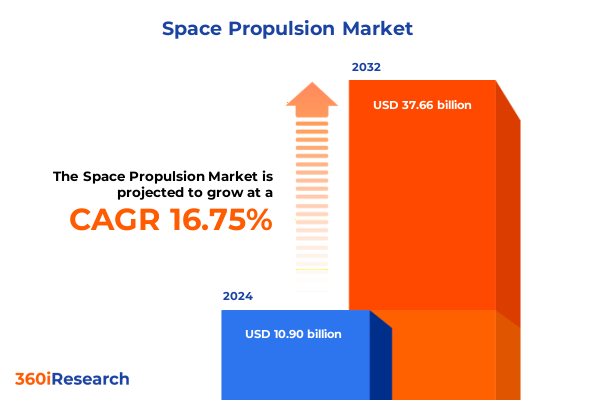

The Space Propulsion Market size was estimated at USD 12.86 billion in 2025 and expected to reach USD 13.91 billion in 2026, at a CAGR of 9.93% to reach USD 24.96 billion by 2032.

Exploring the Crucial Role of Propulsion Systems in Enabling the Next Era of Space Exploration and Satellite Operations

Space propulsion systems serve as the fundamental enabler of humanity’s pursuit beyond Earth, forming the backbone of both scientific missions and commercial satellite operations. From chemical thrusters that have powered voyages since the dawn of the Space Age to electric and hybrid systems ushering in new efficiencies, propulsion technology is at the heart of mission performance and reliability. NASA’s recent integration of the Interim Cryogenic Propulsion Stage, powered by an RL10 engine, atop the Space Launch System underscores the critical role of high-performance propulsion in advancing crewed lunar exploration under the Artemis II program. Concurrently, deep-space missions rely on robust upper-stage engines to propel spacecraft toward distant targets, reflecting the relentless drive to push propulsion boundaries further.

Revolutionary Breakthroughs Are Reshaping Spacecraft Propulsion from Electric and Nuclear Thrusters to Green Monopropellants and Additive Manufacturing

The propulsion landscape is undergoing a profound transformation driven by breakthroughs across multiple domains. Electric propulsion has emerged from niche applications to mainstream adoption, highlighted by recent environmental qualification and flight operations of Hall-effect thrusters on NASA’s Psyche mission and the acceptance testing of 12-kilowatt hall thrusters for the Gateway lunar station’s Power and Propulsion Element. Simultaneously, chemical systems are evolving with the successful flight demonstration of AF-M315E green monopropellant, which offers nearly 50 percent higher density and improved specific impulse compared to hydrazine, promising safer handling and cost reductions for future spacecraft. Beyond conventional chemistries, nuclear thermal propulsion is reemerging as a contender for deep-space operations, with DARPA’s DRACO program and NASA collaborations targeting an in-space demonstration of a nuclear rocket engine by 2027, poised to slash transit times for crewed Mars missions and enhance cislunar maneuver agility. Underpinning these shifts, additive manufacturing is revolutionizing engine production; the first fully additively manufactured rocket injector has completed hot-fire testing, showcasing up to a 70 percent cost reduction and accelerated production timelines for critical engine hardware.

Assessing How New United States Tariff Measures in 2025 Are Reshaping Cost Structures and Supply Chains in the Space Propulsion Industry

The imposition of targeted U.S. tariffs in 2025 has begun to reshape cost structures and supply chains within the space propulsion sector. A 25 percent duty on aerospace components originating from China, including advanced engine modules and reaction control hardware, coupled with a 20 percent levy on specialized composite materials, has increased procurement costs for manufacturers who depend on international supply networks. Additionally, 10 to 15 percent tariffs on defense electronics have impacted avionics and control systems critical for thruster operation, prompting companies to diversify sourcing strategies and assess onshore production alternatives. The combined effects are already manifesting in project budgets, with leading aerospace suppliers reporting multihundred-million-dollar impacts: RTX anticipates up to an $850 million hit from these levies, and GE Aerospace projects a $500 million cost increase for its engine operations. As firms navigate this tariff landscape, strategic adjustments-from supply chain realignment to tariff mitigation initiatives-are becoming imperative to sustain innovation and competitiveness.

Unveiling Key Market Segmentation Insights That Illuminate Distinct Pathways in Propulsion Types, Vehicle Platforms, Applications, and User Profiles

The diversity of the space propulsion market is best understood through its multifaceted segmentation. In terms of propulsion type, operators can choose between time-tested chemical systems, cutting-edge electric thrusters offering high efficiency, and hybrid architectures that blend the advantages of both. Platforms span crewed spacecraft bound for lunar or Martian environments, deep-space scientific probes charting new frontiers, heavy-lift launch vehicles delivering mass to orbit, and an expanding array of satellite platforms. These satellite systems themselves encompass large communication constellations, high-resolution earth observation vehicles, navigation arrays, specialized scientific spacecraft, and a burgeoning ecosystem of small satellites-CubeSats, MicroSats, NanoSats, and PicoSats-each requiring tailored propulsion solutions. Mission profiles drive further differentiation, as deorbit sequences, orbit-raising maneuvers, precise station-keeping tasks, and complex transfer operations each demand unique thrust, impulse, and control characteristics. Lastly, the end-user landscape ranges from commercial integrators and private ventures investing in constellation maintenance, through government bodies overseeing exploration initiatives, to military applications and research institutions pushing technological frontiers, all of which shape procurement and development priorities.

This comprehensive research report categorizes the Space Propulsion market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Vehicle Type

- Application

- End User

Revealing Critical Regional Dynamics Driving Space Propulsion Advancements across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping space propulsion trajectories, reflecting varied policy priorities, industrial capacities, and investment landscapes. In the Americas, the United States leads with robust public-private partnerships, substantial research and development funding, and a maturing network of commercial launch and propulsion enterprises. Across Europe, the Middle East, and Africa, collaborative programs under the European Space Agency, national initiatives in countries such as France, Germany, and the United Kingdom, and emerging players in the Gulf region have bolstered capabilities in electric propulsion research and niche chemical innovations. The Asia-Pacific region stands out for its rapid expansion, driven by national space agencies in China, India, and Japan as well as an increasing number of private startups. Investments in next-generation thrusters, from high-power ion engines to green chemical propellants, are accelerating across this landscape, fueled by strategic imperatives to establish independent access to space and leverage propulsion technologies for defense, commercial, and scientific applications.

This comprehensive research report examines key regions that drive the evolution of the Space Propulsion market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Space Propulsion Players Driving Innovation and Shaping Industry Trajectories with Cutting-Edge Technologies

Leading organizations across the propulsion landscape are setting the pace with specialized expertise and strategic investments. Aerojet Rocketdyne has distinguished itself by pioneering green monopropellant subsystems under the GPIM program and validating additively manufactured injectors for next-generation engines. SpaceX continues to redefine large-thrust architectures with its Starship system while simultaneously deploying argon-based Hall-effect thrusters aboard Starlink satellites to achieve scalable constellations with efficient orbit maintenance and deorbit capabilities. Busek, in collaboration with industry consortia, has advanced its family of Hall thrusters through rigorous environmental qualification processes, targeting applications ranging from small satellites to in-orbit servicing modules. Rocket Lab’s innovative use of additive manufacturing for its Rutherford engine highlights the transition toward rapid prototyping and domestic supply resilience. Blue Origin and Thales Alenia Space are further augmenting lunar and interplanetary propulsion options through specialized lander engines and electric thruster integration. Each of these key players contributes unique technological competencies that collectively shape market evolution and competitive dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Space Propulsion market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerojet Rocketdyne Holdings, Inc.

- ArianeGroup SAS

- AVIO S.p.A.

- Blue Origin Enterprises, L.P.

- Cobham Limited

- IHI Aerospace Co., Ltd.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries, Ltd.

- Moog Inc.

- Northrop Grumman Corporation

- Rocket Lab USA, Inc.

- Safran SA

- United Launch Alliance, LLC

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Propulsion Trends and Mitigate Regulatory and Supply Chain Risks

Industry leaders should prioritize the integration of electric propulsion systems into both existing and future spacecraft fleets to capitalize on efficiency gains and extended mission lifetimes. Concurrent investment in green chemical propellant capabilities will address safety and environmental concerns while unlocking cost efficiencies in ground operations. To mitigate tariff-induced supply chain disruptions, organizations must cultivate diversified sourcing strategies, including the establishment of onshore manufacturing and strategic partnerships with allied supplier networks. Embracing additive manufacturing and digital design workflows will accelerate product development cycles, reduce lead times, and enable modular scalability of propulsion subsystems. Furthermore, active collaboration with government agencies and participation in cooperative R&D initiatives-particularly in nuclear thermal and advanced electric propulsion-will ensure access to emerging technologies and funding. By aligning corporate strategies with these actionable recommendations, industry leaders can reinforce resilience and secure competitive advantages in this rapidly evolving sector.

Comprehensive Research Methodology Combining Primary Stakeholder Engagements and Multi-Source Data Triangulation to Ensure Rigor and Accuracy

This research synthesized insights through a dual-phase methodology combining primary stakeholder engagements with rigorous secondary data analysis. Expert interviews were conducted with propulsion engineers, program managers, and policy advisors to capture nuanced perspectives across the value chain. Concurrently, an exhaustive review of technical papers, patent filings, regulatory filings, and open-source mission data provided objective baselines. Quantitative findings were validated through triangulation across multiple sources, ensuring consistency and mitigating bias. A dedicated advisory panel of propulsion specialists and market analysts reviewed preliminary conclusions, refining the analytical framework and corroborating key inferences. This multi-source, iterative approach ensures the findings are underpinned by comprehensive data, expert validation, and methodological rigor designed to inform high-stakes strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Space Propulsion market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Space Propulsion Market, by Propulsion Type

- Space Propulsion Market, by Vehicle Type

- Space Propulsion Market, by Application

- Space Propulsion Market, by End User

- Space Propulsion Market, by Region

- Space Propulsion Market, by Group

- Space Propulsion Market, by Country

- United States Space Propulsion Market

- China Space Propulsion Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Synthesis of Strategic Insights to Inform Decision-Making in the Rapidly Evolving Space Propulsion Sector

Space propulsion is at the cusp of a new era defined by diversification of technologies, shifting supply chain landscapes, and evolving mission demands. The convergence of electric thruster maturity, green chemical innovations, nuclear thermal ambitions, and additive manufacturing capabilities underscores the multidimensional nature of market evolution. Regional strategies and tariff environments add further complexity, while leading companies continue to push boundaries with bold investments and strategic partnerships. Collectively, these dynamics shape a propulsion ecosystem that demands agility, foresight, and collaborative innovation. As stakeholders navigate this transformative landscape, the insights presented herein provide a strategic compass to align investments, optimize operations, and harness emerging opportunities within the global space propulsion arena.

Engage Directly with Ketan Rohom to Secure Your In-Depth Space Propulsion Market Research Report and Unlock Actionable Insights

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our in-depth analysis can inform your strategic decisions and drive competitive advantage in space propulsion. Partnering with Ketan will grant you access to detailed assessments of propulsion technologies, segmentation insights, regional dynamics, and company profiles tailored to your needs. His expertise will guide you through the report’s findings, enabling you to translate intelligence into impact. Don’t miss the opportunity to equip your organization with actionable insights-reach out to Ketan Rohom today to secure your copy of the comprehensive space propulsion market research report.

- How big is the Space Propulsion Market?

- What is the Space Propulsion Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?