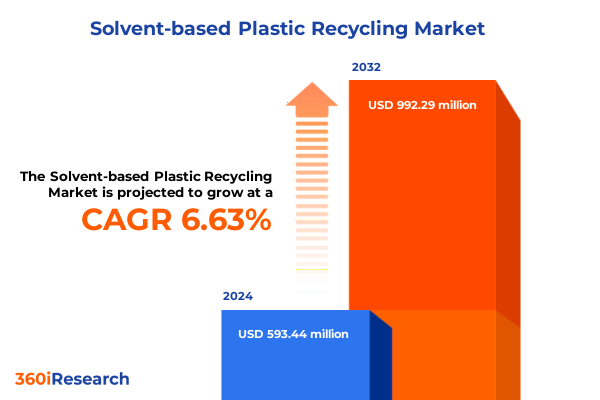

The Solvent-based Plastic Recycling Market size was estimated at USD 630.77 million in 2025 and expected to reach USD 671.07 million in 2026, at a CAGR of 6.68% to reach USD 992.29 million by 2032.

Understanding the Role of Solvent-Based Technologies in Revolutionizing Plastic Recycling for a Sustainable and Circular Future

Solvent-based plastic recycling is at the forefront of a paradigm shift in waste management, offering a technically viable alternative to traditional mechanical methods. By dissolving and recovering polymer fractions with precision, this approach facilitates high-purity outputs capable of re-entering the manufacturing stream without significant property loss. Consequently, it addresses critical challenges posed by contamination and polymer degradation that have historically limited closed-loop recycling efforts.

As resource constraints and regulatory pressures intensify, manufacturers and policymakers alike see solvent-based processes as a potent enabler for advancing circular economy objectives. Moreover, this technology aligns with global sustainability agendas, promoting responsible stewardship of petroleum-based materials while mitigating environmental externalities. In this context, stakeholders across the value chain-from feedstock suppliers to brand owners-are increasingly evaluating solvent-based recycling as a centerpiece of their long-term strategies.

This section establishes the foundational principles of solvent-based plastic recycling, examines its core mechanisms, and highlights the compelling drivers underpinning its rapid emergence. By setting the stage with a comprehensive introduction, readers gain the necessary context to appreciate the transformative potential of dissolutive recycling and the conditions that favor its broader deployment.

Emerging Paradigms and Regulatory Forces Transforming the Landscape of Solvent-Based Plastic Recycling Across Industries

The landscape of solvent-based plastic recycling is undergoing remarkable transformation driven by technological breakthroughs and evolving regulatory frameworks. Recent innovations in dissolution–precipitation techniques have enhanced process efficiency and reduced solvent consumption, thus narrowing the environmental footprint of recycling operations. Simultaneously, advancements in solvent recovery systems are boosting economic viability by enabling near-complete solvent reuse, which translates into tangible cost savings.

Regulatory initiatives are also catalyzing change, as policymakers introduce stringent mandates on recycled content and landfill diversion. Extended producer responsibility legislation across multiple jurisdictions compels brands to secure high-quality recyclates, thereby accelerating investment in solvent-based solutions. At the same time, voluntary corporate sustainability commitments are amplifying demand for advanced recyclates with performance characteristics comparable to virgin resins.

Together, these industrial and policy shifts are reshaping competitive dynamics. Established chemical manufacturers are forming strategic alliances with recyclers to co-develop proprietary solvent blends, while emerging technology providers are securing funding to scale pilot plants into commercial-scale facilities. As such, the confluence of innovation, capital flow, and regulatory momentum is redefining how plastic waste is valorized, setting the stage for widespread adoption of solvent-based recycling methods.

Analyzing the Cumulative Impact of Recent United States Tariff Policies on Solvent-Based Plastic Recycling Supply Chains and Competitiveness

The recent tranche of United States tariff measures, enacted in early 2025, has exerted a profound influence on the solvent-based plastic recycling ecosystem. By adjusting import duties on foreign-produced recycled polymers and chemical reagents, these policies have reconfigured supply chain economics. Recyclers traditionally reliant on imported feedstocks are now compelled to diversify sources or invest in domestic recovery capacities to mitigate cost inflation.

Furthermore, the cumulative effect of tariff shifts has prompted a strategic reorientation among multinational chemical firms. Many have accelerated the establishment of local refining and purification facilities, seeking to internalize value chains and preserve margin integrity. Meanwhile, smaller recycling ventures are forging technical partnerships to secure solvent inventories at predictable price points, thereby insulating operations from further trade volatility.

Consequently, stakeholders are reevaluating procurement strategies, often opting for vertically integrated models that emphasize feedstock sovereignty. In parallel, discussions with policymakers are intensifying, as industry groups advocate for calibrated tariff relief or targeted incentives to sustain critical recycling infrastructure investments. Ultimately, these developments underscore the intricate nexus between trade policy and the viability of advanced recycling technologies in the United States.

Deep Segmentation Insights Revealing How Polymer Types, Feedstock Origins, Processing Technologies, and End-Use Industries Shape Recycling Dynamics

Performance characteristics vary significantly across polymer families, necessitating differentiated recycling protocols. For instance, polyolefins such as polyethylene and polypropylene require tailored solvent systems to address their nonpolar chemistry, whereas polyesters like PET benefit from solvents that selectively disrupt ester linkages. In parallel, specialty resins such as polystyrene and polyvinyl chloride demand unique dissolution–precipitation parameters to maintain material integrity upon recovery.

Moving upstream, the provenance of feedstock profoundly influences both process design and end-product quality. Post-consumer streams-particularly those derived from food containers and multilayer films-are often contaminated with residues and additives, which drives the need for more robust purification stages. Conversely, post-industrial waste exhibits narrower variability, enabling streamlined separation routines and higher throughput. This dynamic underscores the importance of feedstock characterization in optimizing yield and product consistency.

On the technology front, the dichotomy between dissolution–precipitation and solvent extraction de-waxing processes shapes capital deployment and operational priorities. Dissolution–precipitation systems excel in preserving polymer molecular weight, while extraction de-waxing methods are often preferred for tackling complex contaminant matrices. Finally, end-use industries impose distinct quality thresholds, with automotive and consumer electronics demanding near-virgin performance, whereas textile and construction applications tolerate broader property variations.

This comprehensive research report categorizes the Solvent-based Plastic Recycling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Polymer Type

- Feedstock Source

- Technology

- End-Use Industry

Key Regional Dynamics Driving Solvent-Based Plastic Recycling Adoption Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Adoption patterns for solvent-based plastic recycling reveal stark contrasts across global regions, influenced by policy, infrastructure maturity, and market demand. In the Americas, strong investment incentives and well-established petrochemical clusters have catalyzed pilot projects and early commercial plants, particularly in North America. Nevertheless, fragmented state regulations create a patchwork environment that companies must navigate carefully.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts-most notably within the European Union-have provided clarity on recycled content targets and waste export restrictions. These measures have not only driven infrastructure expansion but also attracted capital from legacy chemical manufacturers seeking to modernize existing facilities. At the same time, emerging markets in the Middle East are exploring integration of recycling units within petrochemical complexes to bolster circularity goals.

In the Asia-Pacific region, fast-growing consumer markets and intensifying environmental scrutiny are accelerating demand for high-quality recyclates. Governments are issuing ambitious recycling mandates, while technology providers from East Asia are forging cross-border partnerships to deploy modular solvent-based units. This region’s dynamic blend of manufacturing scale and innovation capacity positions it as a pivotal growth arena for advanced recycling modalities.

This comprehensive research report examines key regions that drive the evolution of the Solvent-based Plastic Recycling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborations Propelling Advances in Solvent-Based Plastic Recycling Technologies and Market Positioning

Several pioneering companies are leading the charge in solvent-based plastic recycling through differentiated technology platforms and strategic collaborations. Some have developed proprietary solvent formulations that enhance selectivity and reduce energy consumption during recovery, thereby achieving both environmental and economic benefits. Others are scaling pilot operations to industrial throughput, leveraging joint ventures with materials science firms to expedite commercialization.

Moreover, partnerships between recycling specialists and brand owners are becoming increasingly prevalent. These alliances not only secure off-take agreements for high-purity recyclates but also foster co-investment in demonstration plants. As a result, companies can validate performance standards and consumer acceptance more rapidly, facilitating a smoother transition from pilot to full-scale operations.

Collectively, these strategic moves underscore a broader trend toward vertical integration and ecosystem building. By embedding recycling technologies within value chains, leading players are capturing downstream value and reinforcing their sustainability credentials. This integrated approach is rapidly redefining competitive benchmarks in the solvent-based recycling sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Solvent-based Plastic Recycling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpla Werke Alwin Lehner GmbH & Co KG.

- Borealis AG

- Cleanaway Waste Management Limited.

- COL&BRI PARTNERS, S.L.

- CreaCycle GmbH

- Eastman Chemical Company

- Fraunhofer-UMSICHT

- KW Plastics

- Loop Industries

- LyondellBasell Industries N.V.

- Mura Technology

- PureCycle Technologies, Inc.

- RE&UP Technologies Holding B.V.

- ReSolved Technologies BV

- Saperatec GmbH

- Solvay S.A.

- Sulzer Ltd

- Trinseo PLC

- Viva Energy

Strategic Action Plans for Industry Leaders to Optimize Adoption, Partnerships, and Regulatory Navigation in Solvent-Based Plastic Recycling Initiatives

Industry leaders seeking to capitalize on the promise of solvent-based recycling should adopt a multifaceted strategy that balances technological investment with external partnerships. First, evaluating and piloting solvent systems tailored to specific polymer streams can reveal optimal process parameters and inform capital planning. This approach reduces the risk associated with full-scale deployment and yields critical performance data early in the project lifecycle.

Simultaneously, forging alliances with feedstock aggregators and chemical suppliers is essential for securing cost-effective inputs. Such collaborations can include co-investment in solvent recovery infrastructure or joint R&D initiatives aimed at improving process efficiency. Additionally, engaging proactively with regulatory bodies to shape favorable policy frameworks will help mitigate trade headwinds and facilitate permit approvals.

Finally, embedding robust monitoring and quality assurance protocols will ensure that recycled outputs meet the stringent specifications demanded by high-value end-use applications. By prioritizing continuous improvement and transparency, companies can build brand trust, unlock premium pricing opportunities, and accelerate adoption of solvent-based recyclates among product manufacturers.

Comprehensive Research Approach Outlining Data Collection, Analysis Techniques, and Validation Methods Informing the Solvent-Based Plastic Recycling Study

This study synthesizes primary and secondary data to deliver an authoritative perspective on solvent-based plastic recycling. Primary inputs include in-depth interviews with technology developers, equipment manufacturers, regulatory experts, and leading recyclers, ensuring that insights reflect real-world operational nuances. Secondary research encompasses peer-reviewed literature, patent databases, and policy publications, providing a comprehensive foundation for trend analysis and contextual understanding.

Data verification involves triangulating qualitative findings with documented case studies and facility audits, while financial and operational benchmarks are cross-referenced with industry disclosures and academic models. Advanced analytical techniques, such as scenario mapping and sensitivity analysis, have been employed to assess risk factors, identify value drivers, and evaluate strategic trade-offs.

By combining rigorous methodological rigor with cross-functional expertise, the research delivers a robust framework that underpins the report’s strategic recommendations. This transparent approach ensures that conclusions are both defensible and actionable, serving as a reliable compass for stakeholders navigating the evolving landscape of solvent-based plastic recycling.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Solvent-based Plastic Recycling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Solvent-based Plastic Recycling Market, by Polymer Type

- Solvent-based Plastic Recycling Market, by Feedstock Source

- Solvent-based Plastic Recycling Market, by Technology

- Solvent-based Plastic Recycling Market, by End-Use Industry

- Solvent-based Plastic Recycling Market, by Region

- Solvent-based Plastic Recycling Market, by Group

- Solvent-based Plastic Recycling Market, by Country

- United States Solvent-based Plastic Recycling Market

- China Solvent-based Plastic Recycling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Reflections on the Future Trajectory of Solvent-Based Plastic Recycling Within an Evolving Circular Economy Context

As the circular economy paradigm gains momentum, solvent-based plastic recycling emerges as a critical enabler of sustainable materials management. The convergence of technological maturation, regulatory impetus, and stakeholder collaboration has created fertile ground for this advanced recycling modality to scale rapidly. Importantly, the nuanced interplay between polymer type, feedstock quality, processing approach, and end-market requirements underscores the complexity-and opportunity-within the sector.

Looking ahead, continued innovation in solvent chemistry and process engineering will be essential to surmount remaining technical and economic barriers. Concurrently, stable policy frameworks and strategic public–private partnerships will shape the speed and breadth of adoption. Ultimately, the organizations that proactively align internal capabilities with external momentum will be best positioned to harness the transformative potential of solvent-based recycling.

In synthesizing these insights, it is clear that solvent-based recycling is more than a technological niche; it represents a fundamental shift toward regenerative material flows. Stakeholders who embrace this trajectory today will secure competitive advantage and contribute meaningfully to the global drive for resource efficiency in the decades to come.

Empowering Stakeholders with Customized Insights and Expert Guidance to Acquire the Comprehensive Solvent-Based Plastic Recycling Market Research Report

If you are seeking a definitive source of actionable intelligence to navigate the complexities of solvent-based plastic recycling, look no further. Our research delivers granular analysis on polymer-specific processing, feedstock optimization, regional variations, and emerging technologies, all underpinned by rigorous validation and industry expertise. With this report in hand, you will gain unparalleled visibility into strategic imperatives, enabling you to forge high-value partnerships, optimize your operations, and capitalize on policy shifts and market opportunities.

Engage directly with Ketan Rohom, Associate Director for Sales and Marketing. He will guide you through the bespoke insights tailored to your organization’s strategic objectives, ensuring you extract maximum value and drive tangible results. Reach out today to secure your copy of the comprehensive market research report, and join the vanguard of industry leaders embracing the next frontier of sustainable plastic recycling.

- How big is the Solvent-based Plastic Recycling Market?

- What is the Solvent-based Plastic Recycling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?