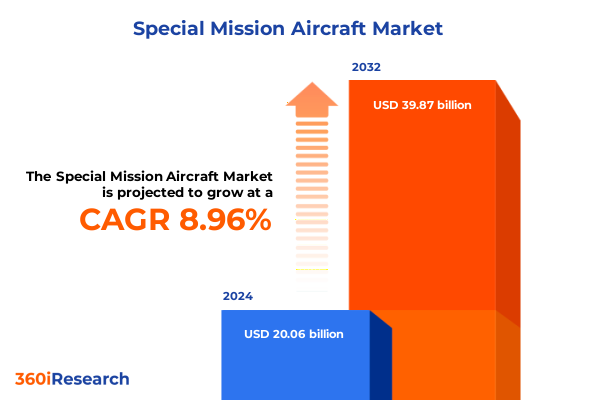

The Special Mission Aircraft Market size was estimated at USD 21.81 billion in 2025 and expected to reach USD 23.72 billion in 2026, at a CAGR of 9.00% to reach USD 39.87 billion by 2032.

Exploring the Evolving Special Mission Aircraft Arena and Its Strategic Importance for Modern Defense, Security, and Humanitarian Operations Worldwide

In recent years, the special mission aircraft sector has emerged as a critical enabler for a broad spectrum of defense, security, and humanitarian operations worldwide. Stakeholders across government and civilian domains increasingly rely on these highly specialized platforms to deliver real-time intelligence, surveillance, reconnaissance, and mission support in complex environments. As threats evolve and operational theaters expand geographically, the demand for versatile airborne capabilities has soared, reshaping how air forces, paramilitary units, and civilian agencies approach mission planning and execution.

Given this dynamic backdrop, industry leaders and decision-makers must grasp the nuances driving the special mission aircraft ecosystem. From next-generation sensor integration and electronic warfare payloads to unmanned aerial vehicle innovations and adaptive modular architectures, the breadth of technological advancements is redefining operational paradigms. Concurrently, rising emphasis on interoperability, digital connectivity, and data fusion underscores the strategic imperative of integrating airborne assets into comprehensive command-and-control networks.

This executive summary distills the key trends, structural shifts, and policy catalysts shaping the market landscape. By examining the transformative forces at play, the cumulative impact of tariff measures, granular segmentation insights, and regional dynamics, readers will gain a holistic understanding of emerging opportunities and potential challenges. Armed with this knowledge, defense planners, procurement officers, and industry stakeholders can align their strategies with evolving requirements and solidify their competitive positioning.

Understanding How Autonomous Systems, Integrated Networks, and Collaborative Ecosystems Are Revolutionizing Special Mission Aircraft Capabilities

The special mission aircraft domain is undergoing a profound transformation fueled by converging technological innovations and shifting threat environments. Autonomous systems have transcended experimental phases to become integral to intelligence surveillance and reconnaissance operations, enabling persistent coverage over vast theaters with reduced pilot risk and operational costs. Simultaneously, advances in propulsion systems and materials science have extended mission endurance and payload flexibility, allowing platforms to operate at higher altitudes for longer durations while accommodating increasingly sophisticated sensor suites.

Electronic warfare capabilities have also experienced a paradigm shift, with cyber-enabled electronic attack and protection systems playing pivotal roles in contesting contested airspaces. Integrated digital architectures now allow seamless coordination between airborne assets and ground-based command centers, facilitating real-time data exchange and dynamic targeting in multi-domain operations. Moreover, the proliferation of network-centric warfare concepts has driven the convergence of airborne early warning, maritime patrol, and border patrol missions onto unified platforms, optimizing resource allocation and reducing logistical footprints.

As a result, collaboration between defense contractors, technology developers, and government agencies has intensified, fostering joint ventures and co-development initiatives that aim to accelerate capability deployment. This collaborative ecosystem is setting the stage for a new era of adaptive, multi-mission aircraft optimized for agility, interoperability, and resilience against emerging threats.

Examining the Repercussions of 2025 Tariff Adjustments on Procurement, Localization, and Supply Chain Strategies for Special Mission Aircraft

In 2025, the United States government implemented a revised tariff structure targeting select foreign-manufactured aerospace components integral to special mission aircraft systems. These measures, aimed at bolstering domestic production and safeguarding critical supply chains, have led to recalibrated procurement strategies among defense agencies and prime contractors. While the intent of protecting national manufacturing has garnered support, the resultant increase in component costs has reverberated across the value chain, prompting reassessment of sourcing models and delivery timelines.

Manufacturers have responded by accelerating localization efforts, expanding domestic partnerships for avionics, sensor, and propulsion subsystem production. In parallel, prime integrators have intensified research into alternative materials and design optimizations to mitigate cost pressures without compromising performance. While some foreign suppliers have sought tariff exemptions by establishing U.S.-based assembly lines or forging joint ventures with American firms, others have experienced reduced competitiveness and contract downgrades.

Furthermore, program managers are increasingly incorporating total life-cycle cost assessments into acquisition decisions, weighing upfront tariff-driven price hikes against long-term maintenance and upgrade benefits. As a result, industry participants are striving for balanced portfolios that blend domestically sourced components with internationally proven subsystems, ensuring both compliance with tariff policies and sustained mission effectiveness.

Revealing the Multi-Dimensional Fabric of Mission Roles, Platform Configurations, Propulsion Systems, and End-User Applications Driving Market Dynamics

The special mission aircraft market segments itself across mission roles, platform configurations, propulsion systems, end users, and performance criteria, each offering distinct insights. Those focused on airborne early warning and control contrast sharply with platforms dedicated to medical evacuation and maritime patrol, while electronic warfare applications delve into offensive and defensive electronic counter measures. Within intelligence surveillance reconnaissance, communications and imagery intelligence functions demand specialized sensor payloads, whereas measurement and signature intelligence hinges on advanced signal processing capabilities. When considering platform types, fixed wing variants excel in long-range operations, rotary wing platforms provide vertical lift for rapid deployment and hover stability, and unmanned aerial vehicles deliver cost-effective, risk-mitigated solutions through high-altitude endurance designs.

Propulsion diversity further enriches the landscape, with turbofan engines driving high-speed surveillance jets, turboprop systems offering fuel efficiency for extended loitering, and piston and electric powerplants supporting lightweight, low-noise airborne ISR missions. The military segment spans air force missions requiring national-level coverage to army tactical support and naval coastal patrols, while para-military operations encompass border security patrols and customs enforcement. On the civilian side, emergency medical services rely on rotorcraft for rapid casualty evacuation, firefighting missions integrate sensor-equipped airframes for fire mapping, and surveying and mapping tasks deploy precision imaging platforms. Range capabilities-from short excursion flights to intercontinental deployments-intersect with weight class considerations, where heavy aircraft host integrated mission suites and light platforms emphasize rapid responsiveness.

This comprehensive research report categorizes the Special Mission Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mission Type

- Platform Type

- Propulsion Type

- Weight Class

- End User

Mapping the Divergent Regional Priorities and Collaborative Frameworks Shaping Special Mission Aircraft Acquisition Strategies Globally

Regional dynamics underscore diverse strategic priorities and capability gaps that influence procurement trajectories. Across the Americas, investment in next-generation airborne early warning platforms and long-range maritime patrol assets reflects a focus on hemispheric security and transnational threat monitoring. Collaboration among North American and Latin American partners has spurred technology transfers and joint exercises, enhancing interoperability in coastal and border regions. In Europe, the Middle East, and Africa, the emphasis on versatile, multi-role platforms capable of operating in contested airspaces and austere environments has catalyzed demand for electronic warfare modifications and rapid reconfiguration kits. Nations in these regions are also exploring unmanned aerial systems to supplement manned fleets and achieve persistent surveillance over vast terrains.

Meanwhile, the Asia-Pacific theater witnesses accelerated adoption of high-altitude long-endurance UAVs for maritime domain awareness and island perimeter patrol, driven by territorial disputes and the necessity for over-the-horizon sensing. Regional air forces and coast guards are expanding rotary wing special mission fleets to support disaster relief operations and emergency medical evacuations in archipelagic nations. Across all regions, interoperability initiatives and joint training exercises continue to shape capability roadmaps, while localized manufacturing hubs and maintenance infrastructures play increasingly pivotal roles in sustaining fleet readiness and reducing operational bottlenecks.

This comprehensive research report examines key regions that drive the evolution of the Special Mission Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning and Evolving Business Models of Leading Integrators and Technology Innovators in the Industry

A handful of prime integrators and specialized technology providers dominate the special mission aircraft ecosystem, each leveraging proprietary platforms and sensor suites to secure strategic programs. These organizations invest heavily in research and development to refine mission management systems, multi-spectral payloads, and advanced stealth coatings that meet stringent defense requirements. Through strategic partnerships, they extend their portfolios by integrating third-party avionics, communications nodes, and ground control stations, thereby offering turnkey solutions that streamline customer procurement and program sustainment.

Business models are evolving to include performance-based logistics and managed service contracts, enabling operators to outsource maintenance, upgrade cycles, and training while focusing on mission execution. Firms are capitalizing on this shift by developing digital twin simulations and predictive maintenance algorithms that optimize aircraft availability and reduce downtime. Moreover, some companies are pioneering modular open systems architectures that facilitate rapid insertion of emerging capabilities, ensuring platforms remain responsive to shifting threat landscapes. Competitive differentiation increasingly hinges on an ability to deliver end-to-end lifecycle support, from initial concept design through fielding, sustainment, and eventual divestment or retrofit.

This comprehensive research report delivers an in-depth overview of the principal market players in the Special Mission Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BAE Systems plc

- Bombardier Inc.

- Dassault Aviation S.A.

- Elbit Systems Ltd.

- Embraer S.A.

- General Dynamics Corporation

- Gulfstream Aerospace Corporation

- Israel Aerospace Industries Ltd.

- Kawasaki Heavy Industries, Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries, Ltd.

- Northrop Grumman Corporation

- Pilatus Aircraft Ltd.

- Raytheon Technologies Corporation

- RUAG International Holding AG

- Saab AB

- Sierra Nevada Corporation

- Sikorsky Aircraft Corporation

- Textron Inc.

- Thales Group

- The Boeing Company

Leveraging Modular Architectures, Strategic Partnerships, and Performance-Based Models to Sustain Relevance and Resilience in Special Mission Aircraft Deployments

Industry leaders must adopt agile procurement frameworks that embrace modular upgrades and open architecture standards, ensuring special mission aircraft retain relevance across evolving theaters. By prioritizing digital interoperability and cloud-enabled mission planning, decision-makers can enhance real-time information sharing between airborne assets and joint command networks. Firms should also explore strategic partnerships with autonomous systems developers and cybersecurity specialists to fortify electronic warfare capabilities and protect critical data links from adversarial intrusion.

Additionally, stakeholders should accelerate localization initiatives through knowledge transfer agreements and joint manufacturing ventures, mitigating tariff impacts and securing resilient supply chains. Investing in pilot and operator training pipelines that leverage mixed reality environments will ensure personnel remain proficient in operating next-generation sensor suites and unmanned platforms. Finally, embracing performance-based logistics can shift risk from operators to providers, promoting sustained readiness and cost certainty throughout the asset lifecycle.

Combining Primary Expert Consultations, Patent Analysis, and Policy Review to Develop a Comprehensive View of Market Drivers and Technological Evolution

This analysis synthesizes insights gathered from a multi-faceted research approach incorporating primary interviews, proprietary databases, and open-source literature. Subject-matter experts from defense agencies, avionics manufacturers, and mission planning organizations were engaged through structured interviews to validate technology trends and procurement rationales. Concurrently, a thorough review of industry white papers, academic publications, and trade journal articles provided context on emerging sensor technologies, propulsion innovations, and regulatory frameworks.

Complementing qualitative data, a detailed examination of patent filings and contract announcements offered visibility into future capability roadmaps and competitive positioning. Regional policy documents and government budgets were analyzed to understand funding priorities and acquisition timelines, while defense symposium proceedings and technical conferences supplied real-world case studies on system performance and integration challenges. Triangulating these sources ensured a balanced perspective on market drivers, potential barriers, and the landscape of innovation shaping special mission aircraft developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Special Mission Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Special Mission Aircraft Market, by Mission Type

- Special Mission Aircraft Market, by Platform Type

- Special Mission Aircraft Market, by Propulsion Type

- Special Mission Aircraft Market, by Weight Class

- Special Mission Aircraft Market, by End User

- Special Mission Aircraft Market, by Region

- Special Mission Aircraft Market, by Group

- Special Mission Aircraft Market, by Country

- United States Special Mission Aircraft Market

- China Special Mission Aircraft Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Reflecting on the Intersection of Technological Advances, Policy Influences, and Collaborative Strategies Shaping the Future of Special Mission Aircraft

The special mission aircraft market stands at the nexus of rapid technological progress and shifting geopolitical imperatives. As autonomous capabilities mature and network-centric operations become the norm, platforms must evolve to deliver multi-domain awareness and precision engagement. Economic and policy measures, such as tariff adjustments, are reshaping supply chains and driving localization, while segmentation nuances underscore the importance of tailored solutions for diverse mission requirements.

Regional dynamics will continue to influence procurement decisions, with interoperability and cost-efficiency guiding collaborative ventures and joint capability development. Industry incumbents and new entrants alike must embrace agile architectures, data-driven maintenance paradigms, and strategic alliances to maintain competitive advantage. Ultimately, the organizations that successfully integrate advanced sensor payloads, resilient communications networks, and flexible upgrade pathways will define the next generation of special mission aircraft.

As defense and security challenges grow in complexity, investing in these critical airborne systems remains essential for safeguarding national interests, supporting humanitarian efforts, and ensuring rapid response capabilities in times of crisis.

Empower Your Organization with Tailored Special Mission Aircraft Intelligence and Direct Support from Our Sales And Marketing Expert

Ready to elevate your strategic advantage with in-depth analysis and actionable intelligence on the special mission aircraft market? Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to acquire the comprehensive market research report that will empower your next critical decision. Secure detailed insights, expert recommendations, and the data-driven guidance you need to navigate complex defense, security, and humanitarian landscapes with confidence. Contact Ketan today to get personalized support and unlock the full potential of this transformative market.

- How big is the Special Mission Aircraft Market?

- What is the Special Mission Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?