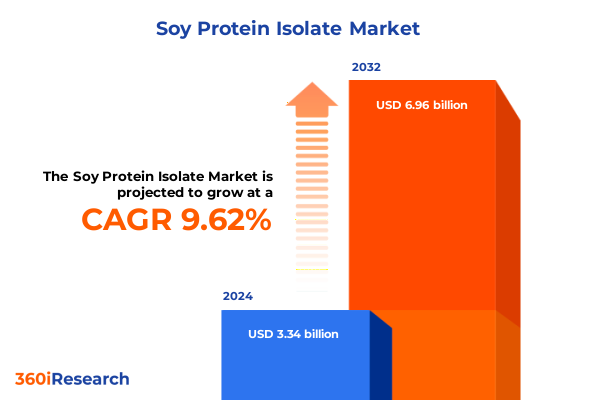

The Soy Protein Isolate Market size was estimated at USD 3.58 billion in 2025 and expected to reach USD 3.85 billion in 2026, at a CAGR of 9.94% to reach USD 6.96 billion by 2032.

Unlocking the Potential of Soy Protein Isolate Through a Comprehensive Market Introduction and Strategic Industry Overview

As the global food and nutrition landscapes increasingly prioritize plant-based protein sources, soy protein isolate has emerged as a cornerstone ingredient valued for its high protein purity, functional versatility, and cost competitiveness. Derived from defatted soybean flakes through a series of purification processes, soy protein isolate offers greater than 90 percent protein content, making it an attractive addition to applications ranging from dietary supplements to meat analogues. Market participants have recognized its capacity to address consumer demands for allergen-free, non-GMO, and vegan formulations while delivering essential amino acids and consistent performance in product development.

In recent years, soy protein isolate has benefited from growing consumer interest in health and wellness, driven by rising protein awareness and dietary diversification. Moreover, innovations in extraction technologies and sustainable soybean cultivation practices have further enhanced the ingredient’s quality and environmental credentials. Consequently, industry stakeholders are investing in research and development to refine functional properties such as emulsification and foaming, while also exploring organic and non-GMO sourcing strategies to align with clean label trends and regulatory requirements across key markets.

Analyzing Pivotal Technological, Consumer Behavior, and Supply Chain Shifts Redefining the Global Soy Protein Isolate Landscape

The landscape of soy protein isolate has been reshaped by a confluence of technological advancements, evolving consumer preferences, and supply chain adaptations. Breakthroughs in enzymatic and ion exchange extraction methods have enabled manufacturers to achieve higher yields, reduce chemical use, and tailor functional properties for specific end-use applications. In parallel, consumer demand for transparent sourcing and traceability has prompted brands to adopt blockchain and digital label technologies, reinforcing trust in non-GMO and organic offerings.

Furthermore, supply chain resilience has become paramount in the face of geopolitical tensions, climate-induced crop variability, and fluctuating commodity prices. Companies have responded by diversifying soybean procurement across geographies, integrating sustainability certifications, and investing in strategic partnerships with growers. These transformative shifts have not only enhanced raw material transparency but also increased the agility of processing operations, enabling rapid response to emerging market needs and regulatory changes.

Examining the Cumulative Effects of 2025 United States Tariffs on Soy Protein Isolate Supply Chains and Cost Structures

In 2025, United States tariff policies targeting imported soy-based derivatives have exerted pronounced effects on the soy protein isolate market’s cost structures and supply dynamics. The continuation of Section 301 duties on certain imported soy products from key trading partners has elevated input costs for processors reliant on cross-border raw materials, thereby prompting a strategic pivot toward domestic sourcing. As a result, manufacturers have accelerated investments in local capacity expansion to mitigate tariff-induced margins pressure and ensure stable supply continuity.

Moreover, the cumulative impact of these tariffs has catalyzed innovation in feedstock diversification, with some industry leaders exploring alternative legume proteins and co-product valorization to offset cost inflation. At the same time, downstream formulators have been compelled to reassess pricing strategies and product portfolios to maintain competitiveness. These developments underscore the critical importance of supply chain agility and proactive regulatory monitoring in safeguarding operational resilience and preserving profitability within the soy protein isolate sector.

Unlocking Market Segmentation Insights Across Application, Product Form, Source Type, Production Process, Distribution, and Functionality

A granular understanding of market segmentation reveals nuanced opportunities across diverse end-use applications, formats, sourcing preferences, production techniques, distribution mechanisms, and functional attributes for soy protein isolate. Within the application domain, soy protein isolate serves the animal feed sector-particularly aquaculture, pet food, poultry, and swine-by delivering high-quality protein with favorable digestibility profiles. Concurrently, the food and beverages segment leverages soy protein isolate in bakery formulations to enhance texture, in beverages for protein fortification, in dairy alternative products to mimic creamy mouthfeel, and in meat products for binding and juiciness benefits. In personal care, formulations in cosmetics, hair care, and skin care harness soy protein isolate’s conditioning and film-forming properties. Meanwhile, the pharmaceutical segment employs soy protein isolate in dietary supplements and nutraceuticals to deliver concentrated protein and bioactive peptides.

Transitioning to physical formats, the market encompasses flakes, granules, liquid concentrates, and powder presentations, each tailored for specific process requirements and handling efficiencies. Supplier portfolios increasingly feature conventional, non-GMO, and certified organic source types to satisfy clean label and sustainability mandates. Extraction processes are differentiated by acid-base, aqueous, enzymatic, or ion exchange methods, with each technique influencing purity, yield, and functional performance. Distribution channels span direct sales to large manufacturers, partnerships with specialized distributors for niche markets, and digital e-commerce platforms catering to formulators seeking just-in-time delivery. Functionality-driven product development focuses on emulsification, foaming, nutritional enrichment, and texture improvement, enabling formulators to deliver enhanced sensory experiences and nutritional profiles in finished products.

This comprehensive research report categorizes the Soy Protein Isolate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Source Type

- Production Process

- Functionality

- Application

- Distribution Channel

Illuminating Regional Dynamics in the Americas, Europe Middle East and Africa, and Asia-Pacific for Strategic Soy Protein Isolate Deployment

Regional dynamics in the soy protein isolate market reflect divergent demand drivers, regulatory landscapes, and supply chain configurations. In the Americas, the United States stands as both a leading producer and consumer, with robust domestic soybean cultivation supporting integrated processing infrastructures. Brazil’s role as a major soybean exporter further influences trade flows, particularly given tariff considerations that have steered raw material sourcing patterns. In turn, Canada’s specialty ingredient sector is capitalizing on value-added protein solutions to serve North American formulators.

The Europe, Middle East & Africa region exhibits growing momentum in plant-based innovation, spurred by stringent regulatory frameworks around labeling, non-GMO certification, and sustainability reporting. European food manufacturers are advancing clean label initiatives and prioritizing organic and traceable soy protein isolates to meet consumer expectations. Meanwhile, Middle Eastern and African markets are in nascent stages of adoption, with imports primarily underpinning early-stage product development in personal care and sports nutrition applications.

Asia-Pacific remains the fastest-growing frontier, driven by rising disposable incomes, urbanization, and shifting dietary patterns in China, India, Japan, and Southeast Asia. Local processing capacity is expanding to capture burgeoning demand for plant-based dairy alternatives and health supplement offerings. Regional collaborations and joint ventures are enhancing technology transfer and local R&D capabilities, further solidifying Asia-Pacific’s role as a critical growth engine for the soy protein isolate industry.

This comprehensive research report examines key regions that drive the evolution of the Soy Protein Isolate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Quality, Competitive Advantage, and Sustainability in the Global Soy Protein Isolate Market

Leading corporate entities are advancing the soy protein isolate market through strategic investments, innovation pipelines, and sustainability programs. Archer Daniels Midland has increased its focus on organic and non-GMO certification, collaborating with growers to enhance traceability and environmental stewardship. Cargill is expanding its specialty protein portfolio by integrating enzymatic extraction capabilities and forging partnerships with biotechnology firms to optimize functional performance.

DuPont Nutrition & Biosciences has leveraged its R&D prowess to introduce high-purity isolates with tailored functionalities, while Kerry Group emphasizes clean label solutions and circular economy initiatives. Fuji Oil continues to differentiate through proprietary processing technologies that yield superior solubility and emulsification properties. Solae and other specialized players are fostering collaborative innovation with ingredient houses and end-user brands to co-develop customized protein blends. These concerted efforts reflect a broader industry commitment to quality, sustainability, and market-responsive product development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Soy Protein Isolate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrawal Oil and Biocheam

- Alax Bioresearch Private Limited

- Archer Daniels Midland Company

- AS-IT-IS Nutrition

- Bunge Limited

- Cargill, Incorporated

- Chaitanya Agro Biotech Pvt. Ltd.

- DuPont de Nemours, Inc.

- Foodchem International Corporation

- Inventiva Labs Private Ltd.

- Kerry Group plc

- Nakoda Dairy Pvt Ltd.

- Natural Nutra

- Nutrabay Retail Pvt. Ltd.

- Nutricore Biosciences Pvt. Ltd.

- Nxinruigroup Co.,Ltd.

- Organicway (xi'an) Food Ingredients Inc.

- Rejoice Life Ingredients

- Shandong Saigao Group Corporation

- Shandong Yuwang Industrial Co., Ltd.

- SunOpta, Inc.

- SunOpta, Inc.

- Taj Pharmaceuticals Limited

- The Scoular Company

- THG Nutrition Limited

- Vigourfuel

- Wilmar International Limited

- Yuwang Group Co., Ltd.

Strategic Actionable Recommendations Empowering Industry Leaders to Optimize Operations, Innovation, and Market Expansion in Soy Protein Isolate

Industry leaders seeking to consolidate market position and future-proof operations should prioritize investments in advanced extraction technologies that deliver higher yields, reduced energy consumption, and enhanced functional properties. Establishing strategic alliances with soybean producers, technology providers, and end-user brands can accelerate innovation cycles, improve raw material traceability, and unlock new application segments. Embracing digital platforms for supply chain monitoring and predictive analytics will empower organizations to anticipate market shifts and optimize inventory management.

Furthermore, companies are encouraged to expand their sourcing strategies to include organic and non-GMO certifications alongside sustainability credentials, catering to evolving regulatory demands and consumer expectations. Developing targeted marketing initiatives that highlight proven functional benefits-such as emulsification performance in dairy analogues or foaming capacity in bakery products-can strengthen brand differentiation. Lastly, fostering cross-functional R&D teams to explore hybrid protein blends and novel product formats will position businesses at the forefront of emerging clean label and plant-based trends.

Detailing the Robust Research Methodology Employed to Ensure Data Integrity, Triangulation, and Insightful Analysis in Market Research

This report’s insights are grounded in a robust research methodology integrating both primary and secondary data sources. Primary research comprised in-depth interviews with senior executives from leading ingredient suppliers, end-user formulators, and industry associations, ensuring a firsthand understanding of technological advancements, market challenges, and growth catalysts. In parallel, secondary research encompassed a thorough review of publicly available information, including regulatory filings, trade publications, company annual reports, and white papers.

Data triangulation techniques were applied to reconcile quantitative findings with qualitative inputs, ensuring consistency and validity. The analytical framework incorporated both thematic analysis for trend identification and comparative assessment to benchmark regional and competitive dynamics. This rigorous approach has produced a comprehensive and balanced perspective on the soy protein isolate market, enabling stakeholders to make well-informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Soy Protein Isolate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Soy Protein Isolate Market, by Product Form

- Soy Protein Isolate Market, by Source Type

- Soy Protein Isolate Market, by Production Process

- Soy Protein Isolate Market, by Functionality

- Soy Protein Isolate Market, by Application

- Soy Protein Isolate Market, by Distribution Channel

- Soy Protein Isolate Market, by Region

- Soy Protein Isolate Market, by Group

- Soy Protein Isolate Market, by Country

- United States Soy Protein Isolate Market

- China Soy Protein Isolate Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Drawing Comprehensive Conclusions to Highlight Key Insights, Industry Trajectories, and Strategic Imperatives for Soy Protein Isolate Stakeholders

In summary, soy protein isolate continues to gain prominence as a versatile, high-purity plant protein ingredient, driven by health-conscious consumer behavior, technological innovation, and sustainability imperatives. The interplay of application-specific requirements, production techniques, and sourcing preferences has created a multifaceted market landscape, offering differentiated opportunities for value creation. Meanwhile, regulatory developments and tariff policies underscore the necessity for supply chain agility and risk mitigation.

As market dynamics evolve, stakeholders equipped with deep segmentation insights, regional intelligence, and competitive benchmarking will be best positioned to capitalize on emerging growth avenues. The strategic imperatives identified-from technological adoption to sustainability alignment-constitute a blueprint for organizations aiming to enhance product portfolios, streamline operations, and deliver superior performance in the dynamic soy protein isolate sector.

Connect with Ketan Rohom to Secure Your Copy of the Comprehensive Market Research Report on Soy Protein Isolate Today

Engaging with Ketan Rohom will enable you to access the comprehensive market research report on soy protein isolate, offering a deep dive into industry dynamics, competitive intelligence, and actionable strategic insights. This tailored resource is designed to support decision-makers in optimizing product portfolios, enhancing supply chain resilience, and capitalizing on emerging market opportunities.

Don’t miss the opportunity to leverage this detailed analysis and equip your organization with the intelligence needed to navigate the evolving soy protein isolate market. Contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full report and begin transforming insights into competitive advantage today

- How big is the Soy Protein Isolate Market?

- What is the Soy Protein Isolate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?