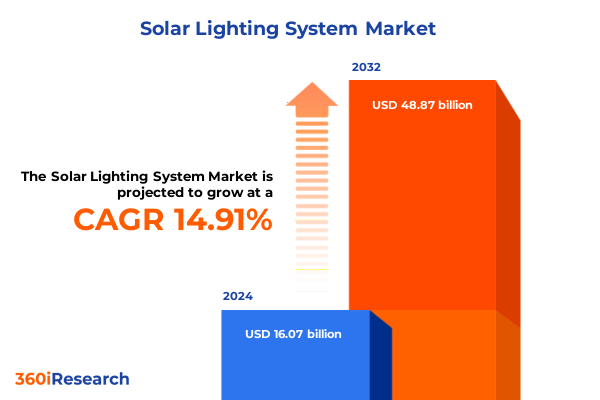

The Solar Lighting System Market size was estimated at USD 18.45 billion in 2025 and expected to reach USD 21.18 billion in 2026, at a CAGR of 14.92% to reach USD 48.87 billion by 2032.

Harnessing Solar Illumination to Drive Sustainable and Energy-Efficient Lighting Innovations Across Residential, Commercial, Industrial, and Public Spaces Worldwide

Solar lighting systems stand at the forefront of sustainable energy innovation, offering versatile illumination solutions that harness the power of the sun to meet diverse needs across residential, commercial, industrial, and public environments worldwide. As concerns over climate change intensify and electricity costs continue to rise, these systems present a compelling alternative to conventional grid-dependent lighting. By integrating photovoltaic panels, energy management electronics, and efficient luminaire design, modern solar lighting solutions support off-grid applications and enhance energy resilience, particularly in remote or underserved communities.

Adoption of solar lighting has accelerated due to advancements in solar cell efficiency, battery storage technologies, and intelligent control systems that optimize performance under varying environmental conditions. Simultaneously, global commitments to decarbonization and net-zero targets have elevated solar-powered illumination from a niche offering to a mainstream priority for municipalities, infrastructure developers, and end users seeking to reduce operational expenses while demonstrating environmental stewardship. As an entry point to this in-depth market study, it’s essential to understand the foundational drivers, technological enablers, and stakeholder motivations that collectively shape the current solar lighting landscape.

Emerging Technological Advancements and Policy Catalysts Shaping a New Era in Solar Lighting Solutions Globally

The solar lighting market is undergoing transformative shifts propelled by breakthroughs in photovoltaic materials, smart connectivity, and policy frameworks that incentivize clean energy deployment. Next-generation solar cells employing perovskite and bifacial technologies are delivering higher conversion rates, enabling more compact and cost-effective designs. Meanwhile, integration of wireless communication modules and Internet of Things (IoT) platforms allows remote monitoring, adaptive dimming, and predictive maintenance, empowering stakeholders to maximize uptime and lower lifecycle costs.

On the regulatory front, governments around the globe are issuing favorable policies and incentives that accelerate solar infrastructure investments. Feed-in tariff schemes, tax credits, and green financing mechanisms have reduced barriers for municipalities and private enterprises to deploy solar lighting projects at scale. This convergence of technological maturity and supportive regulations is fueling a paradigm shift, where off-grid and grid-tied solar lighting solutions are increasingly seen as strategic assets rather than ancillary green embellishments. As a result, market participants are realigning their product roadmaps and forging partnerships to capitalize on the evolving landscape.

Evaluating the Cumulative Economic and Market Impacts of 2025 United States Tariff Measures on Solar Lighting Supply Chains

In 2025, the United States government implemented a series of tariff measures targeting imported solar components, including modules, panels, and ancillary hardware, in response to concerns over domestic manufacturing competitiveness. These levies have incrementally increased the landed cost of key inputs, placing upward pressure on the pricing of integrated solar lighting systems. As a consequence, manufacturers and project developers have had to reevaluate sourcing strategies, either absorbing additional expenses or passing costs onto end users, which has in turn influenced procurement timelines and project economics.

To mitigate the impact of import tariffs, many industry players have accelerated investments in domestic production facilities and established localized supply chains. Joint ventures between U.S. firms and foreign component suppliers have emerged to facilitate technology transfer and reduce exposure to tariff escalations. Additionally, delayed tariff phase-outs have prompted companies to explore alternative materials and modular architectures that maintain performance while offering cost flexibility. Despite these adjustments, the cumulative effect of the 2025 tariff regime underscores the importance of proactive policy engagement and agile operational planning in safeguarding profitability within the solar lighting sector.

Unveiling Critical Market Segmentation Insights Across Product Types, End Users, Light Sources, and Distribution Channels in Solar Lighting

Understanding the market through multiple segmentation lenses reveals nuanced demand drivers that guide product development and go-to-market strategies. When categorized by product type, emergency lighting applications command attention for critical infrastructure projects, while flood lighting finds traction in large-scale commercial and industrial settings. Garden lighting and home lighting segments address aesthetic and functional requirements in residential contexts, whereas lanterns cater to portable, low-intensity needs. Meanwhile, street lighting continues to represent a high-volume use case for municipalities seeking to transition public infrastructure to solar.

Examining the market on the basis of end user highlights commercial entities investing in branded campuses and retail establishments, industrial operators prioritizing facility resilience, and homeowners emphasizing energy savings and design flexibility. From the perspective of light sources, compact fluorescent lamps remain in legacy installations, halogen variants serve niche scenarios requiring specific color rendering, and light-emitting diodes (LED) dominate new deployments due to superior energy efficiency and longevity. Distribution channels further differentiate market access, as traditional offline networks leverage established dealer relationships, whereas online platforms offer streamlined procurement and rapid delivery, particularly for smaller-scale projects. Together, these segmentation insights frame a comprehensive picture of evolving consumer preferences and channel dynamics.

This comprehensive research report categorizes the Solar Lighting System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Light Source

- Distribution Channel

- End User

Analyzing Regional Market Dynamics and Growth Drivers in the Americas, Europe, Middle East and Africa, and Asia-Pacific Solar Lighting Sectors

Regional dynamics exert a profound influence on solar lighting market trajectories as local policies, infrastructure priorities, and economic conditions vary significantly across geographies. In the Americas, municipalities and private developers benefit from mature renewable energy frameworks and incentivized funding programs that foster widespread adoption. North American urban centers are upgrading aging street lighting networks with grid-tied and off-grid solar solutions, while Latin American regions leverage abundant solar irradiation to electrify rural communities.

Europe, the Middle East, and Africa (EMEA) present a mosaic of growth patterns, with Western European countries focused on cutting-edge smart-city initiatives and integration of solar lighting into broader energy management systems. In contrast, Middle Eastern and African markets prioritize standalone off-grid installations to support remote infrastructure, healthcare facilities, and safety enhancements. Across the Asia-Pacific, rapid urbanization and government-led electrification campaigns are propelling demand for solar lighting in residential, agricultural, and industrial contexts. Country-specific targets for renewable energy capacity and rural electrification are key catalysts, driving both hardware innovation and service-based deployment models.

This comprehensive research report examines key regions that drive the evolution of the Solar Lighting System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Driving Innovation and Competitive Differentiation in Solar Lighting

Competition in the solar lighting sector is intensifying as established energy conglomerates, specialized lighting firms, and emerging technology providers vie for market share. Leading global players differentiate through robust research programs that optimize photovoltaic efficiency and luminaire performance, while leveraging strategic partnerships with battery manufacturers and IoT solution vendors. Product portfolios are expanding to include hybrid systems that seamlessly integrate solar and grid power, offering resilience against intermittent sunlight conditions.

Innovative startups are introducing modular, plug-and-play designs that streamline installation and enable scalable rollouts, appealing to both enterprise customers and DIY consumers. Several key companies have also capitalized on mergers and acquisitions to secure complementary technologies and expand geographic reach. As stakeholder expectations evolve toward holistic energy solutions, successful players are those that can offer turnkey services encompassing planning, financing, operations management, and maintenance. This convergence of technological prowess and service-oriented business models is reshaping competitive dynamics and raising the bar for market entry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solar Lighting System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Acuity Brands, Inc.

- Cree, Inc.

- Dialight plc

- Eaton Corporation plc

- Hubbell Incorporated

- OSRAM Licht AG

- Schneider Electric SE

- Signify N.V.

- Zumtobel Group AG

Actionable Strategies for Industry Leaders to Accelerate Adoption, Optimize Supply Chains, and Enhance Market Penetration in Solar Lighting

To thrive in the dynamic solar lighting arena, industry leaders must prioritize strategic investments and operational agility. Cultivating research and development programs focused on high-efficiency photovoltaic materials and advanced energy storage will reinforce technical leadership. At the same time, diversifying supply chains to include both domestic and international manufacturing partners can insulate organizations from tariff volatility and logistical disruptions.

Aligning distribution strategies with customer preferences is equally critical. Enterprises should evaluate the balance between offline channel partnerships, which leverage established networks and service capabilities, and online platforms that provide speed and scalability. Furthermore, cultivating relationships with municipal agencies and utilities through pilot projects can demonstrate performance reliability and build long-term procurement contracts. Embracing data-driven maintenance services powered by IoT analytics will enhance asset uptime and create recurring revenue streams. By adopting these targeted measures, companies can optimize capital allocation, strengthen resilience, and accelerate market penetration across diverse end-user segments.

Comprehensive Research Framework Detailing Methodologies Employed for Data Collection, Validation, and Analytical Rigor in Market Study

This research study employs a rigorous combination of primary and secondary methodologies to ensure analytical reliability and industry relevance. Primary research encompasses interviews with key opinion leaders, including product developers, channel distributors, and end users, to capture firsthand perspectives on technological requirements, procurement challenges, and emerging applications. Survey instruments are designed to quantify adoption drivers and barriers across varied end-use segments, while case studies illustrate successful deployment models.

Secondary research aggregates publicly available data from government agencies, standard-setting bodies, and industry associations to contextualize market trends and policy influences. Cross-referencing information from financial reports, company press releases, and technical whitepapers enhances data validation. Analytical frameworks incorporate scenario analysis to assess tariff impacts, sensitivity testing to evaluate pricing fluctuations, and segmentation modeling to delineate growth pockets. This multi-tiered research approach provides stakeholders with a comprehensive, data-driven foundation for strategic decision-making in the solar lighting systems market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solar Lighting System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solar Lighting System Market, by Product Type

- Solar Lighting System Market, by Light Source

- Solar Lighting System Market, by Distribution Channel

- Solar Lighting System Market, by End User

- Solar Lighting System Market, by Region

- Solar Lighting System Market, by Group

- Solar Lighting System Market, by Country

- United States Solar Lighting System Market

- China Solar Lighting System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Findings to Offer Holistic Perspectives on Trends, Challenges, and Opportunities in the Global Solar Lighting Landscape

The landscape of solar lighting systems is marked by rapid innovation, evolving policy environments, and diverse regional dynamics that collectively shape market opportunities and challenges. Advances in photovoltaic and storage technologies have improved system performance and lowered entry barriers, while global commitments to renewable energy are catalyzing large-scale deployments in municipal, commercial, industrial, and residential sectors.

At the same time, trade policies such as the 2025 U.S. tariffs underscore the need for strategic supply chain planning and policy engagement. Segmentation insights reveal that applications ranging from emergency lighting to street lighting, across multiple end-user and distribution contexts, demand tailored solutions rather than one-size-fits-all products. Leading companies are responding with integrated service models and technology partnerships. Ultimately, success in this sector hinges on an organization’s ability to harness innovation, adapt to regulatory shifts, and address the unique requirements of end users in each region of the globe.

Engage with Ketan Rohom to Unlock In-Depth Market Intelligence and Secure Your Solar Lighting System Market Research Report Today

Unlock unparalleled insights into the rapidly evolving solar lighting systems market and drive strategic decisions that fuel sustainable growth and competitive advantage. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to access the full market research report that offers deep dives into emerging technologies, regulatory impacts, and segmentation analyses. Discover exclusive data on key regional trends, leading players, and actionable strategies designed to optimize your investments and accelerate market penetration.

By partnering with Ketan Rohom, you’ll gain personalized guidance on tailoring the report’s findings to your organization’s unique objectives, ensuring you capitalize on solar lighting opportunities with confidence. Request your comprehensive report today and transform raw market intelligence into high-impact business outcomes that illuminate your path to success in this dynamic industry.

- How big is the Solar Lighting System Market?

- What is the Solar Lighting System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?