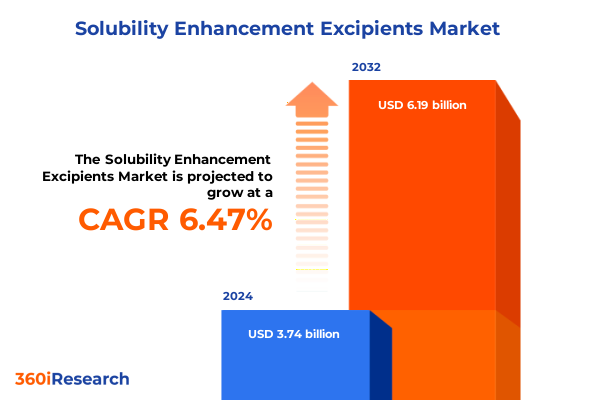

The Solubility Enhancement Excipients Market size was estimated at USD 3.97 billion in 2025 and expected to reach USD 4.22 billion in 2026, at a CAGR of 6.52% to reach USD 6.19 billion by 2032.

Unlocking the Definitive Importance of Solubility Enhancement Excipients in Overcoming Drug Bioavailability and Formulation Barriers

Over the past decade, the pharmaceutical landscape has witnessed a surge in compounds exhibiting poor aqueous solubility, with more than 40% of new chemical entities facing dissolution challenges that impede bioavailability and therapeutic efficacy. This trend has elevated the importance of solubility enhancement excipients, which serve as pivotal agents in improving solubility profiles, stabilizing drug formulations, and unlocking the clinical potential of hydrophobic molecules. As drug developers increasingly prioritize rapid time-to-market and patient-centric outcomes, the demand for reliable, high-performance excipients capable of addressing solubility barriers has become more critical than ever before.

Excipients such as cyclodextrins and advanced polymers have emerged at the forefront of solubility enhancement strategies. Cyclodextrins, cyclic oligosaccharides with a hydrophobic core, form inclusion complexes that can increase the aqueous solubility of poorly soluble APIs by several folds, as evidenced by studies demonstrating up to fourfold solubility improvements via hydroxypropyl-beta-cyclodextrin inclusion complexes. Concurrently, polymers like hydroxypropyl methylcellulose and novel graft copolymers are engineered to perform multifunctional roles-acting as solubilizers, crystallization inhibitors, and controlled-release matrices-thereby streamlining formulation development and enhancing bioavailability outcomes.

The evolving role of solubility enhancement excipients extends beyond mere dissolution aid; it encompasses targeted delivery, stability improvement, and patient compliance optimization. With advancements in solid dispersion technologies and particle size reduction techniques, formulators now leverage excipients not only to overcome solubility hurdles but also to modulate drug release profiles and minimize dosing frequencies. This expanded functionality underscores the strategic value of excipients in modern pharmaceutical development and sets the stage for transformative innovation in drug delivery solutions.

Embracing Digital Innovation Sustainability and Collaboration to Revolutionize Solubility Enhancement Excipients for Modern Formulations

The solubility enhancement excipients sector is undergoing transformative shifts driven by technological, environmental, and regulatory imperatives. Artificial intelligence and machine learning are accelerating excipient selection and formulation optimization, enabling rapid screening of excipient–API compatibility and predictive modeling of dissolution behavior. This digital infusion is reducing development timelines and fostering data-driven decision-making in formulation design.

Sustainability considerations are reshaping excipient innovation, with green chemistry principles guiding the design of biodegradable polymers and plant-derived cyclodextrins. Formulators are increasingly seeking renewable-source excipients that minimize ecological impact while maintaining safety and performance standards. Regulatory agencies have responded with updated guidelines that favor excipients demonstrating clear safety profiles and sustainable sourcing practices, thereby encouraging the adoption of eco-conscious materials in pharmaceutical formulations.

Personalized medicine trends are further influencing excipient development, as patient-specific dosing regimens require excipients capable of precise release modulation and targeted delivery. This has spurred collaborations between excipient manufacturers and contract development organizations, resulting in co-development models that integrate excipient R&D with bespoke formulation services. These strategic alliances are fostering a new ecosystem in which agility, scientific rigor, and sustainability converge to address complex solubility challenges and meet evolving therapeutic demands.

Assessing the Far-reaching Supply Chain Disruptions and Cost Pressures from the 2025 U.S. Pharmaceutical Tariff Framework

In April 2025, the United States introduced a new layered tariff framework targeting pharmaceutical imports and related chemicals. A baseline 10% duty was applied to all pharmaceutical products for an initial 90-day review window, after which rates are subject to increase, potentially reaching 25% or more depending on policy assessments. The administration’s approach reflects a broader goal of strengthening domestic production and reducing reliance on foreign supply chains for critical drug ingredients.

Country-specific levies under this regime disproportionately affect major API suppliers. Chinese imports may incur tariffs ranging from 104% to 245%, reflecting national security considerations, while European Union products face a 20% duty and Indian-origin ingredients attract a 27% rate. Products from Canada and Mexico not compliant with USMCA regulations are subject to a 25% tariff. Although many large-volume chemicals and select APIs received temporary exemptions, the threat of expanded duties has already prompted supply chain realignments and cost inflation across the pharmaceutical sector.

Companies are responding by diversifying sourcing strategies and accelerating reshoring initiatives. Pharmaceutical giants, including Roche, Novartis, and Johnson & Johnson, have announced multibillion-dollar investments in U.S.-based API production facilities to mitigate tariff exposure. Meanwhile, generic manufacturers are exploring alternative suppliers in India and Germany, even as they brace for interim price increases driven by short-term supply shortages. These shifts underscore the critical need for formulators and excipient producers to reassess procurement strategies, secure long-term supply agreements, and implement contingency plans to buffer against trade policy volatility.

Comprehensive Market Segmentation Illuminates Diverse Drivers and Formulation Pathways for Solubility Enhancement Excipients

The market for solubility enhancement excipients is characterized by a multi-dimensional segmentation that reveals distinct growth drivers and formulation imperatives. When analyzed by type, cyclodextrins stand out for their superior inclusion complex capabilities, with beta-cyclodextrin leading due to its balanced cavity size and safety profile, while hydrophilic polymers such as hydroxypropyl methylcellulose and PVP dominate solid dispersion applications. Lipophilic excipients, including fatty acids and lecithins, excel in lipid-based carriers for hydrophobic compounds, whereas solid dispersion agents like maltodextrin and mannitol facilitate rapid drug release in oral forms.

Functional segmentation highlights bioavailability enhancers as pivotal in improving absorption of poorly soluble APIs, while release modifiers and stabilizers ensure consistent drug delivery and longevity. In terms of administration route, oral formulations command widespread adoption, but injectable and topical deliveries are gaining traction for targeted solubility solutions. Source-based analysis shows a growing tilt toward synthetic excipients for tailored performance, yet natural excipients such as plant-derived cyclodextrins are prized for their biocompatibility. Liquid forms offer immediate dissolution benefits, whereas powders provide versatility for solid dosage forms. Lastly, applications span pharmaceuticals, nutraceuticals, and cosmetics, each segment demanding optimized solubility characteristics to achieve efficacy and consumer acceptance.

This comprehensive research report categorizes the Solubility Enhancement Excipients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Functionality

- Route of Administration

- Source

- Form

- Dosage Form

- Application

Global Regional Dynamics Reveal Strategic Opportunities and Adoption Patterns for Solubility Enhancement Excipients

Regional dynamics play a crucial role in shaping the development and adoption of solubility enhancement excipients. In the Americas, strong demand stems from a robust biopharmaceutical sector focused on personalized therapies and high-potency molecules, driving innovation in excipients that support complex injectable and oral applications. Investment in domestic API and excipient manufacturing is rising, partly in response to tariff-induced supply chain realignment, and is supported by favorable regulatory incentives aimed at onshoring critical pharmaceutical ingredients.

Europe, the Middle East, and Africa exhibit a balanced mix of established pharmaceutical hubs and emerging markets. The EU’s stringent regulatory framework encourages high safety and sustainability standards for excipients, fostering the growth of green polymers and advanced cyclodextrin derivatives. In the Middle East and Africa, growing healthcare infrastructure and expanding access to advanced medicines are creating new opportunities for excipient providers to tailor solutions for oral solid dosage forms and topical applications.

Asia-Pacific leads in production capacity and cost-competitive manufacturing, underpinned by large-scale polymer and cyclodextrin producers in India, China, and Japan. Rapid growth in biologics and generic drugs in the region is fueling demand for multifunctional excipients, while rising regulatory harmonization efforts are easing market entry for innovative solubility enhancers. Collaboration with local research institutions further accelerates technology transfer and development of region-specific solutions.

This comprehensive research report examines key regions that drive the evolution of the Solubility Enhancement Excipients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Top Excipients Innovators Highlight Collaborative Models and Portfolio Expansions Driving Market Leadership

Leading excipient manufacturers are deploying varied strategies to maintain competitive advantage and address evolving market needs. Roquette has expanded its cyclodextrin portfolio through targeted acquisitions and capacity scale-ups, enabling tailored solutions such as hydroxypropyl-beta-cyclodextrin for pediatric and high-dose formulations. Collaborative licensing of advanced derivatives like sulfobutylether-β-cyclodextrin highlights the company’s focus on next-generation excipient platforms and regulatory alignment.

Ashland emphasizes co-development partnerships and technical service excellence, showcasing multifunctional polymer innovations at major industry events. Recent launches, including hypromellose acetate succinate grades designed for solid dispersion and film-coating applications, illustrate Ashland’s integrated approach to solubility and stability challenges. The company’s investment in bioresorbable polymers for long-acting injectables further reflects a strategic commitment to advanced drug delivery systems and high-value therapeutic segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solubility Enhancement Excipients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABITEC Corporation

- Air Liquide S.A.

- Ashland Global Holdings Inc.

- BASF SE

- Cargill, Incorporated

- Clariant International Ltd.

- Croda International PLC

- DuPont de Nemours Inc.

- Evonik Industries AG

- FMC Corporation

- FREUND Corporation

- Gattefossé

- IMCD Group

- JRS Pharma GmbH & Co. KG

- Kerry Group PLC

- Lubrizol Corporation

- Merck KGaA

- Nippon Soda Co. Ltd.

- Pharma Excipients International AG

- Roquette Freres SA

- Shin-Etsu Chemical Co., Ltd.

- Solvay SA

- SPI Pharma Inc.

- The DOW Chemical Company

- Wacker Chemie AG

Actionable Strategies for Industry Leaders to Build Resilient Supply Chains and Sustainable Excipient Innovation

To navigate the complex landscape of solubility enhancement excipients, industry leaders should prioritize diversification of supply chains by securing multi-sourced agreements and exploring alternative regions to mitigate tariff and geopolitical risks. Investing in modular manufacturing platforms that can be rapidly reconfigured for different excipient classes will enhance operational resilience and responsiveness to policy shifts.

Leaders must also accelerate sustainable excipient innovation by adopting green chemistry principles, leveraging renewable raw materials, and engaging proactively with regulatory bodies to shape favorable guidelines. Strategic collaborations with AI-driven formulation partners can streamline R&D workflows and uncover novel excipient–API synergies, while co-development models with contract development organizations will facilitate faster market entry and shared risk structures.

Robust Mixed-Method Research Framework Integrating Expert Interviews Literature Analysis and Data Triangulation to Ensure Credible Insights

This analysis is grounded in a rigorous research framework combining primary and secondary methodologies. Extensive interviews with pharmaceutical formulators, excipient suppliers, and regulatory experts provided qualitative insights into real-world challenges and emerging solution trends. Secondary research included comprehensive reviews of peer-reviewed journals, patents, regulatory filings, and trade publications to validate performance claims and supply chain dynamics.

Data triangulation techniques ensured consistency across multiple sources, while quantitative analysis of tariff schedules, production capacities, and technology adoption rates offered objective assessments of market forces. Expert validation workshops were conducted to refine segmentation logic, confirm regional insights, and prioritize actionable recommendations. This robust methodology underpins the credibility and practical relevance of the findings presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solubility Enhancement Excipients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solubility Enhancement Excipients Market, by Type

- Solubility Enhancement Excipients Market, by Functionality

- Solubility Enhancement Excipients Market, by Route of Administration

- Solubility Enhancement Excipients Market, by Source

- Solubility Enhancement Excipients Market, by Form

- Solubility Enhancement Excipients Market, by Dosage Form

- Solubility Enhancement Excipients Market, by Application

- Solubility Enhancement Excipients Market, by Region

- Solubility Enhancement Excipients Market, by Group

- Solubility Enhancement Excipients Market, by Country

- United States Solubility Enhancement Excipients Market

- China Solubility Enhancement Excipients Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Concluding Perspectives on the Expanding Strategic Role of Solubility Enhancement Excipients in Evolving Drug Development Paradigms

Solubility enhancement excipients have evolved from niche formulation aids into strategic enablers of drug development success, addressing critical bioavailability challenges across pharmaceutical, nutraceutical, and cosmetic applications. As digital innovation, sustainability demands, and personalized medicine converge, the role of excipients will expand further, requiring adaptive portfolios and agile development approaches.

By understanding the nuanced implications of segmentation dynamics, regional trends, and trade policy shifts, industry stakeholders can align investments with priority areas, forge impactful partnerships, and deploy cutting-edge technologies that enhance solubility, stability, and patient outcomes. The strategic imperative is clear: those who anticipate change and innovate collaboratively will shape the next generation of high-performance drug formulations.

Connect with Ketan Rohom to Secure Your Complete Solubility Enhancement Excipients Market Research Report Today

To explore deeper insights, tailored analyses, and comprehensive data on solubility enhancement excipients, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through detailed report features and ensure you obtain the precise information needed to inform your strategic decisions. Contact him today to secure access to the full market research report and empower your formulation strategies with authoritative intelligence.

- How big is the Solubility Enhancement Excipients Market?

- What is the Solubility Enhancement Excipients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?