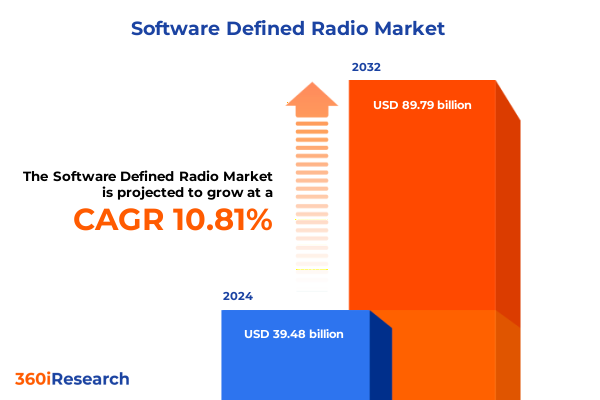

The Software Defined Radio Market size was estimated at USD 43.58 billion in 2025 and expected to reach USD 48.10 billion in 2026, at a CAGR of 10.87% to reach USD 89.79 billion by 2032.

A Paradigm Shift in Wireless Architecture Heralds a New Era of Agile Signal Processing and Customizable Radio Platforms Across Multiple Industry Verticals

Software Defined Radio represents a foundational transformation in how wireless communication systems are architected, shifting intelligence from fixed hardware components to flexible software frameworks. As legacy analog front-ends give way to programmable digital platforms, radio systems can now adapt dynamically to new standards, frequency bands, and modulation schemes without requiring physical redesign. This fluidity not only accelerates time to market for new applications but also empowers organizations to future-proof their networks against evolving spectrum allocation policies and emerging connectivity protocols.

The increasing convergence of communications, sensing, and computing has elevated SDR from a niche research concept to a strategic imperative for defense, telecommunications, public safety, and Internet of Things deployments. By abstracting radio functions into modular software blocks, stakeholders can leverage common processing architectures across multiple use cases, driving economies of scale and streamlining interoperability. Consequently, decision-makers are able to deploy reconfigurable radio assets that respond in real time to spectrum opportunities and network demands, laying the groundwork for more resilient, cost-effective wireless ecosystems.

Emergence of Virtualized and AI-Driven Radio Ecosystems Redefining Connectivity and Enabling Dynamic Spectrum Management in Modern Wireless Infrastructure

The rapid progression of virtualization technologies and the maturation of cloud-native ecosystems have catalyzed unprecedented transformative shifts in the Software Defined Radio landscape. Network functions virtualization and containerization enable radio signal processing chains to execute on general-purpose processors within cloud or edge data centers, dismantling the constraints of purpose-built hardware. This architectural decoupling of software and hardware accelerates innovation cycles, lowers barriers for third-party developers, and facilitates on-demand provisioning of sophisticated radio services.

Simultaneously, advancements in artificial intelligence and machine learning are embedding cognitive capabilities directly into radio platforms, optimizing spectrum access, interference mitigation, and predictive maintenance tasks. Emerging cognitive radio frameworks can now autonomously sense environmental parameters and reconfigure transmission characteristics, delivering improved spectrum efficiency in congested urban environments. As 5G rollouts mature and 6G research intensifies, these converged technologies are poised to redefine heterogeneous network management, enabling seamless interoperability across terrestrial, aerial, and satellite nodes.

Assessing the Strategic Ramifications of Enhanced United States Tariffs on Radio Components and Cross-Border Supply Chains Through 2025

By 2025, a complex tapestry of tariffs and trade policies has reshaped the flow of radio components into and out of the United States, introducing new challenges and strategic considerations for industry participants. Targeted levies on imported semiconductor devices, antennas, and RF front-end assemblies have incrementally increased landed costs of key hardware modules. This cost inflation has exerted pressure on OEMs and service providers to reevaluate sourcing strategies and localize critical production steps to mitigate exposure to punitive tariffs.

In response, major system integrators and component manufacturers have intensified their supply chain diversification efforts, forging partnerships with domestic foundries and regional distribution hubs. Concurrently, some stakeholders are absorbing tariff impacts to preserve volume commitments, while others are passing costs to end users through elevated pricing for turnkey radio solutions. These shifts underscore the need for robust trade-compliance frameworks and proactive risk management processes to navigate a landscape where policy changes can swiftly alter competitive dynamics and total cost of ownership.

Illuminating the Multifaceted Market Segmentation by Component Application Frequency Band and Underlying Technology in Software Defined Radio

The Software Defined Radio market can be viewed through multiple complementary segmentation lenses that reveal nuanced growth trajectories and investment priorities. When analyzing by component, hardware remains a critical focal point, encompassing antenna arrays for signal capture, receivers for down-conversion, and transmitters for agile emission. Layered above this is a robust software ecosystem that orchestrates modulation, demodulation, and digital signal processing, while services deliver system integration, lifecycle support, and firmware maintenance.

Examining application segments uncovers distinct demand drivers across commercial broadcasting networks and cellular infrastructure deployments, as well as consumer electronics innovations in areas such as amateur radio and hobbyist prototyping. Defense applications exert significant influence through specialized deployments in electronic warfare suites, secure military communications networks, and advanced radar systems, while public safety agencies leverage SDR platforms for interoperable dispatch and mission-critical coverage. In parallel, research and academic institutions exploit reprogrammable radios to accelerate experimentation and algorithm development.

The spectrum of operational frequency bands-from extended high frequency down through high, super high, ultra high, and very high segments-dictates radio design trade-offs in terms of antenna form factor, propagation characteristics, and hardware complexity. Underpinning these bands are divergent technology architectures: direct RF sampling platforms offer simplified signal chains and rapid reconfigurability, heterodyne systems balance cost and performance through frequency translation stages, and intermediate frequency sampling solutions optimize between analog front-end processing and digital sampling workloads.

This comprehensive research report categorizes the Software Defined Radio market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Frequency Band

- Technology

- Application

Contrasting Regional Trajectories and Growth Drivers Shaping Software Defined Radio Adoption in the Americas Europe Middle East Africa and Asia Pacific

The Americas continue to benefit from a robust defense procurement pipeline, complemented by vibrant commercial 5G infrastructure rollouts that drive demand for SDR solutions capable of supporting carrier aggregation and dynamic spectrum sharing. North American research initiatives in millimeter-wave experimentation further reinforce the region’s leadership in next-generation wireless technologies. Latin American markets, meanwhile, are favoring cost-effective, modular SDR platforms to modernize broadcasting networks and extend connectivity in underserved areas.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts are enabling cross-border spectrum allocations and collaborative research programs, yielding significant progress in public safety interoperability and smart city deployments. Local manufacturers in Europe are advancing chipsets optimized for energy efficiency and secure communications, while defense consortia in the Middle East accelerate adoption of electronic warfare and tactical communication systems. In Africa, burgeoning tech hubs are leveraging open-source SDR frameworks to foster innovation in community networks.

Asia-Pacific remains the fastest-growing region, driven by expansive telecom infrastructure projects in China and India, as well as specialized defense modernization programs in South Korea and Japan. Regional semiconductor fabrication capacity supports native development of direct RF sampling architectures, enabling cost-competitive solutions that address dense urban deployments and emerging use cases in unmanned aerial systems and industrial IoT.

This comprehensive research report examines key regions that drive the evolution of the Software Defined Radio market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Driving Innovation in Software Defined Radio Through Strategic Partnerships Acquisitions and Technology Advancements

A cadre of established and emerging players is propelling innovation in Software Defined Radio through strategic alliances, targeted acquisitions, and relentless R&D investment. Leading technology providers are differentiating via end-to-end portfolios that integrate advanced FPGA and programmable logic solutions with modular software frameworks, while specialized OEMs focus on niche applications such as high-precision signal intelligence and autonomous spectrum management.

Large defense contractors are leveraging their systems integration expertise to deliver turnkey SDR capabilities for complex military platforms, combining resilient hardware architectures with embedded cybersecurity features. Semiconductor giants are introducing next-generation RF front-end chipsets that deliver higher sampling rates and lower power consumption, fuelling portable and miniaturized SDR designs. At the same time, start-ups are gaining traction by championing open-source architectures that enable rapid prototyping and community-driven enhancements, democratizing access to sophisticated radio experimentation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Software Defined Radio market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Aselsan A.S.

- BAE Systems plc

- Bharat Electronics Limited

- Elbit Systems

- FlexRadio

- General Dynamics Mission Systems

- Huawei Technologies Co. Ltd.

- Indra Sistemas

- Keysight Technologies, Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- National Instruments Corporation

- Northrop Grumman Corporation

- NXP Semiconductors N.V.

- Rohde & Schwarz GmbH & Co. KG

- RTX Corporation

- Thales S.A.

- Viasat, Inc.

Actionable Strategic Imperatives for Industry Stakeholders to Capitalize on Emerging Software Defined Radio Opportunities and Mitigate Supply Chain Risks

Industry leaders should prioritize the establishment of hybrid development environments that combine cloud-native processing capabilities with edge-deployed radio front ends, ensuring both scalability and low-latency performance. Forging alliances with semiconductor fabricators in tariff-free jurisdictions will insulate critical hardware supplies from geopolitical disruptions and support flexible manufacturing footprints.

Additionally, investing in AI-driven spectrum analytics tools will enable organizations to extract actionable insights from complex signal environments, optimizing frequency utilization and accelerating anomaly detection. To capture emerging defense and public safety opportunities, stakeholders should architect modular platform roadmaps that can be rapidly reconfigured for specialized mission profiles while adhering to stringent security and compliance standards. Finally, cultivating an open innovation ecosystem-through developer toolkits, community portals, and collaborative research consortia-will foster a pipeline of creative applications and expand the SDR technology frontier.

Robust Mixed Methodology Leveraging Primary Interviews Secondary Research and Quantitative Analysis to Deliver Insightful Software Defined Radio Market Intelligence

This research is grounded in a rigorous mixed-methodology approach that synthesizes qualitative insights with quantitative data to deliver a holistic view of the Software Defined Radio market. Primary research activities consisted of in-depth interviews with senior executives spanning component manufacturers, system integrators, service providers, and end-users in defense, telecommunications, and public safety sectors.

Secondary research involved comprehensive review of technical whitepapers, industry consortia publications, and regulatory filings to validate emerging technology trends and spectrum allocation policies. Market triangulation techniques were applied to reconcile diverse data sources, ensuring robustness of the segmentation framework across component types, application verticals, frequency bands, and architectural models. Data verification steps included cross-referencing vendor disclosures with government procurement records and financial reports to substantiate key company insights and regional demand patterns.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Software Defined Radio market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Software Defined Radio Market, by Component

- Software Defined Radio Market, by Frequency Band

- Software Defined Radio Market, by Technology

- Software Defined Radio Market, by Application

- Software Defined Radio Market, by Region

- Software Defined Radio Market, by Group

- Software Defined Radio Market, by Country

- United States Software Defined Radio Market

- China Software Defined Radio Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Emerging Trends to Inform Decision Making and Chart a Strategic Course in the Evolving Software Defined Radio Landscape

The convergence of virtualization, artificial intelligence, and cloud orchestration is catalyzing a fundamental redefinition of radio architectures, bestowing unprecedented agility and spectrum efficiency to modern wireless systems. As trade policies continue to evolve, resilient supply chain strategies and strategic partnerships will become indispensable for safeguarding cost structures and maintaining competitive differentiation.

Diverse segmentation by component, application, frequency band, and technology architecture underscores the multifaceted nature of the SDR opportunity, revealing distinct growth corridors for commercial telecom operators, defense contractors, public safety agencies, and research institutions. Regional dynamics further accentuate differentiated trajectories, from North American defense investments to Asia-Pacific telecom megaprojects and collaborative innovation hubs in Europe, the Middle East, and Africa. Armed with these insights, decision-makers can chart a strategic path that harnesses emerging technological capabilities while anticipating policy shifts and market disruptions.

Secure Your Competitive Advantage by Engaging with an Expert Consultant to Access the Comprehensive Software Defined Radio Market Research Report Today

To explore how this comprehensive analysis can empower your organization with unparalleled market intelligence and strategic foresight in the rapidly evolving Software Defined Radio domain, reach out to Ketan Rohom in his capacity as Associate Director of Sales & Marketing today. His deep industry expertise and consultative approach will help align the insights in this report with your unique business objectives, enabling you to identify high-impact opportunities, optimize supply chain resilience, and architect next-generation radio solutions that deliver measurable value. Secure access to the full research findings, detailed competitor benchmarking, and tailored recommendations by engaging directly with Ketan Rohom, ensuring you stay ahead of disruptive trends and maintain a decisive advantage in a competitive global landscape.

- How big is the Software Defined Radio Market?

- What is the Software Defined Radio Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?