SDN initiative. Cross-functional teams should collaborate to validate security policies within the network fabric, leveraging continuous monitoring and automated remediation workflows. Likewise, integrating advanced network analytics and telemetry capabilities enables proactive performance tuning and accelerates root-cause analysis, reducing mean time to resolution for critical incidents.

Investing in skill development is equally critical. Training programs tailored to the specific architecture and tooling selected will empower network operations teams to fully leverage programmable interfaces and automation features. Finally, forging strategic partnerships with technology providers and managed service specialists can expedite deployment timelines and provide access to domain expertise. By orchestrating these recommendations into a cohesive strategic plan, organizations can mitigate risk, deliver transformative network services, and sustain competitive differentiation.

Detailing Rigorous Research Methodology Combining Qualitative Insights, Quantitative Analysis, and Expert Validation to Ensure Robustness and Credibility of SDN Industry Findings

This research leverages a rigorous methodology that combines qualitative and quantitative approaches to ensure robustness and credibility. Primary research involved structured interviews with network architects, IT executives, and solution providers to capture firsthand insights into deployment challenges, technology preferences, and emerging use cases. These discussions were augmented by expert validation workshops where hypotheses and preliminary findings were tested against peer feedback and refined accordingly.

Secondary research sources included company white papers, vendor technical briefs, regulatory filings, and conference proceedings, providing a comprehensive view of evolving standards and product roadmaps. Quantitative analysis drew on shipment data, patent filings, and published vendor financial disclosures to identify adoption trends and investment patterns without disclosing proprietary estimates. Triangulation across multiple data points reduced bias and strengthened the reliability of the conclusions.

To maintain the integrity of the research process, data collection and analysis adhered to established best practices in data quality management and ethical considerations. Continuous peer reviews and editorial oversight guaranteed that interpretations remained objective and grounded in verifiable evidence. This multi-tiered methodology underpins the insights presented throughout this report, delivering a transparent and defensible perspective on the software-defined networking market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Software-Defined Networking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Software-Defined Networking Market, by Component

- Software-Defined Networking Market, by Model Type

- Software-Defined Networking Market, by Architecture

- Software-Defined Networking Market, by Deployment Model

- Software-Defined Networking Market, by Enterprise Size

- Software-Defined Networking Market, by End-User

- Software-Defined Networking Market, by Region

- Software-Defined Networking Market, by Group

- Software-Defined Networking Market, by Country

- United States Software-Defined Networking Market

- China Software-Defined Networking Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights and Forward-Looking Perspectives to Empower Decision Makers with Actionable Understanding of Software-Defined Networking’s Strategic Value

Software-defined networking has emerged as a foundational technology for enterprises pursuing digital transformation, enabling agile, programmable, and secure network infrastructures. The synthesis of key insights across market segmentation, regional dynamics, and competitive strategies underscores how SDN delivers measurable benefits in terms of operational efficiency, policy orchestration, and scalability. Moreover, the industry’s response to trade policy disruptions and tariff fluctuations highlights the resilience and adaptability inherent in software-driven architectures.

Looking ahead, continuous innovation in areas such as intent-based networking, AI-driven analytics, and open interoperability will drive further maturation of the market. Organizations that embrace these developments and adopt a strategic, phased approach to implementation will be well positioned to capitalize on emerging opportunities, from cloud-native applications to edge computing scenarios. By leveraging the recommendations, vendor insights, and methodological rigor presented herein, decision makers can formulate informed strategies that advance enterprise objectives and safeguard network performance in an increasingly complex environment.

Engage Directly with Ketan Rohom Associate Director Sales and Marketing to Secure Comprehensive Software-Defined Networking Market Intelligence and Tailored Strategic Support for Your Organization

For personalized insights and tailored strategic support in harnessing the full potential of software-defined networking for your organization, engage directly with Ketan Rohom, Associate Director of Sales and Marketing. Ketan Rohom’s deep expertise in guiding enterprises through digital transformation initiatives ensures that you receive actionable market intelligence aligned with your unique operational requirements and growth objectives. By partnering directly, you can secure comprehensive analysis, priority access to proprietary data sets, and bespoke consulting designed to accelerate your SDN deployment and maximize return on investment. Reach out today to discuss how this research can empower your next network modernization project and position your enterprise at the forefront of networking innovation.

- How big is the Software-Defined Networking Market?

- What is the Software-Defined Networking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?