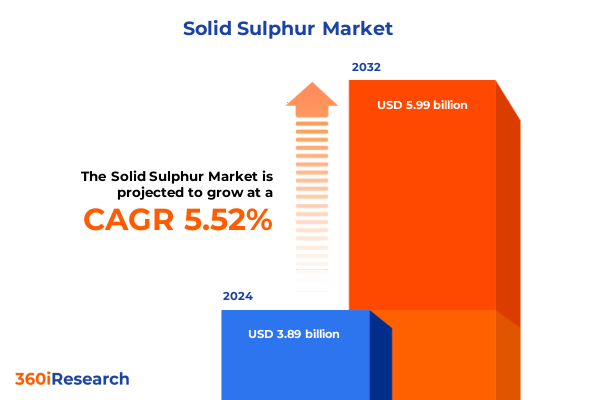

The Solid Sulphur Market size was estimated at USD 4.11 billion in 2025 and expected to reach USD 4.34 billion in 2026, at a CAGR of 5.51% to reach USD 5.99 billion by 2032.

Discover How Solid Sulphur Shapes Critical Industries by Providing Foundational Raw Material for Chemical, Fertilizer, and Emerging Technologies

Solid sulphur underpins a range of high-value industrial and agricultural processes, serving as a cornerstone raw material across multiple sectors. Its unique chemical properties render it indispensable in the production of sulphuric acid, an essential component in fertilizer manufacture, and a critical reactant in numerous chemical synthesis pathways. Beyond its conventional applications, solid sulphur is increasingly harnessed in emerging technologies such as battery cathodes and sulfur-based polymers, reflecting the resource’s evolving importance in advanced material science. Given its dual role in sustaining global food production and driving innovation, solid sulphur remains a strategic resource that demands close market scrutiny.

In light of fluctuating raw material costs, shifting regulatory frameworks, and the rising prominence of sustainable practices, stakeholders are compelled to reassess their solid sulphur procurement and utilization strategies. This executive summary offers an authoritative overview of market dynamics, regulatory influences, and competitive forces that currently shape the solid sulphur landscape. By synthesizing key trends and insights, the following sections equip industry leaders and investors with the intelligence needed to navigate complex upstream considerations, optimize supply chains, and capitalize on value-creation opportunities within this vital materials sector.

Navigating the Rapidly Evolving Solid Sulphur Industry Landscape through Technological Innovations Regulatory Reforms and Supply Chain Optimization

The solid sulphur market has undergone transformative shifts driven by technological advancements, environmental mandates, and a renewed emphasis on supply-chain resilience. Over the past two years, innovative extraction methods-ranging from acid gas recovery refineries to biogenic sulphur production-have begun to displace conventional Frasch mining techniques. These technologies not only reduce environmental footprints but also offer greater flexibility in response to volatile hydrocarbon streams. Concurrently, digital monitoring systems and IoT-enabled performance analytics have optimized sulfur recovery units, yielding incremental gains in process efficiency and product purity.

Regulatory reforms aimed at curbing sulfur dioxide emissions have also spurred significant changes. Stricter air-quality standards in major economies have accelerated the retrofitting of industrial plants with advanced scrubbing systems, boosting the volume of recovered solid sulphur available to the market. These policy-driven adjustments, coupled with heightened end-user scrutiny of carbon footprints, have collectively redefined the competitive landscape. As a result, market entrants and legacy operators alike are investing in low-emission technologies and forging collaboration across the value chain to align with evolving environmental objectives and maintain operational agility.

Analyzing the Far-Reaching Consequences of United States Tariff Adjustments on Solid Sulphur Trade Costs Supply Stability and Competitiveness in 2025

In 2025, recent adjustments to United States tariff schedules have had far-reaching effects on the solid sulphur trade, altering cost structures and supply stability for both domestic and international players. The introduction of modest import levies on key sulphur feedstocks has raised landed costs for end users, driving procurement teams to seek alternative sources or renegotiate long-term contracts to mitigate budgetary pressures. These tariff changes have also incentivized some buyers to accelerate domestic production expansions, aiming to reduce exposure to cross-border cost fluctuations.

At the same time, tariff-induced shifts in trade flows have influenced global sulfur pricing benchmarks, compelling exporters from regions with historically lower trade barriers to rechannel volumes toward third-party markets. While this reorientation has offered new opportunities for select suppliers, it has simultaneously increased logistical complexity and transportation lead times. Consequently, buyers must now navigate a more intricate web of trading partners, balancing the benefits of diversified sourcing against the risks of supply disruptions. Overall, the 2025 tariff adjustments underscore the necessity for robust scenario planning, agile contracting, and strengthened supplier relationships within the solid sulphur ecosystem.

Unpacking Critical Market Segmentation Patterns for Solid Sulphur across Product Types Applications End Users Purity Levels and Distribution Channels

An in-depth examination of market segmentation reveals distinct patterns in solid sulphur demand and user preferences. Looking first at product types, flake sulphur holds a significant share in applications requiring rapid dissolution rates, while lump sulphur is preferred for slow-release agricultural formulations. Powder sulphur, with its fine particle size, caters to specialized chemical processes where high surface area is critical. When considering end-use applications, chemical manufacturing facilities implementing sulfonation processes have shown a growing reliance on premium-grade sulphur, and production of sulphuric acid continues to anchor overall consumption volumes. In fertilizer manufacturing, the integration of sulphur into granular blends remains a primary driver of market growth.

A further layer of segmentation by end user highlights the dominant role of the chemical industry in dictating overall market dynamics, followed closely by fertilizer producers responding to global food security concerns. Pharmaceutical companies, though representing a smaller volume, demand stringent purity standards for sulfur-based excipients. The rubber industry utilizes solid sulphur across vulcanization procedures, with a rising trend toward high-performance elastomers. Turning to purity grades, industrial-grade sulphur is the workhorse for bulk applications, while food, pharmaceutical, and technical grades address highly regulated sectors. Distribution channels have also evolved; direct sales to major processors ensure supply chain security, distributor networks offer regional reach, and online platforms increasingly facilitate small-volume transactions and expedite lead times.

This comprehensive research report categorizes the Solid Sulphur market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Distribution Channel

- End User

- Application

Examining Regional Dynamics Shaping Solid Sulphur Demand and Supply Patterns across Americas EMEA and Asia-Pacific Markets

The Americas region continues to serve as a hub for both sulphur production and refined processing capacities. A robust infrastructure of refineries, combined with ample sour gas recovery operations, cements North America’s position as a competitive exporter. Meanwhile, end-users in South America are ramping up fertilizer compound production to meet domestic agricultural demands, leveraging local sulphur resources and imports to stabilize pricing. Regional sustainability initiatives have also prompted investments in low-emission recovery technologies, reinforcing the region’s supply resilience.

Across Europe, the Middle East & Africa, regulatory stringency on emissions drives significant volumes of recovered sulphur to market, particularly from gas-processing facilities in the Middle East. Europe’s transition toward circular economies has spurred innovation in sulphur reuse within chemical cycles, while North African countries are exploring export partnerships to diversify revenue streams. In the Asia-Pacific, rapid industrialization and agricultural intensification have fueled demand, with China and India at the forefront of consumption. Investments in advanced recovery units in Southeast Asia aim to capitalize on localized sour gas reserves, and emerging markets such as Vietnam are adopting more stringent environmental controls, shaping future supply availability.

This comprehensive research report examines key regions that drive the evolution of the Solid Sulphur market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Solid Sulphur Producers Their Strategic Initiatives Technology Investments and Growth Trajectories in the Current Competitive Environment

Leading solid sulphur producers have adopted a spectrum of strategies to strengthen their market standing. Major integrated energy companies have prioritized debottlenecking existing recovery units and enhancing process yields, thereby lowering per-unit production costs. Several global chemical firms have entered long-term off-take agreements, securing consistent volumes and enabling greater operational predictability. At the same time, specialty materials companies are investing in R&D to develop value-added sulphur derivatives and extend downstream product portfolios.

Collaborations between producers and technology providers have yielded pilot projects focused on modular sulphur recovery units and digital monitoring platforms. These partnerships aim to reduce capital intensity and improve lifecycle performance, particularly for remote installations. Additionally, select companies have pursued vertical integration strategies, acquiring or establishing footprint in key fertilizer blending operations to capture margin uplift. Collectively, these approaches underscore the importance of technological innovation, strategic alliances, and portfolio diversification in maintaining competitive advantage within a complex, commodity-driven market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solid Sulphur market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abu Dhabi National Oil Company

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Exxon Mobil Corporation

- Gazprom PJSC

- Georgia Gulf Sulfur Inc.

- Indian Oil Corporation

- Marathon Petroleum Corporation

- PJSC LUKOIL

- QatarEnergy

- Repsol

- Saudi Arabian Oil Company

- Shandong Linyi Golden Sulphur Chemical Co., Ltd.

- Shell plc

- S‑Oil Co., Ltd.

- Tiger‑Sul, Inc.

- TotalEnergies SE

- Valero Energy Corporation

Crafting Strategic and Operational Recommendations to Drive Innovation Efficiency and Sustainable Growth among Industry Leaders in the Solid Sulphur Market

To secure and expand market position, industry leaders should adopt multifaceted strategic initiatives that emphasize operational excellence and technological differentiation. First, advancing digital transformation within recovery and processing facilities will enhance predictive maintenance capabilities, reduce unplanned downtime, and improve sulfur purity control. Harnessing data analytics can also enable more precise demand forecasting, aligning production schedules with market fluctuations. Furthermore, diversifying feedstock sources-for instance, integrating biogenic or waste-derived sulphur-can mitigate exposure to volatile commodity cycles and bolster sustainability credentials.

Beyond operational efficiencies, forging collaborative ventures with downstream users offers a pathway to co-develop bespoke sulphur grades tailored to specialized applications. Such partnerships not only deepen customer relationships but also unlock premium pricing opportunities. In parallel, engaging proactively with regulatory bodies to influence emissions policies and secure incentives for low-emission technologies can yield long-term cost benefits. Finally, exploring circular economy models-where sulphur waste streams are reintegrated into production loops-can enhance resource efficiency and reinforce corporate sustainability commitments, strengthening stakeholder trust and market differentiation.

Detailing the Rigorous Mixed-Method Research Approach Employed to Gather and Analyze Data on Solid Sulphur Market Trends and Industry Dynamics

This analysis integrates a mixed-method research framework to capture comprehensive insights into the solid sulphur market. Secondary data sources included peer-reviewed journals, industry association publications, and regulatory filings, ensuring a robust understanding of technical processes, environmental standards, and trade policies. Primary research entailed interviews with senior executives across leading producers, technology licensors, and end-user segments, providing qualitative depth on strategic priorities and operational challenges.

Quantitative analyses were conducted using a bottom-up approach, aggregating consumption and production data across segmented categories to identify usage patterns. Purity grade and distribution channel trends were validated through surveys of procurement managers and distribution network stakeholders. Regional dynamics were contextualized with macroeconomic indicators and trade flow statistics, with a particular focus on tariff impacts and infrastructure developments. Throughout the research process, rigorous data triangulation and expert review ensured the reliability and actionable nature of all insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solid Sulphur market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solid Sulphur Market, by Product Type

- Solid Sulphur Market, by Purity Grade

- Solid Sulphur Market, by Distribution Channel

- Solid Sulphur Market, by End User

- Solid Sulphur Market, by Application

- Solid Sulphur Market, by Region

- Solid Sulphur Market, by Group

- Solid Sulphur Market, by Country

- United States Solid Sulphur Market

- China Solid Sulphur Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Key Insights and Strategic Imperatives from the Comprehensive Analysis of Solid Sulphur Market Drivers Challenges and Opportunities

The comprehensive exploration of solid sulphur market dynamics underscores its pivotal role at the intersection of industrial productivity, agricultural output, and emerging technological applications. Recent technological innovations have enhanced recovery efficiencies and product quality, while regulatory evolutions continue to shape supply availability and cost structures. The 2025 United States tariff adjustments have demonstrated the market’s sensitivity to policy shifts, signaling that proactive supply-chain risk management will remain critical.

Segmentation insights reveal divergent needs across product types, applications, end users, purity grades, and distribution channels, highlighting the value of differentiated strategies. Regional analyses further emphasize that supply and demand drivers vary significantly across the Americas, EMEA, and Asia-Pacific, necessitating tailored approaches to sourcing, investment, and market entry. Through strategic innovation, operational agility, and collaborative partnerships, industry stakeholders can capitalize on the solid sulphur market’s inherent opportunities while mitigating potential disruptions.

Connect Directly with Ketan Rohom to Secure In-Depth Solid Sulphur Market Intelligence and Empower Data-Driven Decisions for Competitive Advantage

For tailored insights and a deeper exploration of solid sulphur market nuances, you are invited to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through exclusive data offerings, bespoke analytical support, and practical frameworks designed to inform strategic investment decisions. By partnering with Ketan, decision-makers gain privileged access to comprehensive market intelligence that addresses supply chain dynamics, regulatory changes, and emerging technology impacts. Reach out to secure your complete market research report and position your organization at the forefront of industry developments, leveraging actionable knowledge to enhance competitive positioning and maximize ROI.

- How big is the Solid Sulphur Market?

- What is the Solid Sulphur Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?