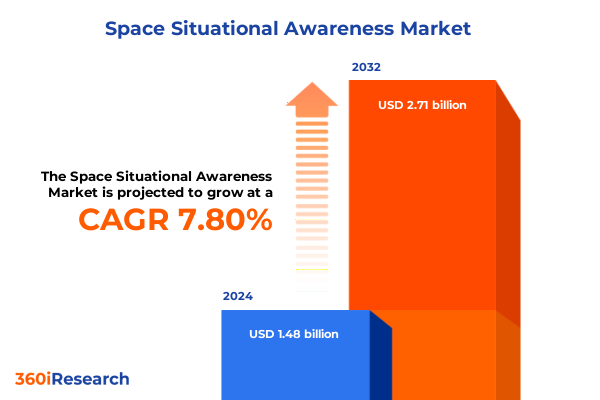

The Space Situational Awareness Market size was estimated at USD 1.60 billion in 2025 and expected to reach USD 1.72 billion in 2026, at a CAGR of 7.82% to reach USD 2.71 billion by 2032.

Navigating the Expanding Frontiers of Space Integrity Through Advanced Situational Awareness Strategies for Comprehensive Risk Identification and Proactive Mitigation

Space situational awareness has emerged as a critical enabler for safeguarding assets, preserving orbital integrity, and ensuring the longevity of both commercial and government space endeavors. The escalating volume of objects traversing Earth’s orbits, ranging from mega-constellation satellites to centuries-old debris, has intensified collision risks and underscored the need for comprehensive tracking frameworks. In response, organizations are increasingly embracing real-time telemetry, predictive analytics, and artificial intelligence to detect and mitigate close encounter threats before they materialize.

Drawing upon cross-disciplinary expertise, industry pioneers are converging advanced sensor networks with cloud-based processing platforms to deliver actionable intelligence. Government entities and private operators alike recognize that enhancing situational awareness is no longer a discretionary effort but a strategic imperative. Legislative bodies are expanding regulatory guidelines, while international collaborations strive to standardize data-sharing protocols to fortify collective resilience against orbital hazards.

Against this backdrop, our analysis synthesizes the latest developments in service delivery models, component innovations, and platform architectures that define the current trajectory of space situational awareness. By charting these dynamics, we lay the groundwork for understanding transformative market shifts, regional differentiation, and the collaborative pathways that will shape the industry’s evolution.

Charting the Pivotal Technological and Strategic Transformations Reshaping Space Situational Awareness Architectures in Response to Accelerating Orbital Congestion and Threats

Over the past few years, the landscape of space situational awareness has been reshaped by a convergence of technological breakthroughs and strategic realignments. The advent of miniaturized sensor systems coupled with the proliferation of low Earth orbit (LEO) constellations has driven an imperative for scalable, high-fidelity tracking solutions. As a result, next-generation sensor arrays now integrate optical, infrared, and radar modalities to deliver multi-spectrum insights, enabling more precise contextual awareness of both cooperative and non-cooperative objects.

Simultaneously, cloud-native processing environments have redefined data analytics capabilities, empowering operators to harness machine learning algorithms for anomaly detection, trajectory prediction, and automated conjunction assessment. This shift from legacy on-premises architectures to distributed computational models has catalyzed faster decision cycles and elevated the standard of service-level agreements across commercial and defense segments. Furthermore, regulatory frameworks have evolved to mandate proactive collision avoidance protocols, compelling stakeholders to integrate automated maneuver planning into their operational toolkits.

Transitioning from siloed point solutions to holistic awareness architectures, the industry now prioritizes interoperability and data federation. Strategic alliances between satellite operators, analytics providers, and ground station networks underscore a collective commitment to shared situational understanding. These transformative currents are setting the stage for an era defined by resilient, collaborative, and predictive space traffic management paradigms.

Assessing the Comprehensive Ripple Effects of 2025 United States Space Technology Tariffs on Global Situational Awareness Supply Chains and Collaboration

In early 2025, the United States enacted revised tariffs targeting the import and export of advanced space technology components, citing national security and technology transfer concerns. These measures, while aimed at protecting domestic innovation, have generated cascading impacts across the global supply chain that underpin situational awareness solutions. Suppliers of communication modules, processing hardware, and specialized sensors have adjusted sourcing strategies, prompting delays in hardware deployments and price adjustments for key subsystems.

Vendors with integrated manufacturing facilities within the United States have navigated these changes more seamlessly, capitalizing on domestic supply continuity to maintain defense contracts and commercial service commitments. Conversely, international manufacturers reliant on cross-border component flows have accelerated partnerships with regional assemblers outside the tariff’s jurisdiction. This recalibration has not only reshuffled the competitive landscape but also galvanized investment in localized production capabilities to mitigate future policy volatility.

Meanwhile, end users from government agencies to research institutions are recalibrating procurement timelines, emphasizing modular architectures that accommodate component substitutions without compromising performance. The cumulative effect of these policy-driven supply realignments underscores the critical importance of adaptive procurement frameworks, agile design philosophies, and diversified sourcing networks as foundational pillars for sustaining space situational awareness resilience.

Unveiling Critical Market Insights Through Segmentation Analysis of Service, Component, Platform, Deployment, and End User Nuances in Space Awareness

A nuanced examination of market segmentation reveals the multifaceted nature of space situational awareness offerings. Service portfolios are distinguished by their operational focus, spanning real-time conjunction assessment and collision avoidance orchestration, advanced data analytics and reporting insights, continuous monitoring and tracking operations, and emergent space debris removal initiatives. These differentiated services address diverse risk profiles, from immediate collision threats to long-term orbital sustainability challenges.

Turning to the underlying component landscape, critical subsystems include communication systems, power systems, processing units, and sensor systems. Within communication frameworks, both antennas and transponders play pivotal roles in sustaining telemetry and command channels. Processing architectures bifurcate into hardware processors and software solutions designed for intensive data fusion tasks, while sensor arrays encompass infrared, optical, and radar modalities that collectively enhance detection fidelity across varying payload signatures.

Platform typologies further refine market dynamics, with ground stations providing terrestrial interface points, mobile tracking units enabling agile field deployment, and satellite platforms delivering on-orbit data acquisition. Satellite classes extend from large flagship vehicles to medium-sized platforms and burgeoning small satellite constellations, each contributing unique deployment considerations. Deployment modes, whether ground based or space based, define infrastructure footprints and operational constraints, while end users, ranging from commercial enterprises to defense organizations, government agencies, and research institutions, shape demand drivers, service-level expectations, and investment priorities.

This comprehensive research report categorizes the Space Situational Awareness market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Component Type

- Platform Type

- Deployment Mode

- End User

Deciphering Regional Dynamics Highlighting Growth Drivers and Strategic Priorities Across Americas, Europe Middle East & Africa, and Asia-Pacific in Space Observability

Regional dynamics are instrumental in shaping the deployment and evolution of space situational awareness capabilities. In the Americas, a robust ecosystem of private sector innovators, supported by government procurement programs, has accelerated the adoption of sensor networks and analytics platforms. Collaborative ventures with national defense agencies have fostered advanced capabilities for real-time monitoring, while commercial operators have sought differentiated service offerings to support expanding satellite constellations.

Within Europe, the Middle East, and Africa, the emphasis on regulatory harmonization has been particularly pronounced. Multinational consortia are standardizing data-sharing frameworks, enabling cross-border tracking and alert exchanges. National space agencies in Europe and the Gulf region are investing in hybrid ground and space-based sensors to bolster regional resilience, while research institutions across Africa are leveraging university-led programs to cultivate local expertise and infrastructure.

Asia-Pacific markets present a diverse mosaic of capability levels, with established programs in Japan and Australia complementing rapidly emerging initiatives in India and Southeast Asia. Investment in mobile tracking units and satellite-based monitoring has escalated, driven by strategic imperatives to safeguard national assets and foster commercial service expansion. Across all regions, the interplay between public sector mandates and private sector innovation continues to define the strategic priorities and growth trajectories of space situational awareness ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Space Situational Awareness market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Advancements in Space Situational Awareness Through Next-Generation Technologies

Across the competitive landscape, leading technology developers and service providers are consolidating their positions through strategic partnerships, acquisitions, and continuous R&D investment. Aerospace and defense conglomerates have augmented their sensor portfolios, integrating multi-sensor fusion capabilities to strengthen conjunction analysis offerings. Simultaneously, specialized analytics companies are expanding their footprint by embedding machine learning-driven predictive tools into established command and control systems.

Innovative new entrants are carving niches by focusing on rapid deployment of mobile tracking units and modular sensor suites tailored for small satellite operators. Partnerships with ground station networks have accelerated service rollouts, enabling near-global coverage at reduced latency. At the same time, established satellite manufacturers are internalizing situational awareness functionalities, embedding onboard processing and sensor subsystems into next-generation platforms to deliver enhanced autonomy.

Collaboration between traditional aerospace firms and agile software-focused enterprises is driving the co-creation of end-to-end solutions that span hardware, data analytics, and mission services. This cross-pollination is yielding integrated platforms capable of addressing the full spectrum of situational awareness needs, from routine orbit determination to advanced maneuver planning. As these symbiotic relationships strengthen, market players are better positioned to deliver resilient, scalable offerings that anticipate evolving orbital challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Space Situational Awareness market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aireon LLC

- ANSYS, Inc.

- Astroscale Holdings Inc.

- DA-Group

- Elecnor Deimos

- Electro Optic Systems Holdings Limited

- ExoAnalytic Solutions, Inc.

- GlobVision Inc.

- GMV Innovating Solutions, S.L.

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies, Inc.

- Launchspace Technologies Corporation

- LeoLabs, Inc.

- Lockheed Martin Corporation

- NorthStar Earth & Space Inc.

- Orbit Logic by Boecore, Inc.

- Orbitform, LLC

- Parsons Corporation

- Peraton Corp.

- Share my space

- SpaceNav

- Swedish Space Corporation

- Telespazio S.p.A.

- The Aerospace Corporation

- Vision Engineering Solutions, LLC

Delivering Strategic and Operational Recommendations to Empower Industry Leaders in Elevating Space Situational Awareness Resilience and Collaborative Agility

Industry leaders should prioritize the development of interoperable architectures that facilitate seamless data exchange across disparate sensor networks and command systems. Establishing common data standards and adopting open application programming interfaces will foster collaboration among operators, analytics vendors, and regulatory bodies, expediting collective responses to emergent threats.

Further, organizations must invest in scalable cloud and edge computing infrastructures to support the accelerating volume of space traffic data. By integrating machine learning pipelines for anomaly detection and automated maneuver recommendations, operators can reduce manual decision bottlenecks and enhance responsiveness to conjunction alerts.

Strategic diversification of supply chains is equally vital to mitigate the impact of policy shifts and geopolitical uncertainties. Cultivating relationships with regional component manufacturers and developing modular hardware designs will safeguard long-term program continuity. Simultaneously, forging public-private partnerships can unlock co-investment opportunities that advance sensor deployment and analytics innovation, aligning government priorities with commercial agility.

Finally, a commitment to workforce development and continuous learning will ensure that technical personnel remain proficient in cutting-edge analytics tools, orbital mechanics simulations, and regulatory compliance frameworks. By embedding these recommendations into strategic roadmaps, industry leaders can bolster both resilience and competitive advantage.

Detailing a Structured Research Framework Integrating Rigorous Primary Interviews and Comprehensive Secondary Analysis for Space Situational Insights

Our research framework integrates a multi-layered approach combining primary data collection with in-depth secondary analysis. Initially, structured interviews with senior executives, systems engineers, and policy experts across defense, commercial, and academic institutions provided qualitative insights into strategic priorities, technology adoption barriers, and collaboration models.

Complementing these interviews, targeted surveys of satellite operators and ground infrastructure providers quantified service utilization patterns and investment preferences. The resulting data were triangulated with publicly available technical white papers, regulatory filings, and satellite catalog databases to contextualize trending developments.

Analytical techniques encompassed thematic coding of qualitative feedback, network analysis of partnership ecosystems, and scenario modeling of orbital traffic densities under varying debris mitigation assumptions. Geospatial mapping tools were employed to assess coverage overlaps and sensor blind spots, while supply chain risk matrices highlighted potential disruption points arising from policy changes and component scarcity.

This cohesive methodology ensures that our findings are grounded in empirical evidence and reflect the nuanced interplay between technological innovation, regulatory dynamics, and market imperatives. By merging rigorous primary research with comprehensive secondary validation, the analysis delivers robust, actionable intelligence for stakeholders navigating the complexities of space situational awareness.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Space Situational Awareness market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Space Situational Awareness Market, by Service Type

- Space Situational Awareness Market, by Component Type

- Space Situational Awareness Market, by Platform Type

- Space Situational Awareness Market, by Deployment Mode

- Space Situational Awareness Market, by End User

- Space Situational Awareness Market, by Region

- Space Situational Awareness Market, by Group

- Space Situational Awareness Market, by Country

- United States Space Situational Awareness Market

- China Space Situational Awareness Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Path Forward for Enhanced Space Situational Awareness and Risk Mitigation

Bringing together the diverse threads of technological evolution, policy influences, and market dynamics underscores the strategic importance of proactive space situational awareness. The industry’s pivot toward holistic sensor integration, cloud-native analytics, and automated maneuver planning is reshaping risk management paradigms and redefining operational standards.

The 2025 tariff adjustments have highlighted the necessity for supply chain resilience and adaptive procurement strategies, underscoring that agility and diversification are essential to maintaining continuity in critical capability deployment. Concurrently, regional initiatives across the Americas, EMEA, and Asia-Pacific reveal that collaborative data-sharing frameworks and cross-sector partnerships will be instrumental in scaling situational awareness infrastructures.

Key industry players are forging alliances that marry hardware innovation with software-centric analytics, delivering integrated solutions capable of addressing both routine tracking and emergent anomaly scenarios. These strategic collaborations exemplify the value of combining domain expertise with agile development methodologies to anticipate and neutralize orbital threats effectively.

Looking ahead, organizations that embrace interoperable architectures, invest in advanced computing ecosystems, and cultivate a skilled workforce will be best positioned to lead the next frontier of space security. The insights presented herein illuminate the path forward, guiding decision-makers toward enhanced resilience and sustainable operational excellence.

Engage with Ketan Rohom to Accelerate Your Strategic Understanding and Secure Comprehensive Insight into Space Situational Awareness Market Opportunities

Empowering stakeholders to capitalize on emergent space situational awareness capabilities demands collaboration, clarity, and a definitive path forward. To that end, engaging with Ketan Rohom presents a unique opportunity to align strategic objectives with actionable insights tailored to your organization’s ambitions. As Associate Director of Sales & Marketing, Rohom offers direct access to the full breadth of our comprehensive research, ensuring you can navigate the complexities of orbital security with confidence.

By initiating dialogue with Ketan Rohom, leaders gain a customized consultation that delves into the market’s nuanced dynamics, from service innovations to regulatory developments. This engagement not only facilitates a deeper understanding of critical risk drivers but also identifies collaboration avenues that can elevate your situational awareness posture. Rohom’s expertise bridges analytical rigor with real-world application, enabling you to translate research findings into decisive strategies.

Reach out today to secure your organization’s competitive edge in the rapidly evolving domain of space situational awareness. Through this partnership, you’ll unlock prioritized recommendations, access to exclusive data sets, and ongoing advisory support designed to transform insights into impactful outcomes at every stage of your operational and strategic planning.

- How big is the Space Situational Awareness Market?

- What is the Space Situational Awareness Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?