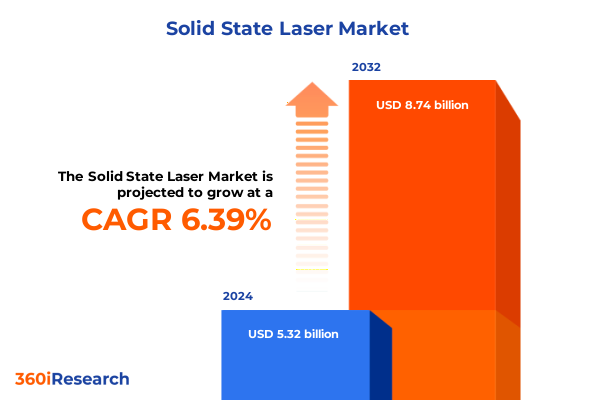

The Solid State Laser Market size was estimated at USD 5.59 billion in 2025 and expected to reach USD 5.88 billion in 2026, at a CAGR of 6.58% to reach USD 8.74 billion by 2032.

A Captivating Introduction That Frames the Modern Role and Advantages of Solid State Lasers Revolutionizing Efficiency Across Cutting-Edge Applications

Solid state lasers have emerged as a cornerstone technology across a diverse array of industries, owing to their remarkable efficiency, reliability, and precision. Offering a compact footprint and exceptional beam quality, these laser systems leverage solid gain media-such as crystalline or glass hosts doped with rare earth or transition metal ions-to produce coherent light at a variety of wavelengths. In recent years, advances in diode pumping architectures and thermal management techniques have accelerated performance improvements while reducing energy consumption and operational costs.

Moreover, solid state lasers have demonstrated a capacity to revolutionize applications spanning industrial material processing, defense systems, medical procedures, and academic research. Through innovations in ultrafast pulsed operation and higher average power outputs, these lasers are enabling finer cutting tolerances, deeper material penetration, and non-invasive surgical techniques. As a result, decision-makers are increasingly prioritizing investments in solid state laser technologies to meet stringent quality standards, drive operational efficiencies, and unlock new capabilities.

Transitioning from legacy laser systems to modern solid state platforms, organizations are positioned to capitalize on higher uptime, simplified maintenance cycles, and enhanced scalability. With ongoing advancements poised to further elevate performance metrics, establishing a clear understanding of the core advantages and technological foundations is critical for stakeholders seeking to maintain a competitive edge.

An In-Depth Exploration of Transformative Shifts in Solid State Laser Technology Revealing Critical Industry Paradigm Changes

The landscape of solid state laser technology has undergone transformative shifts that are reshaping its strategic trajectory. Firstly, the maturation of laser diode pumping has subverted the long-standing dominance of flash lamp excitation. This evolution delivers unprecedented wall-plug efficiencies, extends component lifetimes, and minimizes thermal loads, thereby enabling higher average powers and more compact system architectures.

In parallel, the advent of ultrafast laser modalities has unlocked applications previously deemed unachievable. By generating femtosecond and picosecond pulses, researchers and engineers can now perform micromachining, precision ophthalmic surgeries, and advanced spectroscopy with nanometer-scale resolution. Furthermore, integration of adaptive optics and advanced beam-shaping algorithms is enhancing beam quality and focus control, ushering in a new era of dynamic wavelength agility.

Another pivotal shift involves the convergence of solid state laser systems with digital control platforms and artificial intelligence. Real-time monitoring, predictive maintenance algorithms, and closed-loop feedback systems are increasingly embedded within laser architectures to optimize performance and anticipate component failure. These developments are complemented by additive manufacturing techniques for custom optical mounts and heat sinks, substantially reducing time-to-market for specialized applications. Ultimately, these combined forces are driving solid state lasers toward greater modularity, interoperability, and intelligence than ever before.

A Comprehensive Examination of the Cumulative Impact from United States Tariff Policies on Solid State Laser Supply Chains and Innovation

The imposition of tariffs by the United States on optical components, pump diodes, and crystalline materials in 2025 has exerted a cumulative impact on the solid state laser supply chain and innovation pathways. Initially aimed at protecting domestic manufacturing capabilities, these measures have prompted equipment OEMs to reevaluate procurement strategies and explore alternative sources. As a result, several suppliers have accelerated investments in localized production of laser gain media, crystal growth, and diode arrays to mitigate cost volatility and delivery delays.

Moreover, research institutions and industrial users have begun to pivot toward collaborative partnerships with domestic component fabricators, seeking to lock in long-term supply agreements that include co-development clauses. This shift not only ensures continuity of critical inputs but also fosters technology transfer and process optimization within the United States. In parallel, the higher landed cost of imported pump sources has incentivized R&D teams to refine pump chamber designs and optimize thermal management to extract higher efficiencies from lower-cost diodes.

In addition, the tariffs have accelerated the exploration of substitute materials and novel fabrication techniques. For example, additive manufacturing of heat sinks and optical mounts has gained traction as manufacturers seek to offset increased component prices. At the same time, the strategic landscape has intensified as global players assess the impact of reciprocal trade measures. Collectively, these dynamics underscore the importance of agile supply chain planning and robust innovation roadmaps to navigate the evolving regulatory environment.

Critical Segmentation Insights That Illuminate How Variations in Wavelength Cooling Methods Pump Sources and Applications Influence Market Dynamics

Deep analysis of product segmentation reveals nuanced performance and adoption trends within the solid state laser ecosystem. Segmented according to wavelength, systems delivering outputs within the 1 to 2 micron band dominate applications requiring a balance of tissue interaction depth and minimal thermal damage, whereas lasers operating below 1 micron excel in micromachining due to superior focusability. Conversely, models exceeding 2 microns are increasingly leveraged for specialized sensing and environmental monitoring tasks due to their atmospheric transmission properties.

Turning to thermal management, air-cooled configurations employing natural convection remain preferred for laboratory and low-power industrial deployments due to their simplicity and reduced footprint, while forced convection designs are gaining favor in high-power environments where enhanced heat dissipation is paramount. Water-based cooling solutions, featuring either closed-loop or open-loop architectures, are selected for applications that demand sustained high average power and stringent temperature control, particularly in medical and defense contexts.

Regarding pump source evolution, traditional flash lamp systems supplied by krypton and xenon lamps continue to serve legacy infrastructures, yet laser diode pumping-whether through bar-stacked modules, fiber-coupled arrays, or single-emitter devices-has surged ahead due to its superior electrical-to-optical conversion efficiency. This transition is most apparent in research and industrial workflows where long runtimes and energy costs are critical. Application segmentation further delineates demand drivers, with defense programs emphasizing directed energy and range finding, material processing workflows prioritizing cutting and welding throughput, medical users demanding precise tissue removal in dentistry and ophthalmology, and both academic and industrial research sectors leveraging custom configurations for exploratory experiments.

This comprehensive research report categorizes the Solid State Laser market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Wavelength

- Cooling Method

- Pump Source

- Application

Key Regional Insights Highlighting How The Americas Europe Middle East Africa And Asia-Pacific Regions Are Shaping Solid State Laser Developments

Regional dynamics underscore the differentiated pace and nature of solid state laser adoption worldwide. In the Americas, robust defense partnerships and advanced manufacturing clusters have fostered demand for high-power systems optimized for directed energy and materials processing. At the same time, North American medical device centers and academic laboratories are integrating ultrafast pulsed lasers into novel therapeutic and diagnostic instruments.

By contrast, Europe, the Middle East, and Africa feature a heterogeneous landscape shaped by stringent regulatory regimes and a mix of established industrial users. Western Europe leads in precision machining and ophthalmic surgery applications, supported by an extensive network of research consortia, whereas emerging markets in the Middle East and Africa focus on infrastructure development and mining applications, driving interest in ruggedized and lower-maintenance systems.

Across the Asia-Pacific region, high-growth economies are accelerating deployment of solid state lasers in consumer electronics manufacturing, automotive component fabrication, and semiconductor wafer processing. Localized production of key components has been bolstered by supportive government incentives, while collaborative initiatives between OEMs and research institutes are expanding capabilities in additive manufacturing and material characterization. Together, these regional forces are shaping a dynamic global ecosystem with differentiated specialization and investment profiles.

This comprehensive research report examines key regions that drive the evolution of the Solid State Laser market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Insights into Technology Leaders Their Innovation Portfolios Partnerships And Competitive Positioning within the Solid State Laser Industry

Leading firms within the solid state laser arena are continuously refining their technology portfolios, forging alliances, and pursuing targeted acquisitions to strengthen competitive positioning. Several established developers have prioritized the expansion of diode-pumped platforms, integrating proprietary beam-shaping modules and advanced cooling architectures to deliver greater output stability and reduced operational overhead.

Strategic partnerships between laser OEMs and component fabricators have emerged as a critical lever for accelerating time-to-market. Collaborative ventures aimed at co-designing pump diode arrays and gain media formulations are enabling shorter development cycles and improved cost structures. Concurrently, innovators focused on ultrafast and high-peak-power lasers are establishing specialized research centers to cultivate application-driven breakthroughs in micromachining and biomedical imaging.

In parallel, targeted acquisitions have become instrumental in broadening service offerings and geographic reach. By integrating test and calibration laboratories, select companies have enhanced their service support capabilities, offering turnkey solutions and end-to-end lifecycle management. Additional investments in digital control software and data analytics platforms are equipping users with real-time performance insights, predictive maintenance alerts, and operational dashboards, underlining a shift toward value-added services beyond core hardware.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solid State Laser market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Coherent, Inc.

- Hamamatsu Photonics K.K.

- Han's Laser Technology Co., Ltd

- IPG Photonics Corporation

- Jenoptik AG

- Lumentum Holdings, Inc.

- Lumibird S.A.

- MKS Instruments, Inc.

- NKT Photonics A/S

- nLIGHT, Inc.

- TRUMPF GmbH + Co. KG

Actionable Recommendations for Industry Leaders to Capitalize on Solid State Laser Opportunities Mitigate Risks and Drive Sustainable Growth

Industry leaders must embrace a multi-pronged approach to capitalize on emergent opportunities and mitigate supply chain and regulatory risks. Prioritizing investments in advanced diode-pumped technologies will ensure alignment with efficiency and sustainability objectives, while diversifying sourcing to include emerging domestic production partners will reduce exposure to international trade fluctuations.

Moreover, establishing cross-functional teams that link R&D engineers with end-users in defense, medical, and industrial segments can accelerate application-specific innovations. Co-development initiatives not only foster deeper customer engagement but also enable rapid feedback loops for product enhancements. In addition, developing modular architectures with plug-and-play optical and cooling subassemblies will appeal to customers seeking flexible deployment options and simplified maintenance protocols.

Furthermore, forging long-term partnerships with academic institutions and government laboratories can secure preferential access to cutting-edge research and talent pipelines. Such collaborations, coupled with strategic acquisitions of specialized component firms, will enhance in-house capabilities and support accelerated product roadmaps. Ultimately, organizations that integrate robust risk management frameworks, emphasizing supply chain resilience and regulatory compliance, will emerge as leaders in a rapidly evolving landscape.

Methodology Overview Detailing the Research Design Data Collection Approaches And Analytical Techniques Underpinning Solid State Laser Insights

This report integrates a rigorous research design encompassing both qualitative and quantitative methodologies. Primary research involved structured interviews with key opinion leaders, including R&D directors, application engineers, and procurement specialists across defense, medical, and industrial end-users. These insights provided firsthand perspectives on technology adoption drivers, operational challenges, and strategic priorities.

Secondary research entailed a comprehensive review of technical journals, patent filings, and conference proceedings to trace recent breakthroughs in gain media formulations, cooling techniques, and pump source innovations. Trade literature and industry whitepapers were assessed to contextualize technological trends and regulatory developments. Data triangulation methods were applied to reconcile findings across sources, ensuring accuracy and consistency.

Analytical techniques included thematic coding of qualitative data to identify recurring themes and sentiment analysis to gauge end-user priorities. Quantitative data points, such as system performance benchmarks and procurement lead times, were synthesized to establish comparative frameworks. The research process also incorporated peer review sessions with external experts to validate assumptions and refine conclusions, resulting in a robust and transparent methodological foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solid State Laser market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solid State Laser Market, by Wavelength

- Solid State Laser Market, by Cooling Method

- Solid State Laser Market, by Pump Source

- Solid State Laser Market, by Application

- Solid State Laser Market, by Region

- Solid State Laser Market, by Group

- Solid State Laser Market, by Country

- United States Solid State Laser Market

- China Solid State Laser Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

A Thoughtful Conclusion Summarizing Critical Findings Highlighting Strategic Imperatives And Forecasting Future Trajectories for Solid State Laser Adoption

In summary, solid state lasers are at a pivotal juncture, underpinned by advances in diode pumping, ultrafast pulse generation, and integrated digital controls. These shifts are redefining performance expectations and application possibilities across defense, medical, material processing, and research arenas. Concurrently, evolving tariff landscapes in the United States have catalyzed strategic shifts in supply chain configurations and domestic manufacturing investments.

Segmentation analysis highlights the significance of wavelength selection, cooling strategies, pump source architectures, and end-use requirements in guiding product development and deployment decisions. Regional insights further underscore the differentiated dynamics across the Americas, Europe, Middle East, Africa, and Asia-Pacific, where localized incentives, regulatory frameworks, and industry specializations are driving unique growth patterns.

Looking ahead, companies that proactively diversify supply chains, forge collaborative innovation partnerships, and adopt modular design philosophies will be best positioned to harness the full potential of solid state lasers. By leveraging the strategic recommendations outlined herein, stakeholders can navigate uncertainty, capitalize on emergent opportunities, and secure a sustainable competitive advantage in a rapidly evolving market.

Engage with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Solid State Laser Research and Empower Strategic Decision-Making

Embarking on the next phase of strategic planning is vital for organizations seeking to harness the power of solid state lasers. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive research report and gain immediate access to actionable insights and in-depth analysis. His expertise will guide your team through the report’s findings, highlighting critical opportunities and helping you integrate these insights into your technology and market development plans. Reach out today to accelerate your competitive positioning and ensure your stakeholders have the vital intelligence they need to make informed decisions in a rapidly evolving landscape.

- How big is the Solid State Laser Market?

- What is the Solid State Laser Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?