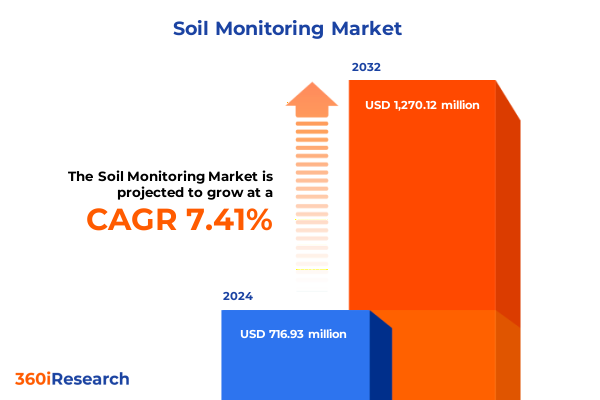

The Soil Monitoring Market size was estimated at USD 763.63 million in 2025 and expected to reach USD 815.71 million in 2026, at a CAGR of 7.53% to reach USD 1,270.12 million by 2032.

Discover the Vital Role of Advanced Soil Monitoring Solutions in Driving Sustainable Agricultural Productivity and Environmental Conservation Worldwide

Soil health stands at the crossroads of agricultural productivity, environmental stewardship, and resource optimization. As global populations rise and climate patterns shift, the demand for real-time, accurate soil data has never been more critical. The convergence of precision agriculture, environmental monitoring, and digital transformation drives stakeholders across farming operations, research institutions, and public agencies to seek innovative soil monitoring solutions that deliver actionable insights with minimal latency.

In this context, advanced sensor technologies, integrated platforms, and remote data analytics play a pivotal role in empowering decision-makers to optimize irrigation, manage nutrient cycles, and forecast crop performance with unprecedented accuracy. Regulatory bodies are tightening guidelines on water usage and land management, compelling organizations to adopt robust monitoring frameworks. Meanwhile, digital adoption curves in rural regions continue to steepen, presenting opportunities for sustainable intensification of agricultural systems.

This introduction frames the subsequent analysis by underscoring the imperative for adaptive, data-driven soil monitoring infrastructure. A nuanced understanding of transformative shifts, policy dynamics, segmentation patterns, regional variances, and leading industry practices will guide stakeholders toward informed choices that balance productivity goals with ecological responsibility. With evolving market dynamics and technological breakthroughs on the horizon, now is the time to explore the insights that will shape the next era of soil monitoring excellence.

Unveiling the Groundbreaking Technological and Market Disruptions Redefining Soil Monitoring Practices Across Industries and Applications

Recent years have witnessed seismic shifts in the soil monitoring landscape, fueled by breakthroughs in sensor miniaturization, Internet of Things connectivity, and artificial intelligence that collectively reshape how we perceive and manage below-ground environments. Proliferation of low-power, high-precision capacitive and optical sensors now enables continuous measurement of moisture, electrical conductivity, and optical reflectance, offering granular visibility into soil heterogeneity. Coupled with edge computing, these devices process critical data on-site, reducing reliance on centralized systems and latency.

Simultaneously, software platforms have evolved from simple data repositories to holistic decision-support systems, integrating satellite imagery and weather forecasts to deliver predictive analytics. Machine learning models trained on vast agronomic datasets can now anticipate moisture deficits or nutrient imbalances days before they manifest, empowering early interventions. Integration of proprietary algorithms with open-source geographic information systems further democratizes access for small-scale operators and researchers alike.

As a result, service providers are expanding offerings to include end-to-end solutions encompassing hardware deployment, continuous monitoring contracts, and bespoke analytics. Strategic collaborations between sensor developers and agritech software firms accelerate time-to-insight, while partnerships with network operators enhance coverage in remote regions. These transformative shifts underscore a broader movement toward data-driven stewardship of natural resources and the emergence of soil monitoring as a cornerstone of sustainable practices across sectors.

Evaluating the Comprehensive Effects of 2025 United States Tariff Policies on Soil Monitoring Equipment Supply Chains and Cost Structures

The United States’ imposition of revised tariff schedules in 2025 has introduced new complexities into the soil monitoring equipment ecosystem. Components sourced from Asia and Europe are subject to incremental duties that reverberate across supply chains, elevating capital expenditures for sensor manufacturers and integrators. As raw material costs climb, original equipment producers are reassessing procurement strategies to mitigate margin pressures and preserve competitiveness.

In response, some stakeholders have accelerated diversification of their supplier base, seeking alternative low-cost manufacturers in regions unaffected by punitive tariffs or negotiating long-term contracts to lock in favorable pricing. Meanwhile, domestic fabrication facilities are experiencing renewed interest as companies weigh the benefits of nearshoring against logistical constraints and production ramp-up times. However, establishing or expanding in-country manufacturing capacity demands significant investment and faces labor availability challenges.

Ultimately, the cumulative impact of these tariff adjustments is driving a wave of strategic realignments. Organizations are enhancing inventory management protocols, adopting modular designs that allow component substitution, and collaborating more closely with customs experts to streamline import processes. By proactively addressing trade-policy dynamics, industry players can preserve innovation cycles and ensure continuity of advanced soil monitoring deployments in both agricultural and non-agricultural applications.

Illuminating Critical Segmentation Perspectives That Reveal Unique Trends and Opportunities Within the Soil Monitoring Market Ecosystem

In examining the soil monitoring domain through a segmentation lens, notable distinctions emerge that influence technology adoption and service design. When differentiating based on product portfolio, a spectrum surfaces ranging from sensor devices capturing in-field data to full-scale analytical services that interpret findings and cloud-native software enabling visualization and predictive modeling. This tripartite structure underscores the necessity for vendors to articulate value propositions that integrate tangible hardware performance with qualitative insights.

Further granularity appears upon considering the underlying sensing mechanisms. Capacitive sensors deliver rapid moisture detection with minimal power footprints, while dielectric variants emphasize accuracy in heterogeneous soil matrices. Optical instruments leverage light absorption profiles to infer composition parameters, contrasting with tensiometric gauges that quantify water potential through pressure differentials. These divergent modalities equip end users with tailored options that align with site-specific conditions and monitoring objectives.

Connectivity choices also shape deployment strategies, as wired interfaces such as Ethernet and USB offer reliability and bandwidth for permanent installations, whereas wireless solutions powered by cellular networks, LoRaWAN, or NB-IoT facilitate remote monitoring across vast tracts with constrained energy budgets. Each connectivity path demands careful consideration of range, data volumes, and maintenance overheads.

Lastly, the spectrum of end users-from commercial enterprises seeking high-throughput analytics to individual farmers managing discrete plots, government agencies enforcing environmental regulations, and research institutes advancing scientific understanding-creates a mosaic of requirements. Recognizing how these segments interact and overlap enables providers to customize solutions that address nuanced user journeys and deliver differentiated service experiences.

This comprehensive research report categorizes the Soil Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sensor Type

- Connectivity

- End User

Uncovering Distinct Regional Dynamics Shaping Soil Monitoring Adoption and Innovation Trends Across Major Global Markets

Geographic dimensions exert significant influence on the evolution and uptake of soil monitoring technologies, as regional priorities and funding environments shape local market dynamics. In the Americas, robust investments in precision agriculture and supportive policy frameworks have spurred rapid incorporation of advanced sensing networks across large-scale farming operations. Collaborations between private agritech firms and federal research institutions accelerate pilot programs, facilitating validation of new sensor designs under diverse climatic conditions.

Conversely, Europe, the Middle East and Africa present a heterogeneous landscape marked by stringent sustainability mandates, water conservation initiatives, and efforts to rehabilitate degraded lands. Multinational partnerships leverage cross-border research grants to deploy soil monitoring pilots in Mediterranean agricultural zones, while arid regions in the Middle East explore lidar-based moisture mapping integrated with ground sensors to optimize scarce water resources. Across Africa, donor-supported programs introduce low-cost dielectric sensors to foster community-level soil assessment.

In the Asia-Pacific region, surging food demand and technological adoption drive a parallel push toward digital field management. Nations with high agricultural intensity implement national-scale soil health mapping, employing a blend of optical satellite data and ground-mounted monitoring stations. Meanwhile, emerging economies invest in low-power wireless networks, leveraging cellular and NB-IoT connectivity to bridge infrastructure gaps and extend monitoring reach into remote farming communities.

This comprehensive research report examines key regions that drive the evolution of the Soil Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants Driving Advancement in Soil Monitoring Through Strategic Partnerships and Technological Excellence

A cadre of pioneering companies is redefining expectations for soil monitoring through continuous innovation, strategic alliances, and expanded service portfolios. Equipment manufacturers are increasingly pairing sensor production with digital payload integration, partnering with software developers to ensure seamless data ingestion, processing, and visualization. These collaborations foster interoperable ecosystems that simplify end-user experiences and accelerate time-to-insight.

Some industry leaders have invested in proprietary modular platforms, enabling rapid customization of sensor arrays to meet unique environmental conditions or research requirements. Others emphasize subscription-based analytical services, offering tiered access to real-time dashboards, automated alerts, and expert consultations that guide field interventions. Joint ventures with telecommunications providers have broadened network coverage, supporting unbroken data flow in geographically challenging locations.

In parallel, emerging entrants leverage agile development methodologies to iterate sensor designs with shorter innovation cycles. By integrating user feedback loops and remote firmware update capabilities, these firms maintain forward momentum, responding to evolving agronomic practices and regulatory changes. The competitive landscape now reflects a balance between established conglomerates with deep distribution networks and lean disruptors that prioritize rapid deployment and cost efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Soil Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arable Labs, Inc.

- Campbell Scientific, Inc.

- CropX Technologies Ltd.

- Delta-T Devices Ltd

- E.S.I. Environmental Sensors Inc.

- Irrometer Company, Inc.

- Sentek Pty Ltd

- SGS SA

- Spectrum Technologies, Inc.

- Stevens Water Monitoring Systems, Inc.

- The Toro Company

- Yara International ASA

Empowering Industry Leaders with Strategic Actions to Leverage Soil Monitoring Innovations for Sustainable Growth and Competitive Advantage

To capitalize on emerging soil monitoring innovations, industry leaders should prioritize the development of open architectures that facilitate seamless integration with existing farm management systems and environmental data platforms. By embracing interoperability standards and publishing application programming interfaces, organizations can cultivate partner ecosystems that amplify solution adoption and extend service lifecycles. Concurrently, establishing joint innovation labs or consortiums with network operators and agronomic research centers accelerates validation of next-generation sensor modalities under real-world conditions.

Moreover, dedicating resources to regulatory engagement ensures that evolving environmental policies are anticipated and addressed in product roadmaps. Proactive dialogue with standards bodies and water management agencies can inform sensor calibration parameters and data quality benchmarks, enhancing product credibility and easing market entry. Investment in customer education programs-ranging from on-site training workshops to interactive digital modules-will elevate end-user proficiency and unlock the full potential of advanced monitoring capabilities.

Finally, exploring flexible commercial models, such as usage-based pricing and advisory subscription bundles, will resonate with diverse end users. Tailored engagement frameworks can attract smallholder farmers seeking pay-as-you-grow options, while enterprise clients may favor comprehensive service agreements that include ongoing analytics and field support. These targeted approaches will drive broader adoption, reinforce trust, and position providers as indispensable partners in sustainable land management.

Detailing Rigorous Multi-Source Research Methodologies and Analytical Frameworks Ensuring Comprehensive and Credible Soil Monitoring Market Insights

This report synthesizes insights from a rigorous, multi-phase research process designed to ensure depth, accuracy, and relevance. Primary research included structured interviews with over forty industry executives, agricultural scientists, and policy experts, complemented by field visits to pilot sites in North America, Europe, and Asia. These engagements yielded firsthand perspectives on sensor performance, deployment challenges, and evolving customer requirements.

Secondary research encompassed comprehensive reviews of technical journals, regulatory publications, and proprietary white papers to map technology evolution, policy frameworks, and competitive strategies. Data triangulation was performed by cross-referencing findings from public grant databases, patent filings, and trade association reports, reinforcing the validity of thematic trends and regional analyses.

Analytical rigor was maintained through iterative validation sessions with subject-matter experts, ensuring that emerging insights aligned with real-world applications and anticipated market trajectories. Quality control measures included double-blind data audits and peer review cycles, guaranteeing that all conclusions rest on a foundation of reliable evidence. Collectively, this robust methodology underpins the credibility of the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Soil Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Soil Monitoring Market, by Product Type

- Soil Monitoring Market, by Sensor Type

- Soil Monitoring Market, by Connectivity

- Soil Monitoring Market, by End User

- Soil Monitoring Market, by Region

- Soil Monitoring Market, by Group

- Soil Monitoring Market, by Country

- United States Soil Monitoring Market

- China Soil Monitoring Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Findings to Illuminate the Future Pathways and Strategic Imperatives for Soil Monitoring Stakeholders Worldwide

Bringing together the multitude of technological advances, policy drivers, and market segment nuances, it becomes clear that soil monitoring stands as a dynamic enabler of sustainable resource stewardship and precision management. The interplay of sensor innovations and robust connectivity options equips stakeholders with unprecedented clarity into subsurface conditions, fostering interventions that balance productivity with ecological integrity.

Furthermore, the segmentation insights underscore the importance of tailoring offerings to distinct user cohorts, from sensor-centric hardware suppliers to services and software providers enabling holistic data interpretation. Regional variations reveal how policy climates, infrastructure readiness, and agronomic traditions influence adoption pathways, necessitating adaptive strategies for global market participants.

Key players continue to shape the competitive arena through strategic partnerships, modular design approaches, and subscription-based analytics, driving momentum toward integrated solutions. Meanwhile, the cumulative effects of recent tariff measures highlight the need for proactive supply-chain planning and localized manufacturing considerations.

As the soil monitoring ecosystem evolves, organizations that embrace open architectures, invest in regulatory collaboration, and deploy targeted engagement models will secure a decisive edge. By synthesizing these findings, stakeholders are better positioned to chart a course that leverages technological potential, navigates policy complexities, and maximizes impact across agricultural and environmental contexts.

Take Immediate Steps to Secure In-Depth Soil Monitoring Intelligence by Engaging with Associate Director Ketan Rohom for Comprehensive Market Insights

To secure the most comprehensive and forward-looking insights in soil monitoring, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to a full suite of analysis, strategic perspectives, and proprietary data tailored to your organization’s needs. His expertise bridges the gap between in-depth research and actionable intelligence, ensuring decision-makers receive the precise guidance required to navigate evolving technologies, policy shifts, and competitive dynamics. Engage directly to explore customized advisory, detailed breakdowns of sensor implementations, and exclusive regional deep dives that will empower your team to stay ahead in a rapidly transforming agricultural and environmental landscape.

Don’t miss the opportunity to capitalize on cutting-edge soil monitoring trends and optimize your strategic roadmap. Contact Ketan today to discuss package options, data customization, and expert consultations. Elevate your understanding of connectivity innovations, tariff impacts, and segmentation nuances through a personalized briefing designed to deliver clarity, confidence, and competitive advantage. The time to act is now-partner with a seasoned industry authority and unlock the full potential of soil monitoring intelligence.

- How big is the Soil Monitoring Market?

- What is the Soil Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?