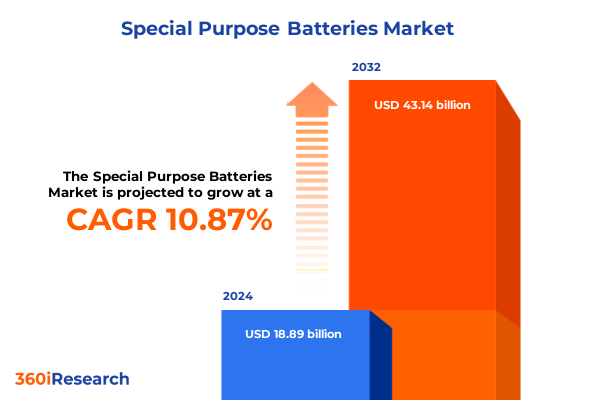

The Special Purpose Batteries Market size was estimated at USD 20.89 billion in 2025 and expected to reach USD 23.10 billion in 2026, at a CAGR of 10.91% to reach USD 43.14 billion by 2032.

Understanding the Rise and Critical Importance of Special Purpose Batteries Across Diverse Industries and Emerging Technological Applications

Special purpose batteries have emerged as indispensable enablers of modern technological advances, powering critical applications that span from life-saving medical devices to next-generation aerospace systems. As demand accelerates across multiple sectors, stakeholders require a holistic understanding of how specialized chemistries, form factors, and application-specific requirements converge to deliver optimized energy solutions. By examining the overarching trends that shape this market, this executive summary lays a foundation for strategic decision-making in an era characterized by rapid innovation and intensifying competition.

In recent years, the emphasis on electrification, renewable energy integration, and automation has propelled special purpose batteries to the forefront of research and capital investment. Organizations are challenged by the need to balance performance, safety, and cost-effectiveness while navigating evolving regulatory landscapes and supply chain disruptions. Consequently, a nuanced perspective is essential to identify both short-term tactical moves and long-term strategic imperatives.

This introduction sets the stage for a multi-faceted exploration of transformative shifts in battery technology, the impact of United States tariffs in 2025, granular segmentation insights, regional dynamics, and leading industry players. Throughout this summary, readers will encounter a clear narrative that connects market forces to actionable recommendations, ensuring preparedness for emerging opportunities and potential risks.

Examining the Key Technological Shifts Redefining Special Purpose Batteries and Shaping Their Role in Future Energy Solutions

As industry demands evolve at a breakneck pace, special purpose batteries are experiencing several transformative shifts that redefine their functional capabilities and strategic importance. Advances in materials science have fueled the emergence of next-generation chemistries such as lithium iron phosphate and solid-state configurations, delivering superior safety profiles, extended lifecycle, and improved energy density compared to legacy systems. These breakthroughs are complemented by ongoing innovation in battery management systems, which utilize predictive analytics and real-time data monitoring to enhance operational reliability and minimize downtime.

Concurrently, manufacturing processes are being reimagined to accommodate flexible form factors, enabling integration in increasingly compact and complex device architectures. From ultra-thin prismatic cells in portable medical implants to high-capacity cylindrical modules in unmanned aerial systems, manufacturers are pushing the boundaries of design to unlock new use cases. In parallel, the circular economy paradigm is gaining traction, with an emphasis on recyclability and recovery of critical raw materials such as cobalt and nickel. These sustainability-driven initiatives not only reduce environmental impact but also mitigate price volatility and supply chain vulnerabilities.

Moreover, digitalization is permeating every layer of the value chain-connecting battery data to cloud platforms, facilitating predictive maintenance, and empowering stakeholders to optimize asset performance. When taken together, these technological and process-oriented transformations are setting the stage for a future in which special purpose batteries will be more intelligent, durable, and environmentally responsible than ever before.

Analyzing the Far-Reaching Consequences of United States 2025 Tariffs on Special Purpose Battery Supply Chains and Industry Dynamics

In 2025, the United States government’s implementation of targeted tariffs on imported battery components has had profound implications for supply chains and cost structures across the special purpose battery sector. These duties, which specifically affect lithium precursors, cathode materials, and specialized alloys, have amplified procurement complexities and compelled manufacturers to reevaluate sourcing strategies. With higher landed costs for critical inputs, some providers have accelerated efforts to diversify supplier bases, pursuing partnerships in regions unaffected by the new tariff regime.

The immediate aftermath saw heightened price volatility, as market participants grappled with fluctuating input expenses that reverberated through contract negotiations and long-term procurement agreements. Midstream processors and cell assemblers have been particularly challenged by abrupt cost escalations, prompting many to renegotiate supply commitments or explore tariff exclusion petitions. In response, a growing number of companies are investing in domestic production capabilities-ranging from lithium refining facilities to advanced cathode synthesis plants-in order to reduce dependence on foreign imports and insulate operations against future policy shifts.

From a strategic perspective, these tariff measures have also encouraged more robust risk management frameworks. Forward-looking organizations are integrating scenario planning into their commercial strategies, assessing potential regulatory changes alongside technological roadmaps. As a result, the industry is witnessing a gradual transition toward more resilient, vertically integrated models that aim to secure critical raw materials, optimize capital allocation, and fortify competitiveness in an increasingly protectionist trade environment.

Unlocking Granular Market Insights through Detailed Chemistry, Form Factor, and Application Segmentation of Special Purpose Batteries

Delving into market segmentation reveals critical nuances that can inform targeted product development and commercialization strategies. Based on chemical composition, the landscape is bifurcated between traditional lead acid systems-available in flooded and valve-regulated variants-and advanced lithium-ion solutions, which encompass subtypes such as lithium cobalt oxide, lithium iron phosphate, lithium polymer, lithium manganese oxide, lithium nickel cobalt aluminum oxide, and lithium nickel manganese cobalt oxide. Each chemistry offers distinct trade-offs in energy density, cost, thermal stability, and recyclability, guiding decision-makers to select the optimal formulation for specific operational demands.

When analyzing form factor, special purpose batteries are differentiated across coin, cylindrical, pouch, and prismatic configurations. Coin cells serve as miniature power sources for compact electronics, with popular diameters that include CR2025, CR2032, and LR44. Cylindrical cells-ranging from 14500 through 26650-are favored in applications that demand modular scalability and robust mechanical resilience. Pouch and prismatic designs, by contrast, provide flexibility in shaping and packaging, making them well-suited for wearable medical devices and high-density automotive modules.

Application-driven segmentation further underscores the diversity of the market, spanning aerospace, industrial automation, medical instrumentation, military and defense, mining operations, oil and gas exploration, and telecommunications infrastructure. Within aerospace, platforms extend from commercial aircraft to drone systems, satellites, and space exploration vehicles. In industrial contexts, automation equipment, backup power solutions, power tools, and robotic systems each impose unique requirements for cycle life and power delivery. Medical devices range from diagnostic and implantable technologies to monitoring and portable equipment. Military and defense applications prioritize reliability for communication equipment, night vision devices, portable power units, and unmanned vehicles. Mining and oil and gas sectors leverage specialized sensing equipment, downhole instrumentation, and subsea monitoring solutions. Finally, telecommunications entities rely on backup power, base station modules, and emergency lighting systems to maintain uninterrupted service.

This comprehensive research report categorizes the Special Purpose Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Technology

- Form Factor

- Application

Evaluating Regional Dynamics and Market Drivers in the Americas, EMEA, and Asia-Pacific for Special Purpose Battery Adoption

Regional dynamics play a pivotal role in shaping the strategic imperatives of special purpose battery manufacturers and end users alike. In the Americas, robust growth in electric vehicles and renewable energy deployments has stimulated demand for high-capacity lithium-ion variants, while mining and oil and gas sectors continue to require resilient power systems for remote operations. Government incentives and state-level regulations also create a patchwork of opportunities and challenges, driving manufacturers to tailor product portfolios to local grid infrastructures and environmental mandates.

Across Europe, the Middle East, and Africa, regulatory frameworks such as the European Union’s Battery Directive and forthcoming battery passport legislation are accelerating the adoption of sustainable chemistries and end-of-life recycling. Established aerospace hubs in Western Europe maintain high standards for safety and performance, whereas oil-rich nations in the Middle East are investing heavily in smart monitoring and subsea battery solutions. Meanwhile, Africa presents untapped potential driven by remote telecommunications networks and mining projects, albeit tempered by logistical constraints and infrastructure gaps.

The Asia-Pacific region represents a powerhouse of production and innovation, with major battery manufacturing bases in China, South Korea, and Japan. Rapid electrification of transportation networks in China and India has driven mass-scale deployment of cylindrical and prismatic cells, while advanced research facilities in Japan and South Korea continue to pioneer next-generation chemistries. Southeast Asia is emerging as a critical node for cathode and anode material processing, bolstered by favorable trade agreements and government-led industrial clusters.

This comprehensive research report examines key regions that drive the evolution of the Special Purpose Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Growth and Technological Advancements in Special Purpose Batteries

Leading organizations at the forefront of special purpose battery innovation have demonstrated a commitment to continuous improvement in performance, safety, and sustainability. Major manufacturers are investing significant resources in expanding production capacities for advanced chemistries, while forging strategic partnerships to secure raw material supply and streamline manufacturing efficiencies. Collaborative R&D initiatives with academic institutions and national laboratories are driving breakthroughs in solid-state and silicon-based anode technologies, which promise to further elevate energy density and cycle stability.

At the same time, specialized suppliers focusing on battery management systems, thermal management components, and advanced separators have carved out essential roles in the value chain. By integrating sensors, IoT connectivity, and AI-driven analytics, these technology providers enable bespoke performance optimization that aligns with the stringent requirements of industries such as aerospace and defense. In parallel, recyclers and material recovery firms are scaling up facilities to capture valuable metals at end of life, thus fostering a more circular and resilient supply ecosystem.

In response to intensifying competition and geopolitical uncertainties, several market leaders are pursuing mergers, acquisitions, and joint ventures to bolster their technology portfolios and expand geographic reach. These strategic moves not only facilitate faster go-to-market timelines but also enhance bargaining power with key component suppliers. As the industry continues to consolidate, the ability to navigate complex collaboration networks will be a defining factor for sustained success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Special Purpose Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Duracell Inc.

- EaglePicher Technologies, LLC

- Energizer Holdings, Inc.

- GS Yuasa International Ltd.

- Panasonic Corporation

- Renata SA

- SAFT Groupe S.A.

- Sony Group Corporation

- Ultralife Corporation

- VARTA AG

Implementing Strategic Initiatives to Capitalize on Emerging Opportunities and Mitigate Risks in the Special Purpose Battery Sector

Industry leaders must prioritize investments in next-generation chemistries and manufacturing technologies to maintain a competitive edge. Allocating R&D resources toward solid-state configurations, silicon anodes, and advanced cathode material formulations will enable faster time-to-market for battery solutions that deliver step-change improvements in energy density and safety. By establishing dedicated technology roadmaps and innovation hubs, companies can accelerate prototype validation and scale-up processes while mitigating technical risks.

To address supply chain vulnerabilities and tariff-related uncertainties, decision-makers should diversify sourcing strategies and explore nearshoring options. Engaging with non-traditional suppliers, regional processing hubs, and domestic refiners can alleviate exposure to geopolitical disruptions and evolving trade policies. Crafting long-term supply agreements with built-in flexibility for pricing adjustments and volume commitments will also enhance resilience.

Collaborative partnerships across the ecosystem-including raw material producers, equipment manufacturers, research institutions, and end users-are essential to drive holistic advancements. By participating in pre-competitive consortia and cross-industry pilots, organizations can share knowledge, co-develop standards, and unlock efficiencies. Furthermore, integrating circular economy practices such as material recovery and cell refurbishment will reduce environmental impact and long-term costs.

Lastly, companies should embrace digital transformation initiatives that leverage data analytics, predictive maintenance, and remote monitoring. Deploying cloud-based platforms and AI-driven insights will optimize asset performance, inform field service strategies, and deliver enhanced customer experiences.

Outlining the Rigorous Research Framework and Methodological Approach Applied to Assess the Special Purpose Battery Market

The research underpinning this executive summary is anchored in a rigorous, multi-tiered methodology designed to ensure both breadth and depth of insight. Initially, a comprehensive secondary research phase was conducted, encompassing trade publications, regulatory filings, patent databases, and academic journals to map the technological landscape and identify key market drivers. This desk-based analysis provided a foundational framework for subsequent primary inquiries.

To validate and enrich these findings, in-depth interviews were carried out with over thirty industry stakeholders, including battery manufacturers, raw material suppliers, design engineers, end users, and regulatory experts. These discussions illuminated real-world challenges and emerging priorities, such as the increasing focus on lifecycle assessment and digital integration. Insights gained from these qualitative exchanges were systematically coded and cross-referenced to detect recurring themes and divergent viewpoints.

Complementary quantitative analysis was performed using proprietary databases that track product portfolios, capacity expansions, and patent filings. While avoiding speculative forecasting, this data-driven approach facilitated the identification of historical trends and correlations among regional policy shifts, technology adoption rates, and supply chain movements.

Finally, all collected intelligence was subjected to a triangulation process involving cross-validation with external expert panels and secondary datasets, ensuring the integrity and reliability of the conclusions presented herein. This disciplined approach underpins the strategic recommendations and segmentation insights detailed throughout the summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Special Purpose Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Special Purpose Batteries Market, by Battery Type

- Special Purpose Batteries Market, by Technology

- Special Purpose Batteries Market, by Form Factor

- Special Purpose Batteries Market, by Application

- Special Purpose Batteries Market, by Region

- Special Purpose Batteries Market, by Group

- Special Purpose Batteries Market, by Country

- United States Special Purpose Batteries Market

- China Special Purpose Batteries Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings and Insights to Illuminate the Strategic Imperatives of Special Purpose Battery Development

Through this in-depth analysis, it is clear that special purpose batteries represent a dynamic convergence of technological innovation, regulatory evolution, and strategic market positioning. The journey from traditional lead acid variants to advanced lithium-ion and next-generation solid-state configurations underscores an industry committed to unlocking higher performance, improved safety, and enhanced sustainability.

Regional diversity, application-specific requirements, and evolving policy landscapes create both complexity and opportunity. Manufacturers and end users must navigate a web of tariff structures, regulatory mandates, and supply chain dependencies while capitalizing on breakthroughs in materials science and digitalization. By synthesizing granular segmentation insights with regional dynamics and competitive profiling, stakeholders can chart more informed pathways toward resilience and differentiation.

Ultimately, success in the special purpose battery sector will hinge on the ability to integrate advanced R&D, agile supply chain strategies, and collaborative partnerships. Organizations that embrace a holistic approach-incorporating circular economy principles, data-driven asset management, and forward-looking scenario planning-will be best positioned to lead in the years ahead.

Take Action Today to Engage with Our Associate Director and Secure Comprehensive Special Purpose Battery Market Intelligence

Engaging with Ketan Rohom as your primary point of contact ensures you gain the strategic guidance and tailored insights necessary to maximize your competitive edge in the rapidly evolving special purpose battery market. This is your opportunity to work directly with an industry expert who understands the nuanced dynamics of advanced battery technologies and can provide clarity on how to leverage these insights for strategic decision-making.

Act now to secure your comprehensive market research report, which delivers an authoritative roadmap for navigating supply chain complexities, regulatory changes, and technological breakthroughs. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, and initiate a conversation to customize your research scope, address specific business challenges, and access bespoke data analyses that align with your organizational priorities.

Don’t miss the chance to transform your roadmap for innovation and market expansion with in-depth, actionable intelligence. Contact Ketan Rohom today and take the decisive step toward informed investments in special purpose battery technologies that will shape your growth trajectory for years to come.

- How big is the Special Purpose Batteries Market?

- What is the Special Purpose Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?