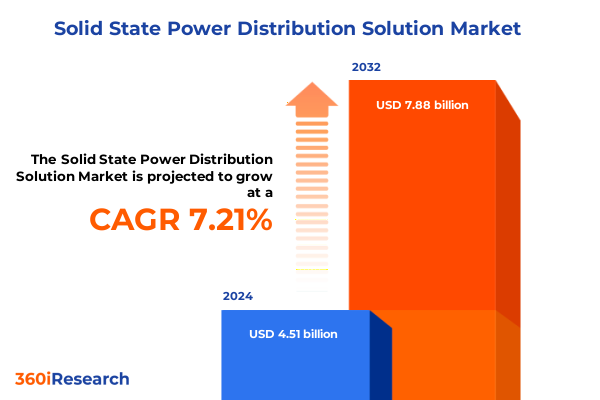

The Solid State Power Distribution Solution Market size was estimated at USD 4.79 billion in 2025 and expected to reach USD 5.17 billion in 2026, at a CAGR of 7.35% to reach USD 7.88 billion by 2032.

Introducing the Imperative of Next Generation Solid State Power Distribution to Address Evolving Efficiency and Resilience Needs

The accelerating shift toward more efficient, intelligent, and resilient energy networks has placed solid state power distribution solutions at the forefront of modern infrastructure investment. As utilities, industrial operators, and technology integrators confront the growing demands for higher power quality and grid flexibility, traditional mechanical switchgear and transformer systems are proving increasingly inadequate in handling dynamic loads, bi-directional power flows, and stringent reliability requirements. In this context, solid state power distribution emerges as a transformative alternative that leverages advanced semiconductor devices, digital controls, and real-time monitoring to deliver unparalleled performance.

This executive summary outlines the critical drivers, market dynamics, and strategic considerations shaping the adoption of solid state power distribution. Beginning with an overview of the technological fundamentals and value proposition, the report navigates through the landscape of established and emerging solutions, dissecting how the convergence of electrification trends, grid modernization initiatives, and end-user demands are redefining distribution architectures. By contextualizing recent regulatory developments, tariff adjustments, and competitive shifts, this section sets the stage for a thorough analysis of segmentation, regional adoption, and actionable recommendations. Ultimately, this introduction underscores the urgency for stakeholders to understand and embrace solid state distribution technologies to secure operational efficiency, future-proof their infrastructure, and capitalize on burgeoning opportunities in a rapidly evolving energy ecosystem.

Revolutionary Convergence of Renewables, Electrification, and Digitalization Driving Adoption of Solid State Power Distribution

The energy landscape is undergoing a paradigm shift driven by the rapid integration of renewable resources, the electrification of transportation, and the proliferation of digital loads. These transformative forces demand distribution architectures that can accommodate two-way power flows, manage high-frequency switching, and provide instantaneous fault isolation. As a result, solid state distribution technologies are migrating from pilot projects to large-scale deployments, fundamentally altering how utilities and industrial operators plan, operate, and maintain their networks.

Alongside these technological advancements, the emergence of microgrids, edge computing, and distributed energy resources has catalyzed new business models and value streams. For instance, dynamic power routers are now enabling load balancing and adaptive protection schemes in real time, while modular solid state transformers facilitate precise voltage regulation and bidirectional power conversion at multiple voltage levels. Consequently, system integrators and OEMs are forging strategic partnerships to deliver turnkey solutions that integrate power electronics, control software, and cyber-secure communication protocols into cohesive platforms. This confluence of trends underscores the transformative shifts rippling through the power distribution sector, where traditional paradigms are being reshaped by semiconductor-enabled innovation.

Evaluating the Compound Effects of 2025 United States Tariffs on Imported Power Electronics and Semiconductor Modules

In 2025, the United States implemented a series of tariffs targeting imported power electronics modules and semiconductor components, significantly affecting the cost structure for manufacturers and end users of solid state distribution equipment. The cumulative tariff burden has elevated import costs by an estimated 10 to 15 percent for key semiconductors, power modules, and system subassemblies sourced from overseas suppliers. In response, domestic and multinational suppliers have recalibrated their supply chains, accelerating localization of critical components to mitigate duty impacts and ensure business continuity.

Moreover, these trade measures have prompted a reevaluation of sourcing strategies, compelling OEMs to diversify their vendor base and forge joint ventures with North American foundries. While the initial cost pressures have been absorbed through margin adjustments and strategic inventory positioning, long-term implications include increased investment in domestic manufacturing capacity and a renewed focus on design for supply chain resilience. Consequently, stakeholders must navigate a complex tariff landscape, balancing near-term cost implications with strategically driven localization efforts to maintain competitiveness and secure uninterrupted access to semiconductor technologies essential for solid state power distribution solutions.

In-Depth Analysis of Market Segmentation Revealing Critical Product Categories Voltage Classes Applications and End-Use Verticals

The solid state power distribution landscape exhibits multifaceted segmentation that underpins product development, commercial strategy, and customer targeting. Component segmentation highlights the distinctions between circuit breakers, power routers, solid state transformers, and switchgear. Circuit breakers, differentiated into SF6 and vacuum technologies, cater to legacy replacement and new installations with varying environmental and performance attributes. In parallel, power routers are segmented into dynamic units capable of real-time load balancing and static units optimized for predictable load profiles. Solid state transformers unfold across centralized systems for utility-scale applications, distributed units embedded within feeder networks, and modular designs suited for microgrids and electric vehicle charging hubs. Complementary to these are air-insulated and gas-insulated switchgear platforms, which offer scalable protection and control functions.

Power rating segmentation encompasses high voltage installations for transmission-level distribution, medium voltage applications in industrial parks and smart grids, and low voltage deployments within commercial and residential facilities. Application segmentation reveals concentrated adoption within data centers-spanning colocation, enterprise, and hyperscale facilities-where uptime and power quality are mission-critical. Electric vehicle charging infrastructure is bifurcated into AC and DC fast-charging stations that demand precise voltage conversion and fault management. Industrial automation segments into factory automation lines and process automation systems, each requiring specialized protection schemes. Renewable energy integration considers hydro, solar, and wind generation, where solid state distribution supports inverter interfaces and energy storage interconnections. Finally, smart grid initiatives focus on demand response orchestration, DER management, and distribution automation frameworks.

End-use segmentation cuts across commercial high-rises, industrial manufacturing floors, residential communities incorporating home energy management, transportation corridors electrified with charging infrastructure, and utility-scale networks undergoing digital transformation. These overlapping segmentation lenses provide a granular view of market dynamics, enabling stakeholders to tailor solutions, prioritize R&D investments, and calibrate go-to-market strategies across diverse customer cohorts.

This comprehensive research report categorizes the Solid State Power Distribution Solution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Power Rating

- Application

- End Use

Comprehensive Regional Landscape Highlighting Capital Deployment and Policy Drivers Shaping Solid State Power Distribution Adoption

Regional dynamics in the Americas underscore robust investment in grid modernization programs, particularly in North America, where federal infrastructure funding has catalyzed upgrades to aging distribution networks. The United States leads in pilot deployments of solid state transformers in urban distribution circuits, while Canada emphasizes renewable integration and microgrid resilience in remote communities. Across Latin America, energy access initiatives and growing electrification efforts have stimulated interest in compact, modular power distribution systems.

In Europe, Middle East, and Africa, stringent emissions regulations and ambitious decarbonization targets are driving utilities to adopt solid state distribution as a means to harmonize renewable variability and enhance grid stability. The European Union’s Green Deal and national smart grid mandates have accelerated trials of power routers and digital switchgear, whereas in the Middle East, large-scale solar parks and high-density urban infrastructure projects are leveraging solid state solutions to optimize land use and energy efficiency. African nations are exploring modular systems to leapfrog traditional infrastructure and enable rapid electrification in off-grid regions.

The Asia-Pacific region remains a focal point for manufacturing scale and technology innovation, with China and Japan leading the development of high-voltage solid state transformers and semiconductor-intensive power electronics. India’s ambitious electrification plans and rising EV adoption have spurred demand for advanced distribution modalities, while Southeast Asian economies are investing in smart grid pilots to bolster network reliability and integrate distributed generation. These varied regional trajectories reflect the global momentum behind solid state power distribution, driven by local policy imperatives, funding frameworks, and distinct infrastructure challenges.

This comprehensive research report examines key regions that drive the evolution of the Solid State Power Distribution Solution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Competitive Dynamics and Innovative Collaborations among Key Players in Power Electronics and Grid Services

Leading industry players are advancing differentiated approaches to capture growing opportunities in solid state power distribution. Established conglomerates are leveraging their deep portfolios in automation, semiconductor manufacturing, and grid services to develop integrated platforms that combine power electronics hardware with advanced analytics and digital control software. These companies invest heavily in R&D to improve device efficiency, thermal management, and scalability, positioning themselves to service large utility and industrial accounts.

Simultaneously, specialized power electronics vendors and agile startups are carving out niches by focusing on modular designs, rapid prototyping, and software-defined functionality. They collaborate with academic institutions and national laboratories to accelerate innovation cycles, particularly in wide bandgap semiconductors such as silicon carbide and gallium nitride. Partnerships with energy storage suppliers and EV charging network operators enable these players to deliver end-to-end solutions that address emergent use cases. Additionally, system integrators are forging alliances with communication and cybersecurity firms to ensure that solid state distribution assets can be deployed securely and interoperably within evolving grid architectures.

This competitive ecosystem is characterized by a blend of scale-driven incumbents, technology-focused challengers, and cross-sector collaborators. Together, they are shaping the future of power distribution, with each participant contributing unique capabilities that span component design, power management software, and service-driven business models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solid State Power Distribution Solution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- AMETEK PDS

- Collins Aerospace

- Data Device Corporation

- Delta Electronics, Inc.

- Eaton

- ETA

- Fuji Electric Co. Ltd.

- General Electric

- Hitachi Energy Ltd.

- Ilika PLC

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- OMRON Corporation

- Panasonic Corporation

- Power Device Corporation

- Rockwell Automation

- Schneider Electric SE

- Sensata Technologies, Inc.

- Siemens AG

- TE Connectivity

- Teledyne Aerospace & Defense Electronics

Blueprint for Strategic R&D Investment and Ecosystem Partnerships to Secure Leadership in Solid State Power Distribution Markets

To maintain a leadership position in this rapidly evolving domain, industry executives should prioritize a dual approach of strategic investment and collaborative ecosystem development. First, organizations must allocate resources to in-house R&D focused on wide bandgap semiconductor integration, digital control algorithms, and thermal optimization techniques. By advancing core technology capabilities, companies can achieve superior performance and reliability metrics that differentiate their offerings.

Concurrently, stakeholders should establish partnerships with regional manufacturing hubs and foundry services to diversify supply chains and mitigate tariff-driven cost pressures. Joint ventures or licensing agreements can expedite localization efforts, ensuring continuity of component supply and fostering co-innovation opportunities. Moreover, forging alliances with utilities, system integrators, and original equipment manufacturers can facilitate field validation of solutions and accelerate market acceptance through demonstration projects.

Finally, executives must drive internal alignment by integrating cross-functional teams encompassing engineering, sales, regulatory affairs, and cybersecurity. This holistic approach enables rapid response to policy shifts, technical standards evolution, and customer feedback loops. By balancing technology leadership with agile go-to-market strategies and ecosystem collaboration, industry leaders can navigate the complex landscape of solid state power distribution and secure sustainable growth.

Detailed Methodological Framework Combining Primary Interviews Secondary Research and Quantitative Modeling for Comprehensive Market Insights

This research synthesized primary insights from in-depth interviews with power utility executives, grid automation specialists, semiconductor manufacturers, and regulatory authorities. Supplementary data were gathered through a rigorous review of technical patents, white papers, and standards publications from industry consortia. Secondary research encompassed a thorough analysis of trade journals, conference proceedings, and government policy documents to validate market drivers and regulatory frameworks.

Quantitative assessments relied on a consolidated database of installed base metrics, semiconductor shipment statistics, and infrastructure investment announcements. Proprietary modeling tools facilitated scenario analyses to evaluate the sensitivity of adoption rates to tariff dynamics, technology maturation timelines, and funding incentives. Interdisciplinary expert workshops were convened to refine segmentation schemas, ensuring that component, voltage class, application, and end-use dimensions accurately reflect market realities.

Quality assurance protocols included multiple rounds of data triangulation, peer review by subject matter experts, and cross-validation against publicly available benchmarks. The methodology’s transparent and replicable design enables stakeholders to adapt analytical frameworks to evolving data inputs and emerging trends, supporting informed decision-making throughout the product lifecycle.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solid State Power Distribution Solution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solid State Power Distribution Solution Market, by Component

- Solid State Power Distribution Solution Market, by Power Rating

- Solid State Power Distribution Solution Market, by Application

- Solid State Power Distribution Solution Market, by End Use

- Solid State Power Distribution Solution Market, by Region

- Solid State Power Distribution Solution Market, by Group

- Solid State Power Distribution Solution Market, by Country

- United States Solid State Power Distribution Solution Market

- China Solid State Power Distribution Solution Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Summarizing the Transformative Promise Operational Challenges and Strategic Imperatives in Solid State Power Distribution Markets

The shift toward solid state power distribution represents a pivotal evolution in how electricity networks are designed, controlled, and optimized. By integrating advanced semiconductor devices with sophisticated digital controls, these solutions offer the promise of enhanced reliability, greater energy efficiency, and unprecedented operational flexibility. Across components, voltage classes, and end-use sectors, the market is poised to accelerate as utilities and industrial operators seek to modernize their grids and meet stringent environmental and performance mandates.

Although tariff headwinds present near-term cost challenges, they also catalyze strategic localization and supply chain resilience efforts that can strengthen domestic manufacturing capabilities. Regional dynamics underscore diverse adoption pathways, from utility-scale pilot projects in North America to modular microgrid rollouts in emerging markets. Competitive dynamics between established conglomerates and nimble startups are fueling innovation, while partnerships across the ecosystem are creating new value propositions.

In summary, industry participants who invest in targeted R&D, forge strategic collaborations, and remain agile in their supply chain approaches will be best positioned to capitalize on the transformative potential of solid state power distribution. With methodical planning and proactive engagement, stakeholders can navigate the complexity of this emerging market and secure long-term competitive advantage.

Unlock Advanced Insights and Strategic Briefing Opportunities with Our Associate Director of Sales & Marketing to Propel Your Competitive Edge in Solid State Power Distribution

I invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive research can inform and transform your strategic decisions. His expertise in connecting industry leaders with actionable insights ensures that your organization will be equipped with the latest analysis on solid state power distribution solution trends, segmentation nuances, tariff impacts, and regional dynamics. Reach out to schedule a personalized briefing tailored to your specific needs and discover how our findings can unlock new opportunities, optimize your investment decisions, and strengthen your competitive advantage. Let us partner with you to harness the full potential of solid state power distribution innovations and drive sustainable growth in an increasingly dynamic energy landscape.

- How big is the Solid State Power Distribution Solution Market?

- What is the Solid State Power Distribution Solution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?