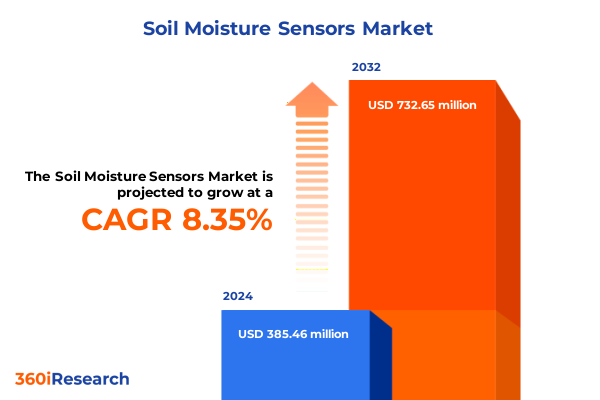

The Soil Moisture Sensors Market size was estimated at USD 402.24 million in 2025 and expected to reach USD 419.78 million in 2026, at a CAGR of 8.94% to reach USD 732.65 million by 2032.

Exploring the Crucial Role of Soil Moisture Sensors in Modern Agriculture Amid Rising Water Scarcity and Technological Advancement

Climate change and intensifying water scarcity have elevated the importance of precise soil moisture management for crop productivity. As agricultural stakeholders seek to optimize irrigation schedules and conserve vital water resources real-time soil monitoring has become a cornerstone of modern farming practices. By capturing granular data on moisture levels at various soil depths these sensors empower growers to make informed decisions that support both sustainability and profitability

Technological advancements are rapidly enhancing the capabilities of soil moisture sensing networks. Innovations in wireless connectivity energy-efficient power systems and integrated analytics platforms are converging to create a new generation of intelligent monitoring solutions. These developments drive adoption not only in large-scale agriculture but also in landscaping construction mining forestry and research applications where precise moisture control is critical

Unveiling How Digital Transformation and Advanced Sensor Technologies Are Reshaping Soil Moisture Monitoring and Agricultural Practices Globally

The soil moisture sensor landscape is being reshaped by a wave of digital transformation that integrates cutting-edge hardware with advanced data analytics. IoT ecosystems now enable seamless connectivity between in-field sensors and cloud-based platforms reducing latency in decision-making and elevating precision in irrigation management workflows. Farmers leveraging these systems can quickly adapt to evolving environmental conditions and allocate water resources with unprecedented accuracy

Parallel to the shift toward connected sensor networks is the emergence of AI-driven insights and decision support tools. Machine learning algorithms analyze historical and real-time data to forecast moisture trends detect anomalies and recommend optimal irrigation events. This level of predictive intelligence is complemented by the fusion of remote sensing imagery and on-the-ground measurements delivering hyper-local microclimate profiles that inform strategic planning across the growing cycle

Evaluating the Far Reaching Consequences of Revised United States Tariff Policies on Soil Moisture Sensor Ecosystems and Supply Chains in Twenty Twenty Five

Revised United States tariff policies in twenty twenty-five have introduced new cost pressures across the soil moisture sensor ecosystem impacting both soil water potential and volumetric sensor manufacturers. Elevated duties on imported electronic components particularly specialized semiconductors communication modules and protective housing materials have increased production costs by an estimated three to five percent according to recent analyses. These tariff adjustments are prompting strategic shifts toward localized assembly and domestic sourcing of critical parts to mitigate trade-related risks

While leading vendors have managed to absorb these incremental expenses through economies of scale and lean production methods smaller suppliers and emerging innovators face tighter profit margins and potential delays in rolling out next-generation sensor models. In response the industry is witnessing a surge in collaborative partnerships between sensor developers and domestic electronics firms facilitating shared R&D investments and co-development of modular sensor architectures that can bypass high-tariff categories. Concurrently standardization initiatives are gaining traction to ensure interoperability across heterogeneous sensor networks and reduce vulnerability to future tariff volatility

Unlocking Strategic Insights Through Comprehensive Sensor Segmentation Based on Type Offering Connectivity and Application in Soil Moisture Management

The market for soil moisture sensors is characterized by distinct layers of segmentation that inform product development go-to-market strategies and investment priorities. When analyzed by type the landscape is divided between soil water potential sensors and volumetric soil moisture sensors the former encompassing granular matrix devices gypsum blocks and tensiometers while the latter includes capacitance probes neutron gauges and time domain transmissometry solutions. Splitting the market by offering reveals dedicated hardware platforms communication modules and data loggers complemented by tailored consulting installation and ongoing maintenance services as well as software suites for data visualization analytics and integration. Further segmentation by connectivity highlights the competitive implications of wired installations versus wireless deployments where network resilience and energy autonomy play pivotal roles. Finally application-based segmentation spans precision agriculture construction and mining forestry landscaping academic research residential irrigation sports turf management and meteorological forecasting each demanding unique sensor performance and integration models

This comprehensive research report categorizes the Soil Moisture Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Offering

- Connectivity

- Application

Analyzing Key Regional Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Soil Moisture Sensor Markets

The Americas continue to lead global adoption of soil moisture sensors supported by robust agricultural infrastructure regulatory incentives for water conservation and a mature ecosystem of precision irrigation integrators and agronomic service providers. In corn and specialty crop regions sensor networks are embedded within variable-rate irrigation platforms and linked to advanced farm management systems enhancing yield and resource efficiency. Across Europe Middle East and Africa stringent sustainability regulations water usage mandates and public funding for climate-smart agriculture drive uptake of interoperable sensor solutions often anchored in open architecture frameworks that align with EU directives on resource optimization. In arid zones of the Middle East precision soil moisture management has become a strategic priority prompting investments in solar-powered remote monitoring systems. The Asia-Pacific region exhibits the fastest growth trajectory fueled by national modernization programs in India China and Southeast Asia where affordable sensor offerings mobile connectivity and targeted subsidies are democratizing access to precision farming technologies

This comprehensive research report examines key regions that drive the evolution of the Soil Moisture Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation Competitive Differentiation and Collaboration in the Soil Moisture Sensor Market Landscape

Industry leadership in soil moisture sensor innovation is distributed among legacy irrigation equipment manufacturers precision instrument specialists and technology-centric startups. The Toro Company and Husqvarna maintain significant market presence leveraging integrated irrigation solutions and smart gardening platforms designed for both large agricultural estates and urban landscapes. Their combined investments in R&D and global distribution have solidified their competitive differentiation. Meanwhile early-stage companies such as Teralytic are pioneering multi-parameter soil probe arrays that track moisture salinity and nutrient levels within a single form factor enabling holistic soil health assessments. Parallel to these players a consortium of domestic electronics firms and sensor developers have emerged through strategic alliances aimed at localizing production and co-innovating modular sensor components to navigate evolving trade regulations and tariff constraints

This comprehensive research report delivers an in-depth overview of the principal market players in the Soil Moisture Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acclima, Inc.

- ATAGO CO.,LTD.

- Campbell Scientific, Inc.

- CropX Inc.

- Delmhorst Instrument Co.

- Delta-T Devices Ltd.

- Denso Corporation

- Dynamax Inc.

- Hunan Rika Electronic Tech Co.,Ltd.

- Irrometer Company, Inc.

- James Instruments Inc.

- Lindsay Corporation

- METER Group, Inc.

- MoistTech Corp.

- Murata Manufacturing Co., Ltd.

- PCE Instruments UK Ltd.

- Rain Bird Corporation

- Riot Technology Corp.

- SDEC France, SAS

- Sensoterra International B.V.

- Sentek Pty Ltd.

- SGS S.A.

- Shandong Renke Control Technology Co.,Ltd.

- Soil Scout Oy

- Spectrum Technologies, Inc.

- Spiio, Inc.

- Stevens Water Monitoring Systems Inc.

- Teledyne Technologies Incorporated

- The Toro Company

- TRUEBNER GmbH

- Vegetronix, Inc.

- Vernier Software & Technology

Actionable Strategies for Industry Leaders to Navigate Competitive Challenges Foster Innovation and Enhance Market Adoption of Soil Moisture Sensor Technologies

To thrive in a competitive environment shaped by rapid technological change and shifting trade policies industry leaders should prioritize modular design principles that support component interchangeability and tariff-resilient supply chains. Aligning product roadmaps with open integration standards will enhance interoperability with legacy infrastructure and third-party platforms fostering ecosystem connectivity. Strategic investments in digital analytics platforms embedded with AI-driven decision support can create differentiated value propositions for end-users by translating raw moisture data into actionable irrigation and resource management recommendations. Additionally cultivating partnerships with irrigation OEMs agricultural service providers and connectivity enablers will amplify go-to-market reach and accelerate adoption across diverse end-use segments. Finally embedding sustainability metrics within product offerings and marketing narratives will resonate with stakeholders navigating increasingly stringent environmental regulations

Outlining Rigorous Research Methodology Principles Employed to Deliver Accurate Comprehensive and Transparent Soil Moisture Sensor Market Insights

The research methodology underpinning this analysis integrates a rigorous blend of primary and secondary data collection techniques to ensure comprehensive and transparent insights. Primary research comprised structured interviews with field agronomists sensor manufacturers channel partners and end users across key geographic markets augmenting quantitative findings with qualitative perspectives. Secondary research involved systematic review of industry publications scientific journals patent databases and government policy documents to triangulate market trends and regulatory impacts. Data validation was achieved through cross-referencing multiple data sources and reconciling discrepancies via consensus-based expert panels. Forecast models were constructed using scenario analysis incorporating tariff adjustments inflationary factors and adoption rate sensitivities while ensuring methodological transparency through detailed documentation of assumptions data inputs and analytical techniques

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Soil Moisture Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Soil Moisture Sensors Market, by Type

- Soil Moisture Sensors Market, by Offering

- Soil Moisture Sensors Market, by Connectivity

- Soil Moisture Sensors Market, by Application

- Soil Moisture Sensors Market, by Region

- Soil Moisture Sensors Market, by Group

- Soil Moisture Sensors Market, by Country

- United States Soil Moisture Sensors Market

- China Soil Moisture Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Conclusive Insights on Soil Moisture Sensor Industry Evolution and Emerging Opportunities for Sustainable Agriculture and Resource Management

The soil moisture sensor industry is at an inflection point where digital transformation sustainability imperatives and trade policy dynamics converge to define future trajectories. The proliferation of connected sensor networks AI-enabled analytics and open architecture standards is facilitating a transition from reactive water management to predictive and prescriptive frameworks enhancing agricultural productivity and environmental stewardship. While tariff adjustments in twenty twenty-five introduce near-term supply chain complexities the strategic pivot toward localized manufacturing and modular component design is fostering resilience and collaboration within the ecosystem. Across segments and regions evolving regulatory environments and technology adoption patterns point to a decentralized and interoperable future where sensor data drives integrated resource management solutions spanning agriculture construction research and beyond

Connect Directly with Associate Director Ketan Rohom to Secure Exclusive Access to the Comprehensive Soil Moisture Sensor Market Research Report and Unlock Strategic Insights Today

Ready to elevate your strategic decision-making with in-depth market intelligence on soil moisture sensors Contact Ketan Rohom Associate Director Sales & Marketing to explore tailored solutions and request a copy of the comprehensive research report for actionable insights

- How big is the Soil Moisture Sensors Market?

- What is the Soil Moisture Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?