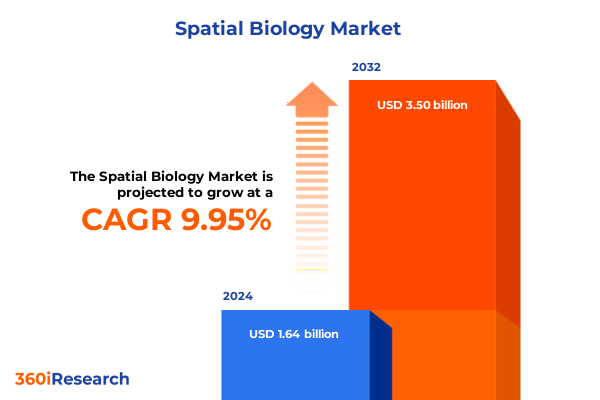

The Spatial Biology Market size was estimated at USD 1.79 billion in 2025 and expected to reach USD 1.97 billion in 2026, at a CAGR of 10.03% to reach USD 3.50 billion by 2032.

Unveiling the Imperative of Spatial Biology to Revolutionize Precision Medicine and Transform Biomedical Research Paradigms Globally

Spatial biology has emerged as a revolutionary discipline at the intersection of molecular analytics and tissue imaging, enabling researchers to map the precise spatial arrangement of biomolecules within biological systems. By integrating high-throughput sequencing with advanced microscopy, spatial biology overcomes the limitations of conventional single-cell analysis, which often detaches cells from their native microenvironment. This paradigm shift not only preserves spatial context but also unveils cellular interactions, architectural heterogeneity, and molecular gradients with unprecedented resolution. Consequently, spatial biology is poised to redefine our understanding of developmental biology, immunology, and oncology by revealing how cells communicate and function within intact tissue structures.

As interdisciplinary collaborations deepen, spatial biology has rapidly transitioned from a nascent research niche to a mainstream investigative framework. Recognized as Nature Methods’ “Technology of the Year” in 2020 and highlighted among the World Economic Forum’s top emerging technologies in 2023, spatial biology’s trajectory is fueled by continual enhancements in throughput, multiplexing capabilities, and three-dimensional imaging. These advancements empower scientists to generate spatially resolved molecular atlases, accelerating translational research and bridging the gap between basic discovery and clinical application. Consequently, spatial biology stands at the forefront of precision medicine, offering the promise of more accurate diagnostics, tailored therapeutics, and novel biomarkers.

Charting the Technological Renaissance of Spatial Biology Fueled by Multiomic Integration and AI-Driven Analytics Pushing Resolution and Throughput Boundaries

The spatial biology landscape is undergoing transformative shifts, characterized by the convergence of multiomic integration and artificial intelligence. Rather than treating genomic, transcriptomic, proteomic, and metabolomic datasets in isolation, next-generation spatial platforms now enable simultaneous profiling of multiple molecular layers within the same tissue section. This holistic approach facilitates deeper insights into cellular heterogeneity, tissue organization, and disease mechanisms, marking an important technological breakthrough in modern life sciences.

Alongside multiomic convergence, artificial intelligence tools have become indispensable for processing the high-dimensional data generated by spatial assays. AI-driven algorithms enhance image segmentation, correct batch effects, and perform super-resolution reconstructions that push assay sensitivity toward true single-cell granularity. Moreover, the integration of deep learning methodologies streamlines workflow automation, reduces analysis time, and increases reproducibility across laboratories. As these digital innovations mature, they deepen the analytical rigor of spatial biology, enabling researchers to decipher complex cellular interactions and molecular networks with greater precision than ever before.

Assessing the Cumulative Impacts of 2025 U.S. Tariff Measures on Supply Chains for Spatial Biology Instruments Consumables and Analytic Platforms

In 2025, the United States introduced a series of tariffs on imported goods from Canada, Mexico, China, and the European Union, directly affecting the supply chains for spatial biology instruments and consumables. Under these measures, tariffs on Canadian and Mexican imports rose to 25 percent, while Chinese goods saw increases from 10 to 20 percent. Subsequent announcements extended duties of up to 20 percent on European shipments and over 30 percent on certain Asian imports, targeting key components such as reagents, imaging probes, and analytical modules. These policy changes increased procurement costs for assay kits, flow cells, and high-precision microscopes, challenging budgetary allocations in both academic and corporate research settings.

As spatial biology workflows are heavily dependent on imported high-plex reagents and specialized detection probes, the tariffs introduced supply uncertainties and price volatility. Consumables like enzyme substrates, detection antibodies, and barcoding slides became subject to elevated import duties, leading to extended lead times and inventory shortfalls. Instruments including sequencers, laser microdissection units, and high-resolution imaging systems faced similar headwinds, with manufacturers citing increased cost of goods sold and recalibrated pricing strategies to absorb tariffs while maintaining market competitiveness.

Despite these challenges, companies and research institutions have pursued mitigation strategies to preserve experimental continuity. Some instrument suppliers accelerated plans for local manufacturing expansion, establishing new production lines within the United States to circumvent import duties. Meanwhile, collaborations between equipment vendors and reagent providers have intensified, focusing on integrated solutions that optimize supply chain resilience. Although short-term impacts on pricing and procurement persisted, these adaptive measures underscore the industry’s commitment to sustaining spatial biology innovation amidst evolving trade policies.

Unlocking Insights Through Comprehensive Segmentation Spanning Product Types Technologies Samples Detection Methods Modalities Applications and End Users

A nuanced understanding of the spatial biology market emerges when exploring its multiple segmentation dimensions, each reflecting distinct demands and growth drivers. Within product typologies, consumables such as assay kits, detection probes, and specialized slides stand out for their recurring revenue potential, whereas instruments-encompassing analyzers, sequencers, and microscopes-anchor significant capital investments that drive long-term relationships between vendors and end users. The rise of software and analytics platforms further enriches this ecosystem by offering advanced data interpretation tools tailored to spatial datasets, thereby reinforcing the value proposition of upstream technologies.

Equally pivotal is the technological segmentation, where spatial transcriptomics leads the adoption curve due to its broad applicability, followed by spatial proteomics that unlocks direct insight into protein localization and post-translational modifications. Emerging spatial metabolomics is gaining traction for its ability to map microenvironmental metabolite distributions, adding an additional layer of functional context. Furthermore, sample type differentiation highlights the central role of tissue specimens in translational research, while cell samples and organoids cater to fundamental studies and drug screening applications.

Detection methodologies influence assay selection based on resolution, multiplexing capability, and quantification precision. Fluorescence-based detection remains a workhorse for high-plex imaging, immunohistochemistry extends established histopathological workflows, and mass spectrometry-based approaches deliver unparalleled molecular specificity. Meanwhile, modality segmentation distinguishes between two-dimensional imaging platforms suited for routine pathology labs and emerging three-dimensional techniques that reconstruct volumetric tissue architectures.

The application spectrum spans from oncology and immunology, where spatial insights guide therapeutic targeting, to neuroscience and regenerative medicine, where cellular mapping informs developmental models. End users vary across academic institutions, diagnostic laboratories, biopharma companies, and environmental sciences, each prioritizing different facets of spatial analysis. Finally, distribution channels-ranging from traditional direct sales and distributor networks to digital marketplaces-shape access and adoption, underscoring the importance of tailored go-to-market strategies.

This comprehensive research report categorizes the Spatial Biology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Sample Type

- Detection Method

- Modality

- Application

- End-User

- Distribution Channel

Illuminating Regional Dynamics and Growth Forces Shaping the Spatial Biology Ecosystem Across Americas EMEA and Asia Pacific

Regional dynamics exert profound influence on the adoption and evolution of spatial biology across the Americas, EMEA (Europe, Middle East & Africa), and Asia-Pacific. In North America, robust research funding and a dense network of academic medical centers catalyze early adoption of advanced platforms. The presence of leading instrument manufacturers and a mature regulatory framework further accelerates the translation of spatial discoveries into clinical diagnostics and drug development pipelines.

Conversely, Europe’s landscape is characterized by collaborative consortia and public-private partnerships that emphasize harmonized protocols and cross-border data sharing. Regulatory bodies in the EU are actively refining guidelines to accommodate spatial assays in precision oncology, fostering a conducive environment for clinical validation studies. Meanwhile, the Middle East and Africa regions are experiencing nascent growth, driven by partnerships with global vendors and targeted investments in translational research centers.

In the Asia-Pacific region, rapid expansion of life science research hubs in China, Japan, and South Korea has propelled demand for spatial analysis solutions. Government initiatives to bolster biotechnology infrastructure and localized manufacturing capabilities are mitigating import constraints and aligning with broader innovation agendas. Southeast Asian markets are also emerging as strategic sites for clinical trials, leveraging cost advantages and diverse patient cohorts. Collectively, these regional forces underscore the need for differentiated market entry approaches that align with local regulatory landscapes, funding mechanisms, and research priorities.

This comprehensive research report examines key regions that drive the evolution of the Spatial Biology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Spatial Biology Innovators and Their Strategic Moves Driving Platform Enhancements Partnerships Mergers and Market Evolution

Leading spatial biology companies are actively refining their portfolios through strategic collaborations, platform enhancements, and organizational restructuring. Ten-year veterans like 10x Genomics have expanded their Visium spatial transcriptomics line with the Visium CytAssist upgrade, enhancing compatibility with FFPE clinical samples and streamlining workflows for translational research teams. In parallel, Akoya Biosciences has solidified its market position through licensing and distribution agreements with major suppliers, such as the integration of Thermo Fisher’s ViewRNA assays into the PhenoImager systems, enabling simultaneous protein and RNA biomarker detection on whole-slide formats.

Strategic consolidations have also reshaped the competitive landscape. Vizgen’s merger with Ultivue established a new private leader with combined expertise in spatial transcriptomics and proteomic profiling, positioning the company for scale-up in clinical laboratory settings. Meanwhile, NanoString Technologies navigated Chapter 11 proceedings before its acquisition by Bruker, a move that promises to reinforce its CosMx Spatial Molecular Imager platform with Bruker’s analytical instrumentation prowess. Concurrently, Bio-Techne’s investment in AI-based spatial analysis systems exemplifies the push toward integrating machine learning capabilities directly into imaging workflows to reduce data processing timelines and enhance user experience.

Emergent companies such as Resolve Biosciences and Spatial Genomics continue to differentiate themselves through niche applications, targeting high-sensitivity spatial transcriptomics and specialized chromatin mapping methods, respectively. These players, along with established titans like Thermo Fisher Scientific and Bruker, underscore a dynamic competitive environment where innovation and collaboration are paramount to capturing the full potential of spatial biology technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Spatial Biology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10x Genomics, Inc.

- Bruker Corporation

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Bio-Techne Corporation

- Carl Zeiss AG

- Danaher Corporation

- Akoya Biosciences, Inc. by Quanterix Corporation

- Illumina, Inc.

- Miltenyi Biotec B.V. & Co. KG

- Revvity Inc.

- BGI Genomics Co.,Ltd.

- Standard BioTools Inc.

- Macrogen, Inc.

- OriGene Technologies, Inc.

- Visiopharm A/S

- Alpenglow Biosciences, Inc.

- Curio Bioscience by Takara Bio USA Holdings, Inc.

- CytoViva, Inc.

- Kromnigon

- Merck KGaA

- Nucleai, Inc.

- Omicsveu

- RareCyte, Inc.

- Resolve Biosciences GmbH

- Seven Bridges Genomics Inc.

- Spatial Genomics, Inc.

- Vizgen, Inc.

Actionable Strategic Pathways for Spatial Biology Industry Leaders to Optimize Innovation Agility and Supply Chain Resilience Amidst Market Disruptions

To navigate the complexities of today’s spatial biology ecosystem, industry leaders should prioritize diversification of their supply chains by fostering partnerships with multiple regional suppliers and investing in localized manufacturing capabilities. This approach will help mitigate the risks associated with import tariffs and logistical disruptions. In addition, companies should accelerate the integration of AI and machine learning modules into their analytics platforms, as these digital enhancements can significantly reduce data processing times and improve reproducibility across diverse laboratory environments.

Furthermore, aligning product development roadmaps with emerging clinical and research applications-such as multiplexed immune profiling in oncology and volumetric tissue reconstruction for developmental biology-will ensure that offerings remain relevant and compelling to key end users. Engagement with regulatory agencies to co-develop validation frameworks for spatial assays will also streamline the path to clinical adoption. Finally, adopting flexible pricing models and subscription-based consumable programs can enhance customer retention and create predictable revenue streams, enabling companies to reinvest in research and bolster market responsiveness.

Outlining Rigorous Primary and Secondary Research Methodologies Ensuring Validated and Actionable Spatial Biology Market Insights

This analysis is grounded in a rigorous methodology combining primary and secondary research. Secondary sources included peer-reviewed journals, industry white papers, patent filings, public company disclosures, and relevant regulatory guidelines. Key publications, such as recent spatial multi-omics reviews and trade policy analyses, provided the contextual framework for identifying technological advancements and market forces.

Primary research comprised structured interviews with senior executives from leading spatial biology firms, key opinion leaders in academic and clinical research settings, and procurement specialists at major research institutions. These engagements were supplemented by quantitative data triangulation, leveraging company annual reports, patent databases, and custom surveys to validate market segmentation, regional dynamics, and tariff impacts.

Data synthesis employed a multi-stage validation process, integrating qualitative insights with quantitative findings to ensure accuracy and relevance. Cross-referencing vendor-provided data with independent market intelligence minimized biases and reinforced the credibility of strategic recommendations. This comprehensive approach underpins the actionable insights and segmentation breakdowns presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Spatial Biology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Spatial Biology Market, by Product Type

- Spatial Biology Market, by Technology

- Spatial Biology Market, by Sample Type

- Spatial Biology Market, by Detection Method

- Spatial Biology Market, by Modality

- Spatial Biology Market, by Application

- Spatial Biology Market, by End-User

- Spatial Biology Market, by Distribution Channel

- Spatial Biology Market, by Region

- Spatial Biology Market, by Group

- Spatial Biology Market, by Country

- United States Spatial Biology Market

- China Spatial Biology Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Concluding Perspectives on Spatial Biology’s Transformative Influence on Biomedical Research Commercialization and Future Scientific Breakthroughs

Spatial biology continues to redefine the boundaries of biomedical research by preserving the intricate spatial context of molecular interactions within tissues. The confluence of multiomic integration, AI-driven analytics, and modular imaging platforms is catalyzing the discovery of novel biomarkers and therapeutic targets across oncology, immunology, neuroscience, and beyond. Despite headwinds such as shifting trade policies and evolving supply chain constraints, the industry’s adaptive responses-ranging from localized manufacturing to strategic partnerships-highlight a resilient ecosystem dedicated to scientific advancement.

Looking ahead, key segmentation dimensions, including product types, technologies, sample preferences, and end-user applications, will remain critical lenses for targeted innovation. Regional dynamics across the Americas, EMEA, and Asia-Pacific underscore the importance of localized strategies, while market leaders continue to differentiate through platform enhancements, mergers, and AI integration. By following the actionable recommendations detailed in this report, stakeholders can navigate uncertainties, capitalize on emerging trends, and ultimately accelerate translational outcomes that benefit patients worldwide.

Connect with Associate Director Ketan Rohom to Access the Comprehensive Spatial Biology Market Research Report and Empower Data-Driven Decisions

To explore the transformative potential of this report and leverage its strategic insights, contact Ketan Rohom, Associate Director, Sales & Marketing. Engaging directly with Ketan Rohom will provide you with tailored guidance on the comprehensive spatial biology market research report, ensuring you secure the detailed analyses, segmentation breakdowns, and regional evaluations that align with your organizational goals. This direct dialogue will help you understand how the data-driven recommendations can inform your investment priorities, innovation roadmaps, and competitive strategies. Reach out to schedule a personalized briefing that will empower your decision-making processes with the depth of expertise encapsulated in this report.

- How big is the Spatial Biology Market?

- What is the Spatial Biology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?