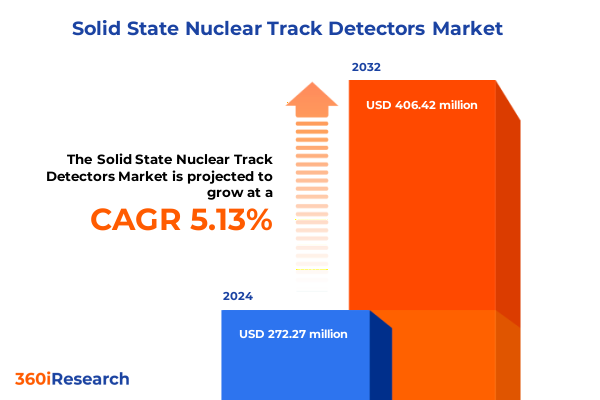

The Solid State Nuclear Track Detectors Market size was estimated at USD 284.75 million in 2025 and expected to reach USD 300.34 million in 2026, at a CAGR of 5.21% to reach USD 406.42 million by 2032.

Unveiling the Strategic Importance and Technological Foundations of Solid State Nuclear Track Detectors in Contemporary Radiation Detection and Dosimetry

Solid state nuclear track detectors represent a cornerstone technology in radiation detection, offering unmatched versatility, passive operation, and high sensitivity across a range of charged particle measurements. Originally developed for cosmic ray research in the mid-20th century, these detectors have undergone successive waves of refinement, transforming passive polymer films and crystalline substrates into precision instruments capable of tracing alpha, beta, and fission fragment tracks at microscopic scales. Over the decades, advancements in material science, etching techniques, and imaging modalities have extended their applicability beyond fundamental research into diverse industrial and safety applications.

In contemporary practice, these detectors serve as the backbone of personal and environmental dosimetry, geological and archeological dating, nuclear research programs, and radiation monitoring initiatives worldwide. Their structural simplicity, durability under harsh environmental conditions, and low production costs continue to drive adoption in both established and emerging markets. Moreover, the capacity to integrate passive detectors with digital optical readout technologies and automated track-analysis software has amplified throughput and analytical rigor, reinforcing their strategic value for laboratories, power plants, and regulatory agencies.

As regulatory frameworks evolve and demand for precise radiation assessment intensifies across healthcare, energy, and research domains, the role of solid state nuclear track detectors has never been more critical. This executive summary presents a concise yet comprehensive overview of the latest industry dynamics, transformative market shifts, and strategic insights that will inform decision-makers seeking to optimize their footprint in this high-value sector.

Analyzing Revolutionary Technological Developments and Emerging Application Paradigms Transforming the Solid State Nuclear Track Detector Ecosystem

The past five years have witnessed a profound transformation in the solid state nuclear track detector landscape, driven by breakthroughs in polymer chemistry, etching processes, and digital integration. Innovators have introduced next-generation polymer matrices engineered at the molecular level to enhance track resolution, reduce background noise, and withstand elevated radiation doses without loss of fidelity. Concurrently, ceramic substrates based on aluminum oxide have gained traction for their thermal stability and chemical inertness, opening new frontiers in high-temperature monitoring applications.

At the same time, image processing algorithms powered by machine learning have revolutionized automated track identification, enabling laboratories to analyze hundreds of thousands of tracks per hour with minimal human intervention. This shift toward data-driven analysis has accelerated research throughput and bolstered quality assurance protocols in clinical dosimetry and nuclear safety assessments. In parallel, the rise of hybrid detector assemblies that combine polymer films with borosilicate or silicate glass layers has expanded dynamic range capabilities, catering to applications from low-level environmental monitoring to high-flux reactor environments.

Moreover, the integration of wireless sensors and Internet of Things frameworks has begun to permeate passive detector workflows, allowing field teams to log deployment parameters, environmental conditions, and real-time metadata alongside passive exposure records. These converging technological trends are redefining performance benchmarks and raising the bar for end-use requirements, compelling manufacturers and end users alike to embrace agility, cross-disciplinary collaboration, and continuous innovation.

Evaluating the Aggregate Effects of 2025 US Tariffs on Supply Chains, Material Costs, and Competitive Dynamics in the Global Track Detector Market

In 2025, the United States implemented revised tariff structures on a suite of polymer-based films, specialty glass blanks, and ceramic powders used in radiation detection devices, reshaping cost structures and supply chain strategies. These duties, designed to protect domestic manufacturing and promote local value creation, have led to a pronounced shift in procurement patterns for detector substrates. Polymer producers outside the United States have seen price escalations that have reverberated through supply chains, prompting device assemblers to explore alternative sourcing options or regional partnerships to mitigate margin pressures.

Meanwhile, import duties on borosilicate and silicate glass have incentivized glassmakers to expand US-based production capacity, accelerating capital investments in melting furnaces and annealing lines. Domestic ceramic manufacturers have likewise capitalized on protective measures to scale up aluminum oxide powder synthesis, fostering closer collaboration with detector developers on custom material formulations. Although these tariff-driven dynamics have elevated raw material costs in the short term, they have also catalyzed supply-chain resilience by diversifying vendor portfolios and reinforcing near-shoring initiatives.

As a result, end users are witnessing a gradual stabilization of component availability, even as negotiated long-term contracts and strategic alliances gain prominence. In this evolving tariff environment, stakeholders with integrated procurement, R&D, and regulatory affairs capabilities are best positioned to navigate cost volatility, secure critical materials, and maintain continuity of supply for high-precision dosimetry and research applications.

Deriving Actionable Insights from Multi-Dimensional Segmentation Across Type, Application, End Use, Material Composition, and Distribution Channels in the Detector Market

Understanding the market through multiple segmentation lenses reveals nuanced requirements and growth avenues for detector suppliers and end users. In terms of detector type, CR-39 remains the gold standard where high sensitivity to alpha particles is paramount, whereas the self-developing properties of LR-115 are favored in extended environmental monitoring campaigns. PM-355 has emerged as a specialist option for applications demanding ultra-fine track resolution, particularly in nuclear research laboratories exploring charged fragment characterization.

Application-wise, dosimetry continues to dominate usage scenarios, but geological dating projects are increasingly harnessing fission fragment tracks for retrospective chronologies of mineral deposits. Nuclear research institutions rely on tailored detector arrays to calibrate particle accelerators and study radiation effects, while radiation monitoring in industrial and healthcare settings demands materials that balance durability with low detection thresholds.

End use sectors also exhibit distinct preferences: healthcare providers prioritize biocompatible, sterilizable detectors for patient dose verification, nuclear power plants emphasize long-duration stability under high neutron flux, and research institutes require modular detector platforms that can be rapidly reconfigured for diverse experimental protocols.

Material composition exerts a profound influence on performance characteristics. Ceramic substrates, notably aluminum oxide, deliver thermal robustness and chemical resistance but require more complex fabrication. Glass variants, including borosilicate and silicate formulations, offer dimensional stability and optical clarity, making them compatible with precision imaging systems. Polymer bases such as CR-39 and PM-355 deliver cost-effective, high-throughput manufacturing, albeit with more stringent handling and storage requirements.

Finally, distribution channels shape customer engagement strategies. Direct channels facilitate customized solutions and technical support for large institutional clients, distributors enable broader geographic reach for standardized detector portfolios, and online platforms accelerate order cycles and support self-service procurement for small laboratories and educational users.

This comprehensive research report categorizes the Solid State Nuclear Track Detectors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End Use

- Material

Mapping Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Solid State Track Detector Markets

Regional dynamics in the solid state nuclear track detector market are defined by distinct regulatory frameworks, research agendas, and infrastructure capacities across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, rigorous safety standards, veteran manufacturing hubs, and expanding radon detection mandates have driven sustained demand for CR-39 and ceramic detector products, particularly in healthcare and environmental monitoring spheres. North American academic institutions and national laboratories continue to invest in hybrid detector research, stimulating local partnerships with specialized material suppliers.

Across Europe, Middle East & Africa, stringent European Union radiation safety regulations and a resurgence of nuclear power initiatives in Eastern Europe have underpinned growth in glass-based track detectors that meet exacting calibration requirements. Meanwhile, emerging programs in the Middle East and North Africa are beginning to integrate fission track dating into geological exploration, fostering demand for LR-115 and PM-355 variants tailored to arid field environments.

In the Asia-Pacific region, robust growth in nuclear power plant construction in China and India, coupled with a proliferation of university research centers in Japan, South Korea, and Australia, has fueled uptake of advanced polymer detectors and automated readout solutions. Manufacturing capacities in Southeast Asia for both polymer and glass substrates are expanding, supported by government incentives for high-tech exports. These regional trends underscore the importance of localized product roadmaps, regulatory alignment, and collaborative R&D programs to capture diverse market opportunities.

This comprehensive research report examines key regions that drive the evolution of the Solid State Nuclear Track Detectors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators, Market Entrants, and Strategic Collaborators Shaping the Competitive Landscape of Nuclear Track Detector Solutions

Key industry participants are pursuing differentiated strategies to gain competitive advantage in a market characterized by technological sophistication and regulatory complexity. Established players with end-to-end capabilities are integrating upstream material synthesis of aluminum oxide ceramics and specialty polymers with downstream detector fabrication, achieving tighter quality control and faster time-to-market for custom sensor arrays. Alliances between detector manufacturers and academic consortia have become commonplace, enabling access to cutting-edge etching methods and image-analysis platforms.

Parallel to this, emerging challengers are leveraging modular design principles, offering plug-and-play detector cartridges compatible with third-party optical readout systems. These entrants often utilize online direct-to-customer channels to reach niche research teams and small-scale monitoring services seeking rapid procurement and lower minimum order quantities. Meanwhile, traditional distributors are evolving into value-added resellers, bundling installation, calibration, and compliance consulting services to deepen customer engagement across healthcare, energy, and industrial safety sectors.

Across all tiers, there is a clear movement toward digital ecosystems that combine passive detection media with cloud-enabled data analytics, subscription-based software suites, and remote calibration management. Organizations that invest in robust service infrastructures and collaborative product roadmaps are best positioned to outmaneuver peers in an increasingly integrated industry ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solid State Nuclear Track Detectors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Amtek Company, Inc.

- Arrow-Tech, Inc.

- Bertin Technologies

- Dosilab

- Fluke Corporation

- Fuji Electric Co., Ltd.

- Landauer, Inc.

- Mirion Technologies, Inc.

- Polimaster

- Radiation Detection Company

- RAE Systems Inc.

- S.E. International, Inc.

- TASL

- Thermo Fisher Scientific Inc.

Strategic Imperatives for Industry Leaders to Enhance Resilience, Innovate Material Platforms, and Capitalize on Emerging Detector Opportunities

Industry leaders should prioritize a strategic pivot toward advanced material platforms that unlock next-generation performance thresholds, while simultaneously mitigating supply chain exposures revealed by recent tariff adjustments. Establishing joint development agreements with domestic ceramic and glass producers can secure preferential access to critical substrates, whereas co-innovation projects with polymer specialists will accelerate the rollout of enhanced CR-39 and PM-355 formulations.

Digital integration represents another imperative: deploying machine learning-driven track analysis and cloud-native data management solutions will not only streamline laboratory workflows but also create new subscription revenue streams. Leaders can further expand their addressable markets by developing configurable online ordering portals, delivering rapid sample dispatch for small labs and educational institutions, and fostering brand loyalty through value-added services.

Finally, forging strategic partnerships with regulatory agencies and academic centers will position organizations at the vanguard of emerging applications in geological dating, environmental monitoring, and personalized medical dosimetry. By balancing material innovation, supply chain resilience, and digital service excellence, industry leaders will capture value across the full detector lifecycle and drive sustainable growth.

Unveiling the Rigorous Research Framework Employed for Comprehensive Data Collection, Triangulation, and Expert Validation in This Study

This study is grounded in a multi-phase research framework that combines primary insights with rigorous secondary validation. Initial scoping research involved an exhaustive review of academic journals, patent filings, regulatory publications, and trade conference proceedings to establish a foundational understanding of material innovations, application trends, and regional policies. Building on this, in-depth interviews were conducted with material scientists, detector designers, calibration specialists, and end users across healthcare, energy, and research institutes to capture firsthand perspectives on technology adoption and unmet needs.

Secondary data sources included industry white papers, supplier technical datasheets, and government import/export records to map tariff changes and supply chain configurations. Quantitative and qualitative data were triangulated through cross-checking historical procurement patterns with expert forecasts, ensuring consistent narrative alignment without relying on proprietary market sizing. Findings were refined through an expert validation workshop, where independent consultants and academic advisors challenged assumptions, corroborated insights, and reinforced the study’s analytical integrity.

Throughout the process, adherence to methodological rigor and transparency was paramount, resulting in a cohesive, actionable, and defensible set of insights tailored to stakeholders in the solid state nuclear track detector arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solid State Nuclear Track Detectors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solid State Nuclear Track Detectors Market, by Type

- Solid State Nuclear Track Detectors Market, by Application

- Solid State Nuclear Track Detectors Market, by End Use

- Solid State Nuclear Track Detectors Market, by Material

- Solid State Nuclear Track Detectors Market, by Region

- Solid State Nuclear Track Detectors Market, by Group

- Solid State Nuclear Track Detectors Market, by Country

- United States Solid State Nuclear Track Detectors Market

- China Solid State Nuclear Track Detectors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Highlight Strategic Takeaways and Future Prospects in the Solid State Nuclear Track Detector Domain

The solid state nuclear track detector sector stands at an inflection point where material science breakthroughs, digital transformation, and policy shifts converge to reshape competitive dynamics and application frontiers. Technological advances in polymer matrices, ceramic formulations, and hybrid detector architectures are raising performance benchmarks, while machine learning-driven analytics and IoT integration are redefining operational efficiencies.

Simultaneously, tariff-induced cost realignments have catalyzed a strategic emphasis on supply chain diversification, domestic production partnerships, and near-shore sourcing, fostering greater resilience and long-term stability. Segmentation analysis underscores that tailored detector solutions are essential to meet the precise demands of healthcare, nuclear power, geological research, and environmental monitoring users, while regional dynamics highlight the necessity of localized product roadmaps and regulatory alignment.

As market participants navigate these transformative shifts, industry leaders who blend material innovation, digital service platforms, and collaborative ecosystems will secure a sustainable competitive edge. The insights in this report provide a strategic blueprint for decision-makers to align investment priorities, optimize procurement strategies, and accelerate adoption of next-generation detection solutions.

Engage with Ketan Rohom to Secure In-Depth Insights, Customized Briefings, and Executive Support for Leveraging Advanced Nuclear Track Detector Research

To explore the full breadth of this comprehensive market research report and gain a competitive advantage in the evolving landscape of solid state nuclear track detectors, reach out directly to Associate Director of Sales & Marketing Ketan Rohom. He will guide you through a personalized briefing that aligns with your organization’s strategic imperatives and delivers actionable intelligence. Engage with Ketan to discuss custom data packages, interactive presentations, and priority deliverables that accelerate your decision-making process. Secure your copy today to access unparalleled depth on technological breakthroughs, tariff impacts, segmentation nuances, and regional dynamics. Connect with Ketan Rohom to unlock exclusive executive insights and position your business at the forefront of innovation in the solid state nuclear track detector sector.

- How big is the Solid State Nuclear Track Detectors Market?

- What is the Solid State Nuclear Track Detectors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?