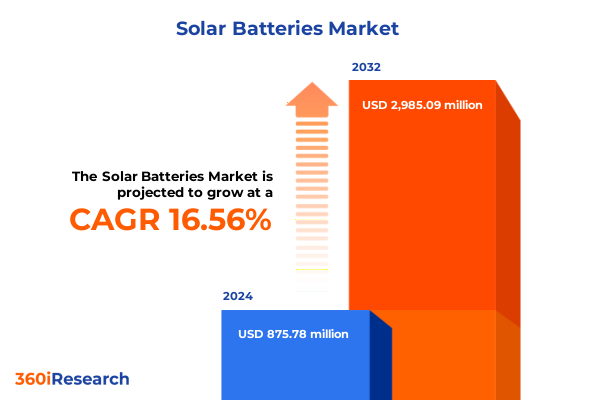

The Solar Batteries Market size was estimated at USD 995.26 million in 2025 and expected to reach USD 1,134.98 million in 2026, at a CAGR of 16.98% to reach USD 2,985.09 million by 2032.

How Solar Battery Energy Storage is Revolutionizing Modern Power Infrastructure and Driving the Future of Clean Energy Access

The solar battery industry is at the forefront of the global energy transition, redefining how electricity is generated, stored, and consumed. As renewable capacity scales rapidly, energy storage systems are increasingly viewed not just as an accessory to solar generation but as a core component enabling grid stability, peak-shaving, and load shifting. With decarbonization goals accelerating across major economies, the integration of solar batteries has become critical in ensuring consistent power delivery from intermittent renewable sources.

Driven by falling cell costs, improved energy density, and supportive policy measures, solar battery solutions are being adopted by residential homeowners, commercial enterprises, and utility-scale developers alike. This adoption is fostering a more resilient grid architecture capable of withstanding cybersecurity threats, extreme weather events, and supply chain disruptions. Moreover, advances in digitalization and battery management systems are enhancing lifecycle performance, safety, and integration with advanced analytics. Consequently, stakeholders-from regulated utilities to off-grid operators-are recalibrating their business models to capitalize on this disruptive technology.

In this executive summary, we explore how solar battery innovations, emerging policy frameworks, and shifting market structures are converging to create new value pools. Through a multilayered lens of technological, regulatory, and competitive factors, we outline the critical forces driving the market’s trajectory and offer insights to support informed strategic decision-making.

Uncovering the Pivotal Technological Advances and Regulatory Changes Redefining the Solar Battery Market's Competitive Dynamics

In recent years, the solar battery sector has undergone a transformative evolution propelled by next-generation chemistries and evolving policy incentives. Lithium-ion continues to dominate, yet improvements in energy density and fast-charging capabilities have elevated performance benchmarks across applications. Simultaneously, lithium iron phosphate (LFP) chemistries are gaining traction for their safety profile and lower cost structure, offering grid operators and residential customers a compelling alternative to nickel-rich cells. These technical advances are complemented by innovations in battery management systems, which now leverage machine learning algorithms to optimize cell balancing, thermal regulation, and predictive maintenance, thereby extending operational lifespans.

On the regulatory front, landmark legislation has reshaped the competitive landscape. Production tax credits for battery cells and modules, introduced under the Inflation Reduction Act, have raised North American content requirements for critical minerals and components to 60 percent in 2025, strengthening domestic manufacturing incentives and encouraging vertically integrated supply chains. At the same time, relaxed sourcing rules for minor mineral inputs have temporarily alleviated bottlenecks, enabling smoother transitions for automakers and equipment suppliers. As policy frameworks continue to adapt, the interplay between trade measures, environmental mandates, and incentive structures is creating new pathways for collaboration between OEMs, technology developers, and network operators.

Collectively, these technological and regulatory shifts are redefining competitive dynamics, encouraging cross-industry partnerships, and unlocking novel use cases-from ancillary services in competitive power markets to behind-the-meter resilience solutions-thus setting the stage for accelerated adoption and diversified revenue models.

Analyzing the Far-Reaching Economic and Strategic Consequences of 2025 US Tariffs on Solar Batteries and Energy Storage Supply Chains

The United States government’s 2025 tariff measures have introduced a complex layer of economic and strategic considerations for solar battery stakeholders. With proposed levies on imported battery cells and related components, project developers and equipment suppliers face upward pressure on procurement costs. According to analysis from Wood Mackenzie, tariffs on Chinese imports could drive storage project costs up by 12 to more than 50 percent, exacerbating budgetary uncertainty for utility-scale installations and larger behind-the-meter programs. In parallel, dependence on international supply chains remains high: nearly 70 percent of grid-scale battery systems imported into the U.S. in recent years originated in China, underscoring the potential for significant disruptions in project timelines and contractual commitments.

These cost escalations have ripple effects throughout the value chain. Utilities and independent power producers may need to revisit power purchase agreements, renegotiate equipment contracts, or explore domestic sourcing partnerships to stabilize margins. For manufacturers, the tariff regime highlights the strategic importance of expanding near-term cell and pack production capacity within North America. Domestic gigafactory expansions, while promising, will require careful alignment of capital allocation, workforce development, and technology de-risking. Moreover, the combined impact of duty increases on aluminum and steel inputs further inflates balance-of-system costs, prompting project sponsors to reassess feasibility under tight incentive structures.

In this environment, scenario planning and agile procurement strategies have become essential risk mitigation tools. Firms that effectively diversify sourcing, leverage tariff relief provisions, and optimize inventory management are better positioned to sustain project pipelines and capitalize on emerging market opportunities.

Dissecting Critical Market Segments Across Multiple Dimensions From Technology Types to End-User Applications for Comprehensive Strategic Clarity

A nuanced understanding of diverse market segments is foundational to effective strategy formulation in the solar battery arena. Technology distinctions map to varying use cases, with flow batteries enabling multi-hour storage in grid services, lead-acid systems serving cost-sensitive backup applications, and lithium-ion cells delivering a blend of energy density and lifespan that suits residential, commercial, and utility-scale deployments. Nickel-based chemistries, while offering high energy density, are progressively complemented by emerging sodium-ion solutions that promise reduced raw-material risk and competitive performance.

Component segmentation further refines the value chain lens. Battery cells underpin critical performance metrics, battery management systems orchestrate safe and efficient operations, and fully integrated packs offer turnkey scalability for end-users. Storage capacity brackets-below 5 kWh, 5 to 10 kWh, and above 10 kWh-reflect distinct installation footprints and customer profiles, from residential demand-charge management to large-scale frequency regulation in wholesale markets.

End-user segmentation highlights divergent purchasing behaviors and financing models. Residential adopters often prioritize reliability and off-grid autonomy, while commercial and industrial users emphasize peak shaving and grid support for cost optimization. Use cases, spanning backup power to load shifting and ancillary grid services, reveal tailored performance requirements. Installation typologies diverge as well, with off-grid systems emphasizing self-sufficiency and on-grid solutions offering seamless utility integration. Ownership models range from leased to capital-owned assets, with each pathway influencing total cost of ownership and operational responsibilities. Finally, sales channels-offline through established distributors and installers, and online platforms offering digital procurement experiences-shape go-to-market approaches and customer engagement strategies. This layered segmentation framework enables stakeholders to pinpoint value pools, align product roadmaps, and prioritize investment flows with surgical precision.

This comprehensive research report categorizes the Solar Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Battery Capacity

- End User

- Application

- Installation Type

- Ownership Model

- Sales Channel

Exploring Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific to Pinpoint Promising Growth Hotspots

Regional market dynamics are shaped by a constellation of policy landscapes, infrastructure readiness, and manufacturing footprints. In the Americas, supportive federal mandates and state-level incentives have driven aggressive deployment of solar plus storage solutions. The rapid buildup of domestic battery production capacity, spurred by targeted tax credits, is gradually reducing reliance on imports and unlocking competitive purchasing models for utilities and municipalities.

Across Europe, the Middle East, and Africa, the transition is defined by diverse regulatory frameworks and grid modernization agendas. European nations have prioritized decarbonization through capacity auctions and integrated resource planning, encouraging hybrid solar-storage plants that bolster system resilience. In the Middle East, where utility-scale solar has become a cornerstone for energy diversification, battery installations are increasingly paired with large-scale photovoltaic farms to mitigate curtailment and enable peak-hour dispatch. African markets, although nascent in battery adoption, are witnessing pilot projects that leverage off-grid solar-storage microgrids to electrify remote communities.

Asia-Pacific markets continue to set global benchmarks in manufacturing scale and technology adoption. With China retaining a leading share of battery cell production, regional integration efforts in Southeast Asia are emerging to capture downstream assembly and value-add operations. In Australia, high residential rooftop PV penetration has catalyzed one of the world’s most mature behind-the-meter battery markets. Meanwhile, Japan and South Korea are focusing on grid-scale hybridization, leveraging advanced BMS for frequency regulation and reserve capacity. These regional insights spotlight localized opportunities and strategic entry points, guiding stakeholders toward markets where regulatory alignment, maturity, and unmet demand intersect.

This comprehensive research report examines key regions that drive the evolution of the Solar Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Innovation Profiles of Leading Global Solar Battery Manufacturers Shaping Key Competitive Industry Dynamics

Leading firms are deploying differentiated strategies to capture value across the solar battery spectrum. One major player has capitalized on vertical integration, aligning raw-material procurement with cell manufacturing and pack assembly. By leveraging production tax credits and co-locating facilities near key demand centers, this company has optimized its cost structure and accelerated time-to-market. Another global challenger distinguishes itself through proprietary BMS algorithms and digital services, offering subscription-based performance guarantees and remote monitoring solutions tailored to commercial and industrial clients.

Strategic collaborations are also reshaping the competitive topology. Joint ventures between established battery cell producers and renewable developers are unlocking novel revenue streams, while partnerships with software providers are embedding analytics-driven asset optimization into storage offerings. In parallel, some traditional automotive battery manufacturers are redirecting excess EV cell capacity toward utility-scale projects, mitigating cyclical demand risks and increasing factory utilization rates.

Innovation leadership is evident in targeted R&D investments focused on next-generation chemistries such as solid-state cells and sodium-ion platforms. These initiatives aim to address critical pain points-material sustainability, safety, and performance consistency-while positioning firms for the post-lithium-ion era. Concurrently, established players are collaborating with academic institutions and national laboratories to validate advanced materials and accelerate commercialization timelines. Viewed collectively, these moves underscore the imperative of agility, ecosystem engagement, and continuous innovation to maintain a competitive edge in the rapidly evolving solar battery market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solar Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BYD Company Limited

- Contemporary Amperex Technology Co., Limited

- Enphase Energy, Inc.

- LG Energy Solution, Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co., Ltd.

- Shenzhen Pylon Technologies Co., Ltd.

- SK On Co., Ltd.

- SolarEdge Technologies, Inc.

- Tesla, Inc.

Strategic Playbook for Industry Leaders to Navigate Market Disruptions and Accelerate Value Creation in Solar Battery Solutions

To thrive amid technical disruption and policy volatility, companies must adopt a proactive, cross-functional approach. First, forging strategic partnerships across the supply chain can mitigate sourcing risks and enhance scale economics. By collaborating with raw-material suppliers, equipment OEMs, and technology providers, organizations can co-develop innovative solutions and lock in critical inputs at predictable costs. Concurrently, diversifying cell chemistries-incorporating LFP, nickel-rich, and emerging sodium-ion technologies-enables deployment flexibility and hedges against raw-material price swings.

Second, stakeholders should institutionalize advanced scenario-planning capabilities. Incorporating tariff scenarios, incentive evolution, and demand fluctuations into financial models supports robust go-/no-go investment decisions. Embedding real-time market intelligence and predictive analytics into procurement workflows can further refine sourcing strategies and inventory management, ensuring resilience against sudden policy or supply chain shocks.

Third, capturing new revenue opportunities requires the development of value-added services. Companies can monetize digital diagnostics, performance optimization, and energy market participation, transforming storage assets from cost centers into dynamic revenue generators. Finally, aligning organizational structures with rapid commercialization processes-shortening R&D cycles, streamlining pilot deployments, and scaling successful pilots-will be essential to outpace competitors and seize emerging market niches.

By integrating these recommendations, industry leaders can not only navigate present challenges but also architect a sustainable growth trajectory underpinned by innovation, partnership, and strategic foresight.

Detailing Robust Research Framework Integrating Primary Interviews and Secondary Data Analysis for Unparalleled Market Intelligence

The research underpinning this report combines rigorous primary and secondary methodologies to ensure robust and verifiable insights. Secondary research canvassed public filings, government databases, industry association publications, and reputable news outlets to map technology trends, regulatory developments, and competitive moves. This desk research was complemented by data triangulation techniques to validate key parameters and triangulate quantitative findings against multiple sources.

Primary research involved in-depth interviews with a cross-section of market participants, including cell manufacturers, integrators, utilities, independent power producers, technology vendors, and regulatory agencies. These structured discussions provided qualitative context on technology roadmaps, procurement priorities, and policy perceptions. Additionally, a global advisory panel of subject-matter experts was convened to review preliminary findings and refine analytical frameworks.

The study’s segmentation framework was constructed through iterative analysis, ensuring that product type, component level, capacity band, end-user profile, application scenario, installation topology, ownership model, and sales channel dimensions capture the full spectrum of market dynamics. Regional analysis leveraged macroeconomic indicators, trade data, incentive structures, and deployment statistics to generate actionable regional profiles.

Quality assurance processes included cross-review by internal analysts and external stakeholders to ensure factual accuracy, methodological rigor, and relevance of conclusions. This research methodology delivers a granular yet holistic perspective tailored for decision-makers seeking to navigate the evolving solar battery landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solar Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solar Batteries Market, by Product Type

- Solar Batteries Market, by Component

- Solar Batteries Market, by Battery Capacity

- Solar Batteries Market, by End User

- Solar Batteries Market, by Application

- Solar Batteries Market, by Installation Type

- Solar Batteries Market, by Ownership Model

- Solar Batteries Market, by Sales Channel

- Solar Batteries Market, by Region

- Solar Batteries Market, by Group

- Solar Batteries Market, by Country

- United States Solar Batteries Market

- China Solar Batteries Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Synthesis of Critical Insights Highlighting the Evolutionary Trajectory and Strategic Imperatives in Global Solar Battery Markets

In synthesizing the critical insights from this report, several overarching themes emerge. Technological innovation continues to drive performance gains and cost reductions, expanding the addressable market for solar battery solutions across residential, commercial, and utility-scale domains. Meanwhile, regulatory frameworks and incentive programs are recalibrating competitive dynamics, prompting stakeholders to strengthen local manufacturing footprints and diversify supply chains.

Tariff actions introduced in 2025 have underscored the strategic importance of near-term supply security and agile procurement strategies. Yet, they also highlight the potential for domestic capacity expansions to capture value and mitigate reliance on international sources. Segmentation analysis reveals a multifaceted market, where chemistry choices, component architectures, and application-specific designs intersect with ownership models and sales channels to create nuanced value pools.

Regional profiles indicate differentiated growth trajectories, from the Americas’ push for decarbonization to EMEA’s hybrid facility deployments and Asia-Pacific’s manufacturing-driven scale. Competitive analysis illustrates how leading manufacturers are deploying integrated strategies-combining R&D investments, partnerships, and digital services-to sustain market leadership. Finally, actionable recommendations offer a strategic blueprint for navigating transitions, capturing emergent revenue streams, and fortifying resilience.

As global energy systems evolve, the solar battery market stands at a pivotal inflection point. By aligning technological prowess, regulatory acumen, and market intelligence, organizations can harness the full potential of storage solutions and secure their position in the clean energy future.

Empower Your Decision-Making With Expert Guidance From Ketan Rohom to Acquire the Definitive Solar Battery Market Research Report

We invite industry stakeholders and decision-makers to advance their strategic initiatives by securing the comprehensive solar battery market research report from our Associate Director, Sales & Marketing, Ketan Rohom. His expert guidance ensures that you receive tailored insights and dedicated support in navigating the complex landscape of technology trends, tariff impacts, and regional dynamics. Engaging directly with Ketan enables you to unlock deeper analysis, clarify specific queries about segmentation, and refine your investment or operational strategies.

Take this opportunity to partner with a seasoned market intelligence professional who can facilitate timely access to the report’s full findings, detailed data tables, and appendices. By collaborating with Ketan, you will gain a competitive advantage built on actionable recommendations and rigorous research methodology. Reach out to him to discuss licensing options, bespoke data requirements, and group access privileges, ensuring your organization is equipped with the knowledge it needs to lead in the evolving solar battery sector.

- How big is the Solar Batteries Market?

- What is the Solar Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?