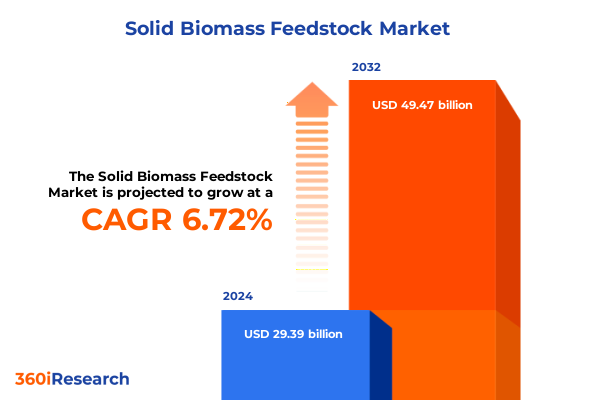

The Solid Biomass Feedstock Market size was estimated at USD 31.33 billion in 2025 and expected to reach USD 33.41 billion in 2026, at a CAGR of 6.74% to reach USD 49.47 billion by 2032.

Emergence of Solid Biomass Feedstock as a Pillar in the Clean Energy Transition Shaping Global Renewable Solutions and Decarbonization Pathways

The global shift towards low-carbon energy sources has positioned solid biomass feedstock at the forefront of sustainable fuel strategies. Defined as organic material derived from agriculture, forestry, and dedicated energy crops, this versatile resource offers a renewable alternative to fossil fuels, boasting carbon neutrality when managed within sustainable forestry and agricultural cycles. In recent years, stakeholders across power generation, industrial heating, and combined heat and power applications have increasingly integrated biomass feedstock into their decarbonization roadmaps, driven by ambitious net-zero targets and regulatory incentives. Transitioning from an ancillary energy source, solid biomass has evolved into a critical component of diversified energy portfolios, supported by policy frameworks and investment inflows.

Building on the heightened urgency to curb greenhouse gas emissions, the solid biomass feedstock market has witnessed intensified collaboration between technology providers, feedstock suppliers, and end users. Innovations in densification, torrefaction, and logistics have streamlined supply chain operations, reducing unit costs and improving handling efficiency. Simultaneously, governments and regulatory bodies are refining sustainability criteria, ensuring feedstock traceability and verifiable carbon savings. These developments underscore the sector’s strategic potential to not only enhance energy security but also foster rural economic development through new revenue streams for agricultural and forestry communities. As a result, market participants are recalibrating their approaches to supply agreements, infrastructure investments, and contract structures to capture the emerging opportunities within this dynamic landscape.

Dynamic Technological, Policy, and Market Forces Reconfiguring the Solid Biomass Feedstock Ecosystem in the New Energy Era

In recent years, the solid biomass feedstock market has undergone profound transformations driven by converging technological advances, shifting policy mandates, and evolving consumer expectations. On the technology front, advancements in gasification systems, including entrained flow, fixed bed, and fluidized bed configurations, have enhanced conversion efficiencies and broadened feedstock compatibility. Simultaneously, improvements in pelletization and briquetting processes have yielded higher-density products, lowering transportation costs and facilitating end-user flexibility. Fast and slow pyrolysis techniques now offer tailored outputs-from bio-oil to biochar-while torrefaction has emerged as a pre-treatment step that improves hydrophobicity and grindability, supporting co-firing in conventional power plants.

Escalating Trade Measures and Tariff Regimes Reshaping North American Solid Biomass Supply Chains and Competitive Dynamics

Escalating trade tensions and tariff enactments in 2025 have significantly reshaped North American biomass feedstock flows and cost structures. In early March 2025, the United States imposed 25 percent tariffs on Canadian wood products, including pellets, chips, and pulp, triggering supply chain disruptions and price volatility for end users reliant on cross-border imports. These duties, paused briefly under a USMCA-compliant exemption, were subsequently supplemented by broader import levies of 10 percent across all origins, with exemptions limited to certain tariff schedule classifications. Collectively, these measures heightened feedstock acquisition costs, prompting U.S. biodiesel and renewable diesel producers to reevaluate sourcing strategies and explore domestic alternatives to mitigate margin pressures. The retaliatory tariffs enacted by Canada further compounded these dynamics, reinforcing a cycle of uncertainty for operators with binational supply agreements.

Dissecting Feedstock, Form, Technology, Application, and End-User Dimensions to Reveal Strategic Biomass Market Pathways

A nuanced segmentation lens reveals the intricate fabric of the solid biomass feedstock market and underscores the importance of tailored strategies. Across feedstock types, agricultural residues such as husk, stalks, and straw exhibit seasonally concentrated supply windows and variable calorific values, whereas animal wastes including cattle manure, pig manure, and poultry litter demand specialized handling protocols to manage moisture content and biosecurity. Dedicated energy crops like miscanthus, switchgrass, and willow present predictable yields and nutrient profiles but require substantial land use commitments. Meanwhile, wood biomass differentiated into hardwood and softwood streams drives the majority of pellet and chip production due to its favorable energy density and established harvesting infrastructure.

When viewed by product form, densified pellets offer uniform quality, consistent size distribution, and high energy content, enabling streamlined automated feeding for boilers and power plants. Chips provide an economical option for co-firing and direct combustion, albeit with higher moisture variability. Briquettes, with their larger dimensions and lower dust generation, address niche applications where pellet handling systems are absent. On the technology front, gasification platforms-across entrained flow, fixed bed, and fluidized bed variants-unlock syngas production for power and chemical synthesis, while pelletization remains the backbone of bulk transport efficiency. Pyrolysis pathways, whether fast or slow, yield bio-oil and biochar products, expanding the value proposition beyond traditional thermal applications, and torrefaction enhances feedstock hydrophobicity and calorific performance.

Application-driven segmentation further delineates market forces: combined heat and power installations capitalize on the high-grade thermal properties of biofuels, heat generation systems optimize cost profiles in district heating networks, and industrial boilers within chemical, food and beverage, and pulp and paper sectors leverage biomass to displace natural gas and heavy fuel oil. Power generation assets increasingly incorporate co-firing or dedicated combustion units to meet renewable portfolio standards, while residential heating solutions are gaining traction in cold climates, driven by sustainability incentives. Finally, end-user industries spanning agriculture, commercial facilities, manufacturing verticals, power plants, and residential consumers demonstrate divergent procurement models-from long-term offtake contracts to spot market purchases-reflecting unique operational requirements and risk appetites.

This comprehensive research report categorizes the Solid Biomass Feedstock market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feedstock Type

- Form

- Technology

- End-User Industry

- Application

Regional Policy Mandates, Infrastructure Strengths, and Sustainability Imperatives Driving Solid Biomass Feedstock Uptake Across Global Markets

Regional market dynamics are instrumental in shaping solid biomass feedstock demand, investment flows, and regulatory frameworks. In the Americas, U.S. policy incentives such as tax credits for renewable diesel and biodiesel, coupled with state-level renewable portfolio standards, have accelerated the deployment of pellet-fired power plants and co-firing projects. Canada’s tariff countermeasures underscore the sector’s reliance on integrated cross-border supply chains, while Mexico and Brazil are emerging as energy crop growth hubs, benefiting from favorable agronomic conditions.

In Europe, the Renewable Energy Directive II has enshrined sustainability criteria for biomass feedstock, mandating lifecycle emissions accounting and forest management benchmarks that influence sourcing decisions for major utilities. The Middle East is exploring biomass as a complementary pathway to solar and natural gas to diversify energy mixes, investing in logistics corridors to import pellets from North America and sub-Saharan Africa. Across Africa, nascent markets in South Africa and Morocco are piloting biomass utilities to address energy access and agricultural waste management challenges.

Asia-Pacific stands at the cusp of rapid biomass adoption, with Japan and South Korea expanding pellet imports under national decarbonization pledges, supported by long-term supply agreements with Canadian and Southeast Asian producers. China’s evolving pellet quality standards and domestic forestry regulations are prompting global suppliers to enhance certification compliance. Australia’s exploration of energy crops and torrefaction technologies signals the region’s intent to integrate biomass within its broader bioeconomy strategies, bridging agricultural innovation and renewable energy expansion.

This comprehensive research report examines key regions that drive the evolution of the Solid Biomass Feedstock market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Restructuring, Innovative Partnerships, and Sustainability Commitments Defining Leadership Profiles in the Biomass Feedstock Sector

Industry leadership profiles in the solid biomass feedstock sector are defined by strategic restructuring, portfolio diversification, and robust sustainability frameworks. Enviva, the world’s largest wood pellet producer, emerged from Chapter 11 bankruptcy in late 2024 after equitizing over one billion dollars of debt and securing a $250 million financing package, positioning it to commission its Epes, Alabama plant by May 2025 and reinforce its liquidity stance amidst contracting margins. Concurrently, Enviva has initiated contract renegotiation proceedings to align long-term offtake agreements with current market realities, ensuring operational continuity and stakeholder confidence.

On the utility side, Drax Group has navigated subsidy reforms in the United Kingdom by consenting to a 50 percent reduction in biomass support payments for the 2027–2031 period, while simultaneously securing an extension of its biomass operation contract through 2031 under enhanced sustainability criteria requiring 100 percent certified feedstock. The group has also diversified its feedstock channel by negotiating a 1 million ton annual supply agreement with Pathway Energy for sustainable aviation fuel production on the U.S. Gulf Coast, highlighting the pellet-versatility playbook for emerging low-carbon fuels. Through these strategic maneuvers, leading companies are recalibrating risk profiles, optimizing cost structures, and embedding traceability standards to meet investor expectations and regulatory obligations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solid Biomass Feedstock market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abengoa, S.A.

- Biomass Secure Power Inc.

- Drax Group PLC

- Enerkem

- Enviva Inc.

- Fram Renewable Fuels, LLC

- RWE AG

- SAEL Energy Solutions LLP

- Segezha Group

- Stora Enso Oyj

- Sumitomo Corporation

- VALEO

- Vattenfall AB

- Ørsted A/S

Strategic Pathways and Collaborative Frameworks for Industry Leaders to Capitalize on Solid Biomass Feedstock Opportunities and Mitigate Risks

To capitalize on the burgeoning opportunities and mitigate emerging risks, industry leaders must pursue a multi-pronged strategy that harmonizes supply security, policy advocacy, and technological innovation. First, strengthening domestic feedstock value chains through targeted investments in energy crop cultivation offers a buffer against cross-border tariff volatility while fostering rural economic development. Second, advancing pre-treatment technologies such as torrefaction and densification can unlock higher-value revenue streams, including bio-coal and biochar markets, enhancing overall system economics.

Moreover, engaging proactively with policymakers to shape sustainability criteria and eco-tariff legislation-such as the proposed Foreign Pollution Fee Act-will safeguard market access and deter unintended trade barriers. Strategic alliances with logistics providers and renewable diesel producers can create integrated hubs that co-locate pellet plants with downstream processing units, reducing transportation redundancies and improving carbon footprints. Finally, embedding advanced traceability platforms that leverage blockchain and satellite monitoring will ensure compliance with stringent certification regimes, fostering confidence among end users and financial backers. By adopting this comprehensive approach, companies can not only navigate current headwinds but also position themselves at the vanguard of a resilient, low-carbon energy future.

Rigorous Data Collection, Multi-Source Validation, and Analytical Frameworks Underpinning the Credible Assessment of the Solid Biomass Feedstock Market

This report’s findings are grounded in a rigorous research methodology encompassing both primary and secondary data sources. Primary insights were obtained through in-depth interviews with stakeholders across the biomass supply chain-including feedstock growers, technology providers, policymakers, and end-user facilities-to capture firsthand perspectives on operational challenges, investment drivers, and regulatory expectations. Secondary inputs were derived from industry publications, government reports, and verifiable news outlets, ensuring that policy changes and trade developments were accurately represented.

Quantitative data were triangulated across multiple databases and public filings, and thematic analysis was applied to extract sector-specific trends. The segmentation framework integrates both qualitative parameters-such as feedstock sustainability criteria-and quantitative metrics-such as production capacity and technology adoption rates. Regional assessments leverage macroeconomic indicators, energy policy reviews, and import-export statistics to elucidate demand patterns. All data points were critically evaluated for credibility, with conflicting sources reconciled through cross-validation protocols to maintain the integrity of conclusions and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solid Biomass Feedstock market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solid Biomass Feedstock Market, by Feedstock Type

- Solid Biomass Feedstock Market, by Form

- Solid Biomass Feedstock Market, by Technology

- Solid Biomass Feedstock Market, by End-User Industry

- Solid Biomass Feedstock Market, by Application

- Solid Biomass Feedstock Market, by Region

- Solid Biomass Feedstock Market, by Group

- Solid Biomass Feedstock Market, by Country

- United States Solid Biomass Feedstock Market

- China Solid Biomass Feedstock Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Converging Trends and Strategic Imperatives Highlight the Role of Solid Biomass Feedstock in Accelerating a Sustainable Energy Future

The convergence of technological maturation, policy recalibrations, and shifting trade dynamics underscores a pivotal moment for the solid biomass feedstock sector. As supply chains adapt to new tariff landscapes, companies that proactively diversify feedstock sources and invest in value-enhancing pre-treatment technologies will secure competitive advantages. Regional policy frameworks-ranging from Europe’s sustainability mandates to Asia-Pacific’s import growth-present differentiated entry points for market expansion, while North America’s domestic incentives bolster the case for vertically integrated cultivation-to-combustion models.

Ultimately, the path forward hinges on collaborative engagement among industry participants, policymakers, and financial stakeholders to balance sustainability imperatives with commercial viability. By leveraging comprehensive market intelligence, embracing innovation, and fortifying supply security, the biomass feedstock ecosystem can deliver on its promise of supporting global decarbonization goals, driving economic resilience, and fostering energy diversity.

Connect with Ketan Rohom to Unlock In-Depth Market Intelligence and Propel Your Solid Biomass Feedstock Strategy Forward

To gain decisive market intelligence on solid biomass feedstock and elevate your strategic positioning in this rapidly evolving sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise provides personalized guidance on leveraging the report’s comprehensive insights-from tariff analysis and technological breakthroughs to regional and segmentation deep dives. Engage directly to explore tailored data, case studies, and scenario planning that align with your organizational priorities. Whether you aim to refine your supply chain strategy, assess competitive landscapes, or identify high-growth applications, Ketan will facilitate a seamless connection to our full research capabilities. Secure your access today and transform critical market data into actionable growth initiatives for sustained competitive advantage.

- How big is the Solid Biomass Feedstock Market?

- What is the Solid Biomass Feedstock Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?