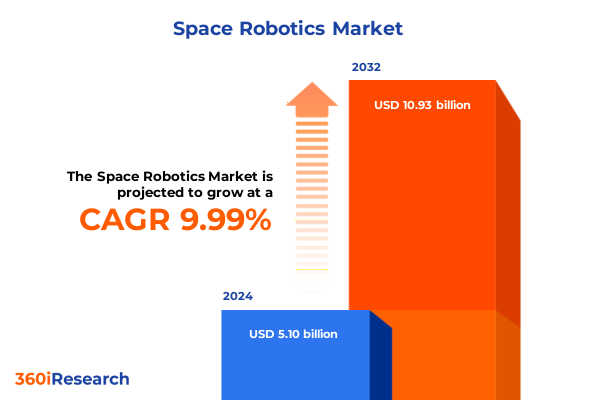

The Space Robotics Market size was estimated at USD 5.57 billion in 2025 and expected to reach USD 6.09 billion in 2026, at a CAGR of 10.10% to reach USD 10.93 billion by 2032.

Unlocking the Future of Celestial Exploration Through Advanced Space Robotics: A Strategic Overview of Emerging Opportunities and Critical Innovations

Advancements in robotic technologies are rapidly transforming the way nations and private enterprises envision operations beyond Earth’s atmosphere. From lunar surface exploration to complex satellite servicing missions, new robotic platforms are enabling unprecedented autonomy and resilience in extraterrestrial environments. Breakthroughs in artificial intelligence, sensor integration, and materials science are converging to deliver systems capable of performing intricate tasks with minimal human intervention, thereby reducing mission risk and driving cost efficiencies.

At the same time, the space ecosystem is witnessing unprecedented collaboration between established aerospace integrators, agile startups, and academic research centers. These synergies are fostering a rich environment for innovation in subsystems, software development, and service delivery. Regulatory frameworks are adapting to accommodate new paradigms in on-orbit assembly, robotic maintenance, and in-space manufacturing, all of which are setting the stage for the next wave of commercial and governmental missions.

This executive summary offers a strategic overview of the space robotics market, emphasizing emerging opportunities, key technological shifts, and external factors shaping strategic decisions. It outlines how recent policy developments, tariff regimes, and regional dynamics intersect with segmentation perspectives to inform investment priorities. By synthesizing these critical insights, decision-makers can navigate the complex landscape of space robotics and position their organizations at the forefront of cosmic exploration and service delivery.

Moreover, sustainability considerations are increasingly influencing system architecture and mission planning. The imperative to minimize space debris and optimize end-of-life de-orbit strategies is driving robust design principles and service offerings focused on safe disposal and reusability. These trends underscore the importance of an integrated view that balances technological ambition with long-term orbital stewardship.

Charting the Dramatic Technological and Operational Shifts Reshaping the Space Robotics Sector and Redefining Extraterrestrial Capabilities

Emerging artificial intelligence frameworks are empowering robotic platforms with adaptive decision-making capabilities, enabling real-time navigation and hazard avoidance in dynamic space environments. These intelligence-driven architectures facilitate autonomous mission execution, reducing reliance on ground control loops and minimizing communication latencies. By integrating machine learning algorithms with high-fidelity sensor suites, robotic units can self-calibrate and adjust operational parameters to maintain peak performance under the extreme conditions of extraterrestrial settings.

In parallel, the trend toward miniaturization and modularity is unlocking new mission profiles that were previously cost-prohibitive or technologically out of reach. Compact subsystems, standardized interfaces, and plug-and-play designs allow rapid reconfiguration of robotic assets for diverse payloads and objectives. This shift not only accelerates deployment timelines but also enhances repairability and upgrade pathways, extending the operational lifespan of in-orbit platforms.

Commercial in-space manufacturing and on-orbit servicing missions are rapidly moving from theoretical concepts to reality. Robotic assembly modules are now being tested for tasks ranging from construction of large structural elements to precision welding in microgravity. Complementary developments in de-orbiting service vehicles and debris capture robotics underscore the holistic approach required to sustain orbital infrastructure and preserve access to critical orbital corridors.

Furthermore, the integration of digital twin models and advanced simulation environments is creating a seamless feedback loop between virtual and physical systems. Blockchain-based data provenance protocols are enhancing the security and traceability of mission telemetry, while edge-computing capabilities reduce the burden on terrestrial data centers. Together, these transformative shifts are redefining the strategic calculus for stakeholders seeking to capitalize on the next generation of extraterrestrial robotics capabilities.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Supply Chains Investment Decisions and Competitive Dynamics in Space Robotics

The introduction of new tariff measures by the United States in early 2025 has reverberated across the global space robotics supply chain, imposing duties on critical components such as advanced sensors, precision actuators, and specialized materials. These policy adjustments reflect a broader strategic intent to strengthen domestic manufacturing capabilities and reduce dependency on foreign suppliers for mission-critical hardware. As a result, regional production hubs are realigning their sourcing strategies to mitigate exposure to escalating import levies.

Component-level costs have increased materially for subsystems heavily reliant on international vendors, prompting prime contractors to reevaluate vendor agreements and explore alternative supply options. Electronics modules, high-precision gears, and composite materials have all experienced escalated end-to-end procurement expenses. In response, some entities have accelerated investment in local foundries and fabrication centers to internalize production of high-value assemblies and insulate their project budgets from tariff volatility.

Investment committees are increasingly prioritizing capital allocation toward domestic ecosystem development, encompassing both physical manufacturing infrastructure and workforce upskilling initiatives. Joint ventures between established aerospace firms and emerging technology startups have gained traction as a means to share risk and pool resources in navigating the new tariff landscape. These collaborative models offer a pathway to maintain program timelines while fostering innovation through cross-pollination of expertise.

Competitive dynamics are shifting as U.S.-based organizations leverage tariff-induced headwinds to consolidate market positioning and advocate for favorable policy adjustments. Meanwhile, non-U.S. operators are adapting by dual-sourcing components and reconfiguring assembly processes. Overall, the tariff regime has underscored the importance of supply chain resilience, strategic localization, and proactive policy engagement in sustaining leadership within the space robotics domain.

Illuminating Critical Segmentation Perspectives Across Product Services Robot Types Applications and End Users Shaping Space Robotics Strategies

Segmenting by product type reveals three pivotal segments. Robotics and subsystems incorporate structural frameworks, actuators, and mobility platforms essential for task execution in microgravity. Sensors and autonomous systems integrate perception modules including LiDAR arrays and inertial units to enable precise navigation. Software platforms power mission planning, diagnostics, and adaptive control, synchronizing hardware elements across diverse operational scenarios.

Service offerings further diversify the market landscape, spanning de-orbiting services and launch support to on-orbit assembly and manufacturing. Re-supply missions deliver critical cargo to space stations, while satellite servicing operations perform in-situ inspections and repairs. Surface mobility services deploy rugged rovers and traction systems for planetary terrain traversal, enhancing exploration and infrastructure development beyond Earth.

Analyzing by type of robots underscores the breadth of platforms in play. Drones facilitate agile inspections and payload delivery in orbital and confined environments. Humanoids emulate human dexterity for maintenance tasks. Microbots and nanobots enable coordinated swarm operations for precise assembly. Rovers traverse planetary surfaces, and satellite robots specialize in docking, refueling, and module reconfiguration.

Application-based segmentation highlights autonomous operations such as resource extraction, robotic satellite assembly, and spacecraft docking, illustrating systems operating independently of human control. Exploration and inspection include planetary surveying and station integrity assessments. Communication roles leverage robotic relays, while defense integrates threat detection capabilities. Maintenance, repair, logistics, and transportation round out mission-critical activities.

End-user segmentation identifies groups ranging from commercial enterprises deploying revenue-driven services to educational institutions conducting technology validation missions. Government agencies leverage robotic assets for defense, scientific exploration, and policy initiatives, while non-profit organizations support standardization and sustainability endeavors. Research institutions drive foundational innovation, advancing autonomy, materials science, and integrated system design that power next-generation space robotics solutions.

This comprehensive research report categorizes the Space Robotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Services

- Type Of Robots

- Application

- End-User

Unearthing Regional Dynamics and Growth Propulsion in the Americas Europe Middle East Africa and Asia Pacific for Space Robotics Adoption

Within the Americas, the United States leads with a mature industrial base, robust defense investments, and dynamic commercial initiatives driving space robotics innovation. Canada contributes advanced sensor development and specialized software platforms, while Latin American actors are exploring collaborative satellite servicing projects and educational missions. This combined ecosystem benefits from a supportive regulatory environment and extensive ground infrastructure, facilitating accelerated prototyping, qualification, and deployment cycles across terrestrial and orbital applications.

In Europe, the Middle East, and Africa, European nations underpin their initiatives through the European Space Agency’s robotics programs, emphasizing cooperation on on-orbit servicing and lunar precursor missions. Middle Eastern actors are rapidly investing in autonomous systems to diversify their space portfolios, establishing innovation hubs and joint ventures with global partners. In Africa, emerging research institutions and government agencies are leveraging low Earth orbit technologies for Earth observation and resource management, laying the groundwork for indigenous robotics capabilities.

The Asia Pacific region is characterized by expanding national space agencies and growing private sector participation. China’s ambitious lunar exploration roadmap includes integrated robotic platforms, while India continues to develop versatile autonomous systems for satellite deployment and planetary exploration. Japan advances dexterous robotic arms and modular lunar landers, and Australia fosters research consortia focusing on surface mobility and digital twin technologies. This convergence of public and private endeavors within Asia Pacific is catalyzing a new wave of innovation and cross-border collaboration in space robotics.

This comprehensive research report examines key regions that drive the evolution of the Space Robotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Pioneers and Emerging Innovators Driving Strategic Developments and Competitive Edge within the Space Robotics Ecosystem

In the commercial and governmental ecosystem of space robotics, established aerospace integrators have been systematically enhancing their portfolios to encompass advanced robotic platforms and service contracts. These industry stalwarts have leveraged decades of experience in structural design, propulsion systems, and mission management to deliver robust robotic solutions that adhere to stringent qualification and certification standards. Their scale and vertical integration enable seamless delivery of end-to-end mission capabilities, from subsystem fabrication through operational support, ensuring continuity for flagship exploration and defense programs.

Concurrently, a wave of agile technology startups is reshaping competitive dynamics by introducing specialized subsystems, AI-driven autonomy layers, and modular deployment architectures. These emerging innovators have harnessed lean development methodologies and iterative prototyping to accelerate time-to-market for novel capabilities, challenging traditional paradigms around cost structures and technology transfer. By focusing on targeted applications such as swarm-based debris removal or in-space additive manufacturing, these new entrants are carving high-growth niches within the broader robotics landscape.

Collaborations between established integrators and startups have become increasingly prevalent, driven by the need to integrate cutting-edge technologies into legacy systems and to share risk in pioneering missions. Strategic partnerships and consortium models are facilitating joint development of scalable standards, interoperability protocols, and integrated test facilities. Research institutions and specialized service providers are also participating in these collaborative frameworks, contributing expertise in autonomy, materials science, and digital simulation to create a cohesive innovation ecosystem that drives continuous improvement across the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Space Robotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus S.E.

- Astrobotic Technology, Inc.

- Baker Hughes Company

- Boston Dynamics, Inc.

- Canadian Space Agency

- ClearSpace

- DFKI GmbH

- European Space Agency

- Fugro

- GMV Innovating Solutions S.L.

- Honeybee Robotics

- Indian Space Research Organisation

- Ispace Inc.

- ispace,inc.

- Japan Aerospace Exploration Agency

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Maxar Technologies Holdings Inc.

- Metecs, LLC

- Mitsubishi Electric Corporation

- Motiv Space Systems Inc.

- National Aeronautics and Space Administration

- Northrop Grumman Corporation

- Oceaneering International, Inc.

- PIAP Space Sp. z o.o.

- PickNik Inc.

- Redwire Corporation

- Rogue Space Systems Corporation

- Russian Federal Space Agency

- SpaceRobotics.EU

Driving Strategic Growth and Operational Excellence in Space Robotics Through Targeted Investments Collaborative Frameworks and Technological Synergies

Industry leaders should prioritize the integration of advanced autonomy frameworks into core robotic architectures to facilitate real-time decision-making and resilience in unpredictable environments. By investing in machine learning pipelines optimized for space-qualified hardware, organizations can reduce reliance on ground stations and enhance mission reliability. Establishing cross-functional centers of excellence that bring together autonomy engineers, systems architects, and data scientists will accelerate development cycles and promote best practices in algorithm validation and flight testing.

To mitigate the effects of supply chain volatility and tariff-induced pressures, enterprises must diversify procurement strategies and cultivate strategic relationships with domestic and international suppliers. This includes selectively onshoring critical manufacturing processes for high-value components while preserving global partnerships for non-core elements. Structured risk assessments, scenario planning workshops, and supplier scorecards will provide the visibility needed to secure tiered supply networks and maintain program cadence under fluctuating trade conditions.

Forging robust partnerships across the innovation ecosystem is essential for rapid capability maturation. Collaborative R&D consortia, co-investment vehicles, and shared laboratory infrastructure can accelerate technology readiness levels and distribute financial risk. Leaders should actively engage academic institutions and research centers to tap into emerging breakthroughs in materials, autonomy, and digital twins. Such synergistic alliances will generate scalable solutions that benefit multiple mission profiles.

Engagement with regulatory bodies and active participation in industry working groups will ensure that evolving policy frameworks remain aligned with technological progress. Decision-makers should champion sustainable practices, incorporating debris mitigation protocols and standards-based interfaces into development roadmaps. By aligning strategic initiatives with environmental and safety mandates, organizations can safeguard long-term access to orbital and planetary environments while fostering public trust and investor confidence.

Detailing a Rigorous Research Methodology Integrating Primary Industry Interviews Secondary Data Analysis and Robust Validation to Ensure Insight Credibility

This research utilized a comprehensive approach to gather and synthesize insights into the space robotics market, drawing upon a diverse array of data sources. A curated compendium of technical journals, government white papers, patent databases, and regulatory filings provided foundational context on technological trends and policy initiatives. Market intelligence from trade publications and conference proceedings enriched the analysis with real-time accounts of pioneering missions and emerging best practices.

Secondary research focused on systematically reviewing publicly available documentation related to subsystem advancements, service offerings, and regional regulatory developments. Academic collaborations and industry consortium reports were examined to track progress in autonomy algorithms, materials innovation, and on-orbit infrastructure projects. This phase established baseline benchmarks and identified key thematic drivers that informed subsequent inquiry.

Primary research involved structured interviews with subject matter experts across the ecosystem, including senior engineers, program managers, procurement specialists, and policy analysts. These qualitative interactions were designed to elicit nuanced perspectives on operational challenges, strategic priorities, and technology adoption timelines. Insights gained from these conversations were cross-referenced with quantitative data points to enhance the depth and precision of the findings.

Data triangulation and validation protocols were applied throughout the analysis to ensure reliability and accuracy. Statistical techniques, comparative scenario modeling, and peer review workshops were employed to resolve discrepancies and refine interpretations. The resulting synthesis offers a balanced and defensible portrayal of current market dynamics and strategic imperatives, delivering actionable guidance for stakeholders navigating the evolving landscape of space robotics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Space Robotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Space Robotics Market, by Product Type

- Space Robotics Market, by Services

- Space Robotics Market, by Type Of Robots

- Space Robotics Market, by Application

- Space Robotics Market, by End-User

- Space Robotics Market, by Region

- Space Robotics Market, by Group

- Space Robotics Market, by Country

- United States Space Robotics Market

- China Space Robotics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Strategic Imperatives and Industry Trajectories to Illuminate the Pivotal Role of Robotics in Propelling Future Space Endeavors

As the frontier of space robotics continues to expand, the convergence of autonomy, modular design, and service innovation is redefining the boundaries of mission capability. The 2025 tariff landscape has underscored the critical importance of supply chain resilience and strategic localization, while segmentation insights have illuminated pathways for targeted investment in hardware, software, and service offerings. Regional dynamics demonstrate the diverse approaches shaping global leadership, from established aerospace nations to rising innovative markets across Asia Pacific and EMEA.

Industry leaders equipped with a comprehensive understanding of these dynamics are poised to capitalize on emerging opportunities, drive strategic partnerships, and navigate policy environments with agility. By integrating the actionable recommendations and leveraging robust research methodologies, organizations can chart a clear course toward sustainable growth and technological excellence. In this pivotal era of exploration, the strategic decisions made today will lay the groundwork for tomorrow’s breakthrough achievements and enduring presence beyond Earth’s orbit.

Engage with Ketan Rohom to Unlock Comprehensive Space Robotics Insights and Propel Your Strategic Decisions with Our Authoritative Market Research Report

As space robotics continues to chart new horizons, access to authoritative market insights becomes indispensable for informed strategic planning and competitive advantage. The comprehensive research report provides deep dives into technological shifts, regulatory impacts, and segmentation analysis, alongside regional and corporate perspectives to support high-stakes decision-making.

Engage with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure this indispensable resource. Ensure your team is equipped with the intelligence needed to drive tomorrow’s missions today and turn visionary concepts into operational realities.

- How big is the Space Robotics Market?

- What is the Space Robotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?