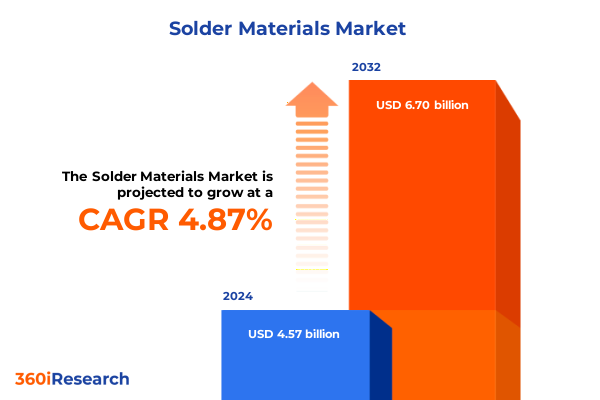

The Solder Materials Market size was estimated at USD 4.79 billion in 2025 and expected to reach USD 5.03 billion in 2026, at a CAGR of 4.89% to reach USD 6.70 billion by 2032.

Understanding the Evolution and Strategic Importance of Solder Materials as the Backbone of High-Reliability Electronic Manufacturing Processes

The growing complexity of electronic assemblies has made solder materials an indispensable component in modern manufacturing, serving as the critical bond that ensures electrical continuity and mechanical stability. Recent advances in miniaturization, heterogeneous integration and high-density interconnect technologies have placed unprecedented demands on solder alloys, flux chemistries, and application methods. As devices shrink and performance metrics rise, the reliability of every solder joint becomes a focal point for designers and production engineers alike.

Today’s market relies on a diverse range of solder solutions to meet stringent requirements across thermal cycling, drop shock and vibrational stresses. Innovations such as novel low-temperature alloys, advanced flux formulations and precision application techniques have emerged in response to the drive for higher throughput and reduced defect rates. By positioning solder materials as a strategic enabler rather than a simple consumable, manufacturers can unlock improvements in yield, cost efficiency, and long-term reliability.

Moreover, the increasing convergence of electronics and other high-value sectors has elevated expectations for solder performance. Industries as varied as aerospace, automotive and medical are placing ever-tighter specifications on joint integrity, traceability and compatibility with harsh operating conditions. Navigating this dynamic landscape requires a sophisticated understanding of both the technical attributes of solder materials and the best practices for integrating them into complex assembly workflows.

Identifying the Pivotal Transformations Reshaping the Competitive Landscape of Solder Materials from Technological and Regulatory Perspectives

The landscape of solder materials has undergone transformative shifts driven by a combination of technological breakthroughs and regulatory mandates. On one front, the push toward lead-free solder alloys has catalyzed extensive research into alternative compositions, including tin-silver-copper formulations optimized for thermal fatigue resistance. At the same time, innovations in flux chemistries-from no-clean to water-soluble formulations-have enhanced wetting behavior and process cleanliness, paving the way for higher solder joint integrity under accelerated manufacturing environments.

In parallel, the proliferation of miniaturized components and complex substrates has elevated the role of precision application methods. Laser soldering and selective soldering automation have become mainstays in high-mix production, enabling targeted heat delivery and reducing thermal stress on sensitive components. Reflow soldering ovens now leverage multi-zone controls and predictive analytics to ensure uniform temperature profiles, while wave soldering systems incorporate dual-wave designs for optimized through-hole assembly.

Regulatory pressures have also redefined competitive dynamics. RoHS and REACH regulations continue to tighten allowable material compositions, prompting manufacturers to pursue robust compliance strategies and invest in eco-friendly innovations. Sustainability considerations, such as reducing flux residues and recycling solder paste, are gaining prominence, influencing procurement decisions and product roadmaps. These converging forces have reshaped the market, rewarding those who can swiftly adapt to evolving technical and environmental requirements.

Assessing the Multidimensional Effects of 2025 United States Tariff Policies on Solder Material Supply Chains, Cost Structures, and Competitive Dynamics

The introduction of new tariff measures by the United States in 2025 has exerted a notable influence on the global solder materials supply chain, compelling stakeholders to reevaluate sourcing strategies and production footprints. Duties applied to a range of base metals and specialty alloys have led to an upward pressure on raw material costs, which in turn has catalyzed the exploration of alternative suppliers both domestically and abroad.

In response, several manufacturers have diversified their procurement by forging partnerships with mills outside of traditional North American sources, while others have sought to insulate their operations through vertical integration or forward-buying programs. As freight costs remain volatile, companies are increasingly consolidating shipments and optimizing inventory buffers to mitigate the impact of duty fluctuations.

Beyond cost considerations, the tariffs have triggered shifts in competitive positioning. Organizations with scale and established logistics networks have gained an edge in negotiating favorable shipping terms and hedging currency risks, whereas smaller players have faced heightened pressure to pass on costs or absorb margin declines. Amid this evolving environment, clear visibility into the cumulative effects of tariff actions has become essential for sustaining pricing discipline and protecting margin integrity.

Unveiling Critical Market Dynamics Revealed by Comprehensive Analysis of Process, Alloy Type, End Use, Flux Type, and Form Variations to Guide Strategic Decisions

A deep dive into process segmentation reveals that reflow soldering continues to dominate high-volume surface mount applications, benefiting from ongoing improvements in profile uniformity and leads to reduced defect rates. Dip soldering remains relevant for larger assemblies and prototypes, offering simplicity for low-volume runs. Selective soldering systems, available in both automatic and programmable configurations, have gained traction in mixed-technology production by delivering targeted heat application without compromising surrounding components. Laser soldering’s pinpoint precision has unlocked new possibilities for delicate assemblies, while wave soldering systems-whether employing dual-wave or single-wave designs-persist in specialized through-hole applications where throughput and joint consistency are paramount.

Alloy type segmentation underscores the importance of material choice in balancing process temperature, joint reliability and environmental compliance. Tin-silver-copper alloys, notably SAC305, SAC387 and SAC405, have emerged as industry workhorses for lead-free surface mount applications, offering a proven record of thermal cycling performance. Tin-bismuth and tin-copper variants provide low-melt options that reduce thermal stress on sensitive components, while tin-lead formulations still serve niche repair and specialized manufacturing needs where the highest reliability is non-negotiable.

End-use segmentation highlights the divergence of requirements across sectors. Within aerospace & defense, avionics systems demand solder materials with exceptional thermal shock resistance, defense electronics require stringent purity standards and satellite systems benefit from high-vacuum compatibility. The automotive sector’s foray into ADAS, engine control units, infotainment systems and sensors has driven demand for solder materials that can withstand extended temperature ranges and vibration. In consumer electronics, LED lighting, PCB assembly, power electronics and semiconductors each impose unique wetting and joint strength criteria. Industrial manufacturing sees use in heavy machinery, precision instrumentation and power generation applications, while medical devices rely on solder materials certified for diagnostic equipment, implantable devices and patient monitoring systems.

Flux type insights indicate that no-clean fluxes dominate assemblies where residue minimization is critical, whereas rosin-based fluxes-offered in both activated and mildly activated variants-remain essential for high-reliability joints in legacy equipment. Water-soluble fluxes, available in inorganic acid and organic acid chemistries, are favored in applications that permit post-solder cleaning to achieve optimal surface cleanliness.

Form factor segmentation reveals that solder paste, available in Type 3 through Type 6 classifications, provides the necessary rheology for fine-pitch surface mount work, while powder and preforms address specialized dispensing and pre-placement needs. Bars cater to wave and dip processes, and wire products, in diameters ranging from 0.5 mm to 1.5 mm, support manual and automated applications where precise volume control is required.

This comprehensive research report categorizes the Solder Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process

- Alloy Type

- Flux Type

- Form

- End Use

Exploring the Unique Regional Trends and Demand Drivers Shaping Solder Material Adoption across the Americas, EMEA, and Asia-Pacific Markets with Strategic Implications

Across the Americas, the solder materials landscape is marked by a blend of advanced manufacturing and domestic sourcing priorities. North American electronics producers are increasingly nearshoring assembly operations to mitigate lead times and buffer against trade uncertainties. This shift has bolstered demand for locally qualified solder alloys and fluxes that comply with rigorous automotive and defense standards. South America’s growing industrial base, particularly in automotive and energy sectors, has also stimulated interest in versatile solder solutions that can withstand diverse environmental conditions, from tropical humidity to high-altitude thermal stresses.

In Europe, Middle East and Africa, a tapestry of regional regulations and industry concentrations shapes solder consumption patterns. The EMEA market benefits from robust automotive manufacturing hubs in Germany and southern Europe, where high-temperature solder materials are essential for engine electronics. Aerospace and defense clusters in the UK and France prioritize ultra-pure fluxes and high-reliability alloys to meet stringent certification demands. Meanwhile, sustainability mandates across the European Union have accelerated the adoption of lead-free chemistries and recyclable solder technologies. In the Middle East and Africa, infrastructure expansion and growing electrification projects have driven demand for solder materials in power generation and industrial machinery applications.

The Asia-Pacific region continues to command a leading role in solder material demand, fueled by its concentration of electronics, semiconductor and automotive manufacturing. China’s high-volume surface mount and power electronics sectors require high-performance SAC alloys and advanced no-clean flux formulations for continuous production lines. Japan’s emphasis on precision electronics and automotive safety systems has spurred development of specialized low-melt alloys and high-purity solder pastes. Southeast Asia’s emerging assembly footprint, supported by competitive labor costs, has created new opportunities for solder suppliers to establish local distribution and technical support, ensuring rapid response to diverse production needs.

This comprehensive research report examines key regions that drive the evolution of the Solder Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Driving Innovation and Competitive Differentiation in Solder Material Markets to Shape Market Trajectories

Leading companies in the solder materials arena have distinguished themselves through sustained investment in alloy innovation and process optimization. Several global suppliers have expanded their product portfolios to include high-reliability, low-silver alloy variants that deliver comparable fatigue resistance at a lower cost profile. Concurrently, advancements in flux chemistry, such as ultra-low-residue formulations and enhanced tack characteristics, have allowed equipment providers to refine soldering recipes for faster cycle times and reduced rework rates.

Beyond product development, strategic partnerships have emerged as a defining trend among top-tier suppliers. Collaborations between alloy producers and equipment manufacturers have yielded integrated solutions that pair solder materials with optimized reflow profiles and automated dispensing systems. Additional joint ventures with research institutions have accelerated the evaluation of next-generation metal matrix composites and hybrid bonding technologies. By leveraging these alliances, leading players have secured early access to breakthrough materials and established themselves as go-to partners for blue-chip electronics and automotive OEMs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solder Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AIM Metals & Alloys LP

- Almit Technology Ltd.

- Belmont Metals, Inc.

- Canfield Technologies by Gen Cap America

- CLIMALIFE

- Electronics Is Fun

- Element Solutions, Inc.

- FCT Solder

- Fusion Inc.

- GENMA Europe GmbH

- Harima Chemicals Group, Inc.

- Heraeus Holding

- Indium Corporation

- Kapp Alloy & Wire, Inc.

- Koki Company Limited by Eppendorf AG

- Mayer Alloys Corporation

- NeVo GmbH

- Nihon Handa Co., Ltd.

- Nihon Superior Co., Ltd.

- Nordson Corporation

- Qualitek International, Inc. by Amtech Software, Inc.

- Shenmao Technology Inc.

- Stannol GmbH & Co. K.G. by Kelsey Industries Plc

- Tamura Corporation

Offering Strategic Recommendations for Industry Stakeholders to Capitalize on Emerging Opportunities and Mitigate Risks within the Solder Material Ecosystem

To capitalize on evolving market conditions, industry leaders should diversify their supplier base by forging relationships with material providers across multiple geographies, thereby reducing exposure to localized disruptions. Investing in the development of advanced alloys tailored for emerging end-use segments-such as electric vehicle power modules and next-generation medical devices-will enable organizations to secure first-mover advantages in high-growth niches. Embracing automation and digital process controls within solder application workflows can yield significant improvements in consistency and traceability, further reinforcing customer confidence in product reliability.

It is equally important to strengthen compliance frameworks in anticipation of tightening environmental regulations. Proactive validation of lead-free chemistries and alignment with international standards will safeguard market access and minimize potential liabilities. Finally, collaboration with industry consortia and academic partners can accelerate the commercialization of sustainable practices, such as solder paste recycling and flux residue recovery, positioning companies as sustainability leaders in an increasingly eco-conscious marketplace.

Detailing the Rigorous Multi-Method Research Approach Employed to Ensure Accurate and Actionable Insights into Solder Material Markets with Transparent Data Validation Processes

This analysis is grounded in a multi-method research framework that integrates extensive secondary and primary data collection. Secondary research encompassed a thorough review of industry publications, technical white papers, patent filings and regulatory documents to capture historical trends, material properties and evolving standards. Complementing this was a primary research phase that included in-depth interviews with key stakeholders across the value chain-solder alloy producers, flux formulators, equipment manufacturers and end-use customers-to gather firsthand perspectives on technological requirements and procurement challenges.

Data triangulation techniques were employed to validate qualitative findings against observed commercial realities, while expert panels provided guidance on emerging applications and regulatory developments. The research further leveraged process-based case studies to illustrate best practices in solder material selection and application, ensuring that the insights presented are both actionable and aligned with current production environments. This rigorous approach underpins the reliability of the segmentation insights, regional analysis and strategic recommendations delivered herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solder Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solder Materials Market, by Process

- Solder Materials Market, by Alloy Type

- Solder Materials Market, by Flux Type

- Solder Materials Market, by Form

- Solder Materials Market, by End Use

- Solder Materials Market, by Region

- Solder Materials Market, by Group

- Solder Materials Market, by Country

- United States Solder Materials Market

- China Solder Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing the Strategic Importance of Adapting to Market Dynamics and Leveraging Solder Material Innovations for Sustained Competitive Advantage

The evolving demands of modern electronics assembly underscore the strategic importance of selecting the right solder materials to balance performance, cost and compliance. As regulatory landscapes shift and technological complexity marches forward, manufacturers must remain agile, leveraging both established best practices and emerging innovations to maintain competitive advantage.

By understanding the nuances of process, alloy, flux and form factor segmentation, industry leaders can tailor material choices to specific application requirements, optimizing yield and reliability. Regional dynamics further influence procurement and application strategies, necessitating localized expertise and supply chain resilience.

Ultimately, the insights and recommendations provided in this summary equip decision-makers with a clear roadmap for navigating the complexities of the solder materials market. Embracing these strategic imperatives will help organizations not only meet today’s challenges but also anticipate future needs, ensuring sustained success in an ever-changing landscape.

Connect with Our Associate Director to Unlock Comprehensive Solder Material Research Insights and Accelerate Your Strategic Decision-Making Process

For deeper insights tailored to your strategic objectives, reach out directly to our Associate Director of Sales & Marketing, Ketan Rohom, to explore how this comprehensive research report can inform your next move in solder materials. Engaging with this in-depth analysis will equip your team with the clarity and confidence needed to navigate complex supply chains, adopt emerging technologies, and strengthen competitive positioning. Contact Ketan to unlock exclusive access to proprietary findings, detailed segmentation breakdowns, and actionable recommendations designed to accelerate your decision-making and drive sustainable growth.

- How big is the Solder Materials Market?

- What is the Solder Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?