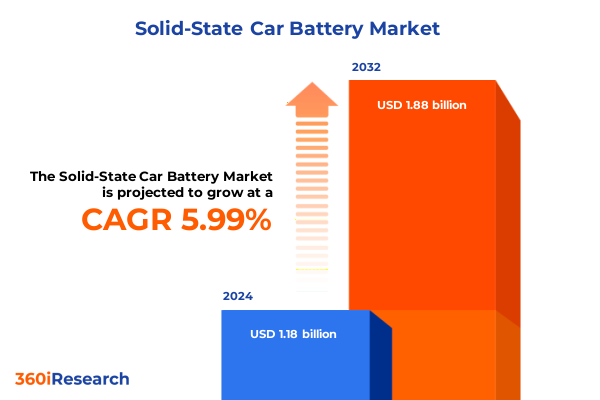

The Solid-State Car Battery Market size was estimated at USD 1.24 billion in 2025 and expected to reach USD 1.31 billion in 2026, at a CAGR of 6.12% to reach USD 1.88 billion by 2032.

Exploring the Pivotal Role of Solid-State Car Batteries in Shaping the Future of Electric Mobility with Enhanced Safety and Performance

The transition from internal combustion engines to electric mobility has entered a critical inflection point, with solid-state battery technology emerging as a pivotal enabler of next-generation vehicle performance. Traditional lithium-ion chemistries, while instrumental in the initial wave of electric vehicle adoption, face inherent limitations in energy density, charge rates, and safety under extreme conditions. In contrast, solid-state designs offer the promise of substantially higher energy density, rapid charging capabilities, and intrinsic resistance to thermal runaway, addressing key pain points that have thus far constrained broader market penetration.

Against a backdrop of escalating environmental imperatives and tightening emissions regulations, automakers and battery developers are racing to bring commercial solid-state solutions to market. This pursuit reflects a confluence of advances in materials science, from ceramic electrolytes with ultra-stable interfaces to lithium metal architectures that maximize energy per unit weight. Coupled with innovations in manufacturing processes and cell design, these breakthroughs are redefining expectations for electric vehicle range, lifecycle performance, and consumer safety.

Moreover, stakeholder momentum extends beyond vehicle OEMs to encompass raw material suppliers, equipment manufacturers, and strategic investors. Collectively, this ecosystem is orchestrating the research, pilot line expansions, and joint development partnerships necessary to overcome scale-up challenges. As competition intensifies, early movers in the solid-state battery domain stand to redefine market leadership through differentiated performance benchmarks and accelerated time to market.

Unveiling the Transformational Technological and Market Dynamics Redefining Solid-State Battery Adoption in the Automotive Industry

Automotive powertrains are undergoing a fundamental shift as solid-state battery platforms transition from laboratory prototypes to viable production candidates. At the materials level, the evolution from liquid electrolytes to solid ceramic and polymer media has unlocked novel cell architectures that deliver unprecedented energy densities. These advancements translate into extended driving ranges and reduced battery pack volumes, while simultaneously enhancing thermal stability and mitigating flammable component risks.

In parallel, manufacturing paradigms are being reimagined. Pilot-scale facilities are adopting roll-to-roll ceramic lamination and precision deposition techniques that ensure uniform electrolyte layers. This manufacturing maturation is complemented by the integration of in-line quality controls and real-time analytics, which collectively drive yield improvements and cost reductions. Additionally, strategic alliances among automakers, battery startups, and equipment vendors are overcoming production bottlenecks, reinforcing the ecosystem’s capacity to support high-volume deployment.

Market dynamics are also evolving at pace. Consumer preferences are increasingly influenced by total cost of ownership considerations, where rapid charging and extended range capabilities offered by solid-state batteries promise competitive advantages. Incentive structures and policy frameworks in key automotive markets are further accelerating adoption by rewarding low-emission vehicle performance and imposing stricter safety mandates. Together, these technological and regulatory shifts are setting the stage for solid-state batteries to redefine the value proposition of electric vehicles.

Assessing the Cascading Effects of 2025 United States Import Tariffs on Solid-State Battery Ecosystems and Automotive Cost Structures

The imposition of targeted import tariffs by the United States in 2025 has created a ripple effect across the solid-state battery supply chain, influencing both cost structures and strategic sourcing decisions. By levying additional duties on certain imported precursor materials and complete cells, domestic manufacturers have gained a pricing buffer that encourages localized production. However, early-stage developers reliant on specialized ceramic powders or lithium metal plating equipment from overseas have encountered increased capital expenditures and extended lead times.

These tariff measures have also catalyzed reshoring initiatives, prompting partnerships with domestic chemical producers and equipment suppliers to mitigate exposure to cross-border duties. Consequently, a growing number of pilot lines and joint ventures are emerging across North America, driven by both governmental incentives and the need for supply chain resilience. This realignment extends beyond raw materials to include contract manufacturers and cell integrators, thereby strengthening the domestic ecosystem and reducing dependency on traditional import routes.

Despite the near-term inflationary pressures introduced by 2025 tariff policies, industry stakeholders recognize the long-term benefits of establishing robust local capabilities. In response, several OEMs and battery innovators are making strategic investments in U.S.-based fabrication sites, harnessing tax credits and research grants to offset incremental costs. As these initiatives mature, they are poised to deliver a more diversified and secure supply network that supports sustained growth in solid-state vehicle deployments.

Decoding Critical Segmentation Trends Revealing How Propulsion Type Capacity Range Material Vehicle Type and Distribution Channels Drive Market Nuances

Discerning the nuanced behaviors of market segments reveals critical inflection points for solid-state battery adoption. Across propulsion type, battery electric vehicles are leading initial uptake due to their full reliance on electric drivetrains, while plug-in hybrid electric vehicles capitalize on dual-mode flexibility where solid-state packs can augment hybrid batteries for extended electric-only range. Within capacity ranges, modules spanning 50 to 100 kilowatt-hours are the workhorses of mainstream passenger cars, whereas configurations above 100 kilowatt-hours are tailored for long-haul applications, and smaller up to 50 kilowatt-hour systems find traction in city-center micro-mobility and compact vehicle platforms.

Material composition introduces another layer of differentiation. Ceramic electrolytes, whether garnet-based or Nasicon variants, excel in chemical stability and interface robustness, making them ideal for high-power applications. Lithium metal anodes, in the form of composite or silicon alloy formulations, drive maximum energy density in flagship vehicle designs. Meanwhile, polymer electrolytes-either gel polymer or fully solid polymer systems-offer manufacturing simplicity and flexibility, which appeal to lower-risk pilot lines and smaller vehicle segments.

Vehicle type segmentation underscores the opportunity spectrum from heavy commercial vehicles, including buses and trucks that benefit from solid-state longevity under high cycle demands, to light commercial pickups and vans where rapid charging and weight reduction translate directly into operational savings. Passenger car adoption extends across hatchback, sedan, and SUV models, each presenting unique packaging and performance requirements. Finally, distribution channel dynamics reflect the balance between OEM direct sourcing for integrated vehicle programs and third-party distributors who service aftermarket and retrofit markets, enabling diverse go-to-market pathways.

This comprehensive research report categorizes the Solid-State Car Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Capacity Range

- Battery Material

- Vehicle Type

- Distribution Channel

Highlighting Regional Market Dynamics Illustrating How the Americas Europe Middle East Africa and Asia Pacific Are Shaping Solid-State Battery Growth

Regional dynamics play a defining role in the evolution of the solid-state car battery market, as geographic priorities and policy landscapes diverge. In the Americas, substantial government support for domestic manufacturing, combined with consumer incentives for electrified vehicles, has spurred investments in pilot production lines and research collaborations. These initiatives strategically target supply chain autonomy, ensuring a steady flow of critical materials and facilitating rapid scale-up of local fabrication capabilities.

Europe, Middle East & Africa regions are characterized by stringent emissions regulations and ambitious decarbonization roadmaps, which drive early adoption of cutting-edge battery technologies. Collaborative consortia uniting OEMs, material suppliers, and research institutions are pioneering next-generation cell designs and establishing standardized safety protocols. Additionally, infrastructure rollouts, including high-capacity charging networks and battery reuse programs, further solidify the region’s commitment to long-term electrification strategies.

In Asia-Pacific, leading economies leverage established battery production ecosystems to accelerate commercial deployments. Pioneering companies are expanding manufacturing footprints while investing in vertically integrated processes covering raw material refinement to cell assembly. Government subsidies and strategic partnerships with global automakers underpin aggressive capacity build-outs, positioning the region as both a manufacturing powerhouse and a high-growth consumer market for solid-state enabled vehicles.

This comprehensive research report examines key regions that drive the evolution of the Solid-State Car Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Their Strategic Initiatives to Advance Solid-State Battery Technology for Next Generation Electric Vehicles

Leading entities in the solid-state battery arena are deploying diverse strategies to secure competitive leadership. Automotive giants are forging deep technology partnerships with specialized battery startups, combining heritage vehicle design expertise with breakthrough cell chemistry innovations. Meanwhile, material science pioneers are scaling up production of key electrolyte substrates, seeking to optimize purity and interface compatibility to meet rigorous automotive standards.

Concurrently, pure-play battery developers are investing heavily in pilot lines that validate manufacturability and long-term cycle performance under real-world conditions. These efforts are complemented by strategic alliances with equipment suppliers to refine deposition and lamination tools tailored to solid-state requirements. Several market leaders are also pursuing joint ventures to co-locate research facilities adjacent to flagship OEM assembly plants, thereby accelerating validation cycles and reducing time to integration.

In parallel, cross-industry collaborations are emerging, where consumer electronics and aerospace partners contribute precision manufacturing techniques and stringent quality controls. Intellectual property portfolios are expanding as research institutions and corporate R&D centers file patents covering novel solid electrolyte formulations, advanced interface coatings, and scalable cell assembly processes. Together, these multifaceted approaches underscore a collective drive to overcome commercial barriers and establish best-in-class performance benchmarks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solid-State Car Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Contemporary Amperex Technology Co. Limited

- Factorial Energy, Inc.

- Ilika plc

- Johnson Energy Storage, Inc.

- LG Energy Solution, Ltd.

- Panasonic Corporation

- Prieto Battery Inc

- ProLogium Technology Co., Ltd.

- QuantumScape Corporation

- Samsung SDI Co., Ltd.

- Solid Power, Inc.

- Toyota Motor Corporation

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Accelerating Solid-State Battery Commercialization and Competitive Advantage

To capitalize on the momentum of solid-state battery innovation, industry leaders should adopt a dual focus on technology de-risking and ecosystem development. Prioritizing targeted pilot programs that validate material performance under automotive cycle profiles can uncover latent challenges early, reducing downstream integration uncertainties. Parallel investments in manufacturing process analytics will facilitate rapid identification of yield-limiting variables, ensuring that scale-up pathways are both cost-effective and quality-driven.

Moreover, forging strategic partnerships across the supply chain-from precursor material suppliers to cell integrators-can create resilient networks capable of adapting to tariff fluctuations and raw material volatility. Engaging with policy stakeholders to shape incentive programs and safety regulations will further align public-sector support with commercial objectives, unlocking grants and tax credits that offset scale-up expenditures.

Finally, cultivating a customer-centric innovation roadmap-where vehicle OEMs, fleet operators, and end users provide continuous feedback on performance priorities-will sharpen product development focus. By integrating insights from real-world usage data and emerging infrastructure trends, organizations can refine cell architectures to deliver differentiated value propositions, whether through fast charging, extended cycle life, or enhanced safety profiles. Such a holistic approach will position industry leaders to capture early mover advantages and define the standards for the coming generation of electric vehicles.

Elucidating a Rigorous Multi-Stage Research Methodology Underpinning Comprehensive Insights into Solid-State Car Battery Market Developments

This report’s analytical framework combines a multi-phase research approach to ensure rigor and depth. Secondary research involved an exhaustive review of industry publications, patent filings, regulatory documents, and publicly disclosed corporate filings, establishing a foundational understanding of market drivers, technological trajectories, and policy environments. These insights were systematically mapped to identify critical innovation clusters and potential bottlenecks in material supply chains.

Primary research comprised structured interviews and surveys with senior executives, R&D specialists, and supply chain managers across automakers, battery developers, material suppliers, and regulatory bodies. This direct engagement yielded qualitative perspectives on commercialization timelines, performance trade-offs, and investment priorities. Insights were then triangulated with quantitative data points to validate assumptions and ensure consistency across multiple stakeholder viewpoints.

In parallel, proprietary data analytics tools were employed to model scenario projections for manufacturing scale-up, tariff impact assessments, and regional adoption patterns. These models were calibrated using historical market data and expert inputs, thereby refining sensitivity analyses and highlighting key risk parameters. Finally, all findings underwent rigorous peer review by an advisory panel of independent subject-matter experts, ensuring that conclusions reflect both current realities and emerging trends in solid-state battery technology.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solid-State Car Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solid-State Car Battery Market, by Propulsion Type

- Solid-State Car Battery Market, by Capacity Range

- Solid-State Car Battery Market, by Battery Material

- Solid-State Car Battery Market, by Vehicle Type

- Solid-State Car Battery Market, by Distribution Channel

- Solid-State Car Battery Market, by Region

- Solid-State Car Battery Market, by Group

- Solid-State Car Battery Market, by Country

- United States Solid-State Car Battery Market

- China Solid-State Car Battery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Reflections on the Strategic Imperatives and Market Catalysts Steering the Evolution of Solid-State Car Battery Innovation and Adoption

The ascendancy of solid-state battery technology represents a pivotal chapter in the electrification of transportation, underpinned by breakthroughs in materials science, manufacturing innovation, and policy alignment. The convergence of ceramic, polymer, and lithium metal approaches has established a diversified innovation landscape, enabling tailored solutions across vehicle classes and performance tiers. Meanwhile, regional policy frameworks and targeted tariff interventions are reshaping supply chain strategies and catalyzing domestic production capabilities.

Segmentation analysis underscores the broad applicability of solid-state systems-from high‐capacity modules for long-distance trucking to compact packs for light commercial vehicles and passenger cars-each informed by distinct material and cost considerations. Simultaneously, the intensifying competitive landscape and collaborative research models are driving rapid iteration of cell designs, positioning early adopters to define the safety and performance benchmarks of future electric mobility.

As the market transitions from pilot initiatives to commercial scale-up, the strategic imperatives will center on de-risking manufacturing, aligning stakeholder incentives, and fostering resilient supply networks. Organizations that embrace cross-disciplinary partnerships, proactive policy engagement, and customer-driven innovation roadmaps will capture first-mover advantages and shape the standards for the next generation of electrified vehicles.

Engage Directly with Our Associate Director to Secure the Definitive Solid-State Car Battery Market Research Report and Unlock Strategic Advantages

To gain a definitive edge in one of the most transformative technology markets of our era, secure access to the in-depth findings and strategic analyses encapsulated in this comprehensive Solid-State Car Battery market research report. Engaging directly with Ketan Rohom guarantees personalized guidance on how these data-driven insights translate into tangible business outcomes and competitive differentiation. Whether you are planning production scale-up, evaluating new material partnerships, or refining your go-to-market model, this report provides the actionable intelligence necessary to navigate regulatory complexities, optimize supply chains, and accelerate product development cycles.

Reach out to our associate director, sales & marketing, to discuss tailored report packages, explore volume licensing options, or request a complementary briefing. Your inquiry will be handled promptly, ensuring you receive the precise level of detail and support needed to drive your strategic initiatives forward. Don’t miss the opportunity to leverage expert research that aligns your organization with the next wave of electrified mobility innovation and positions you at the forefront of the solid-state battery revolution.

- How big is the Solid-State Car Battery Market?

- What is the Solid-State Car Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?