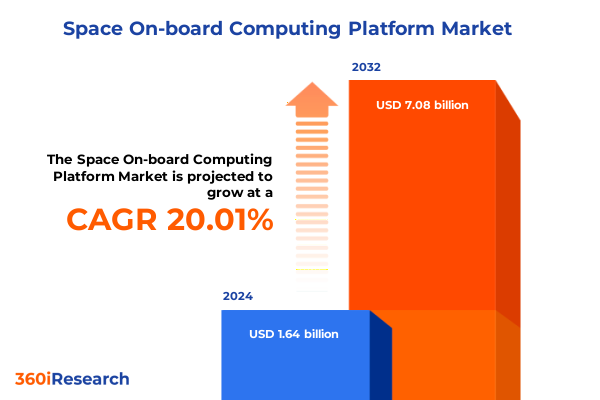

The Space On-board Computing Platform Market size was estimated at USD 1.97 billion in 2025 and expected to reach USD 2.36 billion in 2026, at a CAGR of 20.06% to reach USD 7.08 billion by 2032.

Unveiling the strategic imperative and evolution of space on-board computing platforms that are reshaping mission capabilities in aerospace operations

Space on-board computing platforms have emerged as the critical nexus where hardware robustness meets software intelligence, powering every new frontier of exploration and commercial activity in low Earth orbit and beyond. As modern missions demand ever-greater autonomy, real-time data processing, and resilience under extreme conditions, these platforms serve not just as passive data handlers but as active decision-making engines. From the nascent cubesat constellations enabling global connectivity to the deep-space probes charting our solar system’s mysteries, advancements in on-board computing directly translate into more precise navigation, advanced payload management, and enhanced scientific return on investment.

The evolution of this domain has been relentless. What began as bespoke flight computers with limited memory and processing capability has matured into modular architectures featuring multi-core processors, FPGA-based accelerators, and secure virtualization layers. This progress has been driven by a combination of defense requirements for hardened reliability and commercial drivers for size, weight, and power efficiency. Consequently, space system integrators and component suppliers are collaborating more closely than ever to optimize performance while minimizing the complexity and risk associated with each launch.

In this executive summary, we distill the latest technological breakthroughs, assess the regulatory and economic factors reshaping supply chains, and highlight the market’s most critical segmentation and regional dynamics. Through a rigorous research methodology that blends expert consultations with targeted secondary analysis, the report offers decision-makers the insights needed to navigate an increasingly competitive and fast-evolving landscape. Whether you are engineering the next generation of satellite constellations or pioneering human-rated spacecraft, understanding the strategic imperatives presented here will be crucial for sustaining innovation and ensuring mission success.

Exploring the groundbreaking technological shifts revolutionizing space on-board computing from edge AI to advanced radiation-hardening architectures

Over the past decade, space on-board computing has transitioned from cumbersome monolithic systems to highly integrated, software-defined architectures, marking one of the most transformative shifts in mission design philosophy. Advances in semiconductor technology have shrunk processing nodes while enhancing radiation tolerance, enabling chipmakers to tailor solutions that balance performance and reliability. Simultaneously, the rise of edge artificial intelligence algorithms allows spacecraft to autonomously analyze sensor data, detect anomalies, and optimize power allocation without waiting for ground-station commands.

Virtualization and secure partitioning have also taken center stage, permitting multiple applications-such as flight control, payload management, and cybersecurity-to coexist on a single physical platform. This multiplexed approach not only reduces system complexity but also accelerates integration cycles by standardizing interfaces across modules. In parallel, the incorporation of high-throughput optical interconnects and deterministic networking protocols has fueled deterministic data transport, ensuring critical telemetry and telecommand flows remain uninterrupted even during peak mission phases.

Moreover, the evolution of digital twin methodologies is reshaping how engineers validate on-board software updates. By simulating the spacecraft’s hardware and environmental conditions in high fidelity, teams can iterate code changes on the ground with unprecedented confidence before uplink. These technological trajectories are converging to drive greater autonomy, lower integration risk, and faster time to mission-heralding a new era in which spacecraft function as self-sufficient nodes within a distributed space infrastructure.

Assessing the multifaceted implications of the 2025 United States tariffs on space on-board computing ecosystems spanning supply chains and strategic sourcing

In 2025, a series of tariffs imposed by the United States government on imported semiconductor components and specialized microelectronic assemblies has introduced tangible new dynamics into the global supply chain for space on-board computing hardware. Component manufacturers accustomed to economies of scale in Asia have faced upward pressure on unit costs, prompting several to reevaluate their sourcing strategies or absorb a slimmer margin to remain competitive. Meanwhile, system integrators are exploring localized assembly hubs to mitigate cross-border fee volatility and reduce lead times for critical flight-qualified boards.

These policy measures have spurred increased collaboration between defense contractors and domestic semiconductor foundries, accelerating investments in radiation-hardened process nodes within North American facilities. Though this localization trend enhances supply-chain resilience, it has also generated short-term capacity constraints as new fabs scale up production. In response, prime contractors have turned to hybrid sourcing models that combine commercial off-the-shelf processors with custom radiation-tolerant coatings, balancing cost containment with mission reliability requirements.

Despite the initial disruptions, the tariffs have underscored the strategic importance of supply-chain diversification. Suppliers and system developers are forging cross-regional partnerships, establishing dual-source arrangements across Europe and Asia, and advancing long-term agreements to buffer against future policy shifts. Over time, this realigned ecosystem is expected to yield a more robust industrial base, capable of scaling production for both burgeoning commercial ventures and national security programs.

Delving into critical system end-use processor and architectural dimensions to uncover nuanced market dynamics driving space on-board computing adoption

A nuanced understanding of the space on-board computing market demands attention to multiple layers of segmentation that illuminate where innovation is both most urgent and most viable. Examining system types reveals that communication systems-subdivided into inter-satellite links, telecommand, and telemetry-are at the forefront of enabling high-speed, secure data exchange among constellation nodes. Navigation systems, which include GNSS receivers, inertial measurement units, and star trackers, remain fundamental to precise positioning and attitude control, driving continuous enhancements in sensor fusion algorithms and processing throughput.

End-use segmentation further differentiates trends across launch vehicles, satellites, space stations, and unmanned rovers. Launch vehicles require ruggedized flight control platforms capable of withstanding intense vibration and thermal cycling, while satellite systems often prioritize power-efficient data handling and encryption. Crewed space stations have unique demands for human-machine interface reliability and redundant safety systems, whereas unmanned rovers leverage edge analytics to navigate dynamic terrain with minimal ground intervention.

Processor types bifurcate the landscape between commercial off-the-shelf solutions, valued for rapid development and lower unit costs, and radiation-hardened processors that guarantee operation under high-radiation flux. Architectural segmentation distinguishes centralized mainframe-style designs and single-unit controllers from distributed frameworks that blend cloud-integrated modules with localized edge processing nodes. The latter approach is gaining traction as missions scale in complexity and data intensity, underscoring the need for flexible, modular architectures that can adapt to evolving software and mission requirements.

This comprehensive research report categorizes the Space On-board Computing Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Processor Type

- Architecture

- End Use

Unearthing distinct regional growth vectors and strategic imperatives across the Americas Europe Middle East Africa and Asia-Pacific space computing domains

Regional dynamics play a pivotal role in shaping investment priorities and technological trajectories within the space on-board computing landscape. In the Americas, robust government budgets for defense and civil space exploration continue to underwrite advanced prototypes and incentivize domestic fabrication of radiation-hardened components. Meanwhile, commercial constellations led by private launch and satellite companies are driving cost-effective solutions, forging public-private partnerships to expand broadband coverage and Earth-observation capabilities.

Across Europe, Middle East, and Africa, a balance between institutional research initiatives and emerging national space programs is fostering innovative payloads and niche microsatellite platforms. Regulatory frameworks emphasizing spectrum management and cybersecurity have catalyzed European firms to embed advanced encryption and secure boot capabilities directly within their on-board computing stacks. In select pockets of the Middle East and Africa, government-backed startups are exploring hybrid architectures that combine centralized mission processors with distributed edge nodes to support remote sensing and disaster-monitoring applications.

In the Asia-Pacific region, rapid growth in satellite navigation constellations and Earth-imaging arrays is propelling demand for high-throughput computing solutions. Domestic manufacturers in China, Japan, India, and South Korea are investing heavily in radiation-tolerant microelectronics, while cross-border consortiums spearhead standardization efforts to facilitate interoperable spacecraft systems. This geographic diversity underscores the importance of region-specific supply-chain strategies and local certification pathways as aerospace stakeholders pursue global-scale missions.

This comprehensive research report examines key regions that drive the evolution of the Space On-board Computing Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the strategic positioning and innovation trajectories of leading aerospace manufacturers and semiconductor pioneers in on-board computing

Leading aerospace primes and semiconductor specialists have staked out differentiated positions within the on-board computing ecosystem, leveraging proprietary IP, strategic partnerships, and integrated services to capture the most demanding mission segments. Established defense contractors have reinforced their portfolios by acquiring niche innovators in radiation-hardened microprocessors and advanced FPGA designs, streamlining end-to-end supply-chain visibility from wafer fabrication to qualifying flight modules.

At the same time, several commercial off-the-shelf providers have tailored their commercial CPU and GPU lines for the space environment through bespoke packaging and shielding services, enabling cost-efficient scalability for large satellite constellations. These COTS-plus offerings have gained traction among emerging space ventures that prioritize rapid deployment and iterative software upgrades over the decades-long endurance demanded by deep-space missions.

A parallel trend sees small-and-mid-size innovators introducing AI-accelerator IP cores and secure virtualization frameworks to differentiate their solutions. By embedding machine-learning capabilities directly on the compute node, these companies are carving out opportunities in missions requiring autonomous object detection, anomaly diagnosis, and adaptive power management. Overall, the competitive landscape is characterized by an intricate balance of consolidation among legacy players, collaborative alliances bridging silicon and system expertise, and disruptive entrants redefining performance benchmarks through software-driven innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Space On-board Computing Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Aitech Systems Ltd.

- BAE Systems plc

- Ball Corporation

- Blue Origin, LLC

- Cobham plc

- General Dynamics Mission Systems, Inc.

- GomSpace A/S

- Honeywell International Inc.

- International Business Machines Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Maxar Technologies Inc.

- MDA Ltd.

- Moog Inc.

- Northrop Grumman Corporation

- OHB System AG

- RTX Corporation

- RUAG Space AG

- Saab AB

- Sierra Nevada Corporation

- Singapore Technologies Engineering Ltd.

- Space Exploration Technologies Corp.

- Teledyne Technologies Incorporated

- Thales S.A.

- The Boeing Company

Empowering aerospace executives with targeted strategies to accelerate innovation and resilience in space on-board computing development and deployment

To stay ahead in a rapidly evolving market, aerospace organizations should prioritize the integration of hybrid computing approaches that combine commercial processor economies with radiation-hardened resilience, ensuring both performance and reliability. Cultivating strategic alliances across the semiconductor and systems domains will enable access to specialized packaging, in-facility testing, and joint development programs, driving down cycle times for flight qualification.

Simultaneously, investment in modular, distributed architectures-fusing cloud-connected edge processors with centralized control units-will equip future missions with the scalability to accommodate software updates and new payload demands. Leaders should also accelerate the adoption of advanced cybersecurity measures, embedding secure boot chains and hardware roots of trust to safeguard mission integrity against emerging threats.

Finally, implementing workforce development initiatives focused on real-time operating systems, model-based systems engineering, and AI-enabled fault detection will be essential for maintaining technical parity. By aligning R&D roadmaps with service providers, regulatory bodies, and academic research centers, organizations can create a cohesive innovation ecosystem that drives down integration risk and unlocks new mission profiles.

Outlining a rigorous research approach blending expert consultations with comprehensive secondary data to reveal key dynamics in space on-board computing

This research combined structured expert interviews with satellite systems architects, semiconductor fabrication specialists, and mission operations leads to capture firsthand perspectives on technology adoption and market barriers. Interviews were conducted under a standardized framework, ensuring consistent coverage of topics such as processing performance requirements, environmental qualification pathways, and integration timelines.

Secondary research complemented these insights with a thorough review of industry white papers, regulatory filings, technical conference proceedings, and supplier product portfolios. Patent landscape analysis provided visibility into leading edge architectures and emerging IP conflicts, while qualitative workshops with cross-disciplinary teams helped validate assumptions regarding regional supply-chain resilience and tariff impacts.

Throughout the process, findings were triangulated to reconcile differing viewpoints and to surface areas of consensus and divergence. Key limitations, such as proprietary data gaps in cost structures and evolving policy environments, were transparently documented to guide future updates. This multifaceted methodology ensures that the insights presented herein rest on a solid evidentiary foundation and reflect the complex realities of the space on-board computing domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Space On-board Computing Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Space On-board Computing Platform Market, by System Type

- Space On-board Computing Platform Market, by Processor Type

- Space On-board Computing Platform Market, by Architecture

- Space On-board Computing Platform Market, by End Use

- Space On-board Computing Platform Market, by Region

- Space On-board Computing Platform Market, by Group

- Space On-board Computing Platform Market, by Country

- United States Space On-board Computing Platform Market

- China Space On-board Computing Platform Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesis of insights reinforcing the strategic value of advanced space on-board computing platforms as a cornerstone for future aerospace mission success

In synthesizing the technological, economic, and regional forces at play, it becomes clear that space on-board computing platforms are no longer a mere component but a strategic enabler of mission success. As pressures mount for higher autonomy, cost efficiency, and rapid deployment, the ability to integrate advanced processors, robust architectures, and secure software frameworks will distinguish market leaders from followers.

The cumulative effect of policy shifts such as the 2025 tariffs underscores the need for supply-chain agility and diversified sourcing strategies, while regional investment patterns highlight the importance of localized certification and partnership models. Concurrently, segmentation analysis reveals that end-use demands-from vibration-hardened launch vehicle controllers to AI-driven rover navigation systems-require bespoke configurations that balance performance with risk mitigation.

Looking ahead, the convergence of edge AI, hardened COTS solutions, and distributed architectures promises to unlock new mission capabilities, reduce time to deployment, and open avenues for sustainable commercial space operations. Decision-makers equipped with the insights in this report will be well positioned to navigate uncertainty, harness emerging technologies, and chart a course toward more resilient and responsive space systems.

Drive innovation today engage with Ketan Rohom to secure comprehensive market intelligence on space on-board computing technologies and opportunities

To gain unparalleled clarity into the evolving realities of space on-board computing and to secure a strategic edge in your mission planning and technology procurement, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. With a proven track record of guiding aerospace leaders through complex market dynamics, he will tailor a comprehensive consultation that aligns cutting-edge research with your organizational objectives. Leverage this opportunity to acquire the definitive market research report, arming your teams with actionable intelligence on emerging system architectures, regulatory impacts, regional hotspots, and critical technology roadmaps. Reach out now to transform data into decisive strategy and fuel the next generation of space exploration and satellite innovation.

- How big is the Space On-board Computing Platform Market?

- What is the Space On-board Computing Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?