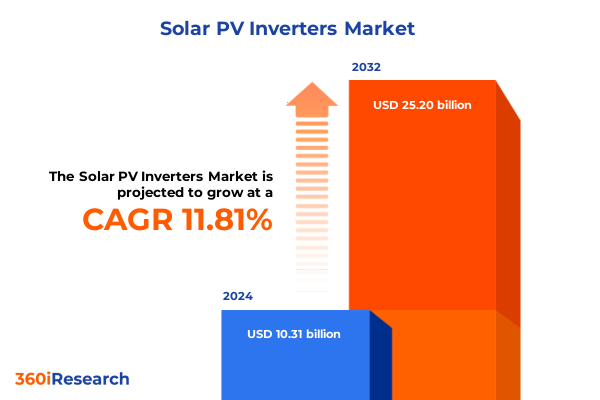

The Solar PV Inverters Market size was estimated at USD 11.44 billion in 2025 and expected to reach USD 12.74 billion in 2026, at a CAGR of 11.93% to reach USD 25.20 billion by 2032.

Exploring the Evolving Role of Solar PV Inverters in Enabling Sustainable Energy Transition and System Reliability Across Diverse Deployments

The critical role of solar photovoltaic inverters has never been more apparent as global energy systems pivot toward decarbonization and decentralized power generation. By converting direct current into grid-compatible alternating current, these devices serve as the indispensable interface between photovoltaic arrays and broader electricity networks. Their performance not only influences the efficiency of energy conversion but also underpins grid stability, power quality, and the integration of energy storage solutions. In recent years, heightened emphasis on renewable penetration, coupled with evolving regulatory frameworks, has propelled inverters from mere power converters to sophisticated energy management platforms.

Innovation within inverter technology is accelerating at an unprecedented pace. Advances in power electronics, semiconductor materials, and digital control algorithms are enabling higher conversion efficiencies, improved thermal management, and enhanced reliability under diverse environmental conditions. Moreover, the integration of artificial intelligence and cloud-based monitoring has introduced predictive maintenance and real-time performance diagnostics, transforming inverters into proactive network assets. These developments are laying the groundwork for new business models that extend beyond hardware sales to encompass software subscriptions, performance guarantees, and grid services participation.

As we embark on this executive summary, the objective is to outline the transformative shifts, policy impacts, segmentation dynamics, and regional variations that define the solar PV inverter marketplace today. By establishing a clear understanding of the technological and market landscape, stakeholders can make informed decisions aligned with future energy developments.

Uncovering the Dramatic Technological and Market Shifts Reshaping Solar PV Inverter Applications and Performance in the Modern Energy Landscape

The solar PV inverter sector is experiencing profound technological and market shifts that are redefining its landscape. Foremost among these is the transition toward multi-functional inverters capable of supporting two-way energy flows, which is essential for integrating distributed energy resources and facilitating grid services. This evolution is driving convergence between traditional inverter functions and advanced features such as local energy storage management, islanding detection, reactive power compensation, and dynamic voltage support. As a result, inverters are assuming responsibilities once reserved for centralized grid infrastructure.

Concurrently, digitalization is transforming operations across the value chain. Real-time data analytics, enabled by IoT connectivity, are empowering asset owners to optimize performance, reduce downtime, and prolong equipment lifespans. This shift toward data-driven service models is spurring partnerships between inverter manufacturers, software developers, and cloud service providers. At the same time, concerns about cybersecurity and interoperability standards are prompting industry-wide collaboration to ensure secure and standardized communication protocols, which will be critical as inverters become increasingly networked.

Finally, the rise of distributed generation and behind-the-meter systems is altering deployment patterns. Hybrid inverters designed for paired PV-and-storage installations, micro inverters offering module-level optimization, and high-voltage string inverters for commercial rooftops are all gaining traction. These versatile configurations underscore the imperative for manufacturers and developers to align product portfolios with diverse use cases, from residential solar-plus-storage to large-scale utility projects.

Assessing How 2025 United States Tariff Policies on Solar PV Inverters Are Altering Supply Chains Costs and Competitive Dynamics Abroad and Domestically

In 2025, the United States implemented expanded import tariffs on solar PV inverters as part of broader trade measures targeting renewable energy components. These tariffs, which levied an additional levy on certain inverter categories, have had a cumulative effect on global supply chains and pricing structures. Manufacturers dependent on imports have faced increased component costs, compelling many to reevaluate sourcing strategies and accelerate investments in domestic production capabilities.

As a direct consequence, several major inverter producers have announced plans to establish or expand manufacturing facilities in North America or partner with regional assembly operations. This shift mitigates tariff exposure while aligning with incentives for onshoring critical energy infrastructure. Meanwhile, downstream project developers are navigating higher upfront expenditures for imported units, leading to greater scrutiny of total cost of ownership and a renewed focus on long-term performance warranties and service agreements.

Beyond cost implications, the tariff environment has influenced competitive dynamics by leveling the playing field for local manufacturers and incentivizing supply diversification across Southeast Asia and Mexico. While short-term market disruptions have tested project timelines and budgets, these policy measures are catalyzing structural shifts toward more resilient, geographically distributed production networks. Looking ahead, the interplay between tariff policy, local manufacturing incentives, and global component availability will continue to shape strategic decision-making across the solar PV inverter ecosystem.

Revealing How Diverse Inverter Types Phase Configurations and System Attributes Influence Market Adoption Across Commercial Industrial and Residential Applications

Market adoption patterns differ markedly when examining inverter portfolios through the lens of system characteristics and operational requirements. In the residential segment, lower-power inverters designed for single-phase connections have gained favor due to their simplicity and cost-effectiveness. By contrast, medium- and high-capacity inverters configured for three-phase distribution are increasingly deployed in commercial and industrial settings, where higher total harmonic distortion tolerance and scalable power ratings up to and beyond 100 kilowatts are essential.

System topology also shapes procurement decisions. On-grid systems prioritize string and central inverters for efficient grid export and straightforward commissioning, whereas off-grid applications lean toward hybrid models that seamlessly integrate battery storage for islanding capability and reliable, standalone operation. Additionally, micro inverters have carved out a niche in scenarios requiring module-level monitoring and shading resilience, particularly on rooftop installations where variable solar exposure is commonplace.

Voltage requirements further segment the landscape, with low-voltage inverters dominating residential markets, medium-voltage solutions emerging in commercial installations, and high-voltage platforms preferred for utility-scale projects. Installation preferences contribute another layer of differentiation: rooftop setups benefit from compact inverter designs that minimize structural load, while ground-mounted systems often employ robust central units capable of handling high DC input voltages. Lastly, the choice between offline and online sales channels remains influenced by regional distributor networks, customer familiarity, and the growing appeal of digital procurement platforms.

This comprehensive research report categorizes the Solar PV Inverters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Inverter Type

- Phase Type

- Power Rating

- System Type

- Output Voltage

- Application

- Installation Type

- Sales Channel

Analyzing Regional Variations in Solar PV Inverter Demand and Deployment Trends Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics play a pivotal role in shaping solar PV inverter deployment patterns and vendor strategies around the world. In the Americas, the United States market is characterized by strong policy support at both federal and state levels, driving expansion of utility-scale solar and behind-the-meter installations. Latin American nations are also ramping up projects, capitalizing on abundant solar resources and favorable financing to address energy access and economic growth objectives.

Across Europe, the Middle East, and Africa, disparate regulatory frameworks and grid infrastructure maturity create a mosaic of opportunities and challenges. Western European countries lead in integrating advanced inverter functionalities to meet stringent grid codes associated with aggressive decarbonization targets. Meanwhile, rapid solar farm rollouts in the Middle East leverage high-efficiency central inverters to maximize power yield under harsh environmental conditions. In Africa, off-grid and hybrid solutions are critical for rural electrification and microgrid development where reliable grid access remains limited.

The Asia-Pacific region continues to dominate global manufacturing capacity and installation volumes. China’s established production ecosystem drives cost reductions and technological innovation, while Australia’s residential rooftop market pioneer polices has propelled module-level power electronics adoption. Emerging markets in Southeast Asia are witnessing accelerated uptake of compact string inverters, supported by governments incentivizing small-scale solar for energy security and economic diversification.

This comprehensive research report examines key regions that drive the evolution of the Solar PV Inverters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Solar PV Inverter Manufacturers and Innovators Highlighting Strategic Partnerships and Product Developments Driving Market Leadership

Leading players in the solar PV inverter space are differentiating through technology innovation, strategic partnerships, and regional footprint expansion. Inverter manufacturers with deep roots in power electronics are investing heavily in next-generation platforms that offer enhanced grid services, embedded intelligence, and seamless integration with battery energy storage systems. Concurrently, software-centric entrants are forging alliances to incorporate energy management and predictive maintenance modules, broadening their value proposition.

Partnerships between inverter OEMs and utilities or project developers are becoming more prevalent, facilitating large-scale pilot programs for advanced grid-forming inverters capable of black start support and reactive power dispatch. These alliances not only validate performance under real-world conditions but also accelerate pathways to regulatory approval for emerging functionalities. Furthermore, several incumbent suppliers are pursuing joint ventures to establish local assembly lines in key markets, balancing global R&D expertise with regional manufacturing advantages.

Mergers and acquisitions continue to reshape competitive positioning, with technology-driven buyouts providing scale and access to complementary capabilities such as power optimizers or digital monitoring platforms. Manufacturers that excel at service delivery, offering modular warranties and performance-based contracts, are securing long-term customer relationships and recurring revenue streams. This convergence of hardware prowess and services acumen is defining the competitive frontier within the inverter landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solar PV Inverters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Energy Industries, Inc.

- Canadian Solar Inc.

- Darfon Electronics Corp.

- Delta Electronics, Inc.

- Eaton Corporation Plc

- Emerson Electric Co.

- Enphase Energy, Inc.

- Fimer S.p.A

- Fronius International GmbH

- General Electric Company

- Ginlong Technologies Co., Ltd.

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- INGETEAM, S.A.

- Larson Electronics LLC

- Loom Solar Pvt. Ltd.

- Maxeon Solar Technologies, Ltd.

- OMRON Corporation

- Power-One Micro Systems Pvt. Ltd.

- Schneider Electric SE

- Siemens AG

- SMA Solar Technology AG

- Sol New Energy (Shenzhen) Co., Ltd.

- Solaredge Technologies, Inc.

- Sungrow Power Supply Co., Ltd.

Providing Strategic Guidance for Industry Leaders to Navigate Tariff Challenges Embrace Emerging Technologies and Optimize Inverter Deployment Across Market Segments

In light of evolving market forces and policy environments, industry participants should adopt a multi-pronged strategic approach. First, investing in hybrid inverter platforms that deliver both conversion and storage management capabilities will position suppliers to capture value in solar-plus-storage deployments. Likewise, emphasizing modular designs with upgradable firmware ensures product longevity and adaptability to future grid code requirements.

Second, companies must diversify supply chains by forging partnerships with component suppliers in tariff-exempt jurisdictions or by expanding nearshore manufacturing. This supply chain resilience not only mitigates policy-driven cost variability but also shortens lead times and reduces logistical complexities. At the same time, embedding digital services into the core offering through cloud-based monitoring and predictive maintenance tools can unlock new revenue streams and strengthen customer retention.

Third, aligning product roadmaps with regional grid integration standards and emerging energy market structures-such as virtual power plants and demand response programs-will be essential for seizing participation opportunities. Finally, fostering collaborative relationships with utilities, regulators, and research institutions can accelerate the validation and certification of advanced inverter features, ensuring that next-generation innovations achieve market readiness.

Detailing the Rigorous Approach Employed to Gather Data Analyze Industry Trends and Validate Findings on Solar PV Inverter Market Dynamics

Our analysis draws upon a rigorous framework of primary and secondary research to deliver comprehensive insights into the solar PV inverter market. Primary data collection involved structured interviews with inverter manufacturers, project developers, regulatory authorities, and industry consultants to capture first-hand perspectives on technology adoption, policy impacts, and market challenges. This qualitative intelligence was complemented by quantitative data sourced from trade associations, customs and tariff filings, and publicly available financial records.

Secondary research included a thorough review of technical white papers, industry standards documentation, and grid code publications to assess the evolution of performance specifications and functional requirements. We also incorporated data from government agencies and international bodies to contextualize policy measures, incentives, and regional deployment statistics. All data points underwent meticulous cross-verification through triangulation, ensuring consistency and reliability across diverse sources.

Finally, an expert advisory panel comprised of engineers, market analysts, and energy economists provided critical validation of key findings and interpretations. This multi-tiered methodology ensures that our conclusions are grounded in robust evidence, offering stakeholders a clear and defensible basis for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solar PV Inverters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solar PV Inverters Market, by Inverter Type

- Solar PV Inverters Market, by Phase Type

- Solar PV Inverters Market, by Power Rating

- Solar PV Inverters Market, by System Type

- Solar PV Inverters Market, by Output Voltage

- Solar PV Inverters Market, by Application

- Solar PV Inverters Market, by Installation Type

- Solar PV Inverters Market, by Sales Channel

- Solar PV Inverters Market, by Region

- Solar PV Inverters Market, by Group

- Solar PV Inverters Market, by Country

- United States Solar PV Inverters Market

- China Solar PV Inverters Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Summarizing Core Insights on Technological Trends Policy Impacts Segmentation and Regional Dynamics Guiding Future Decisions for Solar PV Inverter Stakeholders

The solar PV inverter market stands at a pivotal juncture where technological innovation, policy evolution, and diversified deployment models converge to shape its trajectory. From the advent of multifunctional hybrid inverters to the sharpening impact of United States tariff policies, manufacturers and project developers must navigate an increasingly complex landscape. Segmentation dynamics reveal that system size, voltage levels, phase configuration, and installation modality are critical determinants of product specification and application suitability.

Regional analyses underscore the heterogeneous nature of demand, with mature markets prioritizing advanced grid services and emerging economies focusing on accessibility and cost efficiency. Leading companies differentiate by weaving together hardware excellence and digital service capabilities, while strategic partnerships and regional manufacturing ventures mitigate tariff-induced pressures. Actionable recommendations highlight the importance of modular platform development, supply chain diversification, and proactive engagement with regulatory bodies to capitalize on growth opportunities.

As stakeholders strategize for the future, the interplay between evolving grid code requirements, decentralization trends, and sustainability imperatives will dictate success in this dynamic sector. Armed with a deep understanding of these forces, organizations can craft resilient approaches that deliver reliable, high-performance inverter solutions in service of a decarbonized energy future.

Engage with Ketan Rohom for Customized Market Intelligence to Accelerate Strategic Decisions and Drive Sustainable Growth in Solar PV Inverters

Partnering with Ketan Rohom will provide you direct access to granular data and strategic insights tailored to your organizational objectives. Whether you are evaluating new market entry, optimizing supply chain resilience, or enhancing your product portfolio to address evolving grid integration requirements, bespoke guidance from an experienced sales and marketing executive can streamline your decision-making process. By engaging Ketan Rohom, Associate Director of Sales & Marketing, you will gain an individualized consultation that highlights actionable pathways to capitalize on emerging trends, mitigate tariff-driven risks, and differentiate your offerings in a fiercely competitive environment. Don’t miss the opportunity to elevate your strategic initiatives with an authoritative market research report designed to empower industry leaders. Reach out today to secure your copy and chart a course toward sustained growth in the dynamic solar PV inverter landscape.

- How big is the Solar PV Inverters Market?

- What is the Solar PV Inverters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?