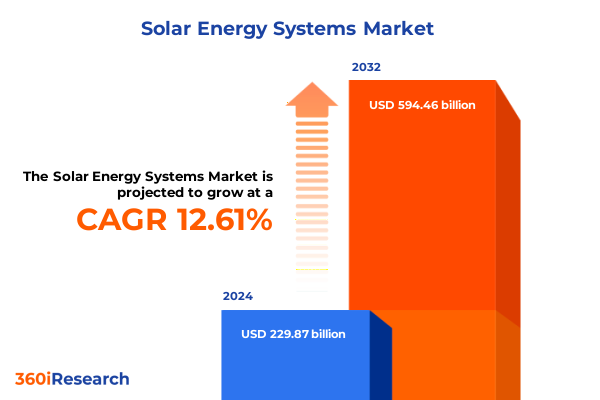

The Solar Energy Systems Market size was estimated at USD 258.93 billion in 2025 and expected to reach USD 289.12 billion in 2026, at a CAGR of 12.60% to reach USD 594.46 billion by 2032.

Unveiling the Strategic Imperatives of Solar Energy Systems to Accelerate Decarbonization and Resilience in Modern Electricity Infrastructures Worldwide

Solar energy systems have become indispensable pillars in the transition toward a low-carbon, resilient energy future. Innovations in photovoltaic technology, coupled with advances in power electronics, have significantly elevated system performance and reliability. As global energy demand grows, solar installations increasingly serve as foundational assets for diversified generation portfolios, providing clean power to residential, commercial, and utility-scale end-users. This report offers an immersive overview of the current solar energy systems landscape, highlighting how technological maturation is reshaping generation paradigms and influencing investment flows.

Against a backdrop of heightened climate commitments and intensifying grid modernization efforts, solar energy systems are driving transformative impacts on energy security and decarbonization goals. Breakthroughs in perovskite tandem cells, emerging bifacial panel deployments, and enhanced inverter architectures have collectively lifted conversion efficiencies beyond historical thresholds. These factors, integrated with digital asset management and predictive maintenance tools, deliver optimized operations and lower total cost of ownership. Through a concise introduction to key system components and market dynamics, this section sets the stage for deeper analysis of policy, technology, and competitive trends affecting solar energy growth trajectories.

Mapping the Disruptive Technological and Market Dynamics Reshaping Solar Energy Deployments Through Digitalization, Storage Innovations, and Policy Evolution

The solar energy landscape is witnessing unprecedented shifts as digitalization, storage integration, and policy frameworks converge to redefine project economics. Advanced inverter platforms now embed machine-learning algorithms to forecast generation profiles and proactively manage intermittency challenges. At the same time, energy storage systems-leveraging next-generation battery chemistries-expand dispatch flexibility, enabling solar to assume baseload roles during peak demand periods. This confluence of technologies not only enhances technical performance but also unlocks new value streams through ancillary service participation and virtual power plant aggregation.

Meanwhile, supply chains are undergoing strategic diversification to mitigate geopolitical and raw-material risks. Manufacturers and developers are forging partnerships across emerging regional hubs in Asia-Pacific and Latin America, establishing near-shore production lines and strategic inventory reserves. On the policy front, evolving incentives such as streamlined permitting processes and performance-based incentives in key markets are accelerating project pipelines. These shifts underscore an era of accelerated innovation, where cross-sector collaboration and dynamic market mechanisms are catalyzing broader adoption of solar energy systems.

Assessing the Cumulative Impact of Evolving United States Solar Equipment Tariffs on Supply Chains, Project Viability, and Competitive Positioning in 2025

Starting January 1, 2025, the Office of the United States Trade Representative enforced a tariff increase under Section 301 that doubles duties on imported solar wafers and polysilicon from China from 25 percent to 50 percent, while raising tariffs on certain tungsten products to 25 percent to counteract unfair trade practices and reinforce domestic manufacturing efforts. These measures aim to address concerns over forced labor and intellectual property theft while promoting the resilience of critical clean energy supply chains.

Simultaneously, preliminary anti-dumping duties have been levied on imports of solar cells from Vietnam, Cambodia, Thailand, and Malaysia, resulting in estimated project cost increases of up to 30 percent for utility-scale installations and prompting developers to diversify their sourcing strategies to maintain pipeline momentum. Recognizing the potential for market disruption, USTR has extended temporary exclusions for select solar manufacturing equipment through August 31, 2025, preserving tariff relief for 14 key equipment categories used in wafer and cell production.

The cumulative effect of these trade actions is a recalibration of project economics, with some industry players accelerating domestic capacity expansions while others seek long-term supply partnerships beyond traditional sourcing geographies. This tariff landscape will likely drive continued investment in localized manufacturing zones and fuel negotiations for new bilateral trade agreements aimed at stabilizing import dependencies.

Uncovering Key Segmentation Perspectives That Illuminate Product, System Scale, Installation Approaches, and End-Use Applications in the Solar Energy Market

Insight into market segmentation reveals how product types, system sizing, installation methodologies, and end-use categories collectively shape the solar energy ecosystem. Batteries are distinguished from charge controllers, inverters, and solar panels by their roles in energy storage, regulation, power conversion, and energy capture, respectively, each component driving unique performance metrics and cost considerations. Evaluating large-scale, medium-scale, and small-scale solar systems highlights the varying capital intensities and operational complexities inherent in utility-grade versus distributed generation deployments.

Furthermore, the contrast between ground-mounted, integrated, and rooftop solar systems illustrates distinct installation strategies influenced by land availability, architectural constraints, and regulatory approvals. End-use segmentation-spanning commercial, industrial, residential, and utility applications-reveals how demand drivers differ across sectors, from distributed energy resource aggregation in corporate portfolios to grid-scale renewables procurement by utilities. These insights collectively inform technology roadmap prioritization, financing structures, and go-to-market approaches, enabling stakeholders to tailor solutions to discrete market niches.

This comprehensive research report categorizes the Solar Energy Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- System Size

- Installation Type

- End-use

Highlighting Strategic Regional Dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific That Shape Solar Adoption and Policy Alignment

Regional dynamics significantly influence solar energy system deployment strategies and policy harmonization. In the Americas, robust tax credits, streamlined interconnection frameworks, and municipally driven renewable targets have spurred a surge in both utility-scale and distributed installations. Prevailing market conditions in North America demonstrate the importance of integrated energy storage pairings, particularly as grid operators pursue decarbonization objectives and demand response integration.

Across Europe, the Middle East, and Africa, policy diversity presents both opportunity and complexity. European jurisdictions are leveraging capacity auctions and risk-sharing mechanisms to sustain growth, while Middle Eastern markets accelerate large-scale developments through sovereign wealth fund investments. Meanwhile, Africa’s solar landscape is characterized by off-grid and microgrid initiatives, addressing energy access challenges and unlocking socioeconomic benefits in underserved regions.

Asia-Pacific continues to lead in manufacturing scale and technology innovation, with strategic government initiatives fostering module fabrication clusters and advanced R&D partnerships. Regional export corridors and bilateral trade agreements are integral to supply chain resilience, enabling cross-border collaboration and knowledge transfer that further drive solar adoption.

This comprehensive research report examines key regions that drive the evolution of the Solar Energy Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Competitive Forces in the Solar Energy Ecosystem to Reveal Strategic Differentiators and Growth Drivers

Leading companies within the solar energy systems domain exhibit distinct strategic approaches that underscore market leadership and competitive differentiation. First Solar commands attention through its advanced thin-film technology and vertically integrated manufacturing footprint, enabling cost advantages and a reduced carbon intensity profile. Jinko Solar and Trina Solar, as two of the largest module suppliers globally, invest heavily in automation and scaling production to meet surging global demand, while also diversifying geographic production to mitigate tariff and logistics risks.

On the inverter and storage front, established power electronics firms and emerging battery innovators alike are forging alliances to co-develop integrated platforms that optimize performance and expedite deployment. Residential solar leaders are leveraging digital sales channels and financing models, including leases and power purchase agreements, to lower barriers to entry. Utility-scale project developers are differentiating through hybridization strategies and resource integration, bundling solar with large-scale storage, wind assets, and grid-stabilizing technologies. Collectively, these companies drive continuous innovation, setting benchmarks for efficiency, reliability, and financial viability across the solar ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solar Energy Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Green Energy Limited

- Azure Power Global Limited

- Brookfield Renewable Partners L.P.

- Canadian Solar Inc.

- Enphase Energy, Inc.

- First Solar, Inc.

- Goldi Solar Private Limited

- Jakson Limited

- JinkoSolar Holding Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.

- Loom Solar Private Limited

- Mahindra Susten Private Limited

- NextEra Energy, Inc.

- REC Solar Holdings AS

- RenewSys India Private Limited

- SunPower Corporation

- Tata Power Solar Systems Limited

- Trina Solar Co., Ltd.

- Vikram Solar Limited

- Waaree Energies Limited

Delivering Actionable Strategic Recommendations That Empower Industry Leaders to Navigate Market Complexities and Capitalize on Solar Energy Opportunities

Industry leaders should prioritize strategic vertical integration to harness cost efficiencies and supply security across the solar value chain. Securing raw-material sourcing agreements and scaling in-house manufacturing capabilities can mitigate exposure to volatility in global trade policies and currency fluctuations. Equally, forging partnerships with technology providers to co-develop smart inverters and advanced storage solutions will drive differentiated service offerings and bolster revenue diversification through grid-support services.

Furthermore, executives must engage proactively with regulatory bodies to shape incentive structures and expedite permitting processes. Establishing collaborative frameworks with utilities and grid operators to pilot virtual power plants and demand-response integrations will position companies at the forefront of emerging revenue streams. Embracing data-driven asset management, underpinned by predictive analytics, will enhance operational uptime and extend equipment lifecycles. Finally, crafting bespoke financing vehicles that align risk-return profiles with investor objectives will unlock new capital flows, ensuring robust project pipelines and sustainable growth trajectories.

Elucidating Rigorous Research Methodology Framework and Data Validation Processes Underpinning Comprehensive Solar Energy Market Analysis

This research is grounded in a rigorous methodology that synthesizes primary and secondary data sources to deliver reliable market insights. Primary research includes expert interviews with C-suite executives, project developers, and technology providers, while secondary research encompasses industry reports, regulatory filings, and financial disclosures. Quantitative analysis leverages historical project data and component-level performance benchmarks to validate trends and inform segmentation breakdowns.

Qualitative assessments are conducted through scenario planning workshops and policy impact simulations to gauge regulatory shifts and technology adoption trajectories. Data triangulation is achieved by cross-referencing government databases, trade association publications, and peer-reviewed literature. Finally, proprietary validation protocols ensure consistency and accuracy, with iterative reviews by technical advisors to refine assumptions and contextualize findings within the broader clean energy transformation landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solar Energy Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solar Energy Systems Market, by Product

- Solar Energy Systems Market, by System Size

- Solar Energy Systems Market, by Installation Type

- Solar Energy Systems Market, by End-use

- Solar Energy Systems Market, by Region

- Solar Energy Systems Market, by Group

- Solar Energy Systems Market, by Country

- United States Solar Energy Systems Market

- China Solar Energy Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Insights on Solar Energy System Advancements and Strategic Imperatives for Sustainable Decarbonization and Resilient Power Infrastructures

The evolution of solar energy systems has been driven by the confluence of technological advances, policy incentives, and shifting market dynamics. Breakthroughs in component design and digital optimization have elevated system performance, while evolving tariff landscapes and supply-chain strategies continue to reshape cost structures. As the world advances toward net-zero ambitions, solar energy systems will remain central to diversifying energy portfolios, enhancing grid resilience, and unlocking new value chains.

Strategic insights from this report underscore the importance of adaptive business models that integrate manufacturing scalability, policy engagement, and advanced analytics. By aligning product offerings with regional policy frameworks and end-use demands, industry participants can position themselves for sustained leadership. The cumulative lessons from segmentation, regional analysis, and company profiling point to a future where solar energy systems not only meet immediate sustainability goals but also catalyze broader economic and social benefits.

Engage with Associate Director Ketan Rohom to Gain Exclusive Access to In-Depth Solar Energy Systems Market Insights and Propel Your Strategic Initiatives Today

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, offers an exclusive opportunity to deepen your competitive advantage through bespoke solar energy systems market insights. By connecting directly with Ketan Rohom, readers can explore tailored data interpretations, clarify granular findings, and identify strategic pathways that align with organizational objectives. This dialogue fosters accelerated decision-making processes and ensures your teams have unfettered access to the latest analytical frameworks and validation methodologies. Understanding the nuanced implications of supply chain shifts, tariff evolutions, and technology integrations empowers decision-makers to seize high-impact initiatives.

To secure your copy of this comprehensive market research report and discuss customized consultancy solutions, reach out to Ketan Rohom. His expertise in translating complex datasets into actionable business intelligence will guide your next steps, from project planning to investment prioritization. This direct engagement ensures you harness the full value of our rigorous analysis and benefit from targeted recommendations tailored to your specific operational context. Elevate your strategic initiatives by partnering with Ketan Rohom today and unlock the insights that will drive solar energy success.

- How big is the Solar Energy Systems Market?

- What is the Solar Energy Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?