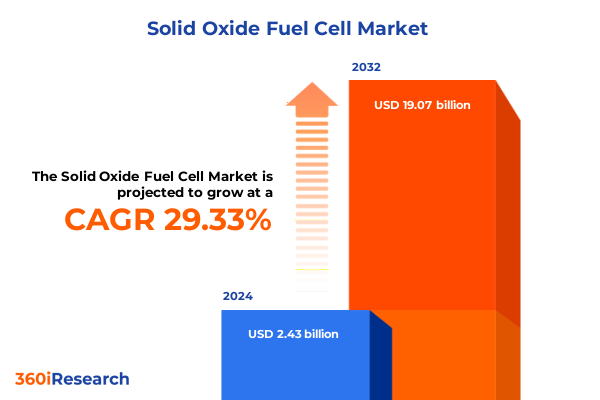

The Solid Oxide Fuel Cell Market size was estimated at USD 3.10 billion in 2025 and expected to reach USD 3.98 billion in 2026, at a CAGR of 29.58% to reach USD 19.07 billion by 2032.

How Solid Oxide Fuel Cell Technology Is Revolutionizing Distributed Power Generation and Enabling a New Era of Efficient Decarbonization

Solid oxide fuel cell technology is rapidly emerging as a cornerstone of the global energy transition, delivering unparalleled efficiency through direct electrochemical conversion of fuels into electricity. Operating at elevated temperatures, this technology leverages ceramic electrolytes to facilitate high‐temperature reactions that drive electrical output with minimal environmental pollutants. This makes solid oxide fuel cells an attractive solution for distributed power generation, particularly in settings where combined heat and power applications can harness waste heat for additional value.

Recent federal investment initiatives underscore the strategic importance of solid oxide fuel cells for industrial decarbonization. In September 2024, the U.S. Department of Energy allocated up to $4 million to advance reversible solid oxide fuel cell systems focused on hydrogen production and energy storage, reflecting a strong policy commitment to enhance both versatility and cost‐effectiveness in fuel cell technology. Concurrently, leading industry innovators have demonstrated breakthrough efficiencies of up to 60% electrical conversion and 90% combined heat and power performance when operating on pure hydrogen, showcasing the platform’s potential to meet the 24/7 clean power needs of data centers and advanced manufacturing. These developments signal a decisive shift toward scalable, high‐temperature electrochemical systems as a viable cornerstone for resilient and low-carbon energy infrastructures.

Revolutionary Advances in Materials, Designs, and Policy Are Shaping the Future of Solid Oxide Fuel Cells for Diverse Energy Applications

The landscape of solid oxide fuel cell development is being transformed by converging advances in materials science, cell architecture, and policy incentives that collectively are driving rapid innovation. Breakthroughs in planar cell designs, which enable higher volumetric power densities, are now complemented by tubular configurations that offer enhanced thermal shock resistance and modular scalability. Together, these contrasting platforms enable integrators to optimize for specific operating conditions, whether the priority is compactness for urban microgrids or robustness for industrial deployments.

Material innovations have also accelerated performance gains, as researchers refine ceria interlayers to bolster ionic conductivity and mitigate degradation at critical interfaces. Enhanced lanthanum strontium manganite cathodes are providing more stable oxygen reduction kinetics, while zirconia electrolytes with tailored dopants are lowering activation energies, leading to longer operational lifetimes and reduced maintenance needs. On the policy front, global mandates for net-zero targets are unlocking incentives under programs such as the U.S. Inflation Reduction Act, which provides tax credits to domestic fuel cell manufacturing, and Europe’s Green Deal, which subsidizes hydrogen infrastructure. Together, these drivers are reshaping supply chains and accelerating the deployment of next-generation SOFC systems in both new and retrofit scenarios.

Assessing How 2025 United States Trade Measures and Section 301 Increases Are Reshaping the Supply Chains of Solid Oxide Fuel Cell Components

In early 2025, the U.S. government implemented significant tariff adjustments under Section 301 that directly affect key inputs for solid oxide fuel cell production. Effective January 1, polysilicon wafers and solar cell products saw an increase from 25% to 50%, while certain semiconductor and critical mineral tariffs also rose, introducing added cost pressures for components such as specialized ceramic substrates and power electronics. These measures, aimed at enhancing domestic manufacturing resilience, have nonetheless prompted manufacturers to reevaluate global procurement strategies and explore localized assembly to mitigate exposure to upstream duties.

Parallel to these targeted measures, reciprocal tariffs of 25% on imported automobiles and powertrain parts under Section 232 have introduced uncertainty for companies relying on international supply of high-performance battery components and advanced power electronics, further complicating cross‐border collaboration. As a result, stakeholders are balancing near-term cost absorption with longer-term reengineering of supply chains, including nearshoring of electrolyte sintering and cell stacking operations within tariff-free trade zones. This evolving regulatory landscape underscores the importance of agile sourcing and strategic partnerships to navigate rising component costs while preserving competitive positioning in a dynamic market.

Deep Dive into Critical Market Segmentation Reveals How Applications, Fuel Variations, Materials, and Power Ratings Define the Solid Oxide Fuel Cell Ecosystem

Market segmentation in the solid oxide fuel cell sector reveals distinct dynamics across design, performance, materials, fuel sources, applications, and end-user profiles. Planar and tubular cell configurations each address specific resilience and scalability requirements, while power ratings above and below the 5 kilowatt threshold cater to everything from small residential modules to larger industrial installations. Material choices such as ceria, lanthanum strontium manganite, and zirconia are not only critical for ionic conductivity and thermal durability, but also influence manufacturing costs and resource availability.

Fuel type selection further delineates market opportunities, as biogas systems align with circular economy goals in waste-to-energy facilities, hydrogen operations support emerging clean hydrogen networks, and natural gas configurations leverage existing infrastructure for transitional decarbonization projects. In application segments, auxiliary power units within automotive and marine contexts drive demand for mobile, reliable capacity, while stationary power generation installations prioritize continuous, high-efficiency baseload power with combined heat utilization. Finally, the distribution of commercial, industrial, and residential end users underscores the breadth of strategic use cases, ranging from critical backup power in commercial buildings to on-site microgrid deployment for industrial complexes and home energy resilience.

This comprehensive research report categorizes the Solid Oxide Fuel Cell market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Power Rating

- Material

- Fuel Type

- Application

- End User

Regional Dynamics and Policy Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific That Are Catalyzing Solid Oxide Fuel Cell Deployment

Regional dynamics in the solid oxide fuel cell market are characterized by varying policy frameworks, infrastructure maturity, and resource endowments across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, federal incentives paired with state-level clean energy mandates are accelerating deployment of stationary and backup power systems, while regional hydrogen hubs in the U.S. and Canada are driving pilot projects that integrate SOFC technology with green hydrogen produced from renewables.

Across Europe Middle East & Africa, stringent greenhouse gas reduction targets under the EU Green Deal and energy diversification imperatives in the Gulf Cooperation Council are fostering a diverse landscape of demonstration plants and microgrid installations. Collaborative partnerships between industrial end users and technology providers are enabling modular SOFC solutions for remote operations, data centers, and critical infrastructure. In the Asia-Pacific region, strategic investments in manufacturing capacity across China, Japan, South Korea, and Australia are leveraging abundant ceramic raw materials and robust engineering ecosystems to scale both planar and tubular SOFC stacks. Government-sponsored R&D consortia and preferential tariff treatments under regional trade pacts are further catalyzing technology transfer and local production, positioning Asia-Pacific as a pivotal growth engine.

This comprehensive research report examines key regions that drive the evolution of the Solid Oxide Fuel Cell market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Leadership and Innovation Profiles of Major Players Advancing Solid Oxide Fuel Cell Technology on the Global Stage

Leading the charge in innovation and commercialization, key companies are leveraging strategic partnerships and technological breakthroughs to solidify their positions. Bloom Energy, recognized for its Energy Server platform, has achieved 60% electrical efficiency and 90% combined heat and power performance on pure hydrogen, setting new benchmarks for distributed power systems. The company’s proprietary ceramic wafers underscore the critical role of advanced zirconia electrolytes and robust cathode coatings in achieving high conversion rates.

On the licensing front, Ceres Power’s SteelCell technology has attracted global partners, most recently collaborating with Cummins in a U.S. Department of Energy project to develop scalable 5 to 100 kilowatt SOFC modules for data centers, promising significant cost and emissions reductions in critical digital infrastructure. Cummins itself has expanded its decarbonization portfolio through the acquisition of First Mode assets, integrating hydrogen and battery hybrid solutions for industrial heavy-duty applications and reinforcing its commitment to diversified clean powertrain technologies. Together, these strategic initiatives illustrate how collaborative ecosystems and diversified IP models are driving resilient market leadership across the SOFC value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solid Oxide Fuel Cell market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bloom Energy

- Ceres Power Holdings plc

- Cerpotech AS

- Compagnie de Saint-Gobain S.A

- Convion Ltd.

- Delta Electronics, Inc.

- Doosan Fuel Cell Co., Ltd.

- Edge Autonomy

- Elcogen AS

- Forschungszentrum Jülich GmbH

- H2E Power

- KYOCERA Corporation

- Mitsubishi Power, Ltd.

- Nexceris

- Niterra Co., Ltd.

- OSAKA GAS CO.,LTD

- OxEon Energy, LLC.

- SOLIDpower S.p.A.

- SolydEra SpA

- Sunfire GmbH

- TAIYO YUDEN CO., LTD.

- Topsoe

- Toshiba Corporation

- Versa Power Systems Inc.

- Watt Fuel Cell Corporation

Immediate Strategic Actions Industry Leaders Should Adopt to Capitalize on Emerging Opportunities in Solid Oxide Fuel Cell Advances

Industry leaders seeking to capitalize on the momentum in solid oxide fuel cell technology should prioritize localizing critical manufacturing steps to mitigate tariff exposure and enhance supply chain resilience. By vertically integrating electrolyte synthesis and cell assembly within strategic trade zones, companies can optimize cost structures while accelerating time to market. Concurrently, strengthening partnerships with advanced materials suppliers will support ongoing innovations in ceria and doped zirconia formulations, unlocking new performance thresholds.

Moreover, engagement with policymakers to secure stable incentive frameworks under both clean energy legislation and domestic manufacturing credits will be essential to sustaining long-term investment confidence. Industry stakeholders should also explore co-development models with OEMs and utilities, enabling early adoption of reversible SOFC systems that deliver both power generation and hydrogen production capabilities. Lastly, cultivating a robust aftermarket service network will ensure high uptime and expand revenue streams through maintenance contracts, positioning companies to deliver end-to-end solutions and defend against competitive pressures.

Comprehensive Methodological Framework Combining Primary Expert Interviews and Rigorous Secondary Data to Deliver Unbiased Solid Oxide Fuel Cell Analysis

This analysis draws upon a rigorous combination of primary and secondary research methodologies designed to ensure comprehensive coverage and data integrity. Primary research involved structured interviews with executive-level decision makers across fuel cell manufacturers, material suppliers, and end-user organizations in commercial, industrial, and residential segments. These interviews provided firsthand insights into technology adoption drivers, supply chain challenges, and strategic roadmaps.

Secondary research encompassed a systematic review of policy documents, federal funding announcements, corporate disclosures, and industry white papers. Trade association reports and peer-reviewed academic literature were also examined to validate emerging material and design innovations. Data triangulation was achieved through cross-referencing public filings, credible news sources, and direct input from technology consortiums. Together, this methodological framework underpins a robust segmentation analysis and regional overview, delivering an unbiased perspective on current trends and strategic imperatives within the solid oxide fuel cell market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solid Oxide Fuel Cell market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solid Oxide Fuel Cell Market, by Type

- Solid Oxide Fuel Cell Market, by Power Rating

- Solid Oxide Fuel Cell Market, by Material

- Solid Oxide Fuel Cell Market, by Fuel Type

- Solid Oxide Fuel Cell Market, by Application

- Solid Oxide Fuel Cell Market, by End User

- Solid Oxide Fuel Cell Market, by Region

- Solid Oxide Fuel Cell Market, by Group

- Solid Oxide Fuel Cell Market, by Country

- United States Solid Oxide Fuel Cell Market

- China Solid Oxide Fuel Cell Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights to Illuminate the Strategic Imperatives Driving the Solid Oxide Fuel Cell Market’s Next Phase of Growth

The solid oxide fuel cell market stands at an inflection point, propelled by technological breakthroughs, supportive policy landscapes, and evolving end-user demands for resilient, low-carbon power solutions. Advances in planar and tubular cell architectures, alongside materials enhancements in ceria interlayers and doped zirconia electrolytes, have catalyzed performance improvements that were previously unattainable with traditional fuel cell platforms.

Looking ahead, strategic localization of manufacturing, coupled with targeted partnerships and incentive alignment, will determine market leaders’ ability to scale operations and deliver competitive value propositions. As companies refine reversible SOFC systems to integrate both power generation and hydrogen production, the sector will unlock new business models that transcend conventional barriers. Ultimately, the confluence of innovation, policy support, and strategic execution will chart the course for solid oxide fuel cells to assume a central role in the global energy transition, meeting the growing imperative for efficient, distributed, and sustainable power.

Connect with Ketan Rohom to Secure Exclusive Insights and Acquire the Most Comprehensive Solid Oxide Fuel Cell Market Research Report Available

Don’t miss the opportunity to elevate your strategic decisions with the definitive Solid Oxide Fuel Cell market research report. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive analysis will empower your organization to unlock new pathways for growth and innovation. Ketan’s expertise and guidance will ensure you receive tailored insights and support that align with your strategic objectives. Engage today and gain the competitive edge by securing data-driven recommendations and deep market intelligence designed to inform your next critical moves.

- How big is the Solid Oxide Fuel Cell Market?

- What is the Solid Oxide Fuel Cell Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?