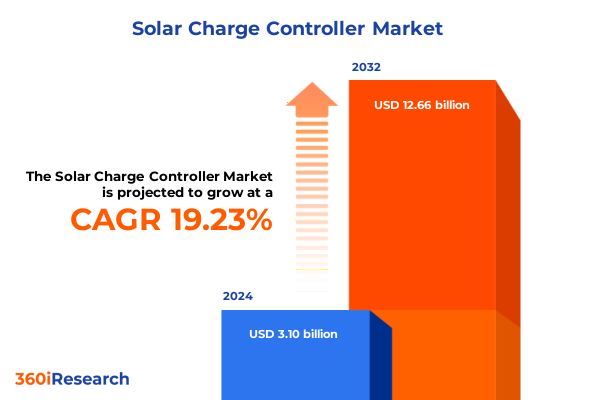

The Solar Charge Controller Market size was estimated at USD 3.71 billion in 2025 and expected to reach USD 4.36 billion in 2026, at a CAGR of 19.17% to reach USD 12.66 billion by 2032.

Unveiling the Critical Role of Advanced Solar Charge Controllers in Revolutionizing Renewable Energy Management Worldwide

Solar energy has emerged as the frontrunner in the global shift toward sustainable power generation, with renewables consistently outpacing fossil fuels in capacity additions. In 2024, renewable power capacity increased by a record 700 gigawatts, marking a 22nd consecutive annual rise and accounting for 80% of the total expansion in global electricity generation. Of this surge, solar photovoltaics led the charge, recording an unprecedented 553 gigawatts of new installations-a 30% year-on-year jump-highlighting its critical role in meeting the world’s growing energy demands.

Amidst this rapid uptake, solar charge controllers have assumed a pivotal position in maximizing system performance and ensuring longevity. By regulating the flow of electricity from photovoltaic arrays to storage batteries, these devices safeguard energy assets and optimize yield. The latest controllers leverage advanced Maximum Power Point Tracking algorithms, augmented by artificial intelligence, to adapt in real time to fluctuating irradiance, thereby improving conversion efficiency by as much as 25% compared to conventional regulators. Additionally, the integration of IoT-enabled remote monitoring and diagnostics empowers technicians to perform proactive maintenance, reducing downtime and streamlining operations.

As renewable portfolios diversify to include residential, commercial, and utility-scale applications, demand for robust, feature-rich charge controllers continues to intensify. Contemporary models offer modular designs that accommodate a broad range of battery chemistries-chiefly lead acid and lithium ion-and support scalable output ratings from light off-grid units to heavy-duty industrial systems. With embedded cybersecurity measures, these controllers not only face remote threats but also enable end-to-end data integrity, positioning them at the confluence of resilience and digital transformation in solar energy management.

Exploring the Transformative Technological Shifts Driving Innovation and Efficiency within the Solar Charge Controller Sector

Today, the migration toward MPPT charge controllers over traditional PWM regulators is redefining performance benchmarks. By dynamically adjusting the operating point of solar arrays to track peak power output, MPPT systems extract maximum energy under diverse lighting conditions. This shift has led to notable improvements in overall energy harvest, particularly in partially shaded or low-irradiance environments-enhancing both reliability and return on investment.

Simultaneously, the integration of Internet of Things connectivity has ushered in a new era of remote accessibility, allowing stakeholders to monitor real-time parameters, analyze performance metrics, and perform diagnostics via cloud-based platforms. Such continuous visibility fosters proactive maintenance strategies, minimizes unplanned outages, and elevates system uptime across residential and commercial deployments.

In parallel, solar charge controllers are evolving into hybrid power management hubs that seamlessly interface with smart grids and energy storage arrays. By balancing on-grid interaction and off-grid autonomy, these advanced devices optimize load distribution and support grid stability. The convergence of storage integration further empowers operators to smooth energy flows and reduce reliance on conventional power sources during peak demand periods.

Finally, the rise of modular hardware and embedded cybersecurity frameworks underscores a commitment to scalability and resilience. Modular platforms enable tailored system configurations, facilitating rapid expansion from single-string off-grid installations to multi-string commercial farms. Concurrently, robust encryption protocols and secure firmware updates safeguard critical infrastructure against emergent cyber threats in an increasingly interconnected energy landscape.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Solar Components and Charge Controller Cost Dynamics

In April 2025, the United States implemented a comprehensive reciprocal tariff regime affecting a broad spectrum of imported solar energy components. Under this policy, crystalline silicon wafers, photovoltaic cells, and complete module assemblies from China now incur a cumulative duty of 54%, while imports from Vietnam, India, South Korea, and Malaysia face levies ranging between 24% and 46%. These measures are designed to bolster domestic manufacturing but have swiftly injected uncertainty into procurement strategies across the sector.

Industry analysis indicates that such tariffs could elevate utility-scale energy storage project costs by as much as 50%, with storage systems bearing the brunt due to their dependence on imported lithium-ion cells. A recent report highlights that projected duties could increase battery costs between 12% and 50%, and destabilize long-term planning cycles for developers, triggering delays in project execution and elevated capital outlays.

On the consumer front, higher equipment price tags have already begun to impinge on residential adoption, with sector observers noting a 32% downturn in home installations amid tariff-driven cost escalations and evolving trade policies. Installers report client hesitancy in locking in prices, exacerbating scheduling uncertainties and affecting market momentum in key regional markets.

While solar charge controllers themselves are not directly targeted, their reliance on imported power electronics and semiconductor components subjects them to overlapping duties. As a result, manufacturers are absorbing 5–10% increases in bill-of-materials costs, leading to strategic shifts toward domestic sourcing, stockpiling of critical parts, and renegotiation of supplier agreements to preserve margin and maintain timely delivery schedules.

Deciphering Critical Market Segmentation Insights to Understand Battery Types, Current Ratings, Distribution Channels, and Application Demands

The landscape of solar charge controllers becomes clearer when viewed through the lens of battery chemistry. Traditional lead-acid configurations continue to command a presence in cost-conscious off-grid and remote installations, appreciated for their mature technology profile and end-of-life recyclability. Conversely, lithium-ion solutions are rapidly ascending, prized for their superior energy density, extended cycle life, and fast-charging capabilities, driving adoption in both residential backup and commercial storage arenas.

Differentiating by output current rating further refines market understanding, dividing devices into compact controllers supporting light loads up to 10 amperes, workhorse mid-range units handling 10 to 20 amperes in small commercial roofs, and robust regulators exceeding 20 amperes for demanding large-scale and industrial energy storage systems. This segmentation underscores the necessity of tailoring system design to specific power requirements, balancing cost efficiency with performance thresholds.

Channel dynamics also play a pivotal role in shaping charge controller accessibility. Offline distribution remains anchored in traditional retail and wholesale networks, servicing installers who value immediate product availability and face-to-face technical guidance. Simultaneously, online avenues have matured, with manufacturers offering direct-to-customer portals and e-commerce platforms that streamline procurement, deliver customized firmware configurations, and support rapid scaling of project pipelines across diverse geographies.

Finally, application-based segmentation illuminates end-use priorities, spanning commercial environments such as hospitality and retail, which demand high uptime and integration with building management systems; industrial sites like manufacturing and mining, where controllers must endure harsh conditions and variable loads; and residential deployments, differentiated into rural off-grid homes and urban grid-tied residences, each with distinct reliability, form factor, and connectivity requirements.

This comprehensive research report categorizes the Solar Charge Controller market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Output Current Rating

- Distribution Channel

- Application

Uncovering Regional Market Dynamics across the Americas, Europe Middle East Africa, and Asia-Pacific for Solar Charge Controllers

In the Americas, strong policy support and incentive mechanisms have accelerated solar installations, elevating demand for advanced charge controllers. The United States, buoyed by the Inflation Reduction Act, witnessed a record 32 gigawatts of new photovoltaic additions in 2023 and an influx of home energy storage projects. This surge has prompted developers to prioritize controllers with enhanced battery management and remote diagnostics to capitalize on grid-interactive storage programs.

Across Europe, the Middle East, and Africa, diverse market drivers are at play. The European Union’s REPowerEU initiative has driven a 45% increase in solar capacity with 61 gigawatts of new installations in 2023, leading to heightened interest in smart controllers that integrate with renewable heat, smart grid, and demand response systems. In parallel, off-grid solar electrification programs in parts of Africa have elevated adoption of robust, weather-resistant controllers in rural communities where grid extension remains costly and slow.

The Asia-Pacific region continues to dominate global solar growth, contributing over 72% of global renewable capacity additions in 2024. China alone added more than 357 gigawatts of cumulative capacity by year-end, underscoring a voracious appetite for scalable charge controllers capable of managing multi-string arrays and high-voltage battery banks. Meanwhile, Southeast Asian markets such as Vietnam and Thailand are embracing hybrid solar-plus-storage microgrids, necessitating controllers that balance on-grid export with islanded operation in areas prone to grid instability.

This comprehensive research report examines key regions that drive the evolution of the Solar Charge Controller market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Pioneering Contributions to the Evolution of Solar Charge Controller Technologies

OutBack Power has gained recognition for its lithium-compatible MPPT charge controllers, which rolled out in 2024 and have already been integrated into over 60,000 installations across North America. These systems support advanced battery management protocols and come with factory-calibrated profiles for deep-cycle lithium chemistries, enabling installers to deploy reliable hybrid systems in both residential and commercial contexts.

Schneider Electric has extended its reach by deploying over 100 hybrid microgrid systems in Sub-Saharan Africa, integrating state-of-the-art charge controllers that balance on-grid and off-grid operation. By embedding sophisticated load-shedding algorithms and renewable export controls, these solutions ensure consistent power delivery in regions with intermittent grid access, underscoring the company’s commitment to resilient energy infrastructure.

Tigo Energy, a leader in module-level power electronics, has enhanced its TS4 series MLPE platform to include fail-safe shutdown capabilities and dynamic arc-fault detection, streamlining safety compliance on large commercial rooftops. The platform’s compatibility with multiple inverter brands and open communication standards simplifies integration, marking a significant step toward interoperable solar ecosystems.

Meanwhile, emerging manufacturers such as Ampinvt are pushing boundaries with modular controllers featuring AI-driven MPPT and remote firmware updates. These innovations allow for continuous performance tuning and predictive maintenance across diverse deployment scenarios, positioning them as agile competitors in an increasingly digitalized marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solar Charge Controller market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIMS Power

- Blue Sky Energy Inc.

- Epever

- EPEver

- Genasun LLC

- Giandel

- MidNite Solar Inc.

- Morningstar Corporation

- Mppsolar

- OutBack Power Technologies

- Phocos AG

- PowMr

- Renogy

- Samlex America Inc.

- SRNE Solar

- Steca Elektronik GmbH

- Studer Innotec SA

- Victron Energy B.V.

- Wuhan Wanpeng

Presenting Actionable Strategic Recommendations for Industry Leaders to Navigate Market Challenges and Capitalize on Emerging Opportunities

To mitigate the uncertainties wrought by dynamic tariff regimes, industry leaders should diversify component sourcing across multiple regions, including emerging domestic semiconductor foundries and non-tariffed Asian markets. Concurrently, maintaining strategic safety stocks of critical power electronics and negotiating long-term supplier contracts with floor-price protections can buffer against abrupt cost fluctuations and supply chain bottlenecks.

Embracing digital transformation is essential for sustaining competitive advantage. By incorporating advanced IoT platforms, machine-learning algorithms, and cloud-based analytics, manufacturers can deliver predictive maintenance services and real-time performance insights. This not only enhances customer value propositions but also cultivates recurring revenue streams through software-as-a-service offerings.

Strengthening domestic manufacturing capabilities and forging partnerships with local equipment fabricators can unlock new incentives and qualify projects under emerging clean energy procurement policies. Joint ventures with established electronics firms will accelerate the scaling of controller production, reduce lead times, and secure preferential treatment under national content regulations.

Lastly, embedding robust cybersecurity protocols and delivering comprehensive after-sales support will fortify brand trust and system reliability. Providing modular upgrade paths, firmware update mechanisms, and round-the-clock technical assistance ensures that controllers remain resilient against evolving cyber threats and deliver sustained performance over long deployment cycles.

Detailing a Comprehensive Research Methodology Emphasizing Rigorous Data Collection, Analysis Techniques, and Validation Processes

This analysis integrates a multi-faceted research approach designed to yield robust and actionable insights. By combining qualitative and quantitative methods, the study ensures a comprehensive understanding of solar charge controller market dynamics, technological advancements, and regulatory influences.

Primary data was collected through structured interviews with senior executives at leading charge controller manufacturers, in-depth discussions with installation contractors, and surveys distributed to end-user cohorts across residential, commercial, and industrial segments. These engagements provided first-hand perspectives on emerging requirements, purchasing criteria, and operational challenges.

Secondary research involved meticulous review of public policy documents, including federal tariff proclamations and trade commission reports, as well as analysis of industry publications, technical white papers, and authoritative energy agency statistics. This phase also encompassed scrutiny of patent filings to map innovation trajectories within the controller domain.

To fortify analytical rigor, findings were triangulated across multiple data sources, and a panel of subject-matter experts validated preliminary conclusions. All proprietary information was anonymized to preserve confidentiality, while adherence to established market research standards ensured objectivity, transparency, and reproducibility of results.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solar Charge Controller market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solar Charge Controller Market, by Battery Type

- Solar Charge Controller Market, by Output Current Rating

- Solar Charge Controller Market, by Distribution Channel

- Solar Charge Controller Market, by Application

- Solar Charge Controller Market, by Region

- Solar Charge Controller Market, by Group

- Solar Charge Controller Market, by Country

- United States Solar Charge Controller Market

- China Solar Charge Controller Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insights Reflecting on Key Findings and the Future Outlook of the Solar Charge Controller Landscape

The analysis underscores a clear trajectory toward advanced, digitally enabled solar charge controllers that not only optimize energy yield through sophisticated MPPT algorithms but also enhance system reliability via IoT-driven monitoring and cybersecurity safeguards. Segmentation analysis reveals differentiated demand profiles by battery chemistry, current capacity, distribution channels, and application environments, empowering stakeholders to tailor solutions for targeted market niches.

Meanwhile, evolving trade policies and tariff structures have introduced new cost considerations, compelling industry participants to reexamine supply chains and manufacturing footprints. Regional insights highlight varied growth drivers, from policy-led expansions in North America and Europe to aggressive capacity additions in Asia-Pacific and off-grid electrification in emerging economies. Collectively, these factors paint a dynamic landscape where agility, innovation, and strategic partnerships will determine market leadership in the years ahead.

Connect with Ketan Rohom to Gain Exclusive Access and Secure Your In-Depth Solar Charge Controller Market Research Report Today

For those seeking a deeper dive into these findings and a detailed breakdown of emerging technology roadmaps, supply chain analyses, and competitive benchmarking, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to discuss how this comprehensive market research report can inform your strategic planning, investment decisions, and product development initiatives. Engage now to secure your copy and leverage timely insights that will empower you to navigate market complexities and capture growth opportunities with confidence and precision.

- How big is the Solar Charge Controller Market?

- What is the Solar Charge Controller Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?